The stock market’s bumpy ride continued during February. Last month’s top news story was rising geopolitical tensions and Russia’s invasion of Ukraine.

The headlines briefly pushed the S&P 500 into correction territory, which is defined as a -10% or greater price decline, before U.S. stocks recovered a portion of their losses.

International equities also traded lower as investor risk appetites declined due to rising geopolitical risk.

In the commodity market, energy prices increased amid fears the geopolitical tensions would disrupt oil output and worsen an already under-supplied oil market.

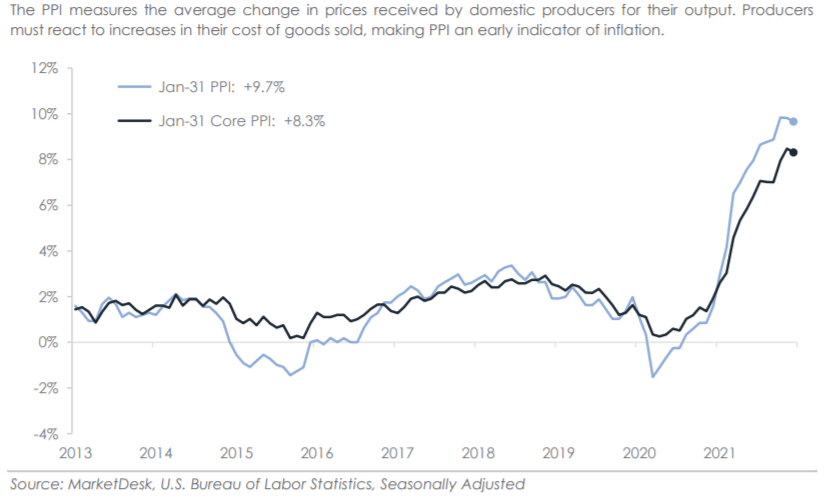

Back in the U.S., markets prepared for the Federal Reserve to raise interest rates. The headline Consumer Price Index, which measures inflation, rose +7.5% year-over-year during January 2022.

It was an increase from December 2021’s +7.1% and the fastest annual increase since 1982.

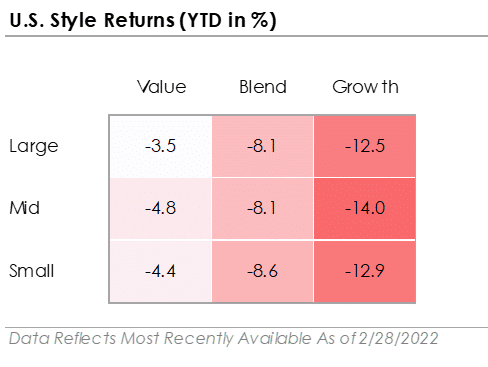

Treasury yields moved higher for a second consecutive month, an indication that investors expect the Federal Reserve to aggressively raise interest rates to ease inflation pressures. Rising yields led to a second straight month of negative credit returns and Growth stocks underperforming Value stocks.

The Federal Reserve will hold its March 2022 meeting from March 15th-16th. It is widely anticipated the Federal Reserve will raise interest rates by one of two amounts ― either +0.25% or +0.50%.

Although the 0.25% difference between the two options may seem insignificant, we believe the decision will chart the course for the remainder of 2022.

If the Federal Reserve only raises the interest rate by +0.25%, investors may interpret the smaller increase as a sign the Federal Reserve will keep interest rates lower for longer, inferring economic growth will be less impacted.

If the Federal Reserve raises the interest rate by +0.50%, investors may view the faster pace of interest rate increases as more likely to slow economic growth and potentially trigger a recession. The takeaway is investors will be watching the Federal Reserve’s next move very closely as it will set the course for the remainder of 2022.

