Separately managed accounts vs mutual funds, which is the better choice for you? Separately managed accounts (SMAs) can be enormously beneficial for individual investors in today’s stock market.

So, I decided to put together this guide to help explain some of the differences between a mutual fund and a separately managed account.

Separately managed accounts are not a new concept among institutional and high-net-worth investors.

These accounts have been around since the 1970s and provided large investors an opportunity to invest in specific strategies, without some of the headaches that come with mutual funds.

Over the past two decades, individually managed accounts have become more and more popular – especially among individual investors.

SMAs accounted for just over a trillion dollars in total investment advisory assets in the first quarter of 2017.

That’s an impressive 16% increase from the previous two years—and an 84% explosion since 2010, according to data from Cerulli Associates.

A good portion of this growth can be attributed to better trading technology and costs among investment advisors and asset managers.

Today, there are numerous platforms that individual investors can use to access separate account managers with minimum account sizes of $25,000 or less (compared with $1 million minimums of the past).

What is a Separately Managed Account?

Before we go any further, let’s take a step back and discuss what a separately managed account actually is.

Investopedia describes SMAs as: “…a portfolio of assets managed by a professional investment firm. In the United States, the vast majority of such firms are called registered investment advisors and operate under the regulatory auspices of the Investment Advisors Act of 1940 and the purview of the U.S. Securities and Exchange Commission (SEC). One or more portfolio managers are responsible for day-to-day investment decisions, supported by a team of analysts, operations, and administrative staff.”

SMAs differ from mutual funds in that each portfolio is unique to a single account (hence the name) instead of being pooled together with other investors.

This allows the portfolio manager much more flexibility when managing the overall investment strategy of the accounts.

So what does that actually mean — and what benefit is it to the individual investor?

The pros and cons depend on your investor type, but I will highlight some of, what I think at least, the advantages separately managed accounts can have over other investment vehicles, such as mutual funds.

Advantages of Separately Managed Accounts vs Mutual Funds

As I mentioned above, I believe using a separately managed account strategy can be a more efficient way of investing compared to mutual funds.

(However, I should note, that I may be a bit biased as I managed multiple SMA accounts for clients.)

SMAs Can Provide Investors with More Adaptable Strategies

Individually managed accounts have much more flexibility when it comes to investment strategy due to the fact that mutual funds are governed by prospectus, and SMAs are not.

If you have ever invested in a mutual fund, you should have received a copy of the fund’s prospectus.

The prospectus lists out useful items such as:

- Description of investment strategy

- Breakdown of historic expenses such as management fees, 12b-1 fees, sales loads, redemption fees, etc.

- The major risks you are likely to face when investing in a particular mutual fund.

- Control persons and principal owners of the fund

- Information about the managers of the mutual fund assets

- Portfolio turnover rate

The idea behind a prospectus is to provide more transparency for an investor. However, the creation of this document was first introduced by the Securities Act of 1933. Since then, in my opinion, they have become bloated “booklets” that most individual investors find too long or confusing to read.

SMAs are mostly managed by registered investment advisors. They are required to provide investors with an ADV brochure that lists information about the firm, investment advisor, fees, and services.

Notice anything missing from the ADV brochure?

Yep, no restrictions on strategy.

This gives the investment advisor much more flexibility with the overall portfolio strategy.

Typically a prospectus will limit a fund’s strategy to specific sectors, asset classes, and how much cash the fund is allowed to hold. While becoming more common, it is still rare for large and established mutual funds to be able to move to 100% cash during volatile stock market cycles.

The problem I see nowadays is markets are rapidly changing. A fund that was created in the year 2000 is following a strategy (as outlined in the prospectus) pre iPhones, Tesla, and the rise of Netflix streaming.

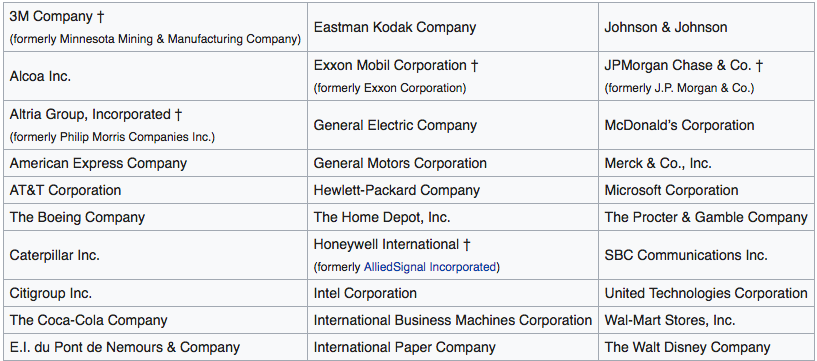

Additionally, major indices such as the Dow Jones Industrial Average have undergone changes:

