[fusion_builder_container hundred_percent=”no” equal_height_columns=”no” menu_anchor=”” hide_on_m

obile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”center center” background_repeat=”no-repeat” fade=”no” background_parallax=”none” parallax_speed=”0.3″ video_mp4=”” video_webm=”” video_ogv=”” video_url=”” video_aspect_ratio=”16:9″ video_loop=”yes” video_mute=”yes” overlay_color=”” video_preview_image=”” border_size=”” border_color=”” border_style=”solid” padding_top=”” padding_bottom=”” padding_left=”” padding_right=””][fusion_builder_row][fusion_builder_column type=”1_1″ layout=”1_1″ background_position=”left top” background_color=”” border_size=”” border_color=”” border_style=”solid” border_position=”all” spacing=”yes” background_image=”” background_repeat=”no-repeat” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” margin_top=”0px” margin_bottom=”0px” class=”” id=”” animation_type=”” animation_speed=”0.3″ animation_direction=”left” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” center_content=”no” last=”no” min_height=”” hover_type=”none” link=””][fusion_text]

In less than a week, the COVID-19 variant known as Omicron has renewed public health concerns around the world. While the World Health Organization has stated that it could have “severe consequences,” reports from South Africa where the “variant of concern” was first identified suggest that symptoms have been mild.

Only time will tell how severe – or not – the public health implications may be, especially as vaccination rates rise and other safety measures become commonplace.

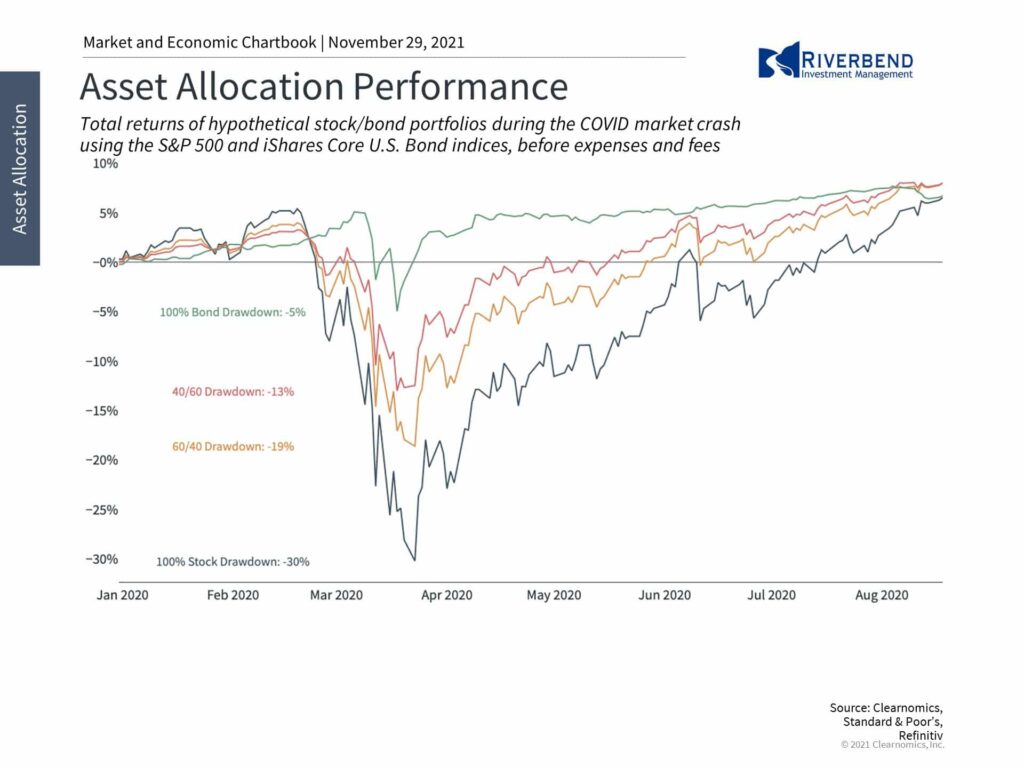

Through all this, it’s more important than ever for investors to distinguish between public health issues – which can be fraught with politics and strong personal beliefs – and what’s best for their portfolios. If the pandemic has taught us anything, it’s that staying focused on the long run is the best approach.

