[fusion_builder_container hundred_percent=”no” equal_height_columns=”no” menu_anchor=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”center center” background_repeat=”no-repeat” fade=”no” background_parallax=”none” parallax_speed=”0.3″ video_mp4=”” video_webm=”” video_ogv=”” video_url=”” video_aspect_ratio=”16:9″ video_loop=”yes” video_mute=”yes” overlay_color=”” video_preview_image=”” border_size=”” border_color=”” border_style=”solid” padding_top=”” padding_bottom=”” padding_left=”” padding_right=””][fusion_builder_row][fusion_builder_column type=”1_6″ layout=”1_6″ spacing=”” center_content=”no” link=”” target=”_self” min_height=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” hover_type=”none” border_size=”0″ border_color=”” border_style=”solid” border_position=”all” border_radius=”” box_shadow=”no” dimension_box_shadow=”” box_shadow_blur=”0″ box_shadow_spread=”0″ box_shadow_color=”” box_shadow_style=”” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” margin_top=”” margin_bottom=”” background_type=”single” gradient_start_color=”” gradient_end_color=”” gradient_start_position=”0″ gradient_end_position=”100″ gradient_type=”linear” radial_direction=”center” linear_angle=”180″ background_color=”” background_image=”” background_image_id=”” background_position=”left top” background_repeat=”no-repeat” background_blend_mode=”none” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=”” filter_type=”regular” filter_hue=”0″ filter_saturation=”100″ filter_brightness=”100″ filter_contrast=”100″ filter_invert=”0″ filter_sepia=”0″ filter_opacity=”100″ filter_blur=”0″ filter_hue_hover=”0″ filter_saturation_hover=”100″ filter_brightness_hover=”100″ filter_contrast_hover=”100″ filter_invert_hover=”0″ filter_sepia_hover=”0″ filter_opacity_hover=”100″ filter_blur_hover=”0″ last=”no”][/fusion_builder_column][fusion_builder_column type=”2_3″ layout=”1_1″ background_position=”left top” background_color=”” border_size=”” border_color=”” border_style=”solid” border_position=”all” spacing=”yes” background_image=”” background_repeat=”no-repeat” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” margin_top=”0px” margin_bottom=”0px” class=”” id=”” animation_type=”” animation_speed=”0.3″ animation_direction=”left” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” center_content=”no” last=”no” min_height=”” hover_type=”none” link=””][fusion_text columns=”” column_min_width=”” column_spacing=”” rule_style=”default” rule_size=”” rule_color=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=””]

U.S. Markets:

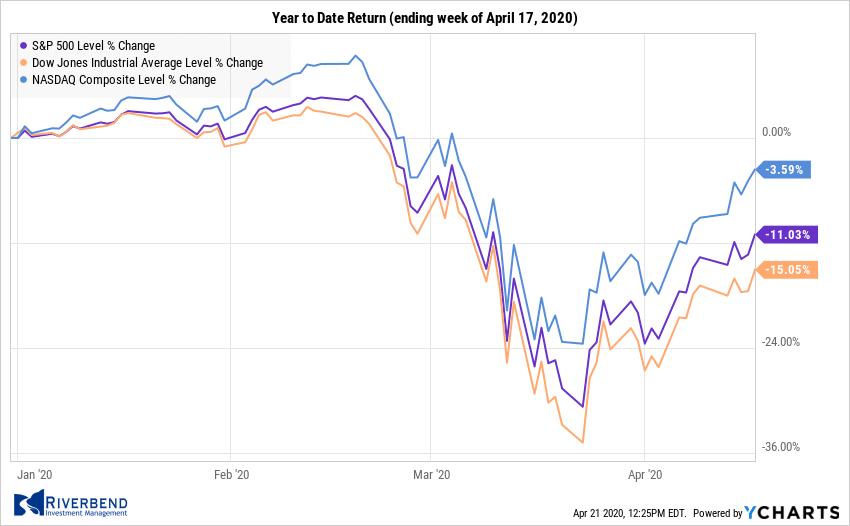

The major indexes recorded mixed returns, as investors weighed record downturns in economic data against hope that progress in containing the coronavirus might soon result in a partial reopening of the economy.

The technology-heavy NASDAQ Composite outperformed by a wide margin, as did growth stocks relative to value shares.

The NASDAQ gained 6.1% last week, while the Dow Jones Industrial Average rose 2.2%.

By market cap, the large cap S&P 500 rose 3.0%, but the mid cap S&P 400 and small cap Russell 2000 finished down -1.6% and -1.4%, respectively.

International Markets:

Canada’s TSX rose 1.4%, while the United Kingdom’s FTSE finished down -1.0%.

On Europe’s mainland, France’s CAC 40 ticked down -0.2%, while Germany’s DAX rose 0.6%. In Asia, China’s Shanghai Composite rose 1.5% and Japan’s Nikkei gained 2.0%.

As grouped by Morgan Stanley Capital International, developed markets rose 0.3% while emerging markets gained 2.6%.

Commodities:

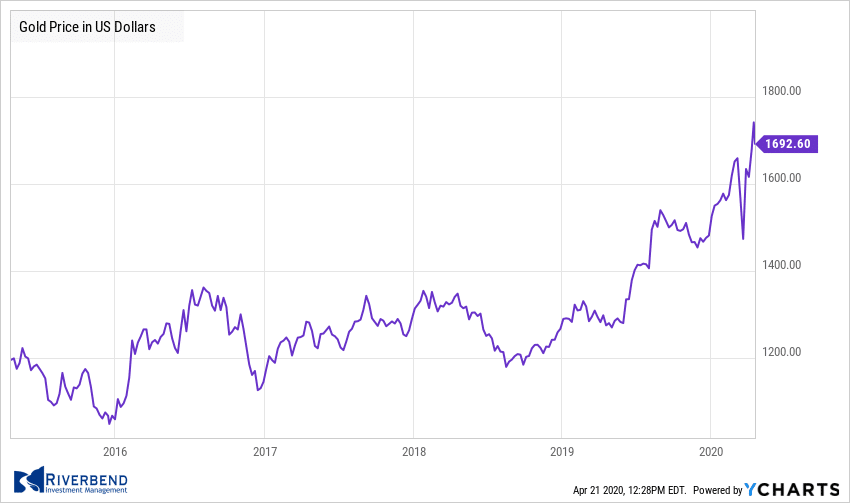

Gold finished the week down in the face of the strength in the equities markets, declining -3.1% to $1,698.80 an ounce.

Silver also finished the week down, declining -4.7% to $15.30 per ounce.

Oil managed a partial rebound from last week’s plunge. West Texas Intermediate crude oil rose 10% last week to $25.03 per barrel.

The industrial metal copper, viewed by some analysts as a barometer of global economic health due to its wide variety of uses, gained 3.8% last week – its fourth consecutive week of gains.

U.S. Economic Highlights:

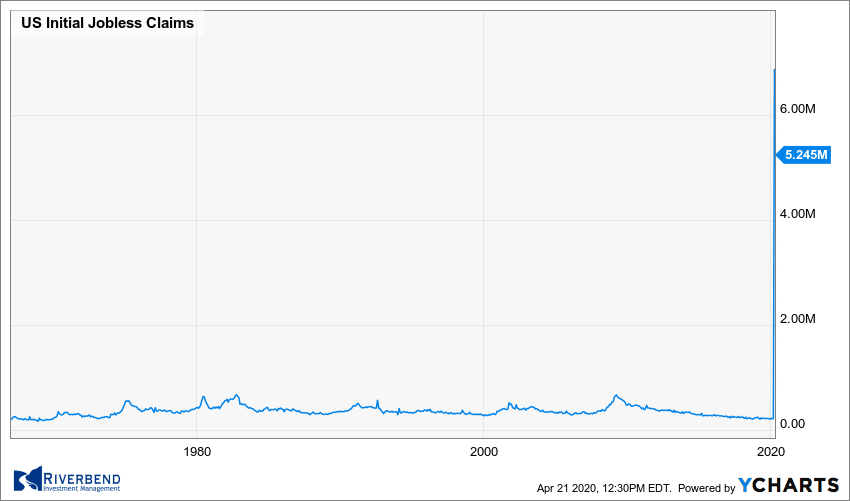

The number of Americans filing for initial unemployment benefits fell by 1.370 million to 5.245 million last week, but the number was still far above the weekly filings seen just over a month ago that were in the low 200,000s. Over the past four weeks, a total of 22.034 million workers have filed for unemployment benefits. That number is consistent with an unemployment rate approaching 20%.

How soon most of the newly jobless Americans get back to work will depend on how quickly the economy reopens. President Trump announced federal guidelines on how states can begin to ease restrictions, though many governors say they are not ready to do so with the number of COVID-19 cases still rising.

How soon most of the newly jobless Americans get back to work will depend on how quickly the economy reopens. President Trump announced federal guidelines on how states can begin to ease restrictions, though many governors say they are not ready to do so with the number of COVID-19 cases still rising.

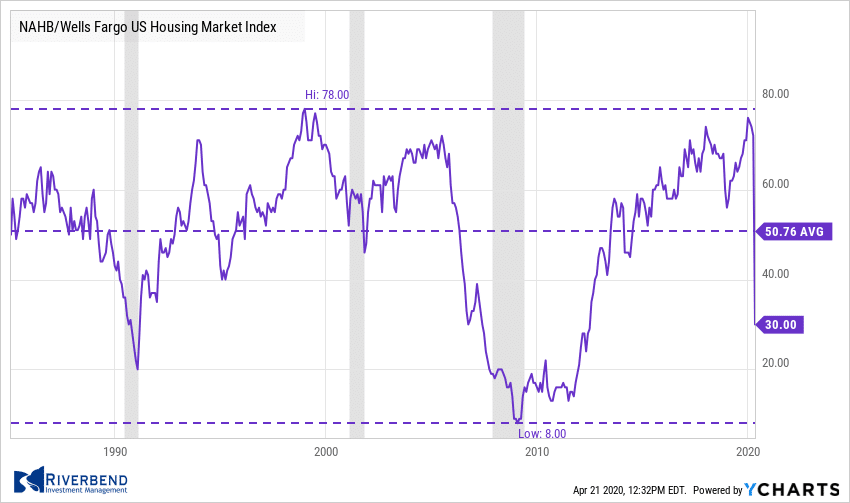

Confidence among the nation’s home builders plunged to its lowest level since 2012 as the coronavirus outbreak weighed on construction activity. The index from the National Association of Home Builders (NAHB) fell a staggering 42 points to a reading of just 30 in April – down from 72 the month prior. The decline was the largest monthly change in the index’s 30-year history.

The monthly index is based on a monthly survey in which the NAHB asks builders to rate various measures regarding the real-estate market as “good,” “fair,” or “poor.” Index readings above 50 indicate improving confidence, while a figure below that threshold would signal the opposite. This is the first time since 2014 that the index has dropped below 50.

On a regional basis, builders were the least optimistic in the Northeast, where the index fell 45 points to 19. The Midwest followed with an index of 25. Builders in the South and West were slightly more upbeat, but still had a very poor view of the housing market.

