[fusion_builder_container hundred_percent=”no” equal_height_columns=”no” menu_anchor=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”center center” background_repeat=”no-repeat” fade=”no” background_parallax=”none” parallax_speed=”0.3″ video_mp4=”” video_webm=”” video_ogv=”” video_url=”” video_aspect_ratio=”16:9″ video_loop=”yes” video_mute=”yes” overlay_color=”” video_preview_image=”” border_size=”” border_color=”” border_style=”solid” padding_top=”” padding_bottom=”” padding_left=”” padding_right=””][fusion_builder_row][fusion_builder_column type=”1_1″ layout=”1_1″ background_position=”left top” background_color=”” border_size=”” border_color=”” border_style=”solid” border_position=”all” spacing=”yes” background_image=”” background_repeat=”no-repeat” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” margin_top=”0px” margin_bottom=”0px” class=”” id=”” animation_type=”” animation_speed=”0.3″ animation_direction=”left” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” center_content=”no” last=”no” min_height=”” hover_type=”none” link=””][fusion_text]

Corporate earnings season for the third quarter is already off to a strong start. Investors are watching these reports closely as concerns over supply chain bottlenecks, the delta variant, rising rates and other factors threaten company bottom-lines.

Although markets have been more volatile in recent weeks, strong profitability has helped stock market gains this year. What can investors expect from corporate profits in the quarters ahead?

Earnings fully recovered from the pandemic lockdowns during the second quarter of the year, rising alongside the broader economy. Third-quarter earnings will likely show that S&P 500 companies generated about $185 per share over the previous twelve months, a significant recovery from $133 at its worst point.