Through all this, it’s more important than ever for investors to distinguish between public health issues – which can be fraught with politics and strong personal beliefs – and what’s best for their portfolios. If the pandemic has taught us anything, it’s that staying focused on the long run is the best approach.

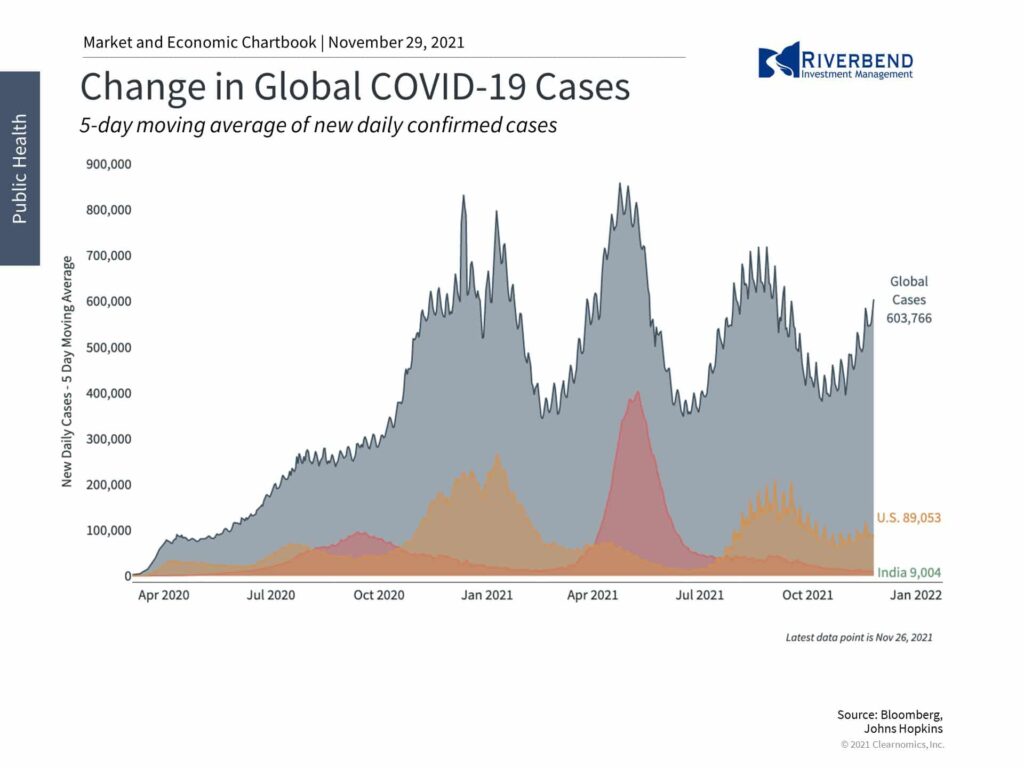

It’s generally accepted that COVID-19 is now “endemic” – i.e., like the flu or common cold, it’s here to stay. Unfortunately, this means that whether due to Omicron or another strain, it is only a matter of time before new variants create public health concerns.

Like the original COVID-19 strains and later the Delta variant, these worries can escalate quickly due to the pace of infection. It’s possible for these variants to spread to multiple continents by the time they are identified, named, and appear in the news.

At the onset of the pandemic, this exponential pace created significant challenges for everyone, not least of which was the emotional toll of isolation and social distancing. Fortunately, the situation today is quite different.

Individuals and businesses alike have fresh experience and playbooks for dealing with the pandemic and there is a much better understanding of the risks. Without diminishing the public health challenges ahead, this means that there is a stark distinction between how officials should respond to the ongoing crisis and how investors should respond in their portfolios.