Here is what the Dow looked like back in 2003:

And here is what it looks like today:

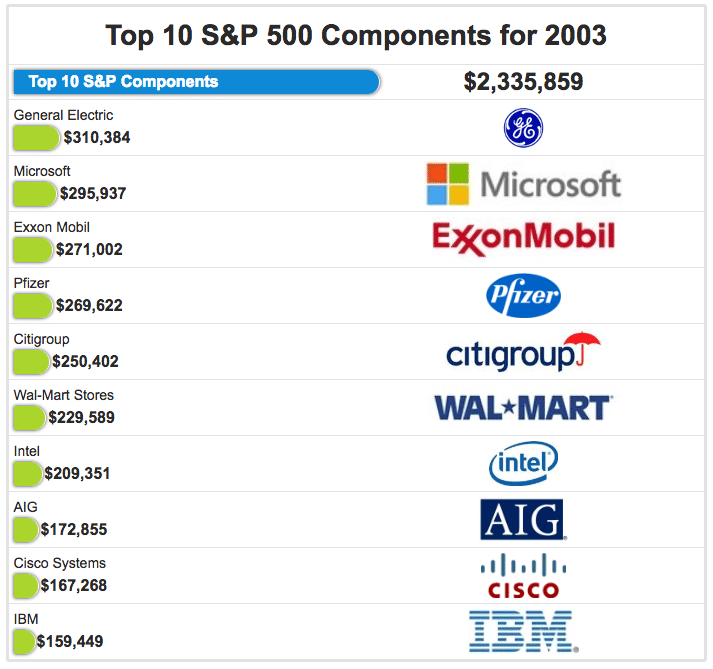

The S&P 500 Index has also gone through some changes.

Here are the top 10 companies in the S&P 500 back in 2003:

source etfdb.com

The top 10 holdings look a bit different today as well:

Source State Street

The point I am trying to show is that the investment strategies that were in place 15-20 years ago are based on a stock market that looks very different than today. Mutual funds that use an active investment strategy are being limited by a prospectus created during an entirely different market cycle.

Using an Active Investment Strategy in Separately Managed Accounts

Since investment advisors using a separately managed account structure are not being limited by a prospectus, they have much more flexibility on their clients’ portfolio strategy.