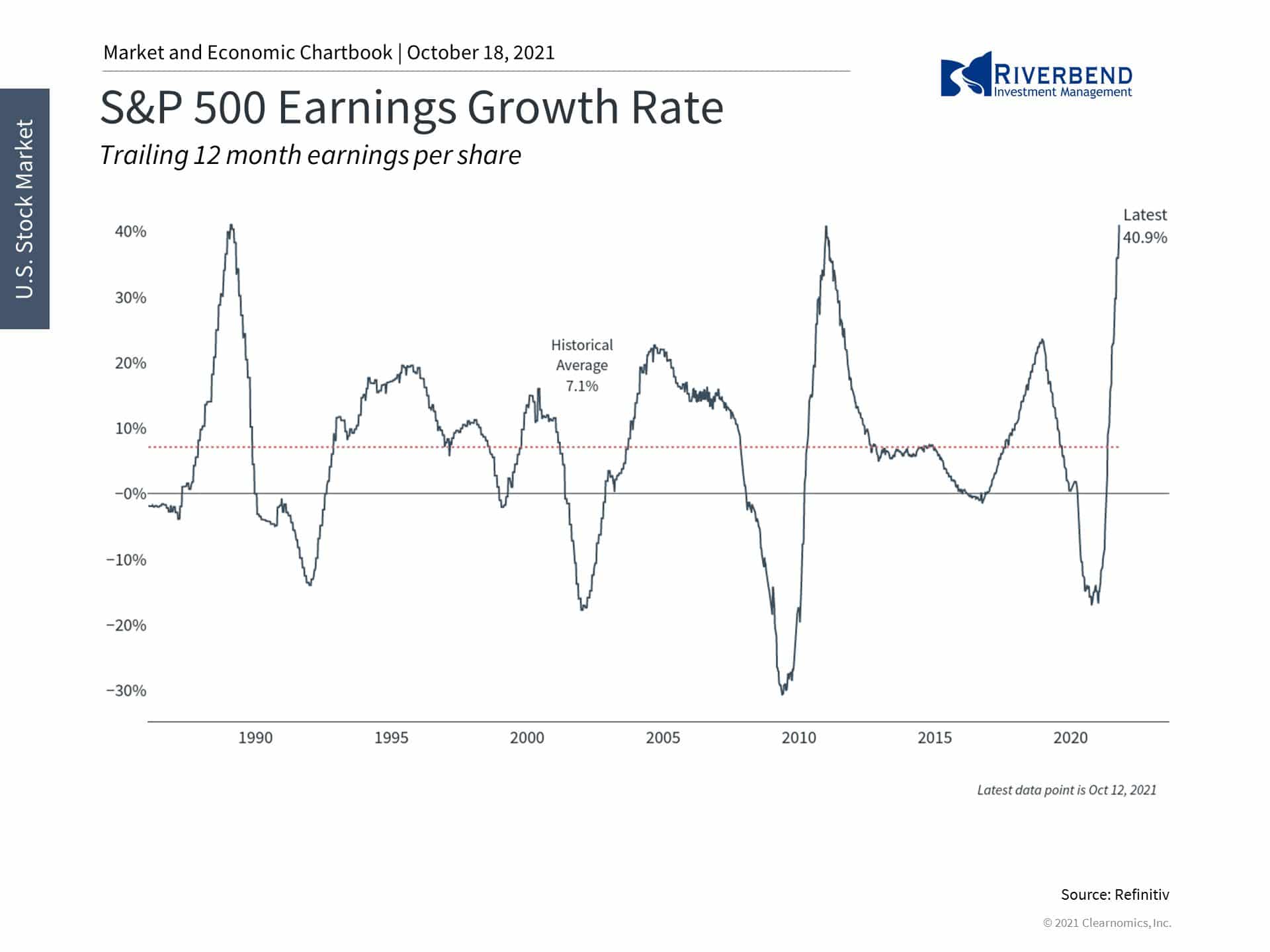

The growth rate of S&P 500 earnings-per-share has accelerated in recent quarters and is expected to reach 46% at the end of the year. While this is partly due to the rebound from the low last year, this growth rate is expected to remain above average over the next two years:

Full-year 2021 could see $197 per share which would represent an astounding 46% growth rate. Profits are then expected to grow nearly 10% each of the next two years.

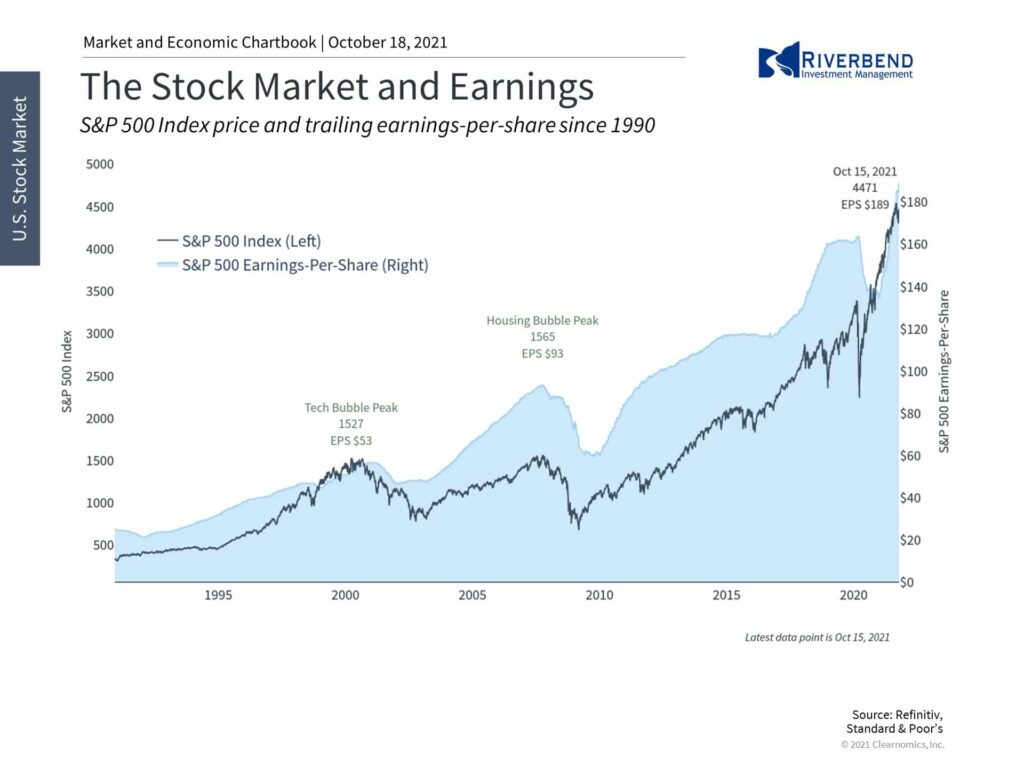

If this occurs, it would be good news since earnings are what drive the stock market in the long run. This is because investors don’t invest in the economy directly. Instead, when the economy grows, companies generate more revenues which can funnel down to greater earnings. This, in turn, supports stock prices over time.

