The flight to safety continues in the market as investors are closely focused on the Ukraine crisis. As a result, the market is primarily being driven by news headlines.

The trend of the S&P 500 is still in decline, below its 200-day moving average, and is struggling to stay above the lows of October 2021 (which has been acting as a level of support).

In addition, the NYSE Advance-Decline line, which measures the number of stocks going up vs going down, continues to decline.

Ideally, we will want to see the Advance-Decline line return to an upward trend as an indication that the market is recovering.

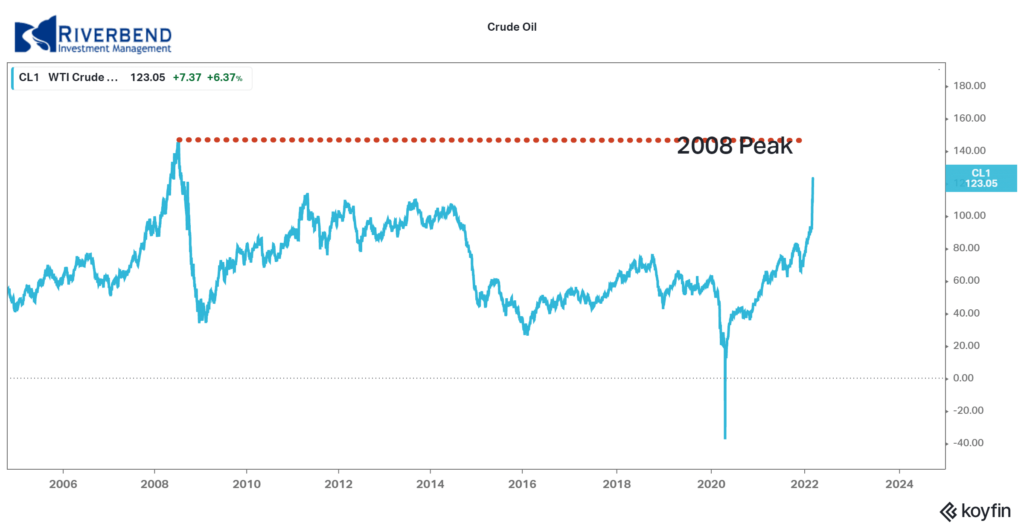

The Ukraine crisis has caused oil prices to dramatically rise. Investors are wondering if oil prices will reach their 2008 peak — which creates yet another problem for the Fed.

Typically high oil prices are both inflationary AND can cause a slowdown in economic growth.

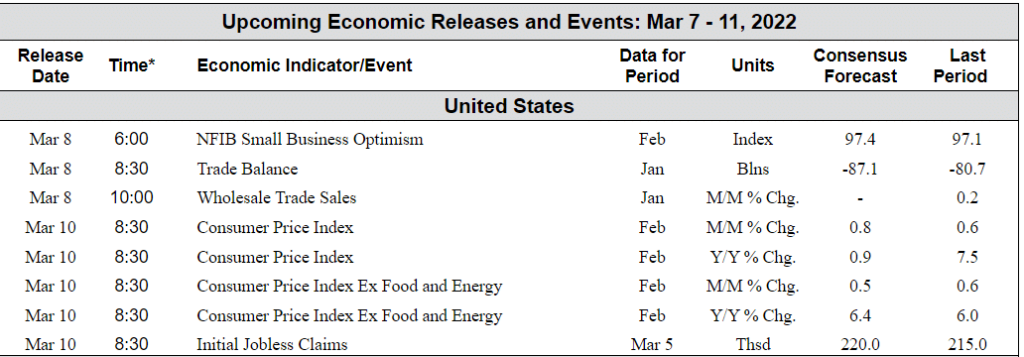

The expectations of future interest rate moves by the Federal Reserve have already been impacted by rising energy costs and the Ukraine crisis.

Previously, the market was expecting the Fed to raise rates by 1/2% during their March meeting. The expectations are now down to a 1/4% rise.

We will be closely watching the March Fed meeting to see if they will take a less aggressive stance on rates, which may help the equity markets begin a recovery process.

Chart of the Week:

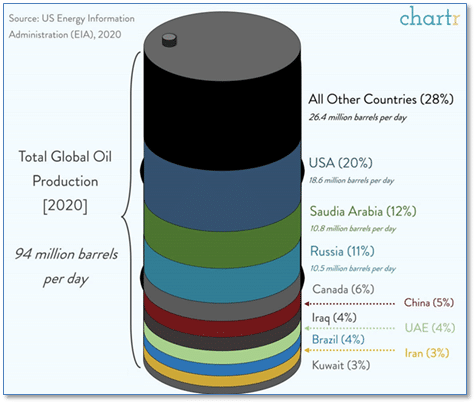

It is well known that Russia is one of the world’s largest producers of energy, both natural gas and oil. So as gas prices continue to hit new highs across the country, just how much of the world’s oil does Russia produce?

Data from the U.S. Energy Information Administration shows that Russia is currently third in the world in daily production of Brent crude oil, with 11% of the total.

The U.S.A. leads with 20% and Saudi Arabia is second at 12%.

Interestingly enough, Russia’s “Urals grade” oil is now trading at an $18 per barrel discount to Brent as buyers are bypassing Russian oil in favor of other exporters.

The Week Ahead:

Source: Bloomberg, TD Economics