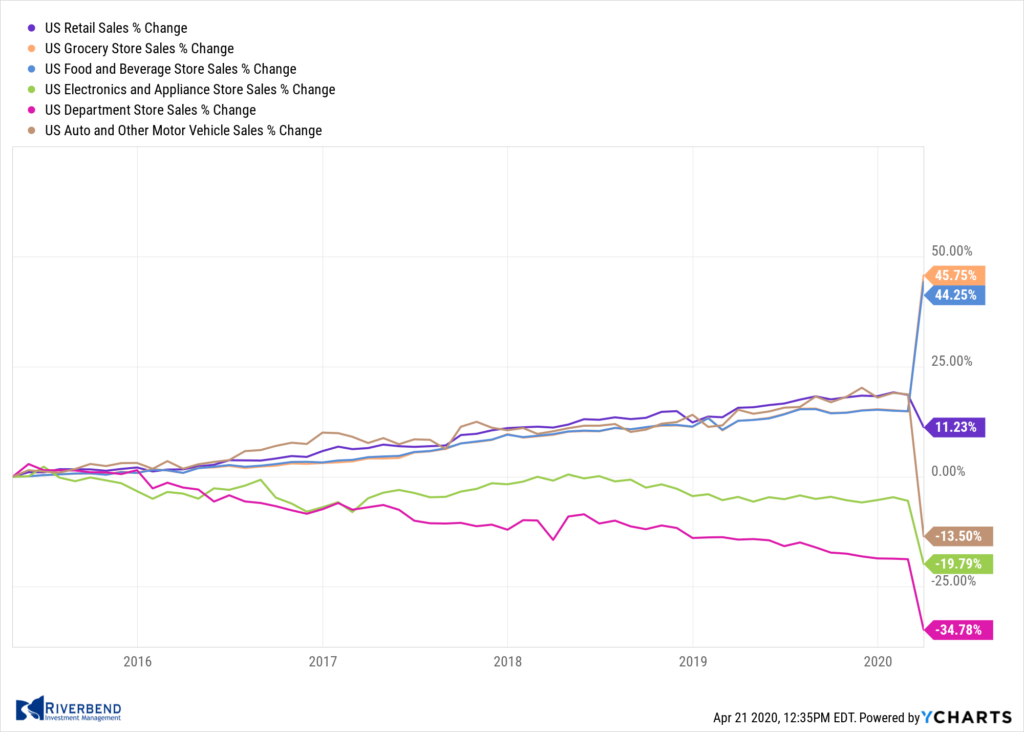

The outbreak of the coronavirus triggered a record -8.7% plunge in March sales at U.S. retailers as large swaths of the economy shut down. The Commerce Department reported sales fell for a second month in what’s likely to be a prolonged period of weakness for an industry that relies heavily on foot traffic and shopping. The reading was even worse than the consensus estimate of -8.0%. Last month’s plunge in sales was more than double the biggest single month decline during the Financial Crisis of 2007-2009.

According to government figures, sales plunged -27% at auto dealers and -17% at gas stations, two of the biggest segments of the retail industry. Excluding those categories, sales fell a smaller -3.1%, but the damage was still unprecedented. Receipts plunged 50% at clothing stores, -26.5% at restaurants and -20% at department stores.

Industrial production plunged -5.4% in March, the most since January 1946 and worse than the consensus of -3.5% as many plants either shut down or greatly reduced their operations amid the COVID-19 pandemic. Durable goods manufacturing fell -9.1%, led by vehicle output which plunged -28%, the most since January 2009. Nondurable manufacturing (goods expected to last less than 3 years) was off by a lesser -3.2%.

Year-over-year industrial production fell -5.5%, its steepest drop since November 2009. The capacity utilization rate declined a record -4.3% to 72.7%. There was more idle capacity across all three industrial production sectors, but the utilization rate was the lowest in the manufacturing sector.

In the city of Brotherly Love, business activity plunged to a record low this month. The Philadelphia Fed reported its Index of General Business Activity declined -43.9 points to -56.6. The reading was much worse than economists’ forecasts of a 30 point decline. Nearly all of the individual indicators were in deep recession territory. New orders, shipments, and hours worked all contracted at record rates.

However, one bright spot was the outlook for growth in the next six months. The index for Future Activity rebounded 7.8 points to 43.0. That suggests manufacturers in the region expect the recession to be short, and growth to return by the end of the year.

It was a similar story in the New York area. The New York Fed reported its Empire State manufacturing index had its second consecutive record decline as the New York-area continued to bear the brunt of the coronavirus pandemic. The Empire State business conditions index collapsed a record -57 points to -78.2 this month. The reading was the lowest on record. Economists had expected a decline of just -35 points. New orders and shipments both declined at a record pace. The only bright spot in the report, similar to the report from Philadelphia, is that firms expect conditions to improve over the next six months.

Chart of the Week:

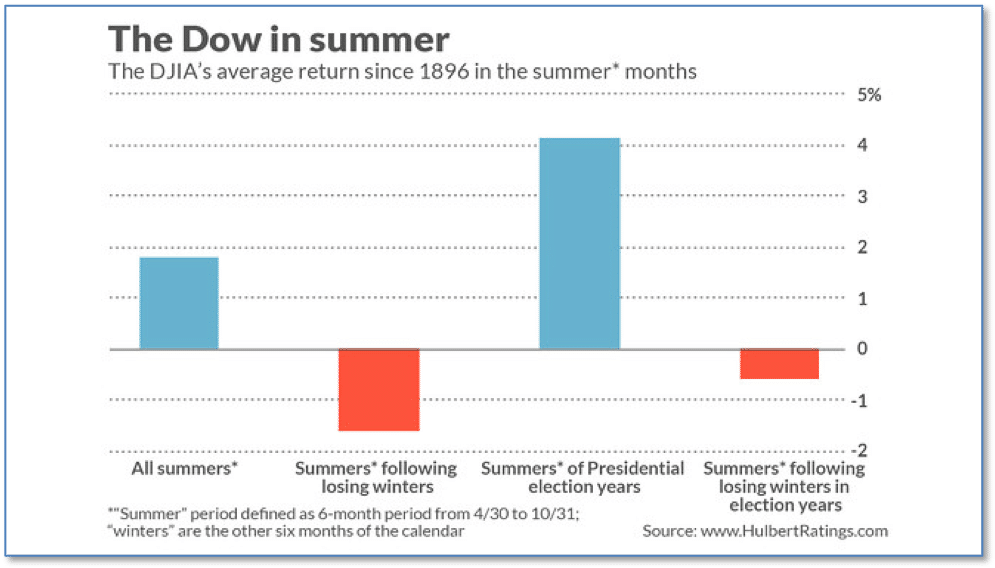

The stock market’s most favorable six-month period is coming to an end, and unfortunately, there’s not much to show for it.

The six-month pattern, known by both the “Halloween Indicator” and the market mantra to “Sell in May and Go Away”, is based on the historical tendency of the market to produce its highest returns during the predominantly winter months and lower average returns during the summer months.

Further, in summers following losing winter periods, the returns are not just lower but, on average, negative. In presidential election years (like 2020), the effect isn’t very pronounced, yet still slightly negative. The chart below, from Mark Hulbert via Marketwatch.com, illustrates the phenomenon.

Market Indicators:

Counting-up of the number of all our indicators that are ‘Up’ for U.S. Equities, the current tally is that three of four are Positive, representing a multitude of timeframes (two that can be solely days/weeks, or months+ at a time; another, a quarter at a time; and lastly, the {typically} years-long reading, that being the Cyclical Bull or Bear status).

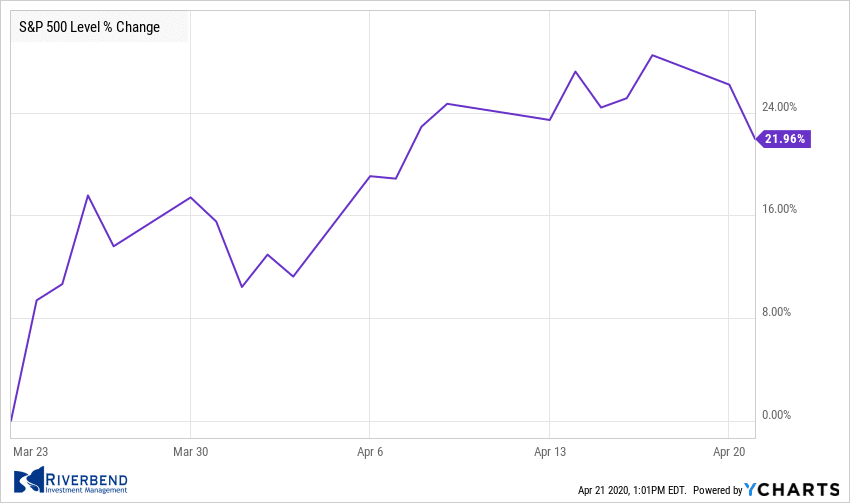

After the March 23rd lows, US equities have rebounded over 20%. Numerous indicators are telling us that the market is due for a rest or retracement.

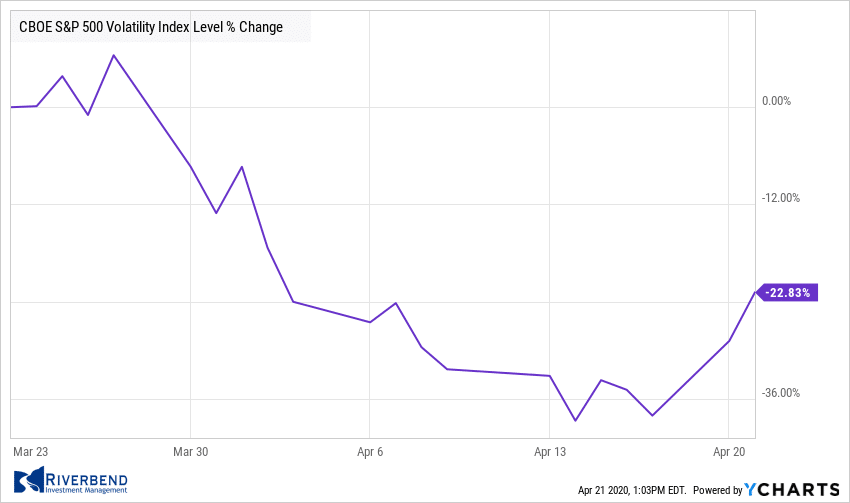

Volatility has started to rise again – possibly indicating that investors are starting to wonder if Fed inflows can keep the current rebound afloat.

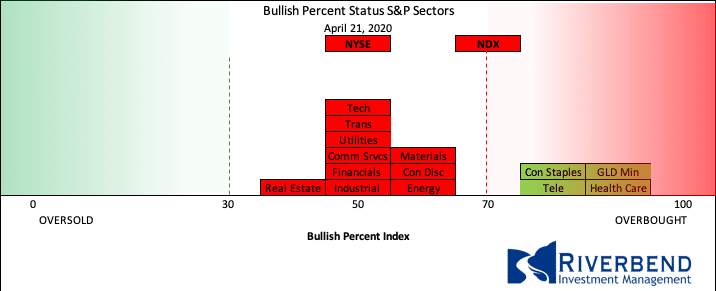

A review of the major S&P 500 sectors shows the market is currently slightly overbought, with Consumer Staples, Telecom, Gold Miners and Healthcare in overbought status.

