I have always found behavioral finance to be a fascinating topic that combines psychology, economics, and finance to explain how investors make decisions and how these choices can impact financial markets.

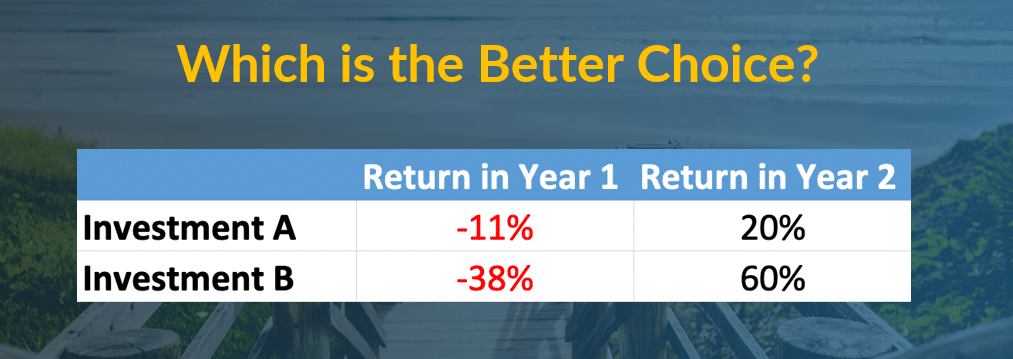

Years ago (Pre-COVID), I would occasionally host in-person investor seminars. During the seminar, I would show the audience the following chart and ask “Which is the better investment?”

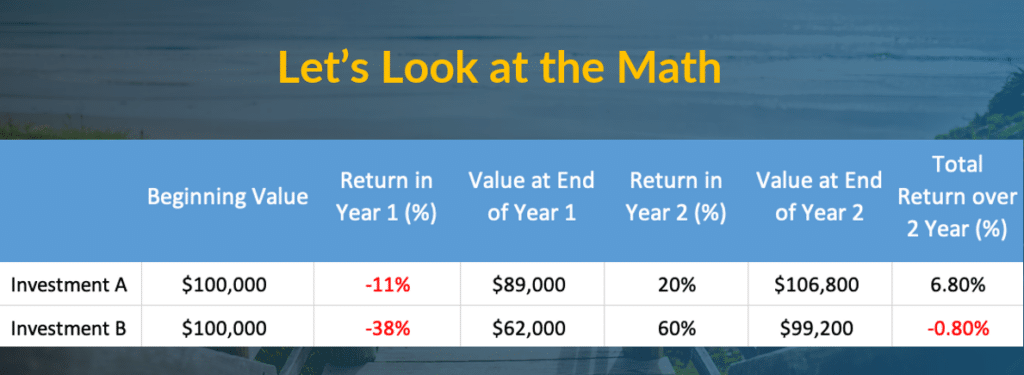

I would then follow up with this slide, showing the math of avoiding losses in the portfolio:

In this example, the obvious choice is “Investment A”. What I found to be particularly interesting is how the answers would skew depending on the current state of the market.

During a quick-rising bull market, the audience leaned more toward “Investment B”. In speaking with them, it was clear that they were excited about the prospect of earning 60% vs 20%.

However, during a market decline, the audience leaned more towards “Investment A”, citing that they would only be down 11%.

This is a great example of behavioral finance.

While, traditional finance theories assume that investors are rational, self-interested, and have access to perfect information. Behavioral finance challenges these assumptions, recognizing that emotions, cognitive biases, and other psychological factors can significantly influence investor behavior and market outcomes.

Key Principles of Behavioral Finance

- Prospect Theory: Developed by Daniel Kahneman and Amos Tversky, prospect theory suggests that people make decisions based on perceived gains and losses relative to a reference point, rather than absolute outcomes. Investors tend to be risk-averse when it comes to gains and risk-seeking when it comes to losses.

- Heuristics and Biases: Investors often rely on mental shortcuts (heuristics) and exhibit systematic biases when making decisions. Common biases include overconfidence (overestimating one’s abilities), anchoring (fixating on irrelevant reference points), availability bias (overweighting easily recalled information), and representativeness bias (assuming small samples represent the larger population).

- Loss Aversion: Investors feel the pain of losses about twice as intensely as the pleasure of equivalent gains. This can lead to holding onto losing positions too long, hoping they’ll rebound, and selling winners too soon to lock in gains.

