Have you heard the one about how bad it is to miss the top-performing stock market days? This warning is usually coupled with the standard advice that you should be invested all the time. But the advice is wrong and the warning is crazily simplistic.

The warning goes like this: If you miss just a handful of the market’s best days, your portfolio returns will be significantly reduced. For proof, the story comes with a fancy chart that compares being invested in U.S. stocks every single day versus missing a few of those top days.

A Chart to Support Something Silly

One version of that chart shows that $1 invested in the Standard & Poor’s 500 from January 1970 through the end of 2017 grew to $97. But missing the top five days – as the warning goes – brings the end value to something like 35% less. And missing the top 20 days brings it to 75% less than just leaving the portfolio alone.

The conclusion seems inevitable: It is a bad idea to cash out of the market for any time, lest you miss those crucial days.

But this argument is seriously flawed. But because people parrot it over and over, the notion has gained undeserved credibility. What’s wrong with it?

Certainly, the underlying premise is true: If you take the best performing days out of any investment, the total return will be lower. What is missing is the explanation for why an investor could possibly be out of the market only during the days when returns were highest, but invested at all other times.

Is Missing the Best 5 Days Realistic?

The chance of anyone accomplishing this exceedingly unlucky feat is minuscule. One could just as well say that avoiding a handful of really bad days creates enormous benefits.

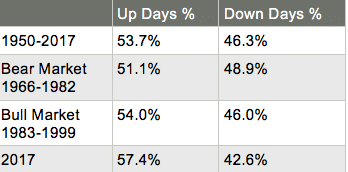

From a purely random perspective, both scenarios are exceptionally unlikely, but equally so because the number of positive days is very close to the number of negative days.

Consider this chart that depicts the percentage of positive and negative days across various time periods for the S&P 500:

Of course, nobody should believe that it is possible to avoid only the worst possible days. Just as unreasonable is assuming that it is any more likely to miss just the best possible days.

Lessons

We can draw a few conclusions from this. First, the myth that being out of the market for a minuscule timespan carries a serious risk is flawed. Institutional asset managers with an incentive to keep everyone invested at all times are quite vocal at propagating this story, which is understandable: that’s how they are paid.

Second, it is true that when investors try to time the market, they often end up doing worse than if they remain always invested. The reason is that most people suffer from behavioral biases that lead them to making the wrong decisions.

Many times, for example, investors carry losing positions far longer than they should because they want to avoid the pain of booking a loss. The result is a larger loss than if they had set an exit threshold in advance, such as a loss of 10% or 15%.

We all know someone who lost 50% or more of his or her portfolio during the financial crisis before cashing out just as the market touched bottom and started going up again. The tendency to let losses run is responsible for many portfolio disasters.

Systematic Asset Allocation

Given the behavioral challenges we all face, a strong argument exists for adopting a systematic approach to asset allocation, designed to deal with those investor shortcomings. This approach should be at the core of your investment strategy.

Using clear rules of exposure can go a long way toward avoiding the mistakes made when emotions drive investment decisions. Fear of loss, impulsive buying or selling, or drawing conclusions from a single event are well-known decision-making problems. Still, investors regularly fall into those traps.

To be fair, creating a systematic asset allocation strategy is not easy. This may well be why simple stories like the “stay invested at all times” are so appealing. Following simple rules of thumb are much easier.

But gross simplifications that ignore the complexities of market behavior can be useless and sometimes quite dangerous.

Investors should talk to their advisors to help them cut through the fog of fairy tales.

—-

—-

Copyright © 2018 RSW Publishing. All rights reserved.

Distributed by Financial Media Exchange.