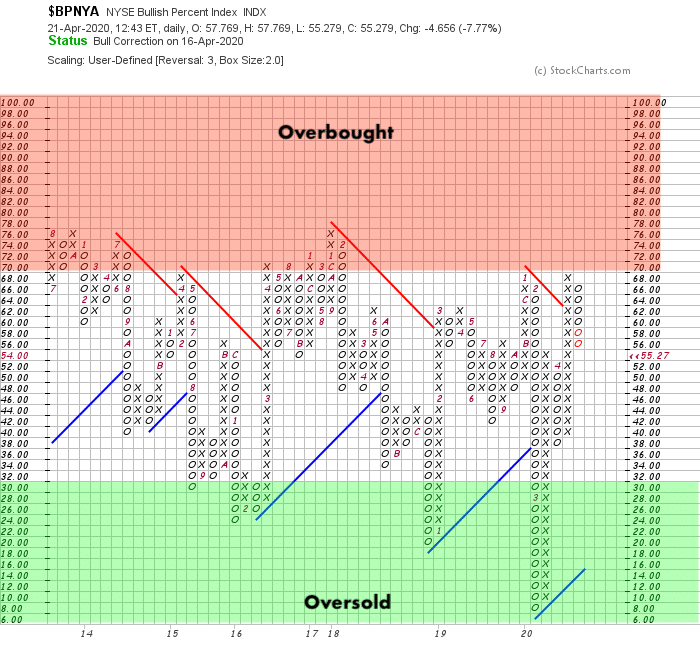

Meanwhile, the NYSE Bullish Percent Index has reversed back down after bouncing up from the March 23rd lows:

Source: Riverbend Investment Management, StockCharts

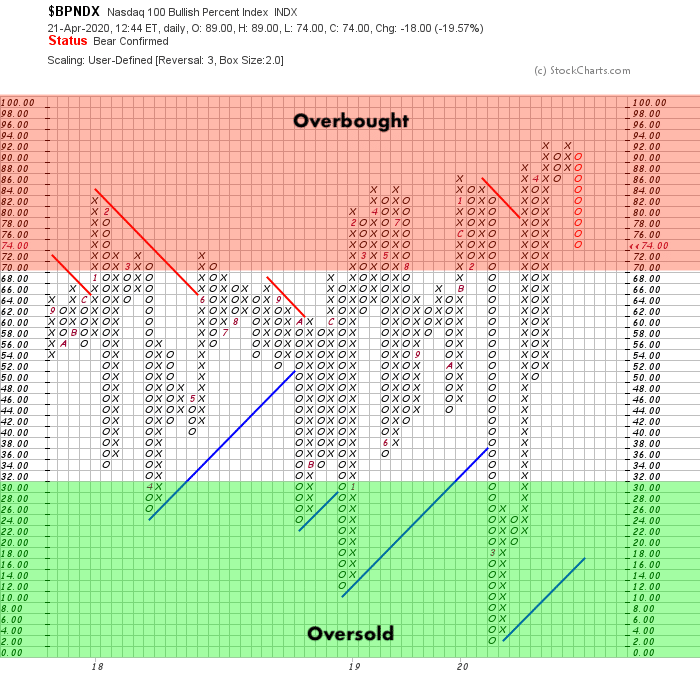

The more volatile Nasdaq 100 has also reversed back down from a very overbought level:

Source: Riverbend Investment Management, StockCharts

Week Ahead:

Monday: Earnings: IBM, HAL

Tuesday: Housing UK Claimant Count Change N/A exp, 17.3k prior German ZEW Economic Sentiment -40.0 exp, -49.5 prior U.S. Existing Sales 5.35 mln exp, 5.77 mln prior Earnings: LMT, KO, NFLX

Wednesday: UK CPI y/y +1.5% exp, +1.7% prior Japan Flash Manufacturing PMI N/A exp, 44.8 prior Earnings: T, DAL, KMB

Thursday: Global PMIs France Flash Services PMI 25.1 exp, 27.4 prior German Flash Manufacturing PMI 39.0 exp, 45.4 prior U.S. Flash Manufacturing PMI N/A exp, 48.5 prior U.S. Flash Services PMI N/A exp, 39.8 prior Earnings: INTC

