[fusion_builder_container hundred_percent=”no” equal_height_columns=”no” menu_anchor=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”center center” background_repeat=”no-repeat” fade=”no” background_parallax=”none” parallax_speed=”0.3″ video_mp4=”” video_webm=”” video_ogv=”” video_url=”” video_aspect_ratio=”16:9″ video_loop=”yes” video_mute=”yes” overlay_color=”” video_preview_image=”” border_size=”” border_color=”” border_style=”solid” padding_top=”” padding_bottom=”” padding_left=”” padding_right=””][fusion_builder_row][fusion_builder_column type=”1_1″ layout=”1_1″ background_position=”left top” background_color=”” border_size=”” border_color=”” border_style=”solid” border_position=”all” spacing=”yes” background_image=”” background_repeat=”no-repeat” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” margin_top=”0px” margin_bottom=”0px” class=”” id=”” animation_type=”” animation_speed=”0.3″ animation_direction=”left” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” center_content=”no” last=”no” min_height=”” hover_type=”none” link=””][fusion_text]

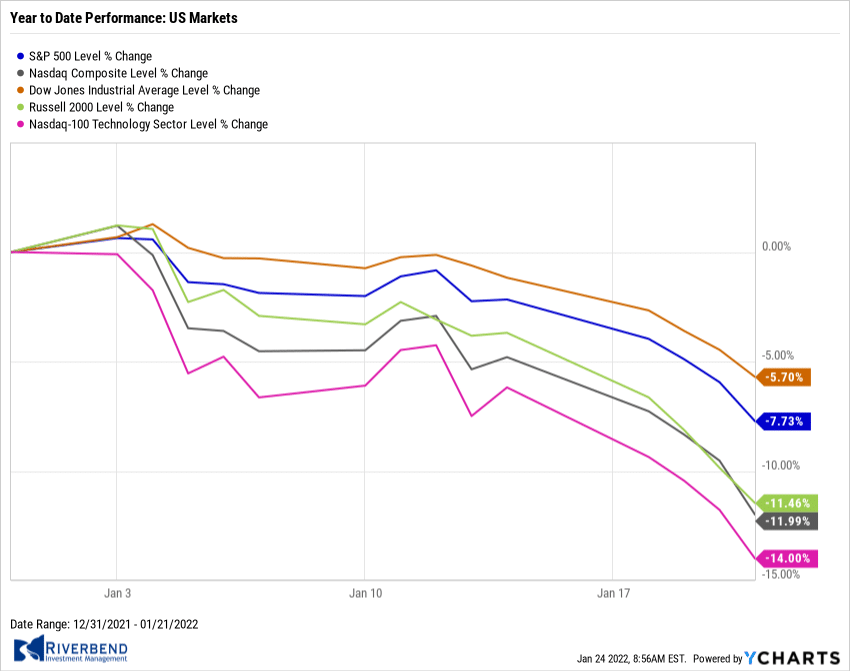

The US equity markets have begun to adjust to the realities that the Fed will need to get more aggressive than expected to combat rising interest rates.

This has been impacting the tech sector the hardest during 2022, and now, investors are starting to move away from the broader market as well.

In addition to worrying about rising interest rates, the economy looks like it is starting to weaken. This presents a potentially large problem for the Fed, as we may be entering a period of stagflation (slowing growth plus inflation).

