[fusion_builder_container hundred_percent=”no” equal_height_columns=”no” menu_anchor=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”center center” background_repeat=”no-repeat” fade=”no” background_parallax=”none” parallax_speed=”0.3″ video_mp4=”” video_webm=”” video_ogv=”” video_url=”” video_aspect_ratio=”16:9″ video_loop=”yes” video_mute=”yes” overlay_color=”” video_preview_image=”” border_size=”” border_color=”” border_style=”solid” padding_top=”” padding_bottom=”” padding_left=”” padding_right=””][fusion_builder_row][fusion_builder_column type=”1_1″ layout=”1_1″ background_position=”left top” background_color=”” border_size=”” border_color=”” border_style=”solid” border_position=”all” spacing=”yes” background_image=”” background_repeat=”no-repeat” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” margin_top=”0px” margin_bottom=”0px” class=”” id=”” animation_type=”” animation_speed=”0.3″ animation_direction=”left” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” center_content=”no” last=”no” min_height=”” hover_type=”none” link=””][fusion_text]

Inflation continues to be a hot topic for investors as markets adapt to worsening supply chain disruptions. However, not all inflation is the same and today’s environment requires a clear understanding of what’s driving prices higher. More importantly, this can affect portfolios and financial plans in different ways.

How should investors react to today’s inflation rates with the right perspective?

All investors understand that the prices of individual goods and services can be affected by supply and demand. Common sense tells us that when supply falls and/or demand rises in a competitive market, prices will tend to rise.

This is true whether we’re talking about used cars, lumber, houses, computers, sneakers or concert tickets. Business owners are faced with balancing these factors every day.

In cases where supply is artificially disrupted, there can be a “deadweight loss” to society since there are willing buyers who miss out – not just because prices are temporarily high, but because there may simply not be enough goods available.

Recent examples are toilet paper and hand sanitizer at the start of the pandemic when a surge in demand caused widespread shortages. Governments and businesses can try to control prices or impose quotas but this doesn’t solve the underlying problem and can create its own imbalances.

While challenging, few economists would describe the situations above as “inflationary.” Instead, the term inflation usually refers to a broad-based increase in prices across an economy.

Historically, these price increases are attributed to factors that can affect the macro-economy, like monetary policy or an overheating growth rate.

This is what makes today’s situation unique.

Prices are rising across the board not necessarily because of the Fed, but because bottlenecks in today’s global world affect nearly all industries. This is akin to the supply curves of these industries all being impacted at once and is not dissimilar to the oil crisis of the 1970s.

Headlines like this are now becoming the new normal:

Just as there is no way to avoid higher energy costs, there is no way to avoid long delays for the materials and supplies that businesses and consumers need. This reduces availability and raises costs.

Thus, when investors talk about “inflation” today, what they really mean is “supply chain disruptions.” Similarly, when investors debate whether higher inflation is “transitory” or not, they are really debating whether they are due to short- and medium-term supply problems or longer-term factors such as Fed policy.

How this is resolved requires a combination of macro forces related to global energy and port capacity, and micro forces on an industry-by-industry basis. Still, the longer this goes on, the more it will affect inflation expectations among businesses, consumers and financial markets.

