[fusion_builder_container hundred_percent=”no” equal_height_columns=”no” menu_anchor=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”center center” background_repeat=”no-repeat” fade=”no” background_parallax=”none” parallax_speed=”0.3″ video_mp4=”” video_webm=”” video_ogv=”” video_url=”” video_aspect_ratio=”16:9″ video_loop=”yes” video_mute=”yes” overlay_color=”” video_preview_image=”” border_size=”” border_color=”” border_style=”solid” padding_top=”” padding_bottom=”” padding_left=”” padding_right=””][fusion_builder_row][fusion_builder_column type=”1_1″ layout=”1_1″ background_position=”left top” background_color=”” border_size=”” border_color=”” border_style=”solid” border_position=”all” spacing=”yes” background_image=”” background_repeat=”no-repeat” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” margin_top=”0px” margin_bottom=”0px” class=”” id=”” animation_type=”” animation_speed=”0.3″ animation_direction=”left” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” center_content=”no” last=”no” min_height=”” hover_type=”none” link=””][fusion_text]

[/fusion_text][fusion_vimeo id=”574082040″ alignment=”center” width=”1000″ height=”” autoplay=”false” api_params=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” css_id=”” /][fusion_text][fusion_text][fusion_text]

U.S. Markets:

The major U.S. benchmarks closed the week mixed, with large caps and growth stocks outperforming for a second week.

The Dow Jones Industrial Average finished the week up 84 points to 34,870, a gain of 0.2%. The technology-heavy NASDAQ Composite rose 0.4%.

By market cap, the large cap S&P 500 gained 0.4%, while the mid cap S&P 400 and small cap Russell 2000 retreated -0.1% and -1.1%, respectively.

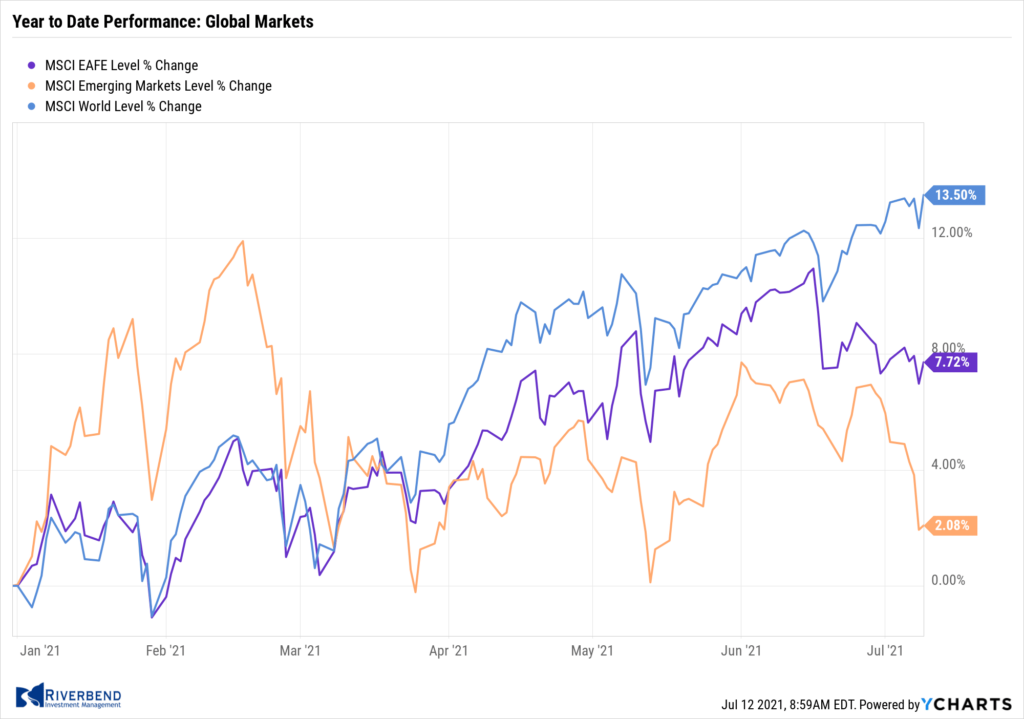

International Markets:

International markets were likewise mixed on the week. Canada’s TSX rose 0.2%, while the United Kingdom’s FTSE 100 remained essentially flat.