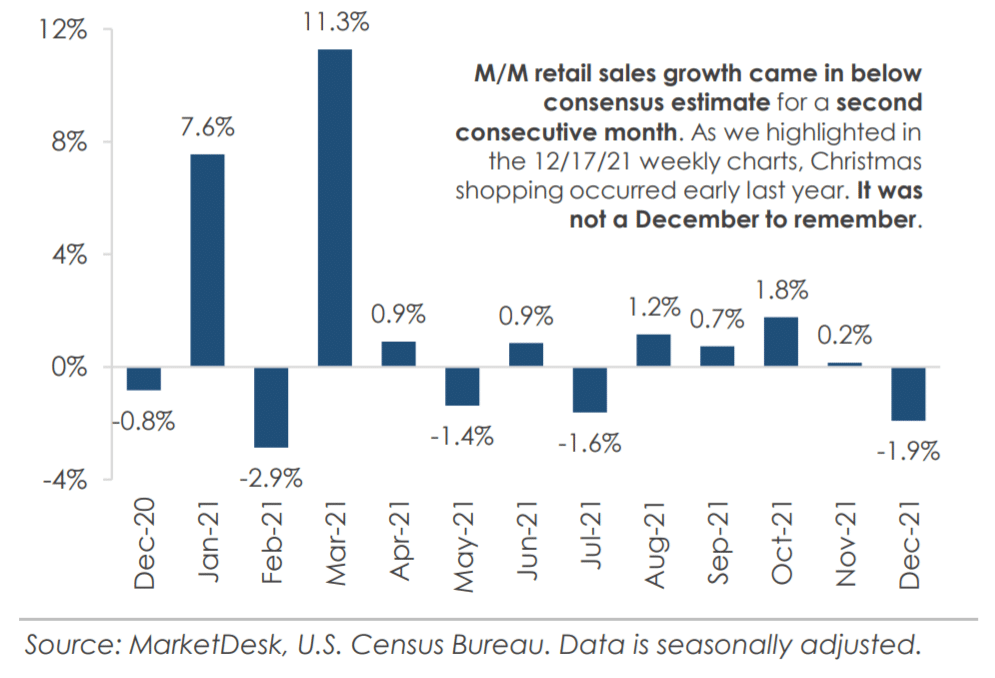

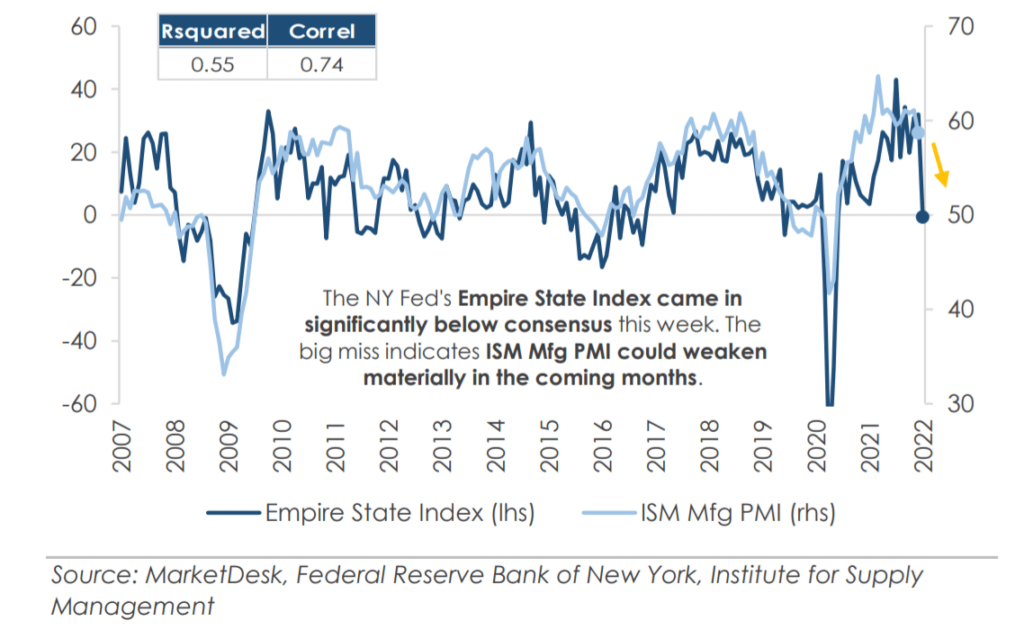

Growth within the retail sector was below expectations for the past 2 months. In addition, the NY Fed’s Empire State Index dropped sharply last week – indicating that the manufacturing sector could begin to weaken in the coming months.