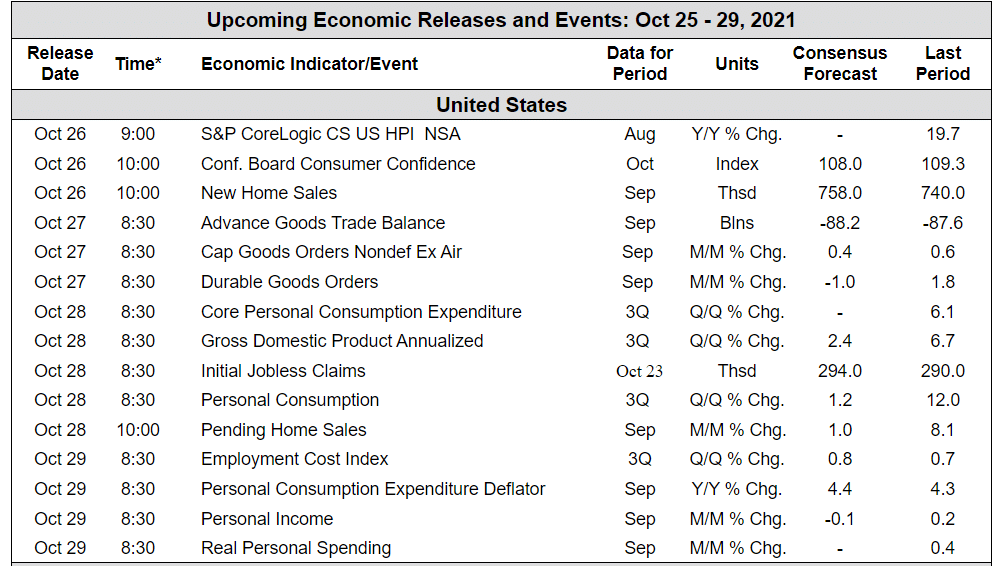

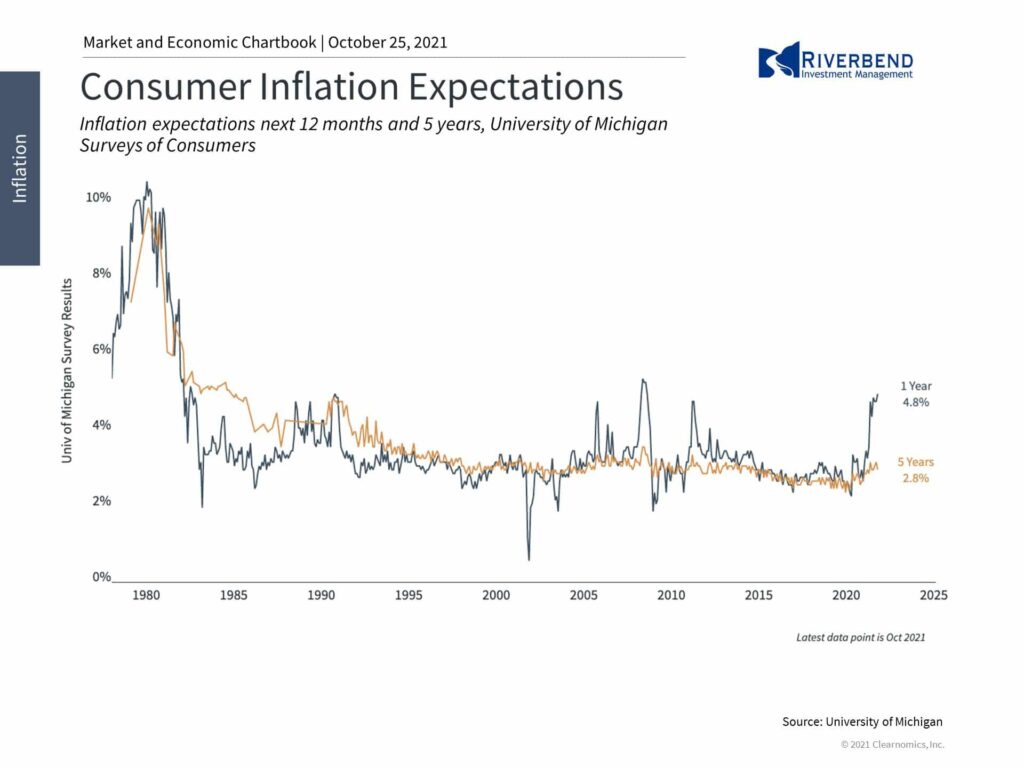

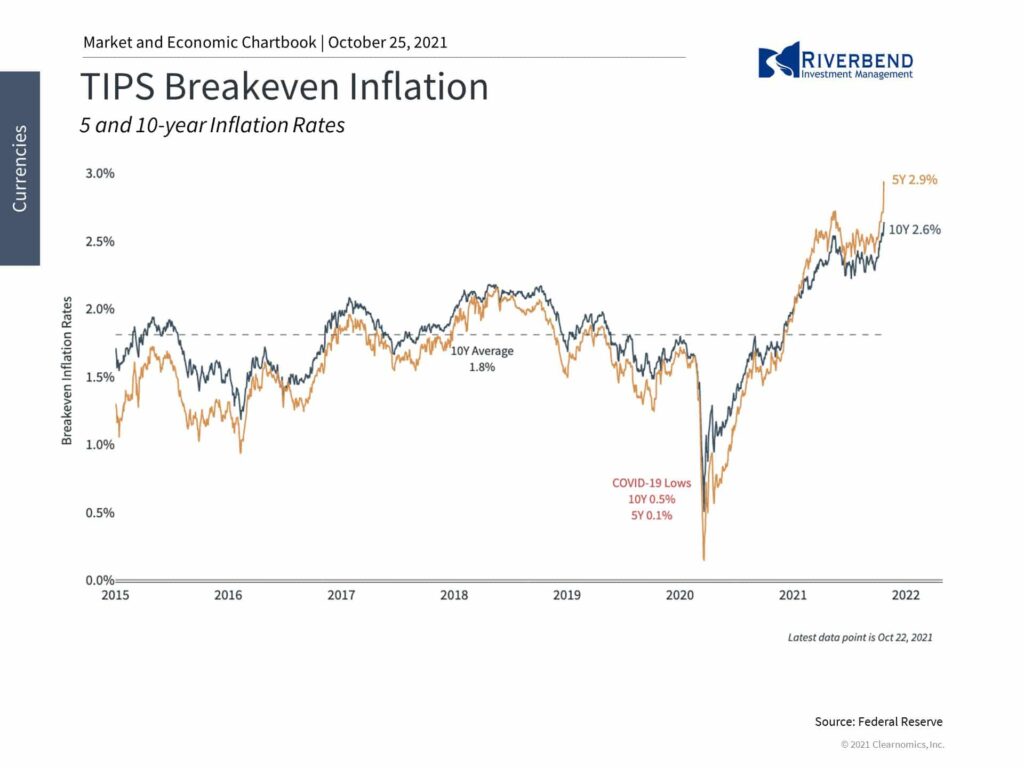

Both TIPS breakeven inflation rates and inflation expectations from the University of Michigan’s Surveys of Consumers are near multi-decade highs. Other measures, such as CPI, PCE and PPI, are also near record levels. Only time will tell if they begin to fall once the year-on-year comparisons to the pandemic fade.