On Europe’s mainland, France’s CAC 40 retreated -0.4%, while Germany’s DAX rose 0.2%.

In Asia, China’s Shanghai Composite ticked up 0.2%. The most notable move was in Japan where the Nikkei plunged -2.9% as a new lockdown was announced.

As grouped by Morgan Stanley Capital International, developed markets rose 0.3%, while emerging markets declined -2.2%.

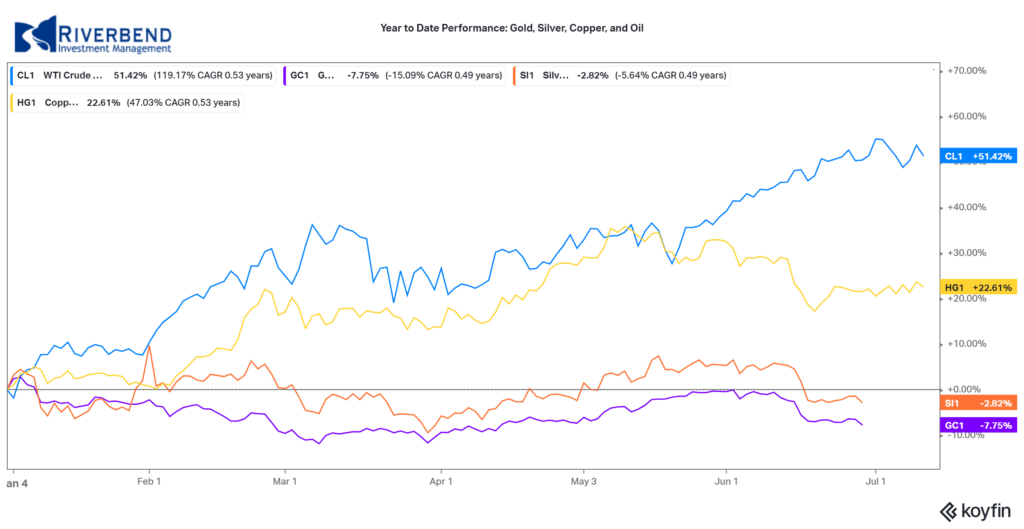

Commodities:

Precious metals finished the week mixed. Gold gained 1.5% to $1810.60 per ounce, while Silver shed ‑1% to $26.23.

Energy experienced its first down week in seven. West Texas Intermediate crude oil declined -0.8% to $74.56 per barrel.

The industrial metal copper, viewed by some analysts as a barometer of global economic health due to its wide variety of uses, finished the week up 1.6%.

U.S. Economic News:

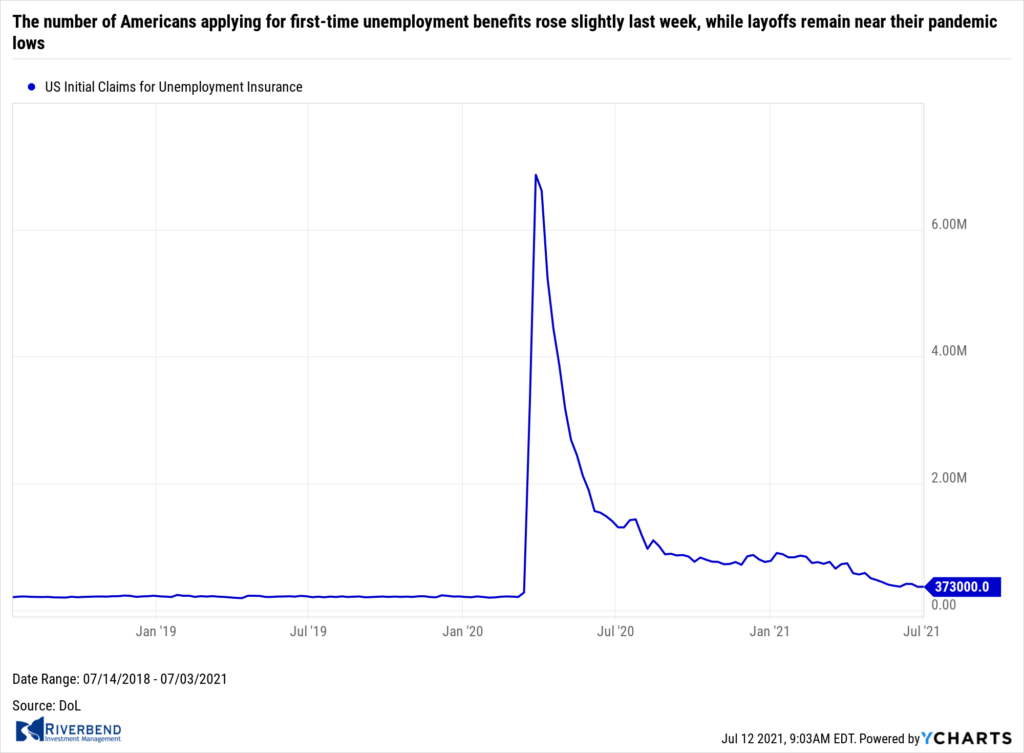

The number of Americans applying for first-time unemployment benefits rose slightly last week, while layoffs remain near their pandemic lows. Initial jobless claims rose by 2,000 to 373,000 in the seven days ended July 3, the government reported. Economists had forecast new claims would fall to a seasonally adjusted 350,000.

The number of people applying for state or federal benefits each week has fallen gradually this year, but claims are still more than double the pre-pandemic average. New claims averaged in the low 200,000s before the viral outbreak. Continuing claims, which counts the number of people already collecting state jobless benefits, fell by 145,000 to a seasonally adjusted 3.34 million. That number is reported with a one-week delay.

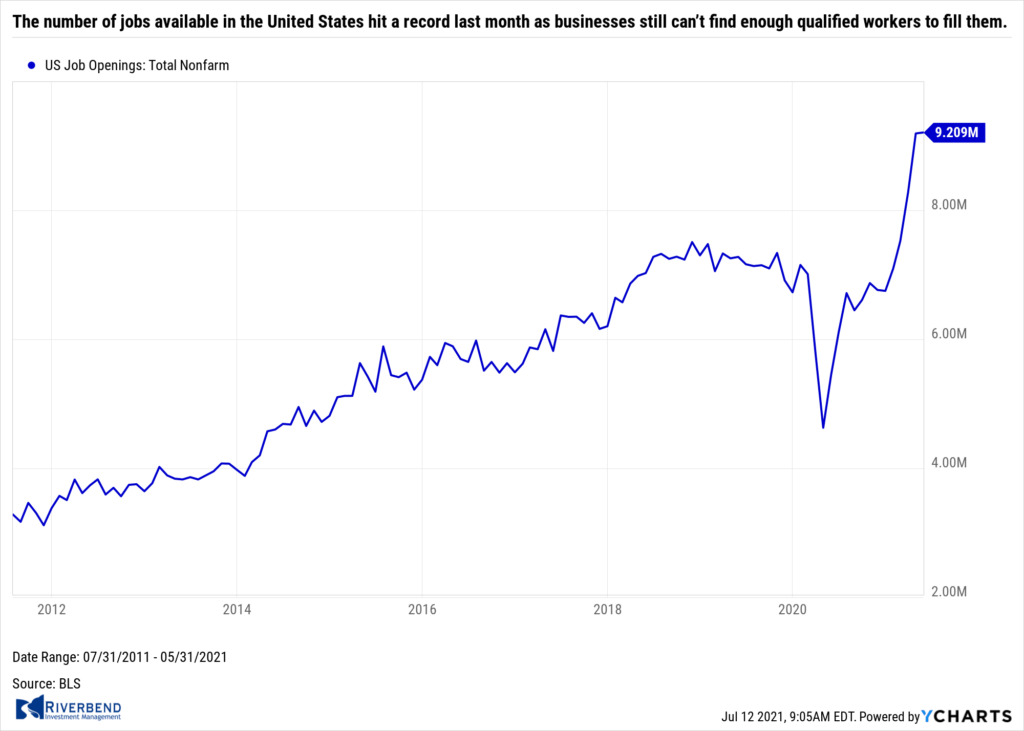

The number of jobs available in the United States hit a record last month as businesses still can’t find enough qualified workers to fill them. The Labor Department reported job openings in the U.S. rose slightly to a record 9.21 million. The number of available jobs has set a record for three consecutive months. Not only that, but a record 4 million people quit their jobs two months ago, nearly double the number from the same time a year earlier. “People are moving from one job to the next,” said Anthony Nieves, chairman of a monthly survey of service-oriented companies that asks how business is going.