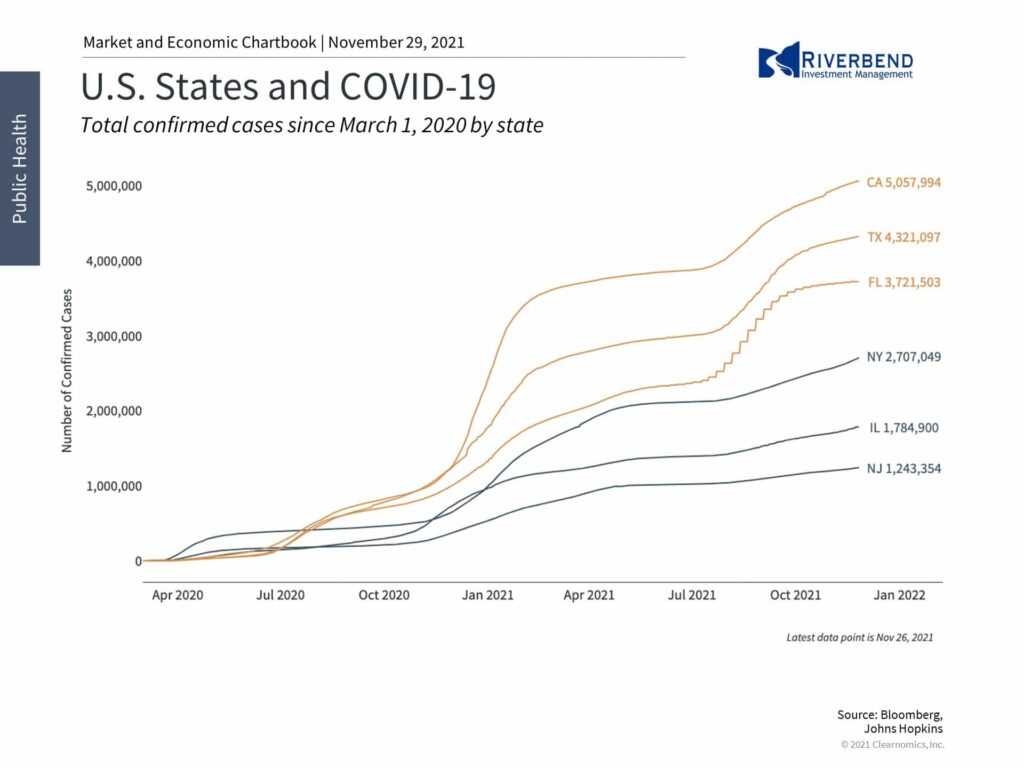

The Delta wave that began in the summer showed that this is the case. Although infections spread rapidly, the death rate remained relatively low. Most importantly for investors, the economic and market impacts were minimal, especially when compared to the initial shutdown measures in 2020.

Through that wave and the more recent uptick in cases, economic growth has been strong, hiring activity has accelerated, profits have reached record levels, and markets have continued to achieve new all-time highs. All this despite concerns around inflation, supply chains, politics, the Fed and more.

Of course, investors should always expect periods of market volatility. This is true even in the best of times, let alone when markets are at new highs and valuations are still above average. It is still true that the market has been quite calm by historical standards this year, despite occasional shallow pullbacks. What has made this possible is the strength of the economic expansion which is now over a year and a half in age. While there may be periods of short-term turbulence ahead, business cycles tend to last for many years if not decades.

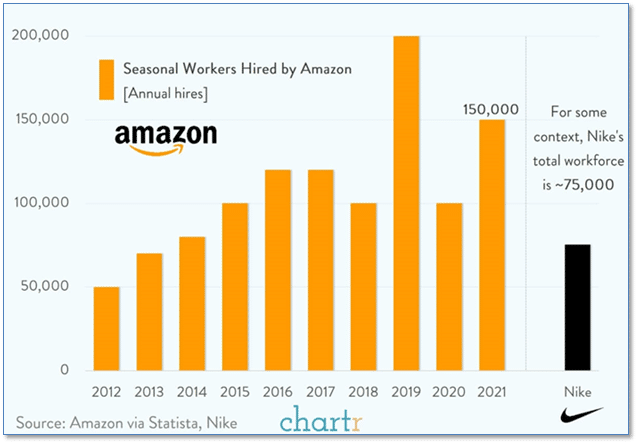

Chart of the Week:

At the end of September, Amazon employed almost 1.5 million people around the world, with nearly a million in the U.S. alone. That translates to roughly 1 in every 150 American workers getting a paycheck from Jeff Bezos and company.