Friday: U.S. Durable Goods Orders m/m -12.0% exp, +1.2% prior

[/fusion_text][fusion_code]PHN0eWxlPgogI19mb3JtXzE3M18geyBmb250LXNpemU6MTRweDsgbGluZS1oZWlnaHQ6MS42OyBmb250LWZhbWlseTphcmlhbCwgaGVsdmV0aWNhLCBzYW5zLXNlcmlmOyBtYXJnaW46MDsgfQogI19mb3JtXzE3M18gKiB7IG91dGxpbmU6MDsgfQogLl9mb3JtX2hpZGUgeyBkaXNwbGF5Om5vbmU7IHZpc2liaWxpdHk6aGlkZGVuOyB9CiAuX2Zvcm1fc2hvdyB7IGRpc3BsYXk6YmxvY2s7IHZpc2liaWxpdHk6dmlzaWJsZTsgfQogI19mb3JtXzE3M18uX2Zvcm0tdG9wIHsgdG9wOjA7IH0KICNfZm9ybV8xNzNfLl9mb3JtLWJvdHRvbSB7IGJvdHRvbTowOyB9CiAjX2Zvcm1fMTczXy5fZm9ybS1sZWZ0IHsgbGVmdDowOyB9CiAjX2Zvcm1fMTczXy5fZm9ybS1yaWdodCB7IHJpZ2h0OjA7IH0KICNfZm9ybV8xNzNfIGlucHV0W3R5cGU9InRleHQiXSwjX2Zvcm1fMTczXyBpbnB1dFt0eXBlPSJkYXRlIl0sI19mb3JtXzE3M18gdGV4dGFyZWEgeyBwYWRkaW5nOjZweDsgaGVpZ2h0OmF1dG87IGJvcmRlcjojOTc5Nzk3IDFweCBzb2xpZDsgYm9yZGVyLXJhZGl1czo0cHg7IGNvbG9yOiMwMDAgIWltcG9ydGFudDsgZm9udC1zaXplOjE0cHg7IC13ZWJraXQtYm94LXNpemluZzpib3JkZXItYm94OyAtbW96LWJveC1zaXppbmc6Ym9yZGVyLWJveDsgYm94LXNpemluZzpib3JkZXItYm94OyB9CiAjX2Zvcm1fMTczXyB0ZXh0YXJlYSB7IHJlc2l6ZTpub25lOyB9CiAjX2Zvcm1fMTczXyAuX3N1Ym1pdCB7IC13ZWJraXQtYXBwZWFyYW5jZTpub25lOyBjdXJzb3I6cG9pbnRlcjsgZm9udC1mYW1pbHk6YXJpYWwsIHNhbnMtc2VyaWY7IGZvbnQtc2l6ZToxNHB4OyB0ZXh0LWFsaWduOmNlbnRlcjsgYmFja2dyb3VuZDojZTA2NjM2ICFpbXBvcnRhbnQ7IGJvcmRlcjowICFpbXBvcnRhbnQ7IC1tb3otYm9yZGVyLXJhZGl1czo0cHggIWltcG9ydGFudDsgLXdlYmtpdC1ib3JkZXItcmFkaXVzOjRweCAhaW1wb3J0YW50OyBib3JkZXItcmFkaXVzOjRweCAhaW1wb3J0YW50OyBjb2xvcjojZmZmICFpbXBvcnRhbnQ7IHBhZGRpbmc6MTBweCAhaW1wb3J0YW50OyB9CiAjX2Zvcm1fMTczXyAuX2Nsb3NlLWljb24geyBjdXJzb3I6cG9pbnRlcjsgYmFja2dyb3VuZC1pbWFnZTp1cmwoJ2h0dHBzOi8vZDIyNmFqNGFvMXQ2MXEuY2xvdWRmcm9udC5uZXQvZXNma3lqaDF1X2Zvcm1zLWNsb3NlLWRhcmsucG5nJyk7IGJhY2tncm91bmQtcmVwZWF0Om5vLXJlcGVhdDsgYmFja2dyb3VuZC1zaXplOjE0LjJweCAxNC4ycHg7IHBvc2l0aW9uOmFic29sdXRlOyBkaXNwbGF5OmJsb2NrOyB0b3A6MTFweDsgcmlnaHQ6OXB4OyBvdmVyZmxvdzpoaWRkZW47IHdpZHRoOjE2LjJweDsgaGVpZ2h0OjE2LjJweDsgfQogI19mb3JtXzE3M18gLl9jbG9zZS1pY29uOmJlZm9yZSB7IHBvc2l0aW9uOnJlbGF0aXZlOyB9CiAjX2Zvcm1fMTczXyAuX2Zvcm0tYm9keSB7IG1hcmdpbi1ib3R0b206MzBweDsgfQogI19mb3JtXzE3M18gLl9mb3JtLWltYWdlLWxlZnQgeyB3aWR0aDoxNTBweDsgZmxvYXQ6bGVmdDsgfQogI19mb3JtXzE3M18gLl9mb3JtLWNvbnRlbnQtcmlnaHQgeyBtYXJnaW4tbGVmdDoxNjRweDsgfQogI19mb3JtXzE3M18gLl9mb3JtLWJyYW5kaW5nIHsgY29sb3I6I2ZmZjsgZm9udC1zaXplOjEwcHg7IGNsZWFyOmJvdGg7IHRleHQtYWxpZ246bGVmdDsgbWFyZ2luLXRvcDozMHB4OyBmb250LXdlaWdodDoxMDA7IH0KICNfZm9ybV8xNzNfIC5fZm9ybS1icmFuZGluZyAuX2xvZ28geyBkaXNwbGF5OmJsb2NrOyB3aWR0aDoxMzBweDsgaGVpZ2h0OjE0cHg7IG1hcmdpbi10b3A6NnB4OyBiYWNrZ3JvdW5kLWltYWdlOnVybCgnaHR0cHM6Ly9kMjI2YWo0YW8xdDYxcS5jbG91ZGZyb250Lm5ldC9oaDl1anFndjVfYWNsb2dvX2xpLnBuZycpOyBiYWNrZ3JvdW5kLXNpemU6MTMwcHggYXV0bzsgYmFja2dyb3VuZC1yZXBlYXQ6bm8tcmVwZWF0OyB9CiAjX2Zvcm1fMTczXyAuX2Zvcm0tbGFiZWwsI19mb3JtXzE3M18gLl9mb3JtX2VsZW1lbnQgLl9mb3JtLWxhYmVsIHsgZm9udC13ZWlnaHQ6Ym9sZDsgbWFyZ2luLWJvdHRvbTo1cHg7IGRpc3BsYXk6YmxvY2s7IH0KICNfZm9ybV8xNzNfLl9kYXJrIC5fZm9ybS1icmFuZGluZyB7IGNvbG9yOiMzMzM7IH0KICNfZm9ybV8xNzNfLl9kYXJrIC5fZm9ybS1icmFuZGluZyAuX2xvZ28geyBiYWNrZ3JvdW5kLWltYWdlOnVybCgnaHR0cHM6Ly9kMjI2YWo0YW8xdDYxcS5jbG91ZGZyb250Lm5ldC9qZnRxMmM4c19hY2xvZ29fZGsucG5nJyk7IH0KICNfZm9ybV8xNzNfIC5fZm9ybV9lbGVtZW50IHsgcG9zaXRpb246cmVsYXRpdmU7IG1hcmdpbi1ib3R0b206MTBweDsgZm9udC1zaXplOjA7IG1heC13aWR0aDoxMDAlOyB9CiAjX2Zvcm1fMTczXyAuX2Zvcm1fZWxlbWVudCAqIHsgZm9udC1zaXplOjE0cHg7IH0KICNfZm9ybV8xNzNfIC5fZm9ybV9lbGVtZW50Ll9jbGVhciB7IGNsZWFyOmJvdGg7IHdpZHRoOjEwMCU7IGZsb2F0Om5vbmU7IH0KICNfZm9ybV8xNzNfIC5fZm9ybV9lbGVtZW50Ll9jbGVhcjphZnRlciB7IGNsZWFyOmxlZnQ7IH0KICNfZm9ybV8xNzNfIC5fZm9ybV9lbGVtZW50IGlucHV0W3R5cGU9InRleHQiXSwjX2Zvcm1fMTczXyAuX2Zvcm1fZWxlbWVudCBpbnB1dFt0eXBlPSJkYXRlIl0sI19mb3JtXzE3M18gLl9mb3JtX2VsZW1lbnQgc2VsZWN0LCNfZm9ybV8xNzNfIC5fZm9ybV9lbGVtZW50IHRleHRhcmVhOm5vdCguZy1yZWNhcHRjaGEtcmVzcG9uc2UpIHsgZGlzcGxheTpibG9jazsgd2lkdGg6MTAwJTsgLXdlYmtpdC1ib3gtc2l6aW5nOmJvcmRlci1ib3g7IC1tb3otYm94LXNpemluZzpib3JkZXItYm94OyBib3gtc2l6aW5nOmJvcmRlci1ib3g7IH0KICNfZm9ybV8xNzNfIC5fZmllbGQtd3JhcHBlciB7IHBvc2l0aW9uOnJlbGF0aXZlOyB9CiAjX2Zvcm1fMTczXyAuX2lubGluZS1zdHlsZSB7IGZsb2F0OmxlZnQ7IH0KICNfZm9ybV8xNzNfIC5faW5saW5lLXN0eWxlIGlucHV0W3R5cGU9InRleHQiXSB7IHdpZHRoOjE1MHB4OyB9CiAjX2Zvcm1fMTczXyAuX2lubGluZS1zdHlsZTpub3QoLl9jbGVhcikgKyAuX2lubGluZS1zdHlsZTpub3QoLl9jbGVhcikgeyBtYXJnaW4tbGVmdDoyMHB4OyB9CiAjX2Zvcm1fMTczXyAuX2Zvcm1fZWxlbWVudCBpbWcuX2Zvcm0taW1hZ2UgeyBtYXgtd2lkdGg6MTAwJTsgfQogI19mb3JtXzE3M18gLl9jbGVhci1lbGVtZW50IHsgY2xlYXI6bGVmdDsgfQogI19mb3JtXzE3M18gLl9mdWxsX3dpZHRoIHsgd2lkdGg6MTAwJTsgfQogI19mb3JtXzE3M18gLl9mb3JtX2Z1bGxfZmllbGQgeyBkaXNwbGF5OmJsb2NrOyB3aWR0aDoxMDAlOyBtYXJnaW4tYm90dG9tOjEwcHg7IH0KICNfZm9ybV8xNzNfIGlucHV0W3R5cGU9InRleHQiXS5faGFzX2Vycm9yLCNfZm9ybV8xNzNfIHRleHRhcmVhLl9oYXNfZXJyb3IgeyBib3JkZXI6I2YzN2M3YiAxcHggc29saWQ7IH0KICNfZm9ybV8xNzNfIGlucHV0W3R5cGU9ImNoZWNrYm94Il0uX2hhc19lcnJvciB7IG91dGxpbmU6I2YzN2M3YiAxcHggc29saWQ7IH0KICNfZm9ybV8xNzNfIC5fZXJyb3IgeyBkaXNwbGF5OmJsb2NrOyBwb3NpdGlvbjphYnNvbHV0ZTsgZm9udC1zaXplOjE0cHg7IHotaW5kZXg6MTAwMDAwMDE7IH0KICNfZm9ybV8xNzNfIC5fZXJyb3IuX2Fib3ZlIHsgcGFkZGluZy1ib3R0b206NHB4OyBib3R0b206MzlweDsgcmlnaHQ6MDsgfQogI19mb3JtXzE3M18gLl9lcnJvci5fYmVsb3cgeyBwYWRkaW5nLXRvcDo0cHg7IHRvcDoxMDAlOyByaWdodDowOyB9CiAjX2Zvcm1fMTczXyAuX2Vycm9yLl9hYm92ZSAuX2Vycm9yLWFycm93IHsgYm90dG9tOjA7IHJpZ2h0OjE1cHg7IGJvcmRlci1sZWZ0OjVweCBzb2xpZCB0cmFuc3BhcmVudDsgYm9yZGVyLXJpZ2h0OjVweCBzb2xpZCB0cmFuc3BhcmVudDsgYm9yZGVyLXRvcDo1cHggc29saWQgI2YzN2M3YjsgfQogI19mb3JtXzE3M18gLl9lcnJvci5fYmVsb3cgLl9lcnJvci1hcnJvdyB7IHRvcDowOyByaWdodDoxNXB4OyBib3JkZXItbGVmdDo1cHggc29saWQgdHJhbnNwYXJlbnQ7IGJvcmRlci1yaWdodDo1cHggc29saWQgdHJhbnNwYXJlbnQ7IGJvcmRlci1ib3R0b206NXB4IHNvbGlkICNmMzdjN2I7IH0KICNfZm9ybV8xNzNfIC5fZXJyb3ItaW5uZXIgeyBwYWRkaW5nOjhweCAxMnB4OyBiYWNrZ3JvdW5kLWNvbG9yOiNmMzdjN2I7IGZvbnQtc2l6ZToxNHB4OyBmb250LWZhbWlseTphcmlhbCwgc2Fucy1zZXJpZjsgY29sb3I6I2ZmZjsgdGV4dC1hbGlnbjpjZW50ZXI7IHRleHQtZGVjb3JhdGlvbjpub25lOyAtd2Via2l0LWJvcmRlci1yYWRpdXM6NHB4OyAtbW96LWJvcmRlci1yYWRpdXM6NHB4OyBib3JkZXItcmFkaXVzOjRweDsgfQogI19mb3JtXzE3M18gLl9lcnJvci1pbm5lci5fZm9ybV9lcnJvciB7IG1hcmdpbi1ib3R0b206NXB4OyB0ZXh0LWFsaWduOmxlZnQ7IH0KICNfZm9ybV8xNzNfIC5fYnV0dG9uLXdyYXBwZXIgLl9lcnJvci1pbm5lci5fZm9ybV9lcnJvciB7IHBvc2l0aW9uOnN0YXRpYzsgfQogI19mb3JtXzE3M18gLl9lcnJvci1pbm5lci5fbm9fYXJyb