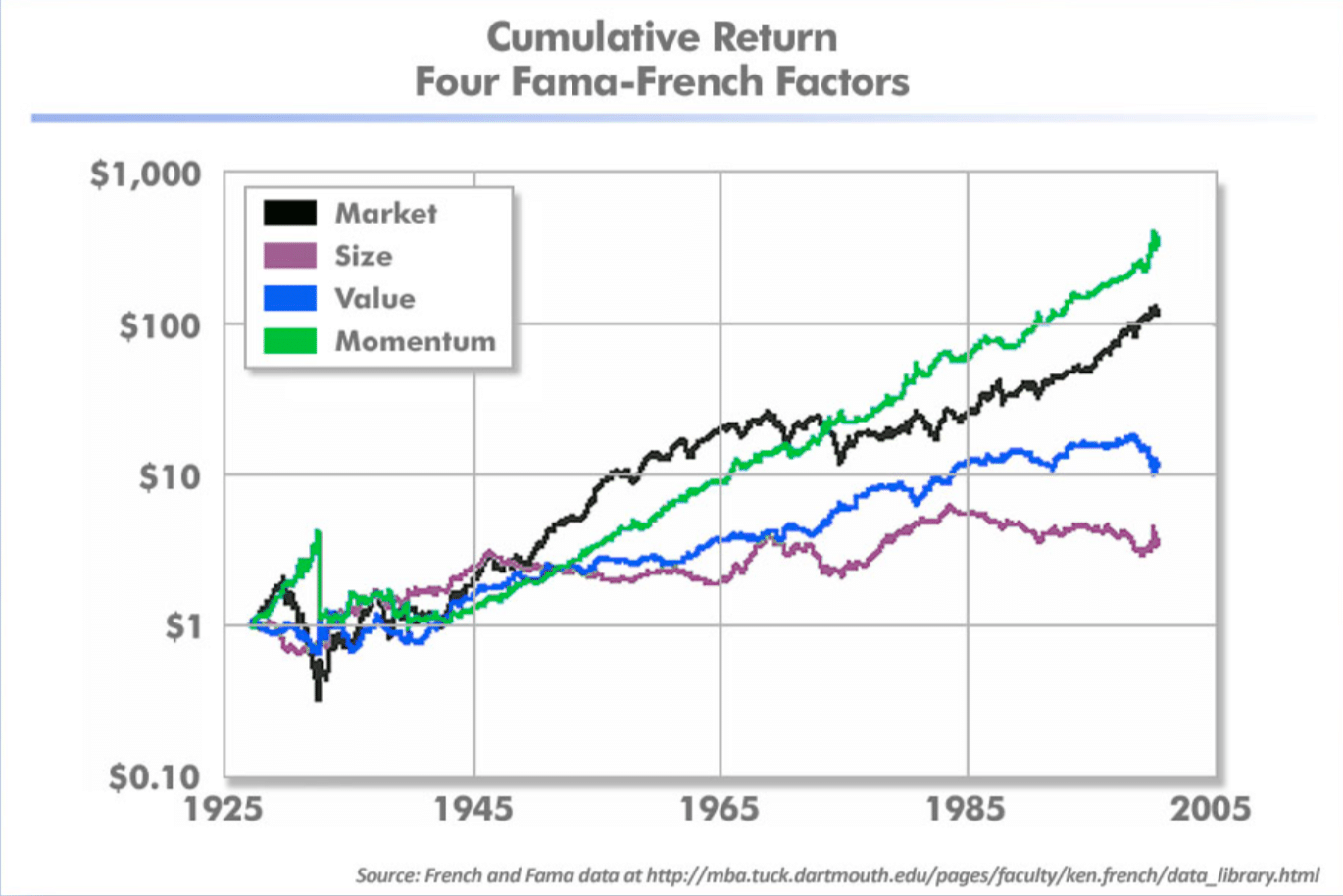

For example, here at Riverbend, we use an ETF strategy that is based on momentum and volatility. This gives us an opportunity to invest a client’s portfolio in only the strongest asset classes (as defined by relative strength).

We also have the ability to manage risk at a predetermined level, which allows us to rotate from an equity strategy into a capital preservation strategy during volatile markets.

Separately Managed Accounts vs Mutual Funds: Tax Benefits

Investors are increasingly concerned with after-tax returns. Investing in an actively managed equity mutual fund vs an SMA tends to be tax-inefficient for many individuals.

Mutual funds are known as pass-through investments. This means the fund must pass through to investors any realized income and capital gains.

Realized capital gains or losses can result from the portfolio manager trading and/or managing investor cash-flow activity.

Sometimes mutual fund investors are surprised when they receive taxable capital gains distributions even though they haven’t sold the mutual fund itself.

An individual who utilizes an SMA owns the portfolio’s securities directly. This means that there are opportunities to control, and perhaps minimize, the distribution of taxable gains.

Mutual Funds and the Problem with Embedded Gains

One example I like to use to demonstrate this concept is to look at the embedded capital gain exposure of some of the more popular stocks from the past.

Source Morningstar

Looking back at 2003, a taxable mutual fund investor that thought he/she was “investing at a great time” due to the 2000-2001 market sell-off, is actually hurting themselves.

The fund investor has now exposed him/herself to taxable gains from previous investors.

This is one of those times when a fund investor is surprised to receive a tax bill, even if the value of the fund has declined.

One last point about tax efficiency…

Should an investor wish to change mutual funds, they will need to sell the fund itself, resulting in a potential capital gains tax. The investor then buys the new fund with the proceeds.

The mutual fund investor:

- Potentially owes a capital gains tax.

- May have embedded gains in the new fund.

- Has paid taxes on fund gains, to then turn around and buy the same stocks again through a different fund.

The investor that is using the SMA owns the stocks within the portfolio.

If they want to switch portfolio managers/strategies the new portfolio manager will not need to re-purchase overlapping stocks –and– can work with the client on how to best offset any capital gains from stocks that are being sold.

Better Relationship with the Portfolio Manager

This leads me to my next point – clients have a better working relationship with the portfolio manager.

The majority of mutual fund investors never speak with the person who is actually managing their money.

SMA investors have a much different experience.

Since a large number of separate account managers are small business owners, they tend to be more involved with clients and day-to-day operations. In essence, the portfolio manager is working for his/her own company instead of working for a nameless corporation.

This allows SMAs to reduce the various levels between a client and portfolio manager, with many having one-on-one working relationships.