The number of jobs available in the United States hit a record last month as businesses still can’t find enough qualified workers to fill them. The Labor Department reported job openings in the U.S. rose slightly to a record 9.21 million. The number of available jobs has set a record for three consecutive months. Not only that, but a record 4 million people quit their jobs two months ago, nearly double the number from the same time a year earlier. “People are moving from one job to the next,” said Anthony Nieves, chairman of a monthly survey of service-oriented companies that asks how business is going.

The closely-watched “quits rate” among private-sector workers declined to 2.9% from a record 3.2%. The quits-rate is rumored to be the Federal Reserve’s preferred measure of the health of the labor market. At the height of the coronavirus crisis, the quits rate had fallen to a seven-year low of 1.8%.

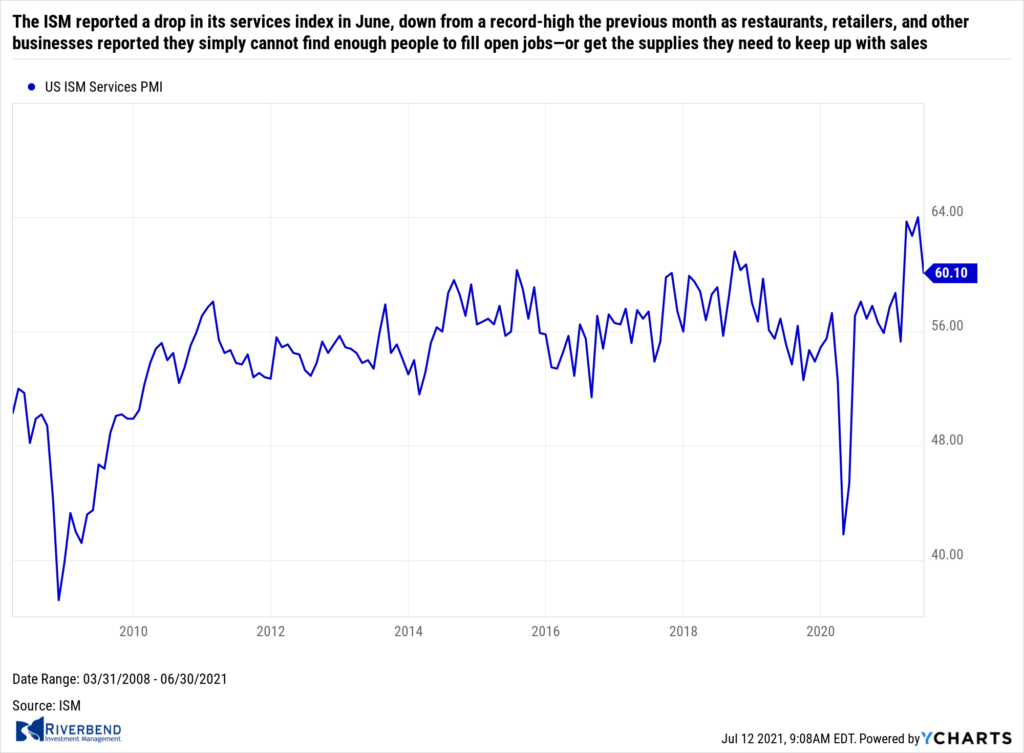

The Institute for Supply Management (ISM) reported a drop in its services index in June, down from a record-high the previous month. ISM’s survey of service-oriented businesses fell to 60.1 in June, down from a record 64.0 in May. Restaurants, retailers, and other businesses that compose the huge services side of the U.S. economy reported they simply cannot find enough people to fill open jobs—or get the supplies they need to keep up with sales.

The Institute for Supply Management (ISM) reported a drop in its services index in June, down from a record-high the previous month. ISM’s survey of service-oriented businesses fell to 60.1 in June, down from a record 64.0 in May. Restaurants, retailers, and other businesses that compose the huge services side of the U.S. economy reported they simply cannot find enough people to fill open jobs—or get the supplies they need to keep up with sales.

These shortages are boosting the cost of materials and labor and adding to the upward pressure on prices. The reading missed economists’ expectations for a reading of 63.3. Senior U.S. economist Michael Pearce of Capital Economics stated, “Shortages and price increases are becoming an increasing drag on hiring and economic activity.”

