Entrepreneurs know that it is prudent to build a personal investment portfolio apart from the investment in their own company. However, that is often easier said than done. In reality, a new venture often requires at least several years of risk and self-sacrifice, with an entrepreneur typically returning all earnings and energy back into strengthening his or her business.

Owners may be so involved with their companies that they pay limited attention to their personal finances. While setting detailed long-range plans for their firms, they may have done little to establish long-term financial goals for themselves. The solution is to develop a complete investment strategy—one that addresses both personal and business needs.

Accountants suggest that business owners tighten up management and accounting controls, ultimately making the business financially stronger and allowing the owner to take out more cash.

It is certainly not uncommon for owners to have a substantial percentage of their personal wealth tied up in, or loaned to, their business. Thus, it is important to separate personal investments from those of the company.

Portfolio management for business owners differs from the approach taken by other investors. Business owners often find they need a more imaginative and flexible investment strategy. While they may be innovative elsewhere, they may have had a narrower view when it comes to personal investing.

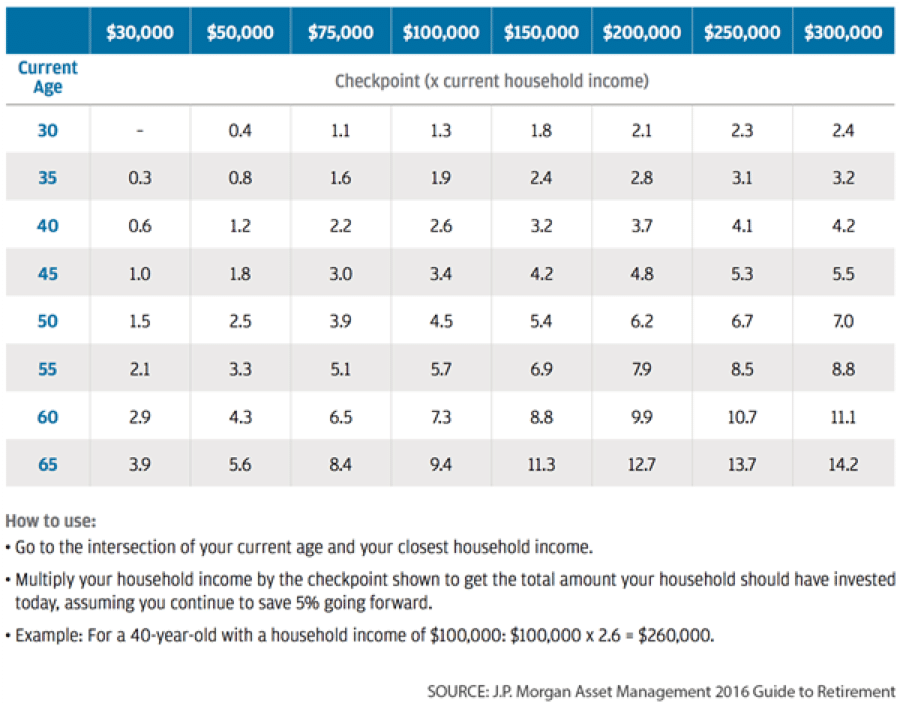

Two key elements should be liquidity and diversification. High liquidity is often required of business owners, allowing them greater flexibility to take advantage of new opportunities. Diversification is important; it helps reduce risk by spreading investments among a number of alternatives, such as real estate, bonds, and mutual funds.

At some point, however, all owners must take as much control of their personal finances as they do those of their business. Consider the following list of recommendations to develop a more complete investment strategy:

- Reduce receivables to increase cash flow.

- Improve inventory management.

- Balance the mix between invested capital and borrowed capital.

- Lease office space rather than buying.

- Renegotiate credit arrangements and concentrate on an advantageous tax strategy.

Long-term business planning and budgeting are important to the ultimate success of a business. The creation of a long-term personal financial plan and investment strategy is critical to the success of the business owner.

Need Help?

Need help, a second opinion, or just want to learn more about us? Click here to schedule a free strategy session with us.