3cgeyBtYXJnaW4tYm90dG9tOjEwcHg7IH0KICNfZm9ybV8xNzNfIC5fZXJyb3ItYXJyb3cgeyBwb3NpdGlvbjphYnNvbHV0ZTsgd2lkdGg6MDsgaGVpZ2h0OjA7IH0KICNfZm9ybV8xNzNfIC5fZXJyb3ItaHRtbCB7IG1hcmdpbi1ib3R0b206MTBweDsgfQogLnBpa2Etc2luZ2xlIHsgei1pbmRleDoxMDAwMDAwMSAhaW1wb3J0YW50OyB9CiBAbWVkaWEgYWxsIGFuZCAobWluLXdpZHRoOjMyMHB4KSBhbmQgKG1heC13aWR0aDo2NjdweCkgeyA6Oi13ZWJraXQtc2Nyb2xsYmFyIHsgZGlzcGxheTpub25lOyB9CiAjX2Zvcm1fMTczXyB7IG1hcmdpbjowOyB3aWR0aDoxMDAlOyBtaW4td2lkdGg6MTAwJTsgbWF4LXdpZHRoOjEwMCU7IGJveC1zaXppbmc6Ym9yZGVyLWJveDsgfQogI19mb3JtXzE3M18gKiB7IC13ZWJraXQtYm94LXNpemluZzpib3JkZXItYm94OyAtbW96LWJveC1zaXppbmc6Ym9yZGVyLWJveDsgYm94LXNpemluZzpib3JkZXItYm94OyBmb250LXNpemU6MWVtOyB9CiAjX2Zvcm1fMTczXyAuX2Zvcm0tY29udGVudCB7IG1hcmdpbjowOyB3aWR0aDoxMDAlOyB9CiAjX2Zvcm1fMTczXyAuX2Zvcm0taW5uZXIgeyBkaXNwbGF5OmJsb2NrOyBtaW4td2lkdGg6MTAwJTsgfQogI19mb3JtXzE3M18gLl9mb3JtLXRpdGxlLCNfZm9ybV8xNzNfIC5faW5saW5lLXN0eWxlIHsgbWFyZ2luLXRvcDowOyBtYXJnaW4tcmlnaHQ6MDsgbWFyZ2luLWxlZnQ6MDsgfQogI19mb3JtXzE3M18gLl9mb3JtLXRpdGxlIHsgZm9udC1zaXplOjEuMmVtOyB9CiAjX2Zvcm1fMTczXyAuX2Zvcm1fZWxlbWVudCB7IG1hcmdpbjowIDAgMjBweDsgcGFkZGluZzowOyB3aWR0aDoxMDAlOyB9CiAjX2Zvcm1fMTczXyAuX2Zvcm0tZWxlbWVudCwjX2Zvcm1fMTczXyAuX2lubGluZS1zdHlsZSwjX2Zvcm1fMTczXyBpbnB1dFt0eXBlPSJ0ZXh0Il0sI19mb3JtXzE3M18gbGFiZWwsI19mb3JtXzE3M18gcCwjX2Zvcm1fMTczXyB0ZXh0YXJlYTpub3QoLmctcmVjYXB0Y2hhLXJlc3BvbnNlKSB7IGZsb2F0Om5vbmU7IGRpc3BsYXk6YmxvY2s7IHdpZHRoOjEwMCU7IH0KICNfZm9ybV8xNzNfIC5fcm93Ll9jaGVja2JveC1yYWRpbyBsYWJlbCB7IGRpc3BsYXk6aW5saW5lOyB9CiAjX2Zvcm1fMTczXyAuX3JvdywjX2Zvcm1fMTczXyBwLCNfZm9ybV8xNzNfIGxhYmVsIHsgbWFyZ2luLWJvdHRvbTowLjdlbTsgd2lkdGg6MTAwJTsgfQogI19mb3JtXzE3M18gLl9yb3cgaW5wdXRbdHlwZT0iY2hlY2tib3giXSwjX2Zvcm1fMTczXyAuX3JvdyBpbnB1dFt0eXBlPSJyYWRpbyJdIHsgbWFyZ2luOjAgIWltcG9ydGFudDsgdmVydGljYWwtYWxpZ246bWlkZGxlICFpbXBvcnRhbnQ7IH0KICNfZm9ybV8xNzNfIC5fcm93IGlucHV0W3R5cGU9ImNoZWNrYm94Il0gKyBzcGFuIGxhYmVsIHsgZGlzcGxheTppbmxpbmU7IH0KICNfZm9ybV8xNzNfIC5fcm93IHNwYW4gbGFiZWwgeyBtYXJnaW46MCAhaW1wb3J0YW50OyB3aWR0aDppbml0aWFsICFpbXBvcnRhbnQ7IHZlcnRpY2FsLWFsaWduOm1pZGRsZSAhaW1wb3J0YW50OyB9CiAjX2Zvcm1fMTczXyAuX2Zvcm0taW1hZ2UgeyBtYXgtd2lkdGg6MTAwJTsgaGVpZ2h0OmF1dG8gIWltcG9ydGFudDsgfQogI19mb3JtXzE3M18gaW5wdXRbdHlwZT0idGV4dCJdIHsgcGFkZGluZy1sZWZ0OjEwcHg7IHBhZGRpbmctcmlnaHQ6MTBweDsgZm9udC1zaXplOjE2cHg7IGxpbmUtaGVpZ2h0OjEuM2VtOyAtd2Via2l0LWFwcGVhcmFuY2U6bm9uZTsgfQogI19mb3JtXzE3M18gaW5wdXRbdHlwZT0icmFkaW8iXSwjX2Zvcm1fMTczXyBpbnB1dFt0eXBlPSJjaGVja2JveCJdIHsgZGlzcGxheTppbmxpbmUtYmxvY2s7IHdpZHRoOjEuM2VtOyBoZWlnaHQ6MS4zZW07IGZvbnQtc2l6ZToxZW07IG1hcmdpbjowIDAuM2VtIDAgMDsgdmVydGljYWwtYWxpZ246YmFzZWxpbmU7IH0KICNfZm9ybV8xNzNfIGJ1dHRvblt0eXBlPSJzdWJtaXQiXSB7IHBhZGRpbmc6MjBweDsgZm9udC1zaXplOjEuNWVtOyB9CiAjX2Zvcm1fMTczXyAuX2lubGluZS1zdHlsZSB7IG1hcmdpbjoyMHB4IDAgMCAhaW1wb3J0YW50OyB9CiB9CiAjX2Zvcm1fMTczXyB7IHBvc2l0aW9uOnJlbGF0aXZlOyB0ZXh0LWFsaWduOmxlZnQ7IG1hcmdpbjoyNXB4IGF1dG8gMDsgcGFkZGluZzoyMHB4OyAtd2Via2l0LWJveC1zaXppbmc6Ym9yZGVyLWJveDsgLW1vei1ib3gtc2l6aW5nOmJvcmRlci1ib3g7IGJveC1zaXppbmc6Ym9yZGVyLWJveDsgKnpvb206MTsgYmFja2dyb3VuZDojNTI4OWZmICFpbXBvcnRhbnQ7IGJvcmRlcjo0cHggc29saWQgI2IwYjBiMCAhaW1wb3J0YW50OyB3aWR0aDo2NTBweDsgLW1vei1ib3JkZXItcmFkaXVzOjE5cHggIWltcG9ydGFudDsgLXdlYmtpdC1ib3JkZXItcmFkaXVzOjE5cHggIWltcG9ydGFudDsgYm9yZGVyLXJhZGl1czoxOXB4ICFpbXBvcnRhbnQ7IGNvbG9yOiNmZmYgIWltcG9ydGFudDsgfQogI19mb3JtXzE3M18gLl9mb3JtLXRpdGxlIHsgZm9udC1zaXplOjIycHg7IGxpbmUtaGVpZ2h0OjIycHg7IGZvbnQtd2VpZ2h0OjYwMDsgbWFyZ2luLWJvdHRvbTowOyB9CiAjX2Zvcm1fMTczXzpiZWZvcmUsI19mb3JtXzE3M186YWZ0ZXIgeyBjb250ZW50OiIgIjsgZGlzcGxheTp0YWJsZTsgfQogI19mb3JtXzE3M186YWZ0ZXIgeyBjbGVhcjpib3RoOyB9CiAjX2Zvcm1fMTczXy5faW5saW5lLXN0eWxlIHsgd2lkdGg6YXV0bzsgZGlzcGxheTppbmxpbmUtYmxvY2s7IH0KICNfZm9ybV8xNzNfLl9pbmxpbmUtc3R5bGUgaW5wdXRbdHlwZT0idGV4dCJdLCNfZm9ybV8xNzNfLl9pbmxpbmUtc3R5bGUgaW5wdXRbdHlwZT0iZGF0ZSJdIHsgcGFkZGluZzoxMHB4IDEycHg7IH0KICNfZm9ybV8xNzNfLl9pbmxpbmUtc3R5bGUgYnV0dG9uLl9pbmxpbmUtc3R5bGUgeyBwb3NpdGlvbjpyZWxhdGl2ZTsgdG9wOjI3cHg7IH0KICNfZm9ybV8xNzNfLl9pbmxpbmUtc3R5bGUgcCB7IG1hcmdpbjowOyB9CiAjX2Zvcm1fMTczXy5faW5saW5lLXN0eWxlIC5fYnV0dG9uLXdyYXBwZXIgeyBwb3NpdGlvbjpyZWxhdGl2ZTsgbWFyZ2luOjI3cHggMTIuNXB4IDAgMjBweDsgfQogI19mb3JtXzE3M18gLl9mb3JtLXRoYW5rLXlvdSB7IHBvc2l0aW9uOnJlbGF0aXZlOyBsZWZ0OjA7IHJpZ2h0OjA7IHRleHQtYWxpZ246Y2VudGVyOyBmb250LXNpemU6MThweDsgfQogQG1lZGlhIGFsbCBhbmQgKG1pbi13aWR0aDozMjBweCkgYW5kIChtYXgtd2lkdGg6NjY3cHgpIHsgI19mb3JtXzE3M18uX2lubGluZS1mb3JtLl9pbmxpbmUtc3R5bGUgLl9pbmxpbmUtc3R5bGUuX2J1dHRvbi13cmFwcGVyIHsgbWFyZ2luLXRvcDoyMHB4ICFpbXBvcnRhbnQ7IG1hcmdpbi1sZWZ0OjAgIWltcG9ydGFudDsgfQogfQoKU3R5bGUgQXR0cmlidXRlIHsKICAgIGJhY2tncm91bmQ6ICM1Mjg5RkY7CiAgICBib3JkZXI6IDRweCBzb2xpZCAjQjBCMEIwOwogICAgLW1vei1ib3JkZXItcmFkaXVzOiAyMHB4OwogICAgLXdlYmtpdC1ib3JkZXItcmFkaXVzOiAyMHB4OwogICAgYm9yZGVyLXJhZGl1czogMjBweDsKICAgIGNvbG9yOiAjRkZGRkZGOwogICAgd2lkdGg6IDUxN3B4Owp9Ci5fZm9ybSBidXR0b24sIC5fZm9ybSBpbnB1dFt0eXBlPXN1Ym1pdF0gewogICAgZm9udC1mYW1pbHk6IGFyaWFsLHNhbnMtc2VyaWYhaW1wb3J0YW50OwogICAgLXdlYmtpdC1hcHBlYXJhbmNlOiBub25lOwogICAgY3Vyc29yOiBwb2ludGVyOwogICAgZm9udC1zaXplOiAyMHB4OwogICAgdGV4dC1hbGlnbjogY2VudGVyOwp9Ci5fZm9ybSBpbnB1dFt0eXBlPWRhdGVdLCAuX2Zvcm0gaW5wdXRbdHlwZT10ZXh0XSwgLl9mb3JtX2VsZW1lbnQgaW5wdXRbdHlwZT1kYXRlXSwgLl9mb3JtX2VsZW1lbnQgaW5wdXRbdHlwZT10ZXh0XSB7CiAgICBwYWRkaW5nOiA2cHg7CiAgICBib3JkZXI6IDFweCBzb2xpZCAjOTc5Nzk3OwogICAgYm9yZGVyLXJhZGl1czogNHB4OwogICAgZm9udC1zaXplOiAxOHB4OwoKLl9mb3JtLl9pbmxpbmUtZm9ybSB7CiAgICB0ZXh0LWFsaWduOiBjZW50ZXI7PC9zdHlsZT4KPGZvcm0gbWV0aG9kPSJQT1NUIiBhY3Rpb249Imh0dHBzOi8vcml2ZXJiZW5kaW52ZXN0bWVudG1hbmFnZW1lbnQuYWN0aXZlaG9zdGVkLmNvbS9wcm9jLnBocCIgaWQ9Il9mb3JtXzE3M18iIGNsYXNzPSJfZm9ybSBfZm9ybV8xNzMgX2lubGluZS1mb3JtICAiIG5vdmFsaWRhdGU+CiAgPGlucHV0IHR5cGU9ImhpZGRlbiIgbmFtZT0idSIgdmFsdWU9IjE3MyIgLz4KICA8aW5wdXQgdHlwZT0iaGlkZGVuIiBuYW1lPSJmIiB2YWx1ZT0iMTczIiAvPgogIDxpbnB1dCB0eXBlPSJoaWRkZW4iIG5hbWU9InMiIC8+CiAgPGlucHV0IHR5cGU9ImhpZGRlbiIgbmFtZT0iYyIgdmFsdWU9IjAiIC8+CiAgPGlucHV0IHR5cGU9ImhpZGRlbiIgbmFtZT0ibSIgdmFsdWU9IjAiIC8+CiAgPGlucHV0IHR5cGU9ImhpZGRlbiIgbmFtZT0iYWN0IiB2YWx1ZT0ic3ViIiAvPgogIDxpbnB1dCB0eXBlPSJoaWRkZW4iIG5hbWU9InYiIHZhbHVlPSIyIiAvPgogIDxkaXYgY2xhc3M9Il9mb3JtLWNvbnRlbnQiPgogICAgPGRpdiBjbGFzcz0iX2Zvcm1fZWxlbWVudCBfeDAyNDI0OTI3IF9mdWxsX3dpZHRoIF9jbGVhciIgPgogICAgICA8ZGl2IGNsYXNzPSJfZm9ybS10