by John Rothe, CMT | Nov 14, 2023 | Financial Planning, Retirement

In the age of personalized medicine, tailored education, and customized diets, isn’t it time we started considering a personalized approach to inflation? Inflation, as any economist will tell you, is the general rise in prices and the concurrent decrease in...

by John Rothe, CMT | Nov 8, 2023 | Retirement

Understanding retirement account options for small business owners is essential in today’s economic landscape. As an entrepreneur, it’s not just about ensuring a comfortable retirement for yourself—it’s also about offering compelling benefits to your...

by John Rothe, CMT | Apr 23, 2019 | Financial Planning, Retirement

Along with Social Security, guaranteed income from pensions and annuities are key sources of income for retired Americans, the results of a survey conducted by the Insured Retirement Institute (IRI) showed. The survey was completed in August 2018 by 820 Americans aged...

by John Rothe, CMT | Dec 4, 2018 | Financial Planning, Retirement

Entrepreneurs know that it is prudent to build a personal investment portfolio apart from the investment in their own company. However, that is often easier said than done. In reality, a new venture often requires at least several years of risk and self-sacrifice,...

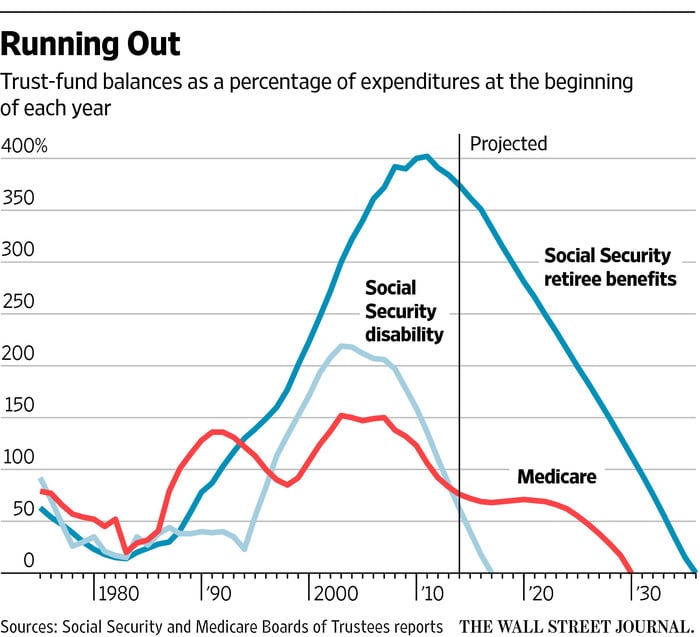

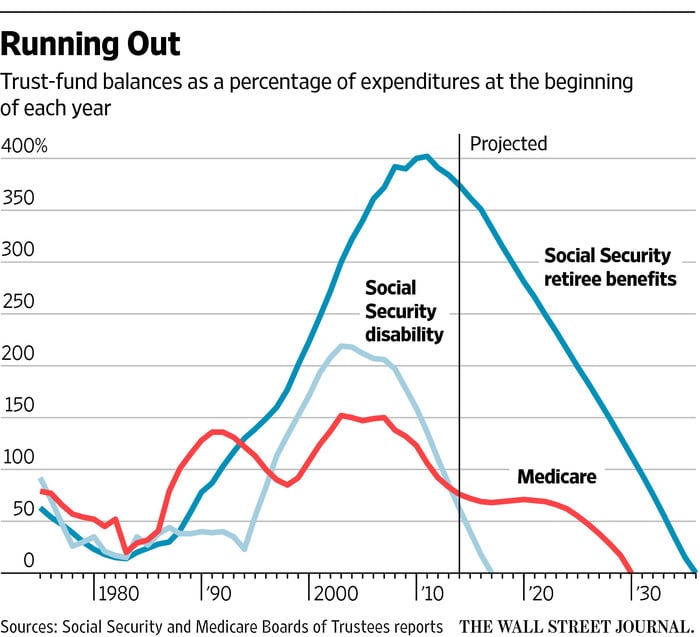

by John Rothe, CMT | Aug 23, 2018 | Retirement

Recent reports that the Social Security trust fund will pay out more than it takes in—for the first time since 1982—could trigger a rush to claim benefits. Financial planners say that often their clients want to sign up for Social Security at age 62 (the earliest they...

by John Rothe, CMT | May 2, 2018 | Retirement

This popular retirement savings vehicle comes in several varieties. What don’t you know? Many Americans know about Roth and traditional IRAs, but there are other types of Individual Retirement Arrangements. Here’s a quick look at all the different types of IRAs: ...