During the holidays that number goes up even more.

This year, Amazon announced it would take on another 150,000 seasonal employees—that’s essentially the equivalent of hiring the entire workforce of a company like Nike – twice.

Riverbend Indicators:

Each week we post notable changes to the various market indicators we follow.

- As a reading of our Bull-Bear Indicator for U.S. Equities (comparative measurements over a rolling one-year timeframe), we remain in Cyclical Bull territory.

- Counting up of the number of all our indicators that are ‘Up’ for U.S. Equities, the current tally is that four of four are Positive, representing a multitude of timeframes (two that can be solely days/weeks, or months+ at a time; another, a quarter at a time; and lastly, the {typically} years-long reading, that being the Cyclical Bull or Bear status).

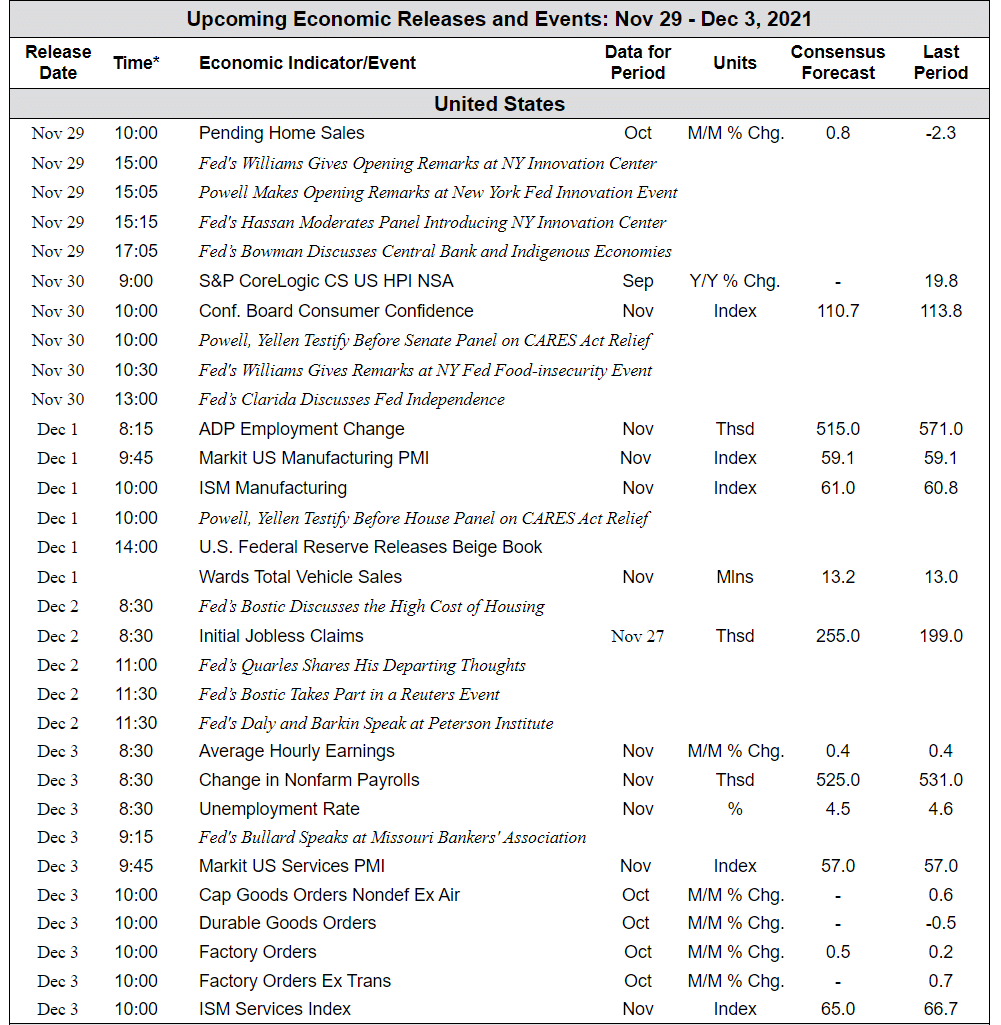

The Week Ahead:

Source: Bloomberg, TD Economics

[/fusion_text][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]