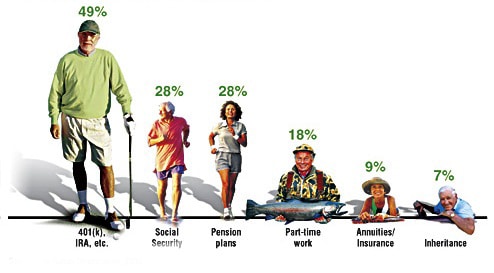

Along with Social Security, guaranteed income from pensions and annuities are key sources of income for retired Americans, the results of a survey conducted by the Insured Retirement Institute (IRI) showed.

The survey was completed in August 2018 by 820 Americans aged 65-85 with investable assets of at least $50,000. The survey report, “Retirement, Income, and Risk,” is part of a series of studies examining the retirement experiences of people who have been living in retirement for a meaningful length of time, with this year’s report focusing on retirees’ reliance on guaranteed sources of income.

The survey found that relatively few respondents have taken a significant “pay cut” since retiring, with 43% saying their income is either the same or has increased, 32% indicating that they have seen a 25% reduction in income, and just 21% reporting that they have seen their income decrease by one-half or more.

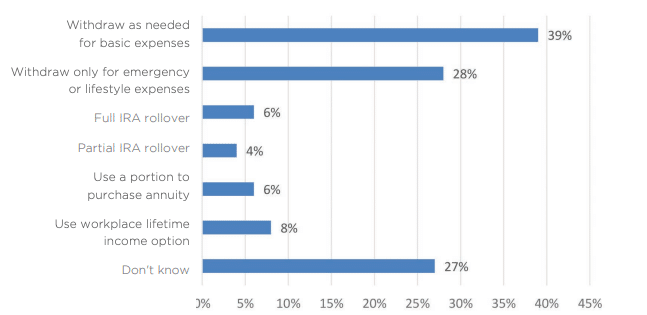

Planned Methods of Accessing Retirement Savings (source: IRI)

The results also showed that more than 90% of respondents are collecting Social Security benefits, and that of those who are not, about half are eligible but have not yet filed. Among the survey sample, the average married couple receiving Social Security benefits reported receiving $28,080 per year.

Almost half of respondents said Social Security accounts for less than 25% of their household income, and just 16% said these benefits account for 50% or more.

Meanwhile, 81% of the retirees surveyed reported that they receive at least some income from a pension, with 64% saying they depend on a pension for at least 25% of their income, and 40% saying they rely on a pension for 50% or more of their retirement income.

The survey also found that one-third of respondents reported owning an annuity, although just 15% said they are receiving lifetime income payments from an annuity.

When retirees who have defined contribution plan accounts were asked about the frequency of their withdrawals, only 39% indicated that they are taking systematic withdrawals from their balances.

Of those who reported making systematic withdrawals, 59% said they are doing so to satisfy the Required Minimum Distribution rule, and 66% said they are withdrawing 6% or less of the funds in the accounts annually.

Moreover, 59% of these respondents reported that their withdrawals are in line with their expectations, while 21% said they are withdrawing less than anticipated, and just 20% reported that they are withdrawing more than expected.

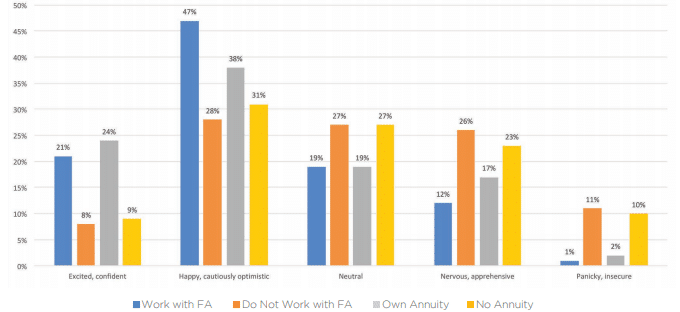

The results further pointed to the importance of financial advisor relationships for retirees.

Confidence About Transitioning to Retirement

The survey showed that 72% of respondents who retired with at least $100,000 in investable assets said they either have or had a relationship with a financial advisor, with 63% reporting that they continue to work with a financial advisor.

The survey also found that very few of the retirees polled are working, with 73% saying they receive no income from employment and only 4% saying employment accounts for 50% or more of their income. Of those respondents who said they are receiving no income from employment, just 15% said they have ever looked for paying work since retiring from a full-time occupation.

Moreover, most of the respondents indicated that they have not moved in retirement: 63% said they are still living in the same home they lived in prior to retirement, while 25% said they have sold their home to move to a smaller place.

In addition, the survey showed that most of the respondents feel relatively secure in retirement, with more than one-half saying they believe they are better off financially now than at the point of retirement, and 36% reporting that they are about as well off now as when they retired.

Interestingly, 72% of respondents said they feel more financially secure in retirement than their parents were or are.

Researchers cautioned, however, that many retirees may be underestimating the risks they face from high medical and long-term care costs. They noted, for example, that while there is a 68% chance that an American aged 65 or older will become disabled in at least two activities of daily living, only 25% of respondents said they think it is likely that they will need long-term care.

Thus, researchers warned, “the risk of exhausting financial assets due to a long-term care event is quite real, and underappreciated.”