Rising profits have supported stocks which are near all-time highs. This is true not only over the past year but across cycles, since earnings are a primary driver of bull markets. Over time, this will also help to deflate valuation levels.

So, although investors tend to focus on day-to-day market moves which are driven by multiples, long-term profits are what provide the foundation on which stock markets rise over years and decades.

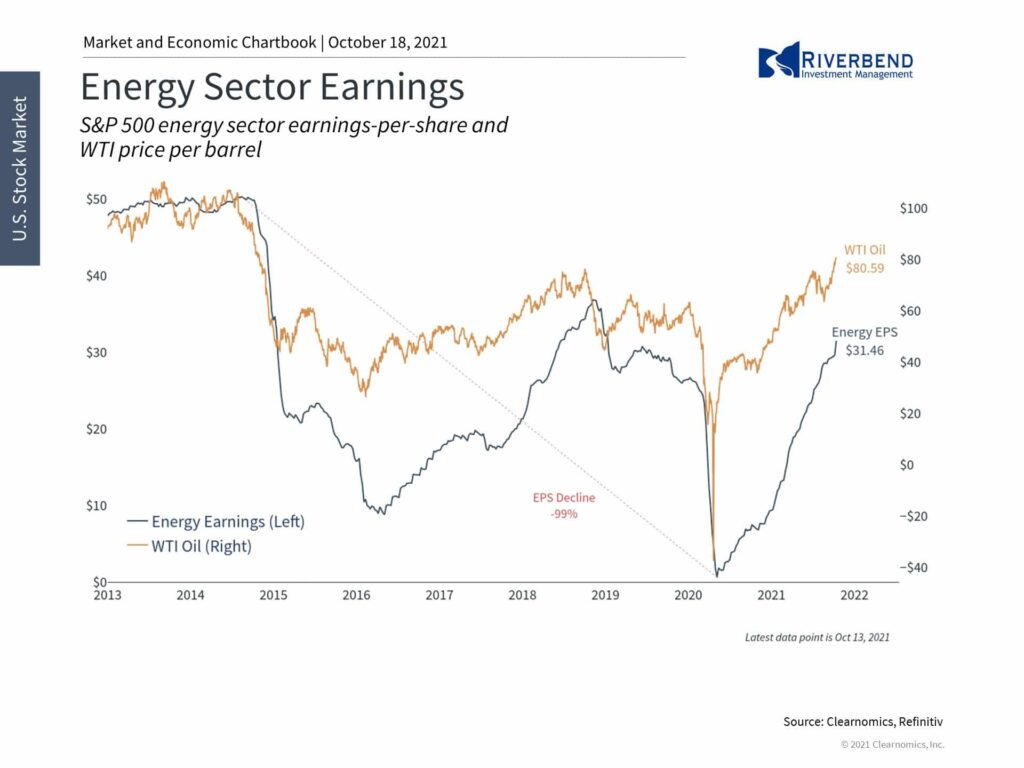

Even sectors which had been left behind the past several years have seen a rebound. The energy sector, for instance, had struggled due to an oversupply of oil and gas prior to the pandemic. With energy prices now at multi-year highs, energy sector profits are expected to reach their highest levels in over three years with the fastest growth rate for the S&P 500.

In fact, all eleven sectors are expected to experience positive earnings growth with industrials and consumer discretionary rounding out the three fastest groups.

The big question that investors will seek to answer is whether ongoing supply constraints will impact corporate profits in future quarters. So far, it’s been an industry-by-industry story with bottlenecks occurring alongside higher prices for final goods and services, thus offsetting their broad negative effects.

It’s fortunate that the average consumer is in a strong financial position which has allowed them to absorb higher inflation rates. This can only continue if supply issues are resolved quickly and current inflation rates prove to be “transitory.”

Ultimately, investors should continue to focus on earnings and valuations since, in the long run, they are what drive stock market returns. Although there are always uncertainties, history shows that those who are able to stay invested throughout the business cycle can improve their odds of financial success.