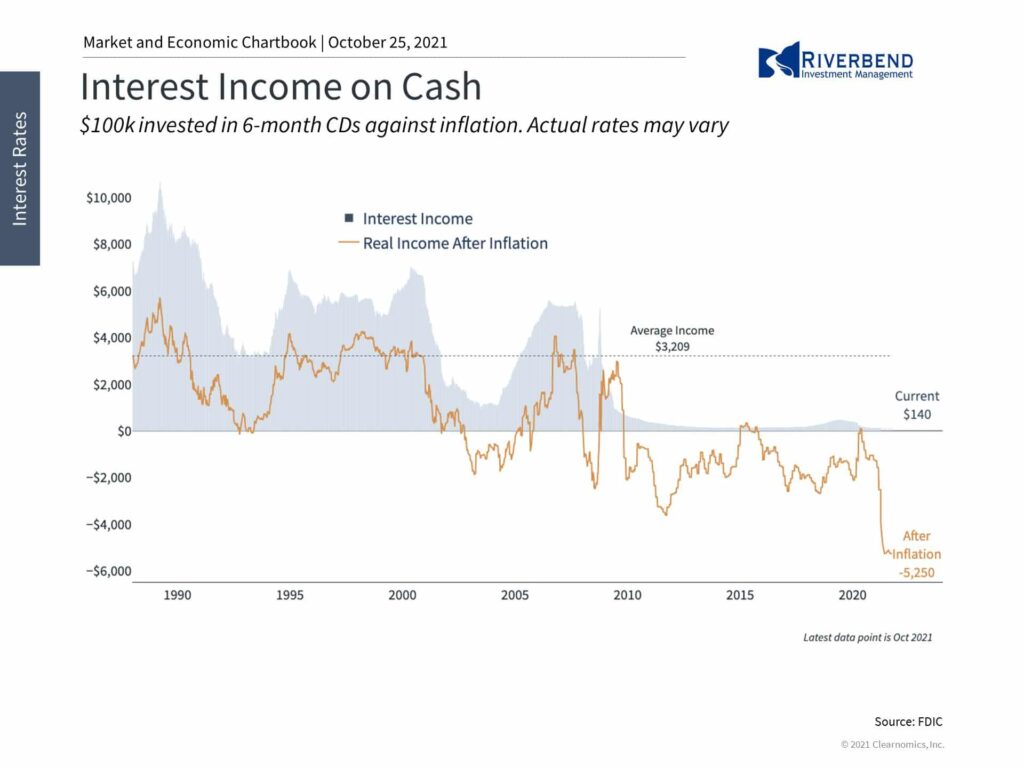

For savers, inflation slowly erodes the value of hard-earned cash. If your daily purchases cost more, it doesn’t really matter if it’s due to factory shutdowns in Asia or the size of the Fed’s balance sheet – the effect on a household’s bottom line is the same.

Unlike traditional gains and losses which are explicit on a monthly statement, the balance in one’s checking account may stay the same. However, the amount of goods and services that can be purchased with that cash will fall silently over time.

For investors, different causes of inflation can have a big impact on portfolio strategy. Slow and steady inflation lends itself to assets that match this time horizon, possibly including TIPS, real assets and more.

Sudden spikes in prices due to supply constraints may lend themselves more to sector and industry tilts. Over time, the differences between these two causes may be blurred – but long-term expectations have yet to rise to the same extent.

Ultimately, it’s important for investors to maintain perspective on today’s price increases. Inflation is a reason to stay invested to offset the negative impact to purchasing power.

Chart of the Week:

Source: BCO Research

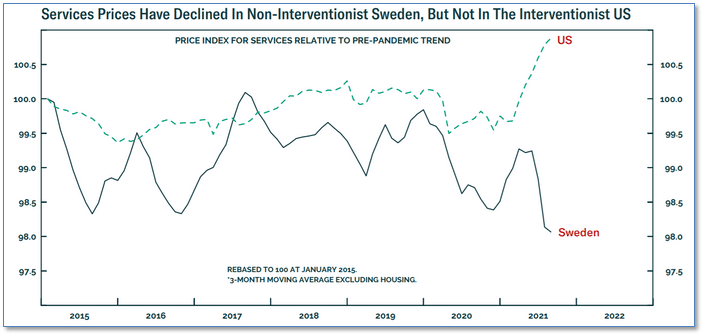

As inflation in the United States is now more than double the Federal Reserve’s stated target of 2% inflation, economists have been at odds on whether this is ‘transitory’ or just the beginning of a new monetary trend.

With the vast majority of the developed world instituting economic lockdowns and massive government stimulus to combat the COVID‑19 pandemic, it makes sense that this would fuel inflation in modernized countries with just-in-time supply chains, negligible spare capacity…and then sudden injections of massive stimulation from governments.

However, there is one country that stood alone bucking the global trend—Sweden. That country did not mandate shutdowns or lockdowns and consequently saw no need to over-stimulate the Swedish economy since everyone was still working.

Now Sweden’s services inflation level is about 3 percentage points less than the U.S., and within its “normal” range.

So the question now facing investors (and the Fed), is will the US follow suit and see its inflation decline — or will the massive current and proposed stimulation continue to generate unmet demand and consequent inflation?

Riverbend Indicators:

Each week we post notable changes to the various market indicators we follow.

- As a reading of our Bull-Bear Indicator for U.S. Equities (comparative measurements over a rolling one-year timeframe), we remain in Cyclical Bull territory.

- Counting up of the number of all our indicators that are ‘Up’ for U.S. Equities, the current tally is that four of four are Positive, representing a multitude of timeframes (two that can be solely days/weeks, or months+ at a time; another, a quarter at a time; and lastly, the {typically} years-long reading, that being the Cyclical Bull or Bear status).

The Week Ahead:

Source: Bloomberg, TD Economics

[/fusion_text][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]