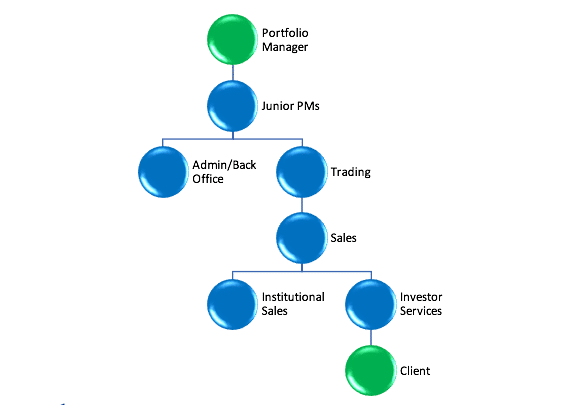

Client – Mutual Fund Relationship

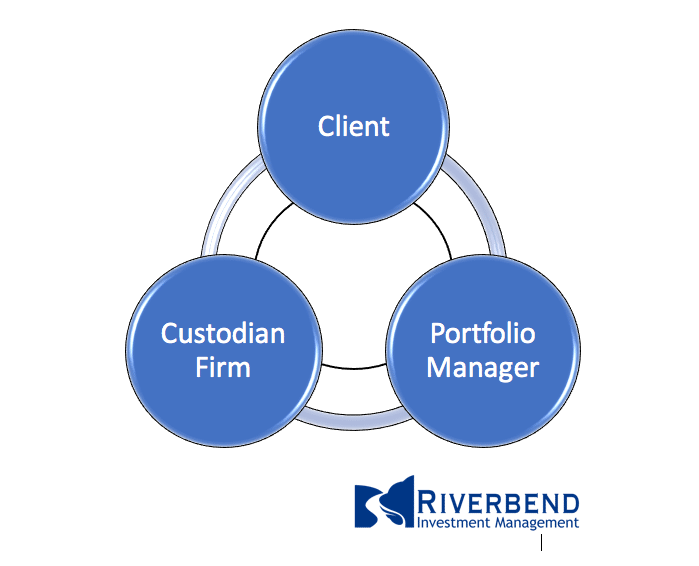

Client – Separately Managed Account Manager Relationship

Transparency: SMAs vs Mutual Funds

“Window Dressing”

Mutual funds will typically share the fund’s holdings with investors at the end of every quarter. Fund holders have no idea what the portfolio manager is or isn’t investing in between that time frame.

This leads to the problem of window dressing.

To window dress, the fund manager will sell stocks that had large losses, and purchase high-flying stocks near the end of the quarter, giving the illusion that the fund has held these high-performing stocks throughout the quarter.

When fund managers are more concerned about the appearance of performance than actual performance, portfolios are compromised. Investors are hurt. Trust is eroded.

Full Transparency

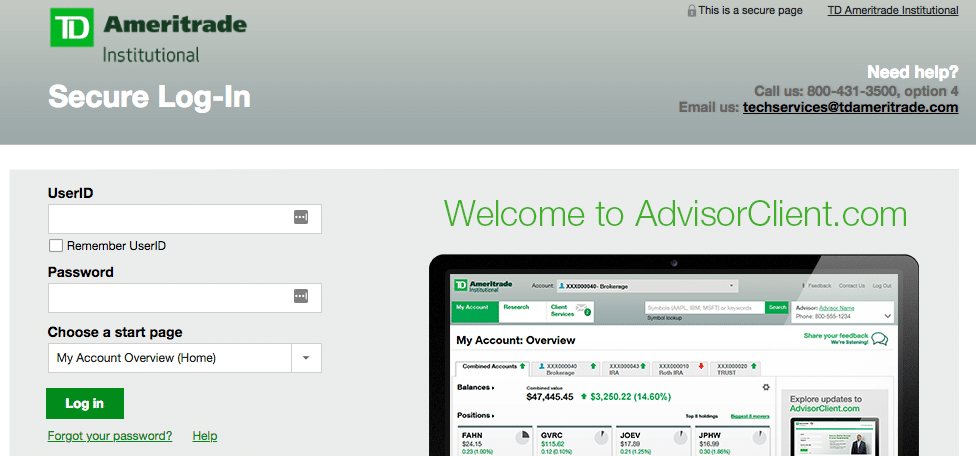

Separately managed account clients have the ability to view their portfolios at any time.

Investors have access to the portfolio 24 hours a day and 7 days a week – and can see in real-time every holding, trade, share price position, and cost that has been taken in the portfolio. Nothing is hidden.

Separately Managed Account Clients can access the custodian’s website and view portfolio holdings 24/7

What Type of Investor Should Use SMAs?

Mutual funds are better suited for smaller investors. Typically a mutual fund minimum will range from $500 to $1000.

The smaller account requirement gives investors the opportunity to build a diversified portfolio without needing to work with an investment advisor, who may have a higher minimum.

For larger investors, separately managed accounts can provide an opportunity to become more tax efficient, participate in various actively managed investment styles, and have better transparency of their portfolio.

3% Better Rate of Return?

Lastly, clients that can work with an investment advisor may have better returns.

Vanguard released a study showing that working with an investment advisor has the potential to add an extra 3% to a portfolio’s gains.

Source: Vanguard