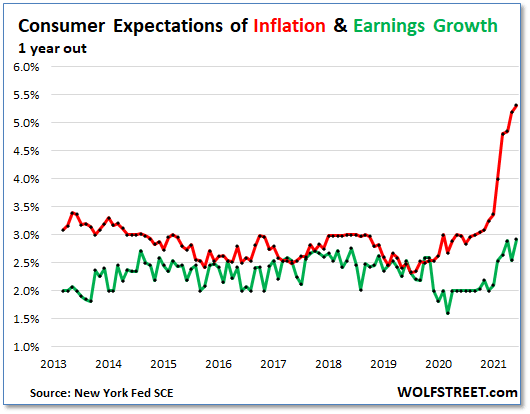

Chart of the Week:

As prices continue to march higher for food, gas, and just about everything else, everyday people are beginning to realize that maybe inflation won’t be as ‘transitory’ as the Federal Reserve continues to assert.

According to the New York Fed’s Survey of Consumer Expectations, inflation expectations for three years from now jumped to 4.2% – the highest level in the survey dataset – and to 5.3% for one year out. But expectations for income growth are way behind expected inflation, at just 2.9%.

If these expectations come true, Americans may be forced into a lower standard of living as expenses outrun incomes.

Riverbend Indicators:

Each week we post notable changes to the various market indicators we follow.

- As a reading of our Bull-Bear Indicator for U.S. Equities (comparative measurements over a rolling one-year timeframe), we remain in Cyclical Bull territory.

- Counting up of the number of all our indicators that are ‘Up’ for U.S. Equities, the current tally is that four of four are Positive, representing a multitude of timeframes (two that can be solely days/weeks, or months+ at a time; another, a quarter at a time; and lastly, the {typically} years-long reading, that being the Cyclical Bull or Bear status).

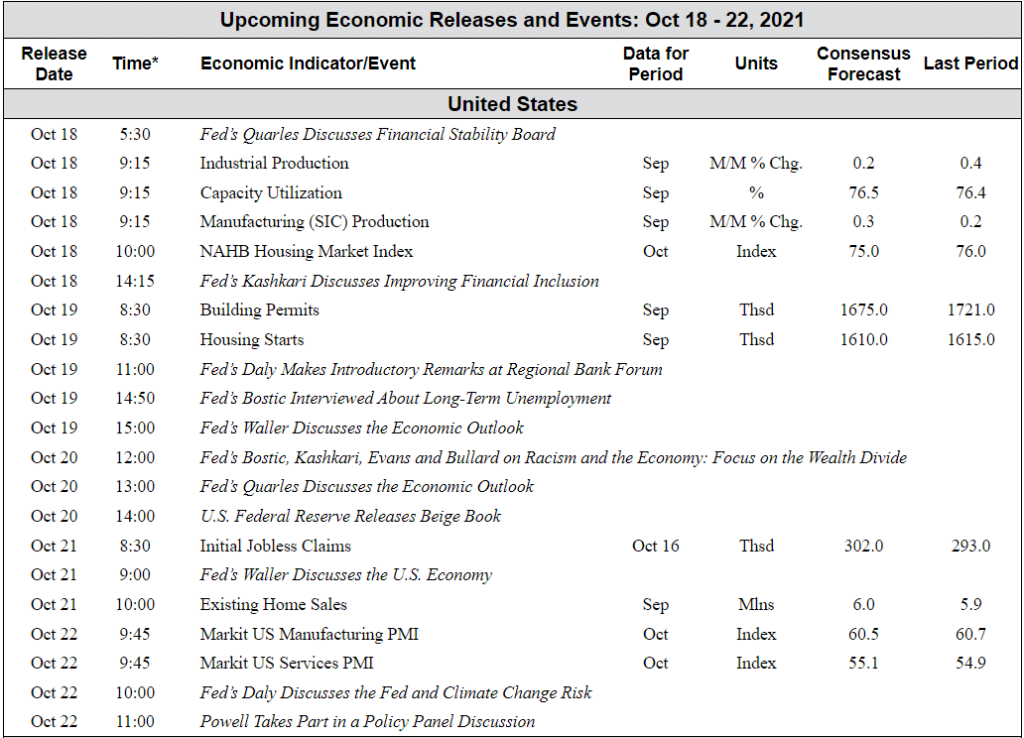

The Week Ahead:

Source: Bloomberg, TD Economics

[/fusion_text][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]