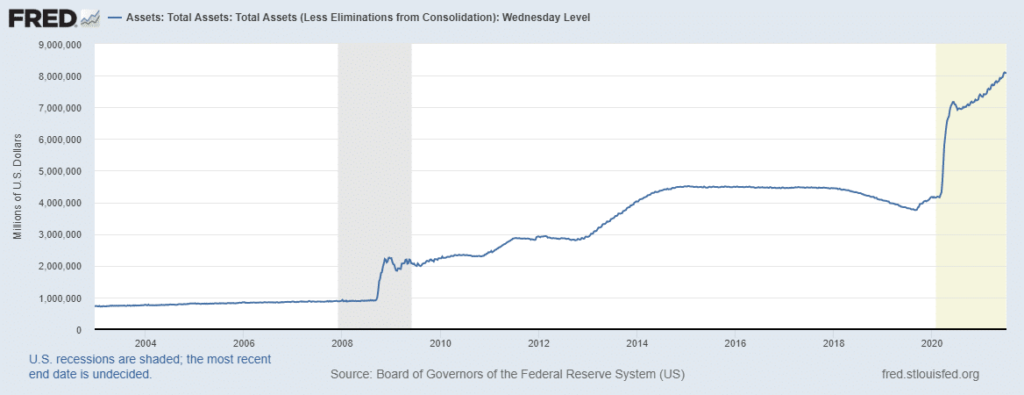

Following two monetary-policy meetings in which there was virtually no discussion of slowing down asset purchases, the minutes from the Federal Reserve’s June meeting show officials dove into the debate about how and when to taper. Currently, the Fed is holding its policy interest rates close to zero and buying $120 billion in Treasuries and mortgage-backed securities each month to bolster the economy. The central bank said it would keep up the pace of purchases until “significant” progress was reached on the labor market and inflation.

Following two monetary-policy meetings in which there was virtually no discussion of slowing down asset purchases, the minutes from the Federal Reserve’s June meeting show officials dove into the debate about how and when to taper. Currently, the Fed is holding its policy interest rates close to zero and buying $120 billion in Treasuries and mortgage-backed securities each month to bolster the economy. The central bank said it would keep up the pace of purchases until “significant” progress was reached on the labor market and inflation.

However, with inflation surging, many economists think it is time for the Fed to move. But there is concern that any move to the exit could set off an outsized market reaction as it did in 2013. The minutes show “various” officials said they thought the committee would meet the “significant further progress” condition to begin to reduce the pace of asset purchases “somewhat earlier” than they had anticipated. Fed-watchers noted that “various” wasn’t a term often used by the Federal Reserve and it was unclear whether it also meant the majority. At his last press conference, Powell said the Fed would go “meeting by meeting” and see if the conditions for tapering are met.

Chart of the Week:

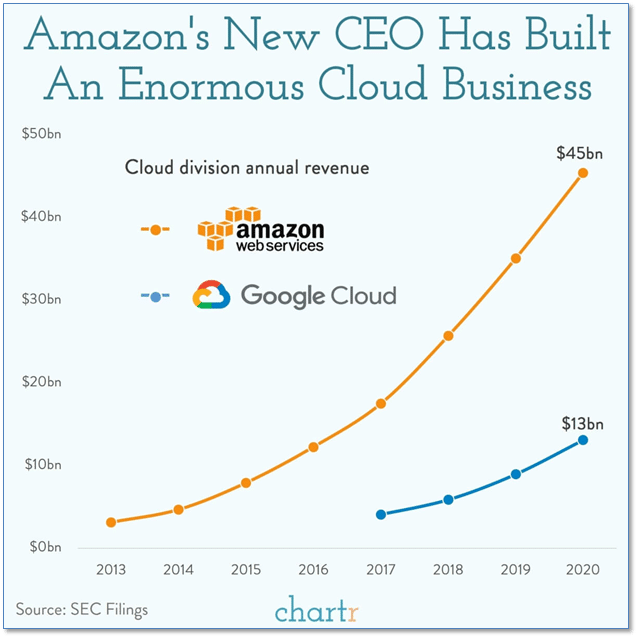

After 27 years at the helm of Amazon, founder Jeff Bezos officially stepped down as CEO. Taking his place is Andy Jassy. The reaction of most Americans was “Who?”