As a result, our Riverbend market indicators have begun to flash “sell” signals across all our models.

In our client portfolios, we began to raise cash/hedge last week and will continue to allocate into cash/safe-haven asset classes until the market begins to strengthen again.

Below is our primary trend indicator. While there is no indicator that is correct 100% of the time, I find that our trend indicator does a good job of getting us out of harm’s way during declining markets.

Occasionally the signal is false and quickly corrects itself — but as a risk manager, I’d rather give up 1-3% on a false signal vs a 20%+ decline in a portfolio.

On Friday, it provided a sell signal for the first time since February 2020:

Short term, the market is oversold. I wouldn’t be surprised to see additional volatility as short-term traders/computer algos try to take advantage of short-term moves.

During this time, we may see more and more investors take any short-term rise in the market as an opportunity to continue to move to the sidelines.

Riverbend Indicators:

- As a reading of our Bull-Bear Indicator for U.S. Equities (comparative measurements over a rolling one-year timeframe), we remain in Cyclical Bull territory.

- Counting up of the number of all our indicators that are ‘Up’ for U.S. Equities, the current tally is that two of four are Positive, representing a multitude of timeframes (two that can be solely days/weeks, or months+ at a time; another, a quarter at a time; and lastly, the {typically} years-long reading, that being the Cyclical Bull or Bear status).

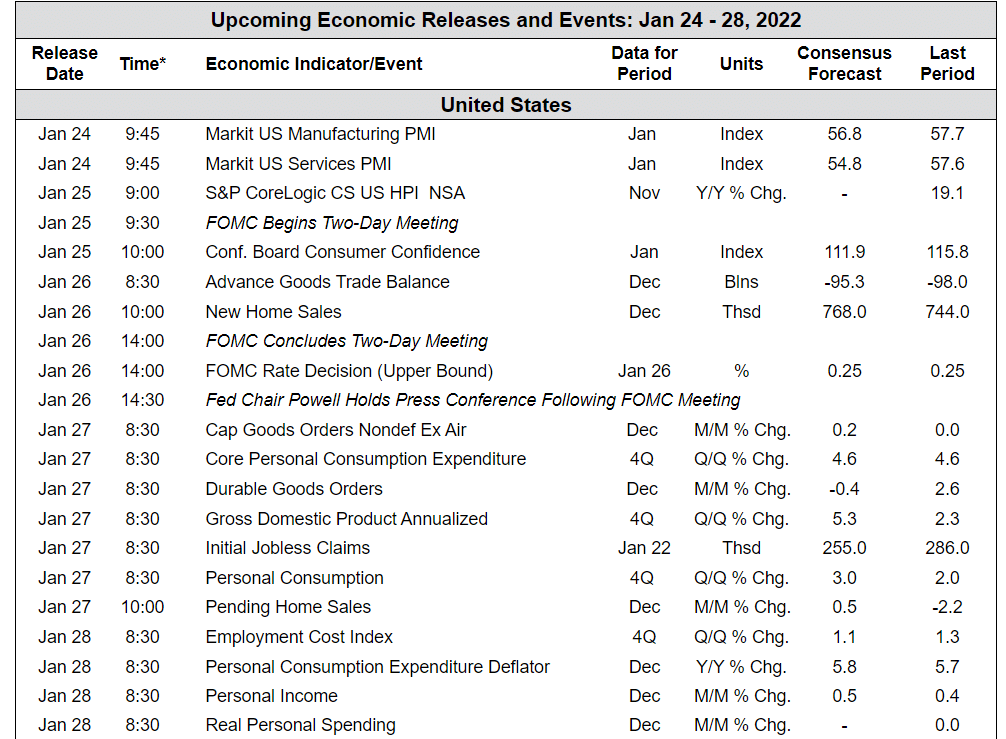

The Week Ahead:

[/fusion_text][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]