- Mental Accounting: People tend to compartmentalize their money into separate “accounts” based on subjective criteria, like the source or intended use of the funds. This can lead to irrational spending and investment decisions, as people treat different pools of money differently rather than optimizing their overall financial situation.

- Herd Behavior: Investors often follow the crowd, chasing hot stocks or selling in a panic. This can create market bubbles and crashes as prices diverge from fundamental values.

Behavioral Finance in Action

Changes in investor sentiment and behavior, as observed through the lens of behavioral finance, can potentially signal shifts in the direction of the overall stock market or individual stocks. Here are some key principles and factors to watch for:

- Herding behavior: When investors start to follow the crowd and buy (or sell) stocks en masse, it can indicate a market shift. If investors pile into “hot” stocks or sectors, it could signal a bubble forming. Conversely, if investors panic and sell stocks in herds, it may foreshadow a market decline.

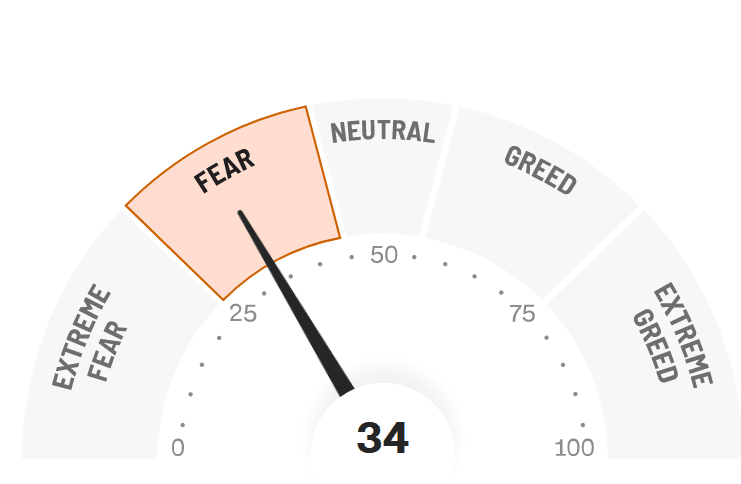

CNN Fear Greed Index

2. Overreaction to news: Behavioral finance shows that investors often overreact to both good and bad news. If a stock soars on good earnings but the fundamentals don’t justify the rise, it could indicate over-exuberance and a potential reversal. Similarly, panic selling on a single piece of bad news could signal a buying opportunity.

3. Shifts in risk perception: If investors suddenly view stocks as less risky and start buying more volatile, speculative equities, it may indicate “animal spirits” taking hold and a bull market forming. Conversely, if investors start shunning risk and flocking to “safe havens,” it may signal a coming downturn.

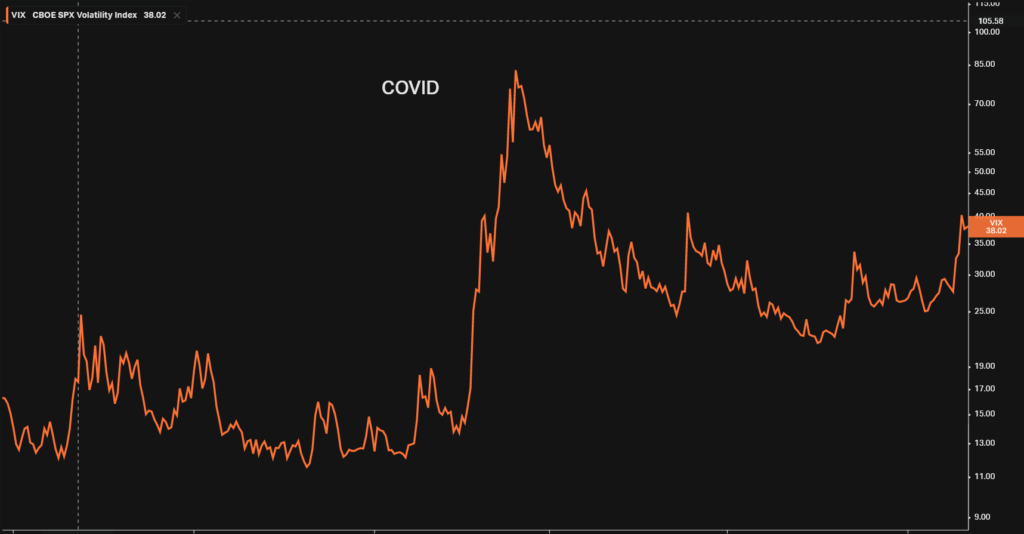

4. Change in sentiment indicators: Indicators like volatility indexes, put/call ratios, and consumer confidence surveys can reveal shifts in overall market sentiment. A spike in the VIX (a volatility gauge) can often precede market drops, for example.