aXRsZSI+CiAgICAgICAgR2V0IG91ciByZXNlYXJjaCB1cGRhdGVzIHNlbnQgdG8geW91ciBpbmJveC4KICAgICAgPC9kaXY+CiAgICA8L2Rpdj4KICAgIDxkaXYgY2xhc3M9Il9mb3JtX2VsZW1lbnQgX3gwNjk2OTc3MSBfZnVsbF93aWR0aCAiID4KICAgICAgPGxhYmVsIGNsYXNzPSJfZm9ybS1sYWJlbCI+CiAgICAgICAgRW50ZXIgWW91ciBFbWFpbCBCZWxvdzoqCiAgICAgIDwvbGFiZWw+CiAgICAgIDxkaXYgY2xhc3M9Il9maWVsZC13cmFwcGVyIj4KICAgICAgICA8aW5wdXQgdHlwZT0idGV4dCIgbmFtZT0iZW1haWwiIHBsYWNlaG9sZGVyPSJUeXBlIHlvdXIgZW1haWwiIHJlcXVpcmVkLz4KICAgICAgPC9kaXY+CiAgICA8L2Rpdj4KICAgIDxkaXYgY2xhc3M9Il9idXR0b24td3JhcHBlciBfZnVsbF93aWR0aCI+CiAgICAgIDxidXR0b24gaWQ9Il9mb3JtXzE3M19zdWJtaXQiIGNsYXNzPSJfc3VibWl0IiB0eXBlPSJzdWJtaXQiPgogICAgICAgIFllcywgU2VuZCBNZSB0aGUgVXBkYXRlcyEgPj4KICAgICAgPC9idXR0b24+CiAgICA8L2Rpdj4KICAgIDxkaXYgY2xhc3M9Il9jbGVhci1lbGVtZW50Ij4KICAgIDwvZGl2PgogIDwvZGl2PgogIDxkaXYgY2xhc3M9Il9mb3JtLXRoYW5rLXlvdSIgc3R5bGU9ImRpc3BsYXk6bm9uZTsiPgogIDwvZGl2Pgo8L2Zvcm0+PHNjcmlwdCB0eXBlPSJ0ZXh0L2phdmFzY3JpcHQiPgp3aW5kb3cuY2ZpZWxkcyA9IFtdOwp3aW5kb3cuX3Nob3dfdGhhbmtfeW91ID0gZnVuY3Rpb24oaWQsIG1lc3NhZ2UsIHRyYWNrY21wX3VybCkgewogIHZhciBmb3JtID0gZG9jdW1lbnQuZ2V0RWxlbWVudEJ5SWQoJ19mb3JtXycgKyBpZCArICdfJyksIHRoYW5rX3lvdSA9IGZvcm0ucXVlcnlTZWxlY3RvcignLl9mb3JtLXRoYW5rLXlvdScpOwogIGZvcm0ucXVlcnlTZWxlY3RvcignLl9mb3JtLWNvbnRlbnQnKS5zdHlsZS5kaXNwbGF5ID0gJ25vbmUnOwogIHRoYW5rX3lvdS5pbm5lckhUTUwgPSBtZXNzYWdlOwogIHRoYW5rX3lvdS5zdHlsZS5kaXNwbGF5ID0gJ2Jsb2NrJzsKICBpZiAodHlwZW9mKHRyYWNrY21wX3VybCkgIT0gJ3VuZGVmaW5lZCcgJiYgdHJhY2tjbXBfdXJsKSB7CiAgICAvLyBTaXRlIHRyYWNraW5nIFVSTCB0byB1c2UgYWZ0ZXIgaW5saW5lIGZvcm0gc3VibWlzc2lvbi4KICAgIF9sb2FkX3NjcmlwdCh0cmFja2NtcF91cmwpOwogIH0KICBpZiAodHlwZW9mIHdpbmRvdy5fZm9ybV9jYWxsYmFjayAhPT0gJ3VuZGVmaW5lZCcpIHdpbmRvdy5fZm9ybV9jYWxsYmFjayhpZCk7Cn07CndpbmRvdy5fc2hvd19lcnJvciA9IGZ1bmN0aW9uKGlkLCBtZXNzYWdlLCBodG1sKSB7CiAgdmFyIGZvcm0gPSBkb2N1bWVudC5nZXRFbGVtZW50QnlJZCgnX2Zvcm1fJyArIGlkICsgJ18nKSwgZXJyID0gZG9jdW1lbnQuY3JlYXRlRWxlbWVudCgnZGl2JyksIGJ1dHRvbiA9IGZvcm0ucXVlcnlTZWxlY3RvcignYnV0dG9uJyksIG9sZF9lcnJvciA9IGZvcm0ucXVlcnlTZWxlY3RvcignLl9mb3JtX2Vycm9yJyk7CiAgaWYgKG9sZF9lcnJvcikgb2xkX2Vycm9yLnBhcmVudE5vZGUucmVtb3ZlQ2hpbGQob2xkX2Vycm9yKTsKICBlcnIuaW5uZXJIVE1MID0gbWVzc2FnZTsKICBlcnIuY2xhc3NOYW1lID0gJ19lcnJvci1pbm5lciBfZm9ybV9lcnJvciBfbm9fYXJyb3cnOwogIHZhciB3cmFwcGVyID0gZG9jdW1lbnQuY3JlYXRlRWxlbWVudCgnZGl2Jyk7CiAgd3JhcHBlci5jbGFzc05hbWUgPSAnX2Zvcm0taW5uZXInOwogIHdyYXBwZXIuYXBwZW5kQ2hpbGQoZXJyKTsKICBidXR0b24ucGFyZW50Tm9kZS5pbnNlcnRCZWZvcmUod3JhcHBlciwgYnV0dG9uKTsKICBkb2N1bWVudC5xdWVyeVNlbGVjdG9yKCdbaWRePSJfZm9ybSJdW2lkJD0iX3N1Ym1pdCJdJykuZGlzYWJsZWQgPSBmYWxzZTsKICBpZiAoaHRtbCkgewogICAgdmFyIGRpdiA9IGRvY3VtZW50LmNyZWF0ZUVsZW1lbnQoJ2RpdicpOwogICAgZGl2LmNsYXNzTmFtZSA9ICdfZXJyb3ItaHRtbCc7CiAgICBkaXYuaW5uZXJIVE1MID0gaHRtbDsKICAgIGVyci5hcHBlbmRDaGlsZChkaXYpOwogIH0KfTsKd2luZG93Ll9sb2FkX3NjcmlwdCA9IGZ1bmN0aW9uKHVybCwgY2FsbGJhY2spIHsKICB2YXIgaGVhZCA9IGRvY3VtZW50LnF1ZXJ5U2VsZWN0b3IoJ2hlYWQnKSwgc2NyaXB0ID0gZG9jdW1lbnQuY3JlYXRlRWxlbWVudCgnc2NyaXB0JyksIHIgPSBmYWxzZTsKICBzY3JpcHQudHlwZSA9ICd0ZXh0L2phdmFzY3JpcHQnOwogIHNjcmlwdC5jaGFyc2V0ID0gJ3V0Zi04JzsKICBzY3JpcHQuc3JjID0gdXJsOwogIGlmIChjYWxsYmFjaykgewogICAgc2NyaXB0Lm9ubG9hZCA9IHNjcmlwdC5vbnJlYWR5c3RhdGVjaGFuZ2UgPSBmdW5jdGlvbigpIHsKICAgICAgaWYgKCFyICYmICghdGhpcy5yZWFkeVN0YXRlIHx8IHRoaXMucmVhZHlTdGF0ZSA9PSAnY29tcGxldGUnKSkgewogICAgICAgIHIgPSB0cnVlOwogICAgICAgIGNhbGxiYWNrKCk7CiAgICAgIH0KICAgIH07CiAgfQogIGhlYWQuYXBwZW5kQ2hpbGQoc2NyaXB0KTsKfTsKKGZ1bmN0aW9uKCkgewogIGlmICh3aW5kb3cubG9jYXRpb24uc2VhcmNoLnNlYXJjaCgiZXhjbHVkZWZvcm0iKSAhPT0gLTEpIHJldHVybiBmYWxzZTsKICB2YXIgZ2V0Q29va2llID0gZnVuY3Rpb24obmFtZSkgewogICAgdmFyIG1hdGNoID0gZG9jdW1lbnQuY29va2llLm1hdGNoKG5ldyBSZWdFeHAoJyhefDsgKScgKyBuYW1lICsgJz0oW147XSspJykpOwogICAgcmV0dXJuIG1hdGNoID8gbWF0Y2hbMl0gOiBudWxsOwogIH0KICB2YXIgc2V0Q29va2llID0gZnVuY3Rpb24obmFtZSwgdmFsdWUpIHsKICAgIHZhciBub3cgPSBuZXcgRGF0ZSgpOwogICAgdmFyIHRpbWUgPSBub3cuZ2V0VGltZSgpOwogICAgdmFyIGV4cGlyZVRpbWUgPSB0aW1lICsgMTAwMCAqIDYwICogNjAgKiAyNCAqIDM2NTsKICAgIG5vdy5zZXRUaW1lKGV4cGlyZVRpbWUpOwogICAgZG9jdW1lbnQuY29va2llID0gbmFtZSArICc9JyArIHZhbHVlICsgJzsgZXhwaXJlcz0nICsgbm93ICsgJztwYXRoPS8nOwogIH0KICAgICAgdmFyIGFkZEV2ZW50ID0gZnVuY3Rpb24oZWxlbWVudCwgZXZlbnQsIGZ1bmMpIHsKICAgIGlmIChlbGVtZW50LmFkZEV2ZW50TGlzdGVuZXIpIHsKICAgICAgZWxlbWVudC5hZGRFdmVudExpc3RlbmVyKGV2ZW50LCBmdW5jKTsKICAgIH0gZWxzZSB7CiAgICAgIHZhciBvbGRGdW5jID0gZWxlbWVudFsnb24nICsgZXZlbnRdOwogICAgICBlbGVtZW50WydvbicgKyBldmVudF0gPSBmdW5jdGlvbigpIHsKICAgICAgICBvbGRGdW5jLmFwcGx5KHRoaXMsIGFyZ3VtZW50cyk7CiAgICAgICAgZnVuYy5hcHBseSh0aGlzLCBhcmd1bWVudHMpOwogICAgICB9OwogICAgfQogIH0KICB2YXIgX3JlbW92ZWQgPSBmYWxzZTsKICB2YXIgZm9ybV90b19zdWJtaXQgPSBkb2N1bWVudC5nZXRFbGVtZW50QnlJZCgnX2Zvcm1fMTczXycpOwogIHZhciBhbGxJbnB1dHMgPSBmb3JtX3RvX3N1Ym1pdC5xdWVyeVNlbGVjdG9yQWxsKCdpbnB1dCwgc2VsZWN0LCB0ZXh0YXJlYScpLCB0b29sdGlwcyA9IFtdLCBzdWJtaXR0ZWQgPSBmYWxzZTsKCiAgdmFyIGdldFVybFBhcmFtID0gZnVuY3Rpb24obmFtZSkgewogICAgdmFyIHJlZ2V4U3RyID0gJ1tcPyZdJyArIG5hbWUgKyAnPShbXiYjXSopJzsKICAgIHZhciByZXN1bHRzID0gbmV3IFJlZ0V4cChyZWdleFN0ciwgJ2knKS5leGVjKHdpbmRvdy5sb2NhdGlvbi5ocmVmKTsKICAgIHJldHVybiByZXN1bHRzICE9IHVuZGVmaW5lZCA/IGRlY29kZVVSSUNvbXBvbmVudChyZXN1bHRzWzFdKSA6IGZhbHNlOwogIH07CgogIGZvciAodmFyIGkgPSAwOyBpIDwgYWxsSW5wdXRzLmxlbmd0aDsgaSsrKSB7CiAgICB2YXIgcmVnZXhTdHIgPSAiZmllbGRcXFsoXFxkKylcXF0iOwogICAgdmFyIHJlc3VsdHMgPSBuZXcgUmVnRXhwKHJlZ2V4U3RyKS5leGVjKGFsbElucHV0c1tpXS5uYW1lKTsKICAgIGlmIChyZXN1bHRzICE9IHVuZGVmaW5lZCkgewogICAgICBhbGxJbnB1dHNbaV0uZGF0YXNldC5uYW1lID0gd2luZG93LmNmaWVsZHNbcmVzdWx0c1sxXV07CiAgICB9IGVsc2UgewogICAgICBhbGxJbnB1dHNbaV0uZGF0YXNldC5uYW1lID0gYWxsSW5wdXRzW2ldLm5hbWU7CiAgICB9CiAgICB2YXIgZmllbGRWYWwgPSBnZXRVcmxQYXJhbShhbGxJbnB1dHNbaV0uZGF0YXNldC5uYW1lKTsKCiAgICBpZiAoZmllbGRWYWwpIHsKICAgICAgaWYgKGFsbElucHV0c1tpXS5kYXRhc2V0LmF1dG9maWxsID09PSAiZmFsc2UiKSB7CiAgICAgICAgY29udGludWU7CiAgICAgIH0KICAgICAgaWYgKGFsbElucHV0c1tpXS50eXBlID09ICJyYWRpbyIgfHwgYWxsSW5wdXRzW2ldLnR5cGUgPT0gImNoZWNrYm94IikgewogICAgICAgIGlmIChhbGxJbnB1dHNbaV0udmFsdWUgPT0gZmllbGRWYWwpIHsKICAgICAgICAgIGFsbElucHV0c1tpXS5jaGVja2VkID0gdHJ1ZTsKICAgICAgICB9CiAgICAgIH0gZWxzZSB7CiAgICAgICAgYWxsSW5wdXRzW2ldLnZhbHVlID0gZmllbGRWYWw7CiAgICAgIH0KICAgIH0KICB9CgogIHZhciByZW1vdmVfdG9vbHRpcHMgPSBmdW5jdGlvbigpIHsKICAgIGZvciAodmFyIGkgPSAwOyBpIDwgdG9vbHRpcHMubGVuZ3RoOyBpKyspIHsKICAgICAgdG9vbHRpcHNbaV0udGlwLnBhcmVudE5vZGUucmVtb3ZlQ2hpbGQodG9vbHRpcHNbaV0udGlwKTsKICAgIH0KICAgIHRvb2x0aXBzID0gW107CiAgfTsKICB2YXIgcmVtb3ZlX3Rvb2x0aXAgPSBmdW5jdGlvbihlbGVtKSB7CiAgICBmb3IgKHZhciBpID0gMDsgaSA8IHRvb2x0aXBzLmxlbmd0aDsgaSsrKSB7CiAgICAgIGlmICh0b29sdGlwc1tpXS5lbGVtID09PSBlbGVtKSB7CiAgICAgICAgdG9vbHRpcHNbaV0udGlwLnBhcmVudE5vZGUucmVtb3ZlQ2hpbGQodG9vbHRpcHNbaV0udGlwKTsKICAgICAgICB0b29sdGlwcy5zcGxpY2UoaSwgMSk7CiAgICAgICAgcmV0dXJuOwogICAgICB9CiAgICB9CiAgfTsKICB2YXIgY3JlYXRlX3Rvb2x0aXAgPSBmdW5jdGlvbihlbGVtLCB0ZXh0KSB7CiAgICB2YXIgdG9vbHRpcCA9IGRvY3VtZW50LmNyZWF0ZUVsZW1lbnQoJ2RpdicpLCBhcnJvdyA9IGRvY3VtZW50LmNyZWF0ZUVsZW1lbnQoJ2RpdicpLCBpbm5lciA9IGRvY3VtZW50LmNyZWF0ZUVsZW1lbnQoJ2RpdicpLCBuZXdfdG9vbHRpcCA9IHt9OwogICAgaWYgKGVsZW0udHlwZSAhPSAncmFkaW8nICYmIGVsZW0udHlwZSAhPSAnY2hlY2tib3gnKSB7CiAgICAgIHRvb2x0aXAuY2xhc3NOYW1lID0gJ19lcnJvcic7CiAgICAgIGFycm93LmNsYXNzTmFtZSA9ICdfZXJyb3ItYXJyb3cnOwogICAgICBpbm5lci5jbGFzc05hbWUgPSAnX2Vycm9yLWlubmVyJzsKICAgICAgaW5uZXIuaW5uZXJIVE1MID0gdGV4dDsKICAgICAgdG9vbHRpcC5hcHBlbmRDaGlsZChhcnJvdyk7CiAgICAgIHRvb2x0aXAuYXBwZW5kQ2hpbGQoaW5uZXIpOwogICAgICBlbGVtLnBhcmVudE5vZGUuYXBwZW5kQ2hpbGQodG9vbHRpcCk7CiAgICB9IGVsc2UgewogICAgICB0b29sdGlwLmNsYXNzTmFtZSA9ICdfZXJyb3ItaW5uZXIgX25vX2Fycm93JzsKICAgICAgdG9vbHRpcC5pbm5lckhUTUwgPSB0ZXh0OwogICAgICBlbGVtLnBhcmVudE5vZGUuaW5zZXJ0QmVmb3JlKHRvb2x0aXAsIGVsZW0pOwogICAgICBuZXdfdG9vbHRpcC5ub19hcnJvdyA9IHRydWU7CiAgICB9CiAgICBuZXdfdG9vbHRpcC50aXAgPSB0b29sdGlwOwogICAgbmV3X3Rvb2x0aXAuZWxlbSA9IGVsZW07CiAgICB0b29sdGlwcy5wdXNoKG5ld190b29sdGlwKTsKICAgIHJldHVybiBuZXdfdG9vbHRpcDsKICB9OwogIHZhciByZXNpemVfdG9vbHRpcCA9IGZ1bmN0aW9uKHRvb2x0aXApIHsKICAgIHZhciByZWN0ID0gdG9vbHRpcC5lbGVtLmdldEJvdW5kaW5nQ2xpZW50UmVjdCgpOwogICAgdmFyIGRvYyA9IGRvY3VtZW50LmRvY3VtZW50RWxlbWVudCwgc2Nyb2xsUG9zaXRpb24gPSByZWN0LnRvcCAtICgod2luZG93LnBhZ2VZT2Zmc2V0IHx8IGRvYy5zY3JvbGxUb3ApICAtIChkb2MuY2xpZW50VG9wIHx8IDApKTsKICAgIGlmIChzY3JvbGxQb3NpdGlvbiA8IDQwKSB7CiAgICAgIHRvb2x0aXAudGlwLmNsYXNzTmFtZSA9IHRvb2x0aXAudGlwLmNsYXNzTmFtZS5yZXBsYWNlKC8gPyhfYWJvdmV8X2JlbG93KSA/L2csICcnKSArICcgX2JlbG93JzsKICAgIH0gZWxzZSB7CiAgICAgIHRvb2x0aXAudGlwLmNsYXNzTmFtZSA9IHRvb2x0aXAudGlwLmNsYXNzTmFtZS5yZXBsYWNlKC8gPyhfYWJvdmV8X2JlbG93KSA/L2csICcnKSArICcgX2Fib3ZlJzsKICAgIH0KICB9OwogIHZhciByZXNpemVfdG9vbHRpcHMgPSBmdW5jdGlvbigpIHsKICAgIGlmIChfcmVtb3ZlZCkgcmV0dXJuOwogICAgZm9yICh2YXIgaSA9IDA7IGkgPCB0b29sdGlwcy5sZW5ndGg7IGkrKykgewogICAgICBpZiAoIXRvb2x0aXBzW2ldLm5vX2Fycm93KSByZXNpemVfdG9vbHRpcCh0b29sdGlwc1tpXSk7CiAgICB9CiAgfTsKICB2YXIgdmFsaWRhdGVfZmllbGQgPSBmdW5jdGlvbihlbGVtLCByZW1vdmUpIHsKICAgIHZhciB0b29sdGlwID0gbnVsbCwgdmFsdWUgPSBlbGVtLnZhbHVlLCBub19lcnJvciA9IHRydWU7CiAgICByZW1vdmUgPyByZW1vdmVfdG9vbHRpcChlbGVtKSA6IGZhbHNlOwogICAgaWYgKGVsZW0udHlwZSAhPSAnY2hlY2tib3gnKSBlbGVtLmNsYXNzTmFtZSA9IGVsZW0uY2xhc3NOYW1lLnJlcGxhY2UoLyA/X2hhc19lcnJvciA/L2csICcnKTsKICAgIGlmIChlbGVtLmdldEF0dHJpYnV0ZSgncmVxdWlyZWQnKSAhPT0gbnVsbCkgewogICAgICBpZiAoZWxlbS50eXBlID09ICdyYWRpbycgfHwgKGVsZW0udHlwZSA9PSAnY2hlY2tib3gnICYmIC9hbnkvLnRlc3QoZWxlbS5jbGFzc05hbWUpKSkgewogICAgICAgIHZhciBlbGVtcyA9IGZvcm1fdG9fc3VibWl0LmVsZW1lbnRzW2VsZW0ubmFtZV07CiAgICAgICAgaWYgKCEoZWxlbXMgaW5zdGFuY2VvZiBOb2RlTGlzdCB8fCBlbGVtcyBpbnN0YW5jZW9mIEhUTUxDb2xsZWN0aW9uKSB8fCBlbGVtcy5sZW5ndGggPD0gMSkgewogICAgICAgICAgbm9fZXJyb3IgPSBlbGVtLmNoZWNrZWQ7CiAgICAgICAgfQogICAgICAgIGVsc2UgewogICAgICAgICAgbm9fZXJyb3IgPSBmYWxzZTsKICAgICAgICAgIGZvciAodmFyIGkgPSAwOyBpIDwgZWxlbXMubGVuZ3RoOyBpKyspIHsKICAgICAgICAgICAgaWYgKGVsZW1zW2ldLmNoZWNrZWQpIG5vX2Vycm9yID0gdHJ1ZTsKICAgICAgICAgIH0KICAgICAgICB9CiAgICAgICAgaWYgKCFub19lcnJvcikgewogICAgICAgICAgdG9vbHRpcCA9IGNyZWF0ZV90b29sdGlwKGVsZW0sICJQbGVhc2Ugc2VsZWN0IGFuIG9wdGlvbi4iKTsKICAgICAgICB9CiAgICAgIH0gZWxzZSBpZiAoZWxlbS50eXBlID09J2NoZWNrYm94JykgewogICAgICAgIHZhciBlbGVtcyA9IGZvcm1fdG9fc3VibWl0LmVsZW1lbnRzW2VsZW0ubmFtZV0sIGZvdW5kID0gZmFsc2UsIGVyciA9IFtdOwogICAgICAgIG5vX2Vycm9yID0gdHJ1ZTsKICAgICAgICBmb3IgKHZhciBpID0gMDsgaSA8IGVsZW1zLmxlbmd0aDsgaSsrKSB7CiAgICAgICAgICBpZiAoZWxlbXNbaV0uZ2V0QXR0cmlidXRlKCdyZXF1aXJlZCcpID09PSBudWxsKSBjb250aW51ZTsKICAgICAgICAgIGlmICghZm91bmQgJiYgZWxlbXNbaV0gIT09IGVsZW0pIHJldHVybiB0cnVlOwogICAgICAgICAgZm91bmQgPSB0cnVlOwogICAgICAgICAgZWxlbXNbaV0uY2xhc3NOYW1lID0gZWxlbXNbaV0uY2xhc3NOYW1lLnJlcGxhY2UoLyA/X2hhc19lcnJvciA/L2csICcnKTsKICAgICAgICAgIGlmICghZWxlbXNbaV0uY2hlY2tlZCkgewogICAgICAgICAgICBub19lcnJvciA9IGZhbHNlOwogICAgICAgICAgICBlbGVtc1tpXS5jbGFzc05hbWUgPSBlbGVtc1tpXS5jbGFzc05hbWUgKyAnIF9oYXNfZXJyb3InOwogICAgICAgICAgICBlcnIucHVzaCgiQ2hlY2tpbmcgJXMgaXMgcmVxdWlyZWQiLnJlcGxhY2UoIiVzIiwgZWxlbXNbaV0udmFsdWUpKTsKICAgICAgICAgIH0KICAgICAgICB9CiAgICAgICAgaWYgKCFub19lcnJvcikgewogICAgICAgICAgdG9vbHRpcCA9IGNyZWF0ZV90b29sdGlwKGVsZW0sIGVyci5qb2luKCc8YnIvPicpKTsKICAgICAgICB9CiAgICAgIH0gZWxzZSBpZiAoZWxlbS50YWdOYW1lID09ICdTRUxFQ1QnKSB7CiAgICAgICAgdmFyIHNlbGVjdGVkID0gdHJ1ZTsKICAgICAgICBpZiAoZWxlbS5tdWx0aXBsZSkgewogICAgICAgICAgc2VsZWN0ZWQgPSBmYWxzZTsKICAgICAgICAgIGZvciAodmFyIGkgPSAwOyBpIDwgZWxlbS5vcHRpb25zLmxlbmd0aDsgaSsrKSB7CiAgICAgICAgICAgIGlmIChlbGVtLm9wdGlvbnNbaV0uc2VsZWN0ZWQpIHsKICAgICAgICAgICAgICBzZWxlY3RlZCA9IHRydWU7CiAgICAgICAgICAgICAgYnJlYWs7CiAgICAgICAgICAgIH0KICAgICAgICAgIH0KICAgICAgICB9IGVsc2UgewogICAgICAgICAgZm9yICh2YXIgaSA9IDA7IGkgPCBlbGVtLm9wdGlvbnMubGVuZ3RoOyBpKyspIHsKICAgICAgICAgICAgaWYgKGVsZW0ub3B0aW9uc1tpXS5zZWxlY3RlZCAmJiAhZWxlbS5vcHRpb25zW2ldLnZhbHVlKSB7CiAgICAgICAgICAgICAgc2VsZWN0ZWQgPSBmYWxzZTsKICAgICAgICAgICAgfQogICAgICAgICAgfQogICAgICAgIH0KICAgICAgICBpZiAoIXNlbGVjdGVkKSB7CiAgICAgICAgICBlbGVtLmNsYXNzTmFtZSA9IGVsZW0uY2xhc3NOYW1lICsgJyBfaGFzX2Vycm9yJzsKICAgICAgICAgIG5vX2Vycm9yID0gZmFsc2U7CiAgICAgICAgICB0b29sdGlwID0gY3JlYXRlX3Rvb2x0aXAoZWxlbSwgIlBsZWFzZSBzZWxlY3QgYW4gb3B0aW9uLiIpOwogICAgICAgIH0KICAgICAgfSBlbHNlIGlmICh2YWx1ZSA9PT0gdW5kZWZpbmVkIHx8IHZhbHVlID09PSBudWxsIHx8IHZhbHVlID09PSAnJykgewogICAgICAgIGVsZW0uY2xhc3NOYW1lID0gZWxlbS5jbGFzc05hbWUgKyAnIF9oYXNfZXJyb3InOwogICAgICAgIG5vX2Vycm9yID0gZmFsc2U7CiAgICAgICAgdG9vbHRpcCA9IGNyZWF0ZV90b29sdGlwKGVsZW0sICJUaGlzIGZpZWxkIGlzIHJlcXVpcmVkLiIpOwogICAgICB9CiAgICB9CiAgICBpZiAobm9fZXJyb3IgJiYgZWxlbS5uYW1lID09ICdlbWFpbCcpIHsKICAgICAgaWYgKCF2YWx1ZS5tYXRjaCgvXltcK19hLXowLTktJyY9XSsoXC5bXCtfYS16MC05LSddKykqQFthLXowLTktXSsoXC5bYS16MC05LV0rKSooXC5bYS16XXsyLH0pJC9pKSkgewogICAgICAgIGVsZW0uY2xhc3NOYW1lID0gZWxlbS5jbGFzc05hbWUgKyAnIF9oYXNfZXJyb3InOwogICAgICAgIG5vX2Vycm9yID0gZmFsc2U7CiAgICAgICAgdG9vbHRpcCA9IGNyZWF0ZV90b29sdGlwKGVsZW0sICJFbnRlciBhIHZhbGlkIGVtYWlsIGFkZHJlc3MuIik7CiAgICAgIH0KICAgIH0KICAgIGlmIChub19lcnJvciAmJiAvZGF0ZV9maWVsZC8udGVzdChlbGVtLmNsYXNzTmFtZSkpIHsKICAgICAgaWYgKCF2YWx1ZS5tYXRjaCgvXlxkXGRcZFxkLVxkXGQtXGRcZCQvKSkgewogICAgICAgIGVsZW0uY2xhc3NOYW1lID0gZWxlbS5jbGFzc05hbWUgKyAnIF9oYXNfZXJyb3InOwogICAgICAgIG5vX2Vycm9yID0gZmFsc2U7CiAgICAgICAgdG9vbHRpcCA9IGNyZWF0ZV90b29sdGlwKGVsZW0sICJFbnRlciBhIHZhbGlkIGRhdGUuIik7CiAgICAgIH0KICAgIH0KICAgIHRvb2x0aXAgPyByZXNpemVfdG9vbHRpcCh0b29sdGlwKSA6IGZhbHNlOwogICAgcmV0dXJuIG5vX2Vycm9yOwogIH07CiAgdmFyIG5lZWRzX3ZhbGlkYXRlID0gZnVuY3Rpb24oZWwpIHsKICAgIHJldHVybiBlbC5uYW1lID09ICdlbWFpbCcgfHwgZWwuZ2V0QXR0cmlidXRlKCdyZXF1aXJlZCcpICE9PSBudWxsOwogIH07CiAgdmFyIHZhbGlkYXRlX2Zvcm0gPSBmdW5jdGlvbihlKSB7CiAgICB2YXIgZXJyID0gZm9ybV90b19zdWJtaXQucXVlcnlTZWxlY3RvcignLl9mb3JtX2Vycm9yJyksIG5vX2Vycm9yID0gdHJ1ZTsKICAgIGlmICghc3VibWl0dGVkKSB7CiAgICAgIHN1Ym1pdHRlZCA9IHRydWU7CiAgICAgIGZvciAodmFyIGkgPSAwLCBsZW4gPSBhbGxJbnB1dHMubGVuZ3RoOyBpIDwgbGVuOyBpKyspIHsKICAgICAgICB2YXIgaW5wdXQgPSBhbGxJbnB1dHNbaV07CiAgICAgICAgaWYgKG5lZWRzX3ZhbGlkYXRlKGlucHV0KSkgewogICAgICAgICAgaWYgKGlucHV0LnR5cGUgPT0gJ3RleHQnKSB7CiAgICAgICAgICAgIGFkZEV2ZW50KGlucHV0LCAnYmx1cicsIGZ1bmN0aW9uKCkgewogICAgICAgICAgICAgIHRoaXMudmFsdWUgPSB0aGlzLnZhbHVlLnRyaW0oKTsKICAgICAgICAgICAgICB2YWxpZGF0ZV9maWVsZCh0aGlzLCB0cnVlKTsKICAgICAgICAgICAgfSk7CiAgICAgICAgICAgIGFkZEV2ZW50KGlucHV0LCAnaW5wdXQnLCBmdW5jdGlvbigpIHsKICAgICAgICAgICAgICB2YWxpZGF0ZV9maWVsZCh0aGlzLCB0cnVlKTsKICAgICAgICAgICAgfSk7CiAgICAgICAgICB9IGVsc2UgaWYgKGlucHV0LnR5cGUgPT0gJ3JhZGlvJyB8fCBpbnB1dC50eXBlID09ICdjaGVja2JveCcpIHsKICAgICAgICAgICAgKGZ1bmN0aW9uKGVsKSB7CiAgICAgICAgICAgICAgdmFyIHJhZGlvcyA9IGZvcm1fdG9fc3VibWl0LmVsZW1lbnRzW2VsLm5hbWVdOwogICAgICAgICAgICAgIGZvciAodmFyIGkgPSAwOyBpIDwgcmFkaW9zLmxlbmd0aDsgaSsrKSB7CiAgICAgICAgICAgICAgICBhZGRFdmVudChyYWRpb3NbaV0sICdjbGljaycsIGZ1bmN0aW9uKCkgewogICAgICAgICAgICAgICAgICB2YWxpZGF0ZV9maWVsZChlbCwgdHJ1ZSk7CiAgICAgICAgICAgICAgICB9KTsKICAgICAgICAgICAgICB9CiAgICAgICAgICAgIH0pKGlucHV0KTsKICAgICAgICAgIH0gZWxzZSBpZiAoaW5wdXQudGFnTmFtZSA9PSAnU0VMRUNUJykgewogICAgICAgICAgICBhZGRFdmVudChpbnB1dCwgJ2NoYW5nZScsIGZ1bmN0aW9uKCkgewogICAgICAgICAgICAgIHZhbGlkYXRlX2ZpZWxkKHRoaXMsIHRydWUpOwogICAgICAgICAgICB9KTsKICAgICAgICAgIH0gZWxzZSBpZiAoaW5wdXQudHlwZSA9PSAndGV4dGFyZWEnKXsKICAgICAgICAgICAgYWRkRXZlbnQoaW5wdXQsICdpbnB1dCcsIGZ1bmN0aW9uKCkgewogICAgICAgICAgICAgIHZhbGlkYXRlX2ZpZWxkKHRoaXMsIHRydWUpOwogICAgICAgICAgICB9KTsKICAgICAgICAgIH0KICAgICAgICB9CiAgICAgIH0KICAgIH0KICAgIHJlbW92ZV90b29sdGlwcygpOwogICAgZm9yICh2YXIgaSA9IDAsIGxlbiA9IGFsbElucHV0cy5sZW5ndGg7IGkgPCBsZW47IGkrKykgewogICAgICB2YXIgZWxlbSA9IGFsbElucHV0c1tpXTsKICAgICAgaWYgKG5lZWRzX3ZhbGlkYXRlKGVsZW0pKSB7CiAgICAgICAgaWYgKGVsZW0udGFnTmFtZS50b0xvd2VyQ2FzZSgpICE9PSAic2VsZWN0IikgewogICAgICAgICAgZWxlbS52YWx1ZSA9IGVsZW0udmFsdWUudHJpbSgpOwogICAgICAgIH0KICAgICAgICB2YWxpZGF0ZV9maWVsZChlbGVtKSA/IHRydWUgOiBub19lcnJvciA9IGZhbHNlOwogICAgICB9CiAgICB9CiAgICBpZiAoIW5vX2Vycm9yICYmIGUpIHsKICAgICAgZS5wcmV2ZW50RGVmYXVsdCgpOwogICAgfQogICAgcmVzaXplX3Rvb2x0aXBzKCk7CiAgICByZXR1cm4gbm9fZXJyb3I7CiAgfTsKICBhZGRFdmVudCh3aW5kb3csICdyZXNpemUnLCByZXNpemVfdG9vbHRpcHMpOwogIGFkZEV2ZW50KHdpbmRvdywgJ3Njcm9sbCcsIHJlc2l6ZV90b29sdGlwcyk7CiAgd2luZG93Ll9vbGRfc2VyaWFsaXplID0gbnVsbDsKICBpZiAodHlwZW9mIHNlcmlhbGl6ZSAhPT0gJ3VuZGVmaW5lZCcpIHdpbmRvdy5fb2xkX3NlcmlhbGl6ZSA9IHdpbmRvdy5zZXJpYWxpemU7CiAgX2xvYWRfc2NyaXB0KCIvL2QzcnhhaWo1NnZqZWdlLmNsb3VkZnJvbnQubmV0L2Zvcm0tc2VyaWFsaXplLzAuMy9zZXJpYWxpemUubWluLmpzIiwgZnVuY3Rpb24oKSB7CiAgICB3aW5kb3cuX2Zvcm1fc2VyaWFsaXplID0gd2luZG93LnNlcmlhbGl6ZTsKICAgIGlmICh3aW5kb3cuX29sZF9zZXJpYWxpemUpIHdpbmRvdy5zZXJpYWxpemUgPSB3aW5kb3cuX29sZF9zZXJpYWxpemU7CiAgfSk7CiAgdmFyIGZvcm1fc3VibWl0ID0gZnVuY3Rpb24oZSkgewogICAgZS5wcmV2ZW50RGVmYXVsdCgpOwogICAgaWYgKHZhbGlkYXRlX2Zvcm0oKSkgewogICAgICAvLyB1c2UgdGhpcyB0cmljayB0byBnZXQgdGhlIHN1Ym1pdCBidXR0b24gJiBkaXNhYmxlIGl0IHVzaW5nIHBsYWluIGphdmFzY3JpcHQKICAgICAgZG9jdW1lbnQucXVlcnlTZWxlY3RvcignI19mb3JtXzE3M19zdWJtaXQnKS5kaXNhYmxlZCA9IHRydWU7CiAgICAgICAgICAgIHZhciBzZXJpYWxpemVkID0gX2Zvcm1fc2VyaWFsaXplKGRvY3VtZW50LmdldEVsZW1lbnRCeUlkKCdfZm9ybV8xNzNfJykpOwogICAgICB2YXIgZXJyID0gZm9ybV90b19zdWJtaXQucXVlcnlTZWxlY3RvcignLl9mb3JtX2Vycm9yJyk7CiAgICAgIGVyciA/IGVyci5wYXJlbnROb2RlLnJlbW92ZUNoaWxkKGVycikgOiBmYWxzZTsKICAgICAgX2xvYWRfc2NyaXB0KCdodHRwczovL3JpdmVyYmVuZGludmVzdG1lbnRtYW5hZ2VtZW50LmFjdGl2ZWhvc3RlZC5jb20vcHJvYy5waHA/JyArIHNlcmlhbGl6ZWQgKyAnJmpzb25wPXRydWUnKTsKICAgIH0KICAgIHJldHVybiBmYWxzZTsKICB9OwogIGFkZEV2ZW50KGZvcm1fdG9fc3VibWl0LCAnc3VibWl0JywgZm9ybV9zdWJtaXQpOwp9KSgpOwoKPC9zY3JpcHQ+[/fusion_code][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container][fusion_builder_container hundred_percent=”no” hundred_percent_height=”no” hundred_percent_height_scroll=”no” hundred_percent_height_center_content=”yes” equal_height_columns=”no” menu_anchor=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” status=”published” publish_date=”” class=”” id=”” border_size=”” border_color=”” border_style=”solid” margin_top=”” margin_bottom=”” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” gradient_start_color=”” gradient_end_color=”” gradient_start_position=”0″ gradient_end_position=”100″ gradient_type=”linear” radial_direction=”center” linear_angle=”180″ background_color=”” background_image=”” background_position=”center center” background_repeat=”no-repeat” fade=”no” background_parallax=”none” enable_mobile=”no” parallax_speed=”0.3″ background_blend_mode=”none” video_mp4=”” video_webm=”” video_ogv=”” video_url=”” video_aspect_ratio=”16:9″ video_loop=”yes” video_mute=”yes” video_preview_image=”” filter_hue=”0″ filter_saturation=”100″ filter_brightness=”100″ filter_contrast=”100″ filter_invert=”0″ filter_sepia=”0″ filter_opacity=”100″ filter_blur=”0″ filter_hue_hover=”0″ filter_saturation_hover=”100″ filter_brightness_hover=”100″ filter_contrast_hover=”100″ filter_invert_hover=”0″ filter_sepia_hover=”0″ filter_opacity_hover=”100″ filter_blur_hover=”0″][fusion_builder_row][/fusion_builder_row][/fusion_builder_container]