Jassy ran Amazon’s cloud computing division, Amazon Web Services (AWS). During its growth, Amazon had become quite good at building and managing tech infrastructure services like databases, storage, and computing. In 2003, AWS was formed with its first products launching in 2006 under the leadership of Jassy.

Amazon’s share of the cloud computing market isn’t just impressive—it is massive. Amazon’s AWS division rakes in more than 3X the amount of revenue as its next closest competitor, Google, and accounted for 63% of Amazon’s operating profit in 2020.

Riverbend Indicators:

Each week we post notable changes to the various market indicators we follow.

- As a reading of our Bull-Bear Indicator for U.S. Equities (comparative measurements over a rolling one-year timeframe), we remain in Cyclical Bull territory.

- Counting up of the number of all our indicators that are ‘Up’ for U.S. Equities, the current tally is that four of four are Positive, representing a multitude of timeframes (two that can be solely days/weeks, or months+ at a time; another, a quarter at a time; and lastly, the {typically} years-long reading, that being the Cyclical Bull or Bear status).

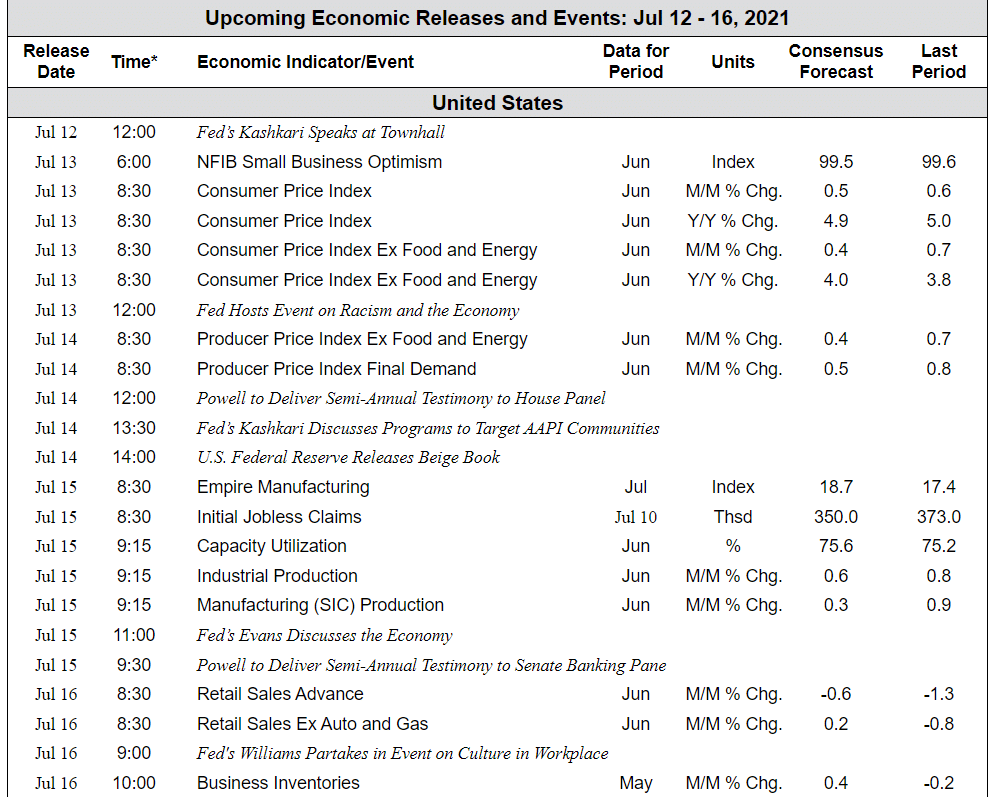

The Week Ahead:

Source: Bloomberg

(Sources: All index- and returns-data from Yahoo Finance; news from Reuters, Barron’s, Wall St. Journal, Bloomberg.com, ft.com, guggenheimpartners.com, zerohedge.com, ritholtz.com, markit.com, financialpost.com, Eurostat, Statistics Canada, Yahoo! Finance, stocksandnews.com, marketwatch.com, wantchinatimes.com, BBC, 361capital.com, pensionpartners.com, cnbc.com, FactSet.)

[/fusion_text][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]