Rising VIX during COVID shows the rise in “fear” within the stock market. Source: koyfin

5. Momentum reversals: Behavioral finance shows investors often chase performance, piling into stocks or funds with recent strong returns. When momentum stocks start to falter, it can signal a sentiment shift and a market turn.

6. Extreme valuations: If investors bid up stock valuations to extreme levels (very high P/E ratios, for example), it can indicate euphoria and a potential market top. Depressed valuations can conversely signal a bottom.

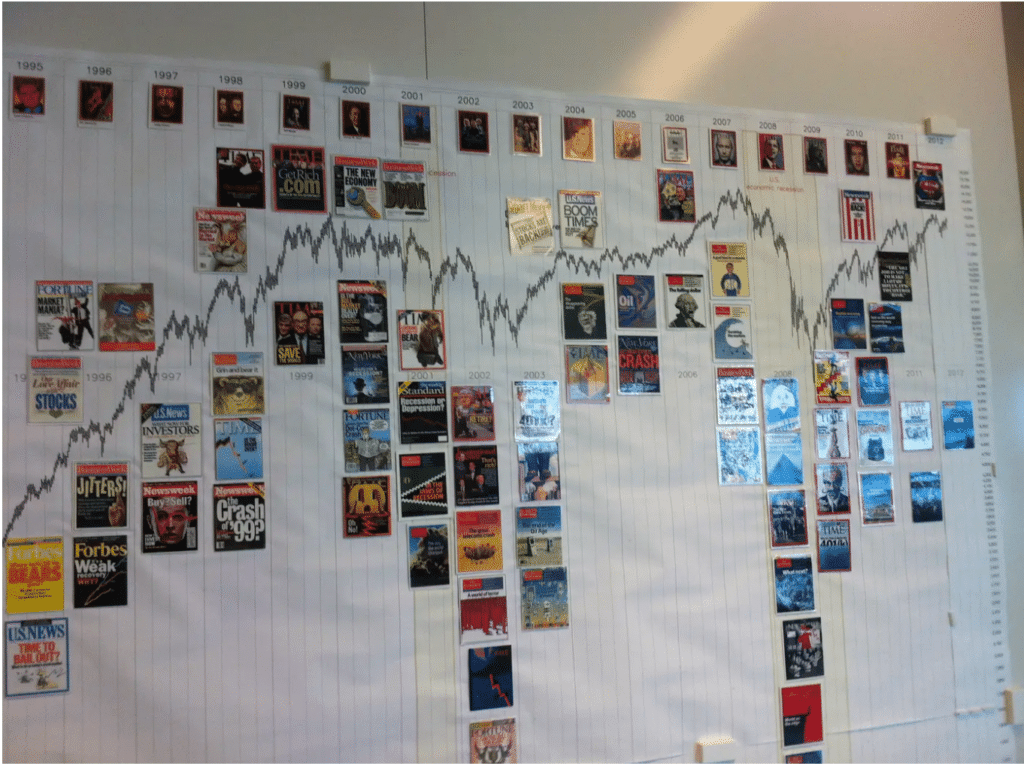

7. Magazine covers and media hype: Behavioral finance has shown that individual investors are often late to market moves. By the time a market trend makes the cover of mainstream magazines or becomes a hot media topic, a turning point may be near.

Fidelity’s infamous chart room with magazine covers highlighting major market and economic reversals. Source: All Star Charts

The Bottom Line

Behavioral finance offers a powerful lens for understanding the often-irrational ways investors think and act. By recognizing and managing the impact of emotions and cognitive biases, investors can make more rational decisions and advisors can better guide their clients.

While not a silver bullet, incorporating behavioral finance principles can lead to better investment outcomes over time. And watching for behavioral red flags can provide an extra edge in navigating shifting market conditions.

Of course, behavioral finance is still an evolving field, and not all biases are easily overcome. But as our understanding of investor psychology grows, so too will our ability to make smarter, more rational financial choices.