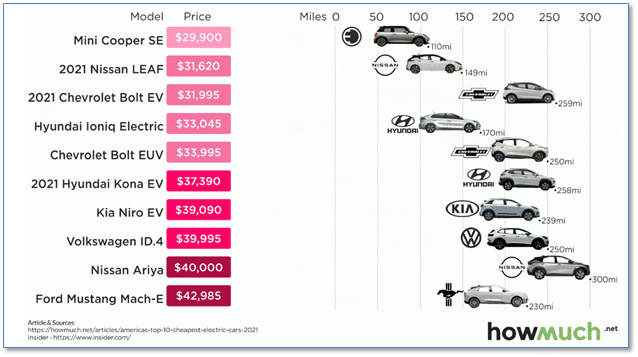

Chart of the Week:

So just how far can America’s top 10 cheapest electric cars go on a single charge?

Financial website HowMuch.net found the average distance most electric cars can travel per charge is around 220 miles, but with a wide variation.

For purposes of their comparison, “cheapest” means an average cost between roughly $30,000 and $40,000.

The Ford Mustang Mach-E tops the list as the most expensive electric car at $42,985 but travels only about 230 miles. The Nissan Ariya traveled the farthest–300 miles–and came in at $40,000.

On the other end, One Mini Cooper SE was both the cheapest and the one with the smallest range of 110 miles.

Riverbend Indicators:

- As a reading of our Bull-Bear Indicator for U.S. Equities (comparative measurements over a rolling one-year timeframe), we remain in Cyclical Bull territory.

- Counting up of the number of all our indicators that are ‘Up’ for U.S. Equities, the current tally is that two of four are Positive, representing a multitude of timeframes (two that can be solely days/weeks, or months+ at a time; another, a quarter at a time; and lastly, the {typically} years-long reading, that being the Cyclical Bull or Bear status).

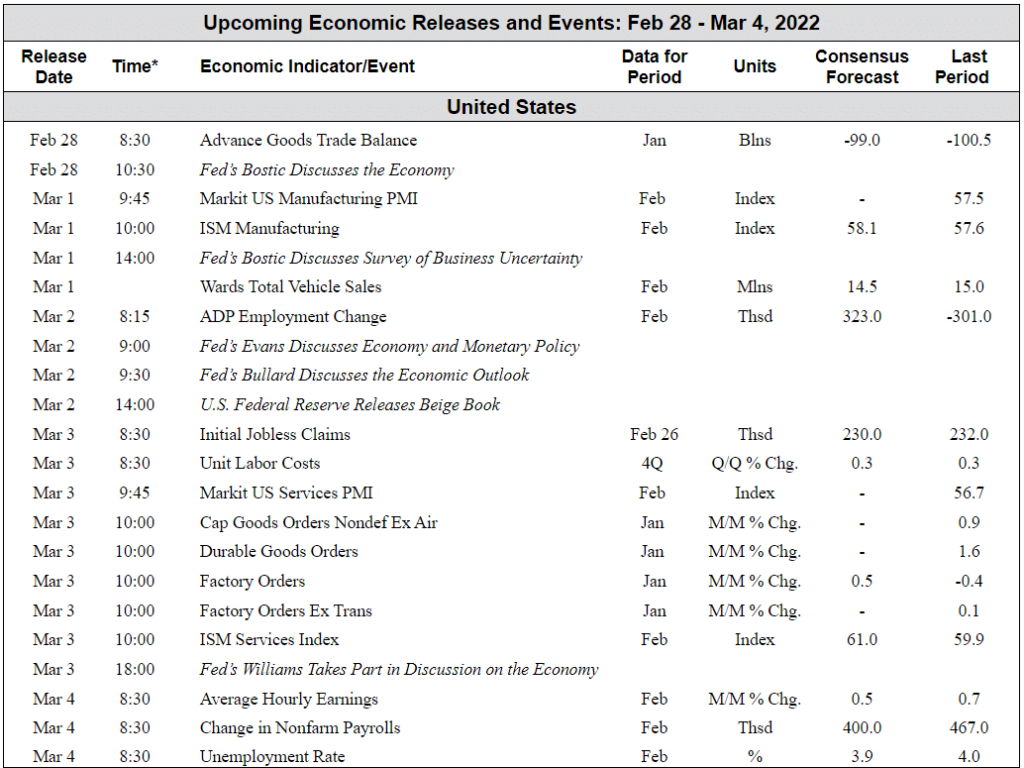

The Week Ahead: