[fusion_builder_container hundred_percent=”no” equal_height_columns=”no” menu_anchor=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”center center” background_repeat=”no-repeat” fade=”no” background_parallax=”none” parallax_speed=”0.3″ video_mp4=”” video_webm=”” video_ogv=”” video_url=”” video_aspect_ratio=”16:9″ video_loop=”yes” video_mute=”yes” overlay_color=”” video_preview_image=”” border_size=”” border_color=”” border_style=”solid” padding_top=”” padding_bottom=”” padding_left=”” padding_right=””][fusion_builder_row][fusion_builder_column type=”1_1″ layout=”1_1″ background_position=”left top” background_color=”” border_size=”” border_color=”” border_style=”solid” border_position=”all” spacing=”yes” background_image=”” background_repeat=”no-repeat” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” margin_top=”0px” margin_bottom=”0px” class=”” id=”” animation_type=”” animation_speed=”0.3″ animation_direction=”left” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” center_content=”no” last=”no” min_height=”” hover_type=”none” link=””][fusion_text]

U.S. Markets:

U.S. stocks recorded solid gains for the week and several indices hit record highs.

The Dow Jones Industrial Average rose 273 points finishing the week at 35,209, a gain of 0.8%. The NASDAQ retraced all of last week’s decline by rising 1.1% to close at 14,836.

By market cap, the large cap S&P 500 rose 0.9%, while the mid cap S&P 400 and small cap Russell 2000 gained 0.5% and 1.0%, respectively.

International Markets:

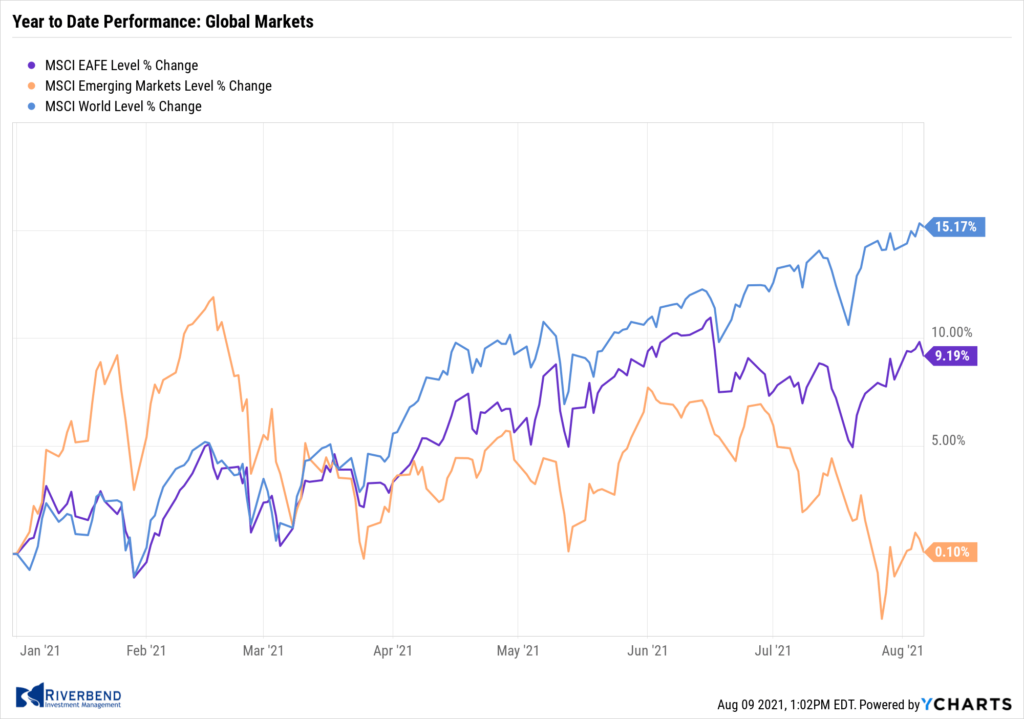

Major international markets also finished the week solidly in the green.

Canada’s TSX added 0.9%, while the United Kingdom’s FTSE 100 gained 1.3%. France’s CAC 40 and Germany’s DAX rose 3.1% and 1.4%, respectively.

China’s Shanghai Composite added 1.8%, while Japan’s Nikkei rallied 2%.

As grouped by Morgan Stanley Capital International, developed markets finished up 1.0% and emerging markets gained 0.7%.

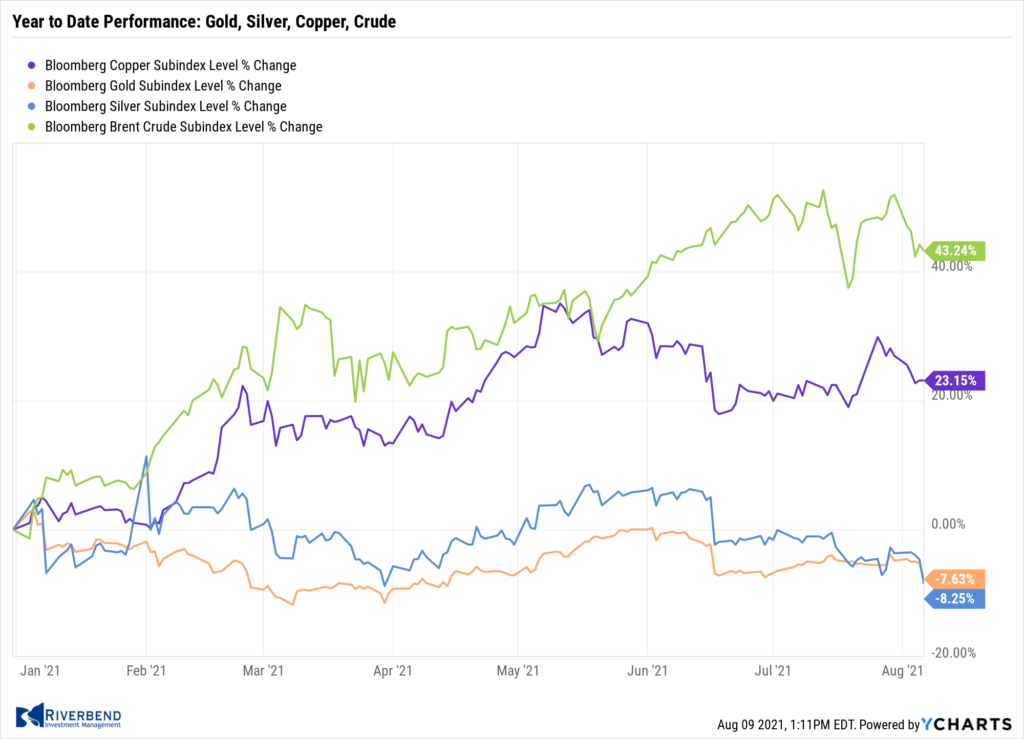

Commodities:

Precious metals had a difficult week. Gold retreated -3.0% to $1763.10 per ounce, while Silver fell a steeper -4.8% to $24.33.

West Texas Intermediate crude oil gave up all of the last two week’s gains, declining -7.7% to $68.28 per barrel.

The industrial metal copper, viewed by some analysts as a barometer of world economic health due to its wide variety of uses, finished the week down -3%.

U.S. Economic News:

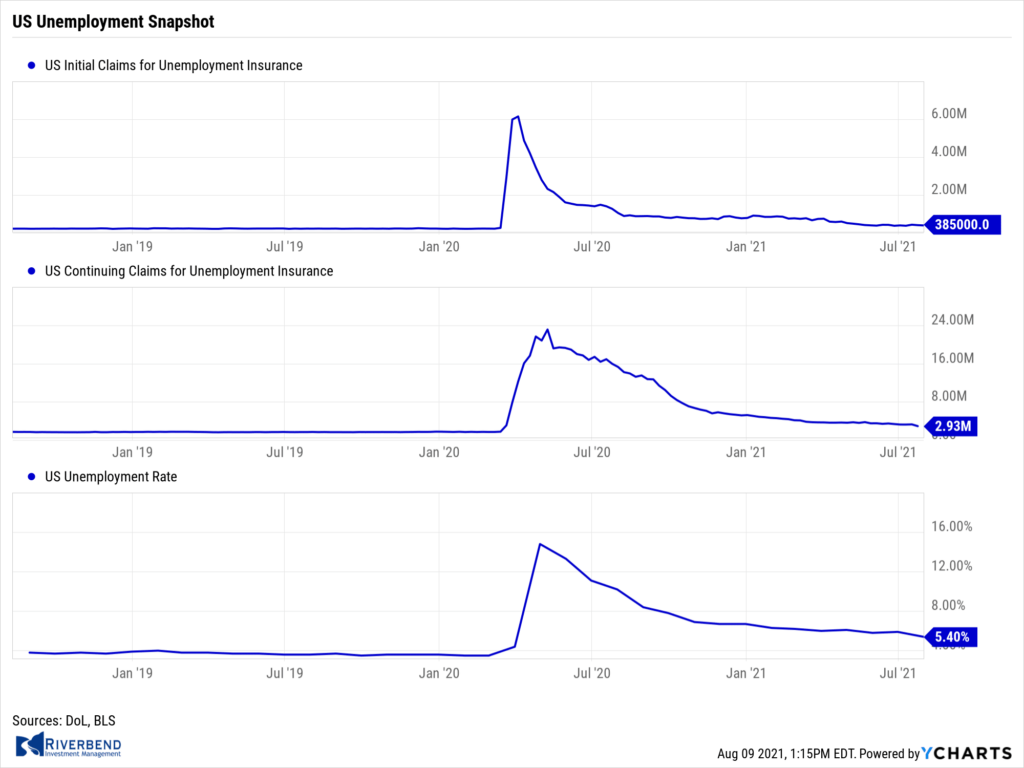

The number of Americans filing first-time unemployment benefits fell close to a pandemic low, indicating the economy is thus far avoiding major damage from the so-called “delta strain” of the coronavirus. Initial jobless claims dropped by 14,000 to 385,000 in the week ended July 31, the government said. The reading matched the consensus forecast. Applications had surged to a two-month high in mid-July, but the increase appears to have stemmed from seasonal swings in summer employment.

Economists are watching to see if the contagious delta strain triggers more layoffs or discourages people from looking for work. New claims fell the most in Pennsylvania, Texas, Michigan and Georgia. The only state to post a large increase was Indiana. Meanwhile, continuing claims, which count the number of people already receiving benefits, declined by 366,000 to 2.93 million. That number is a new pandemic low.

The U.S. added 943,000 jobs in July, a sign the economy continued to gain steam and is (so far) withstanding concerns over a “delta variant” of the coronavirus. The increase in hiring last month–the biggest in nearly a year, easily exceeded Wall Street’s estimates. Economists had forecast just 845,000 new jobs would be created.

Privately owned businesses added 703,000 employees last month, mostly at restaurants, hotels and other providers of leisure and entertainment. Furthermore, the unemployment rate fell sharply to a fresh pandemic low of 5.4% from 5.9% in June. Many economists predict more people will rejoin the labor force in the fall after schools reopen and extra federal benefits put in place during the pandemic expire.

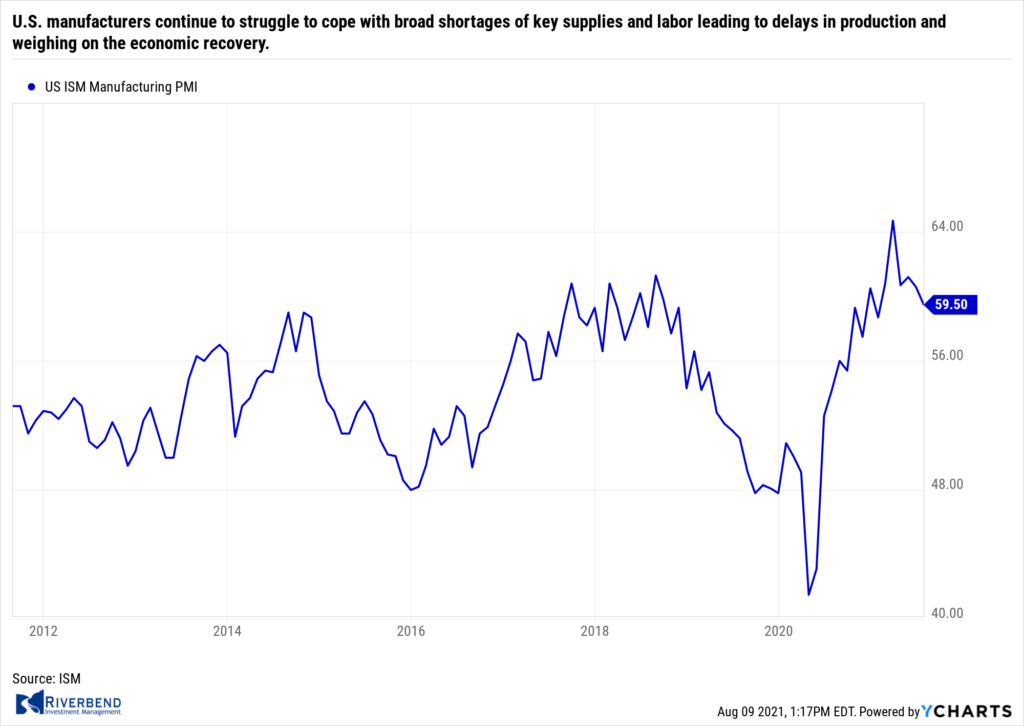

U.S. manufacturers continue to struggle to cope with broad shortages of key supplies and labor leading to delays in production and weighing on the economic recovery. The Institute for Supply Management (ISM) reported its closely-followed index of U.S.-based manufacturing dipped 5.1 points to a six-month low of 59.5 in July. That was slightly below Wall Street forecasts.

U.S. manufacturers continue to struggle to cope with broad shortages of key supplies and labor leading to delays in production and weighing on the economic recovery. The Institute for Supply Management (ISM) reported its closely-followed index of U.S.-based manufacturing dipped 5.1 points to a six-month low of 59.5 in July. That was slightly below Wall Street forecasts.

While numbers above 50 signify growth, the survey had topped 60 for 5 months in a row, a reflection of the strong recovery in the economy. ISM reported that businesses would be growing even faster if not for persistent difficulties in getting materials on time and finding qualified people to hire. In a potentially good sign, Timothy Fiore, chairman of the survey, said price increases may have peaked and companies are starting to resolve supply bottlenecks. “You are going to see prices drop as suppliers have more capacity to meet demand,” he wrote.

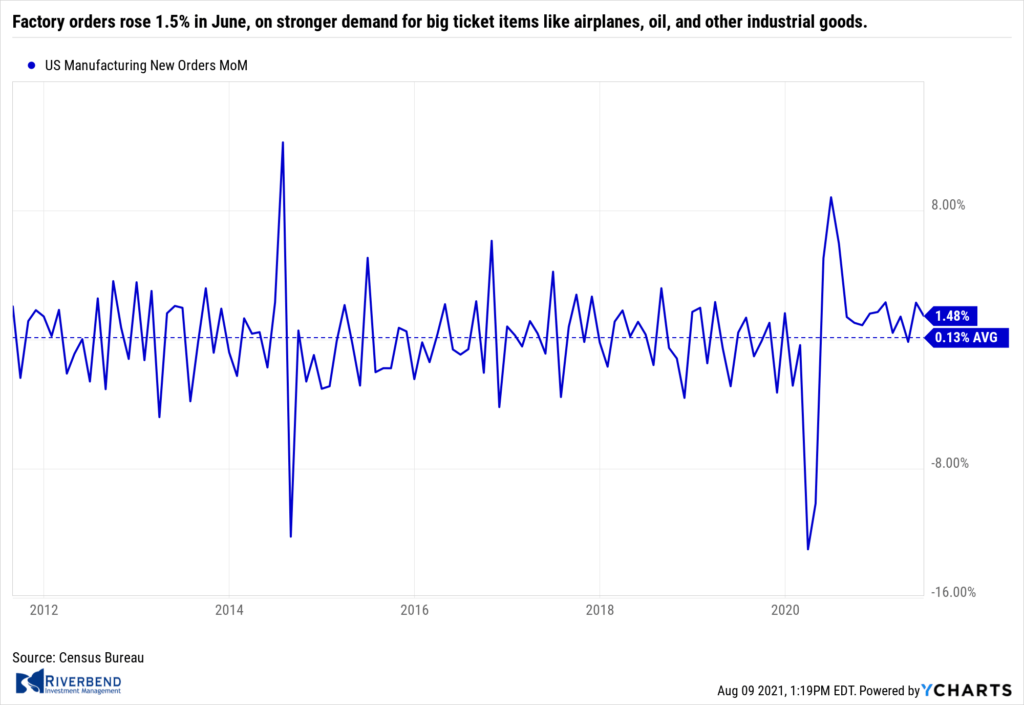

Factory orders rose 1.5% in June, on stronger demand for big ticket items like airplanes, oil, and other industrial goods. New orders have risen in 13 of the last 14 months, reflecting the resiliency of the U.S. economy and the manufacturing sector during the pandemic. Orders for goods expected to last at least three years, so-called “durable goods”, rose 0.9% the Commerce Department said. That number beat expectations by 0.1%. The biggest increase in new bookings involved commercial airplanes. Core capital goods orders, which exclude large ticket items like aircraft and military equipment, rose 0.7% in June. Orders for shorter-lasting “non-durable goods” such as food, clothing, and medications, advanced 2.1% in the month.

Factory orders rose 1.5% in June, on stronger demand for big ticket items like airplanes, oil, and other industrial goods. New orders have risen in 13 of the last 14 months, reflecting the resiliency of the U.S. economy and the manufacturing sector during the pandemic. Orders for goods expected to last at least three years, so-called “durable goods”, rose 0.9% the Commerce Department said. That number beat expectations by 0.1%. The biggest increase in new bookings involved commercial airplanes. Core capital goods orders, which exclude large ticket items like aircraft and military equipment, rose 0.7% in June. Orders for shorter-lasting “non-durable goods” such as food, clothing, and medications, advanced 2.1% in the month.

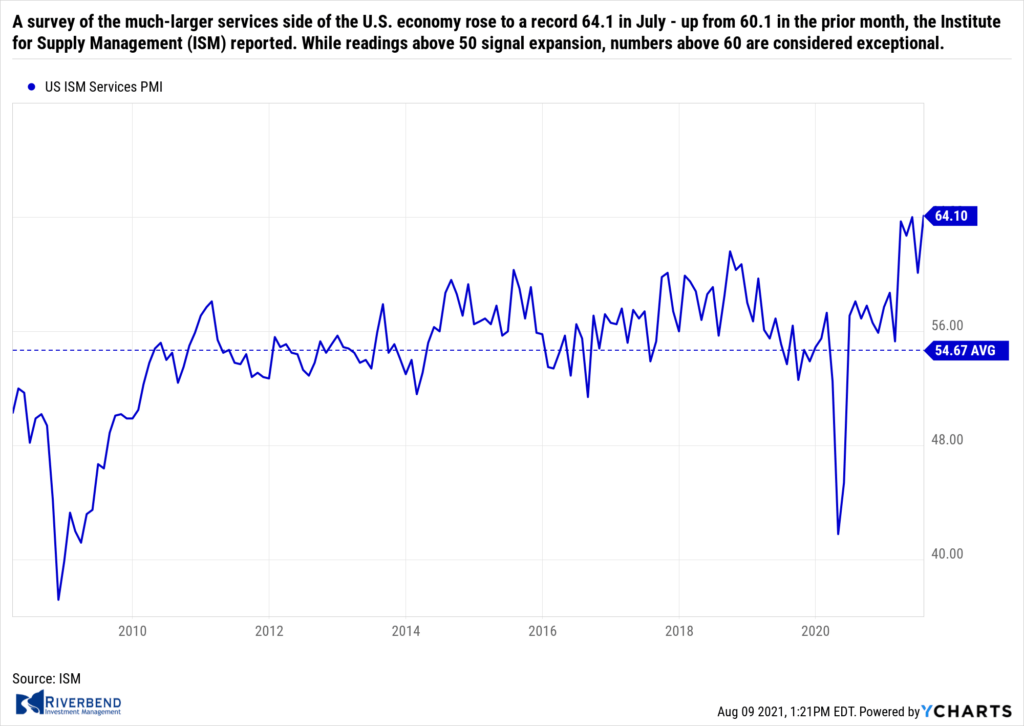

A survey of the much-larger services side of the U.S. economy rose to a record 64.1 in July – up from 60.1 in the prior month, the Institute for Supply Management (ISM) reported. Economists had forecast the index would total just 60.5% in July. While readings above 50 signal expansion, numbers above 60 are considered exceptional.

A survey of the much-larger services side of the U.S. economy rose to a record 64.1 in July – up from 60.1 in the prior month, the Institute for Supply Management (ISM) reported. Economists had forecast the index would total just 60.5% in July. While readings above 50 signal expansion, numbers above 60 are considered exceptional.

In the details of the report, new orders and the level of production rose again in July and were near all-time highs. Employment also turned positive again after a negative reading in June. Seventeen industries tracked by ISM reported growth in July while none contracted. Chief economist Stephen Stanley of Amherst Pierpont Securities wrote in a note to clients, “The economy is literally bursting at the seams, as demand is as strong as I have ever seen it and supply is struggling to catch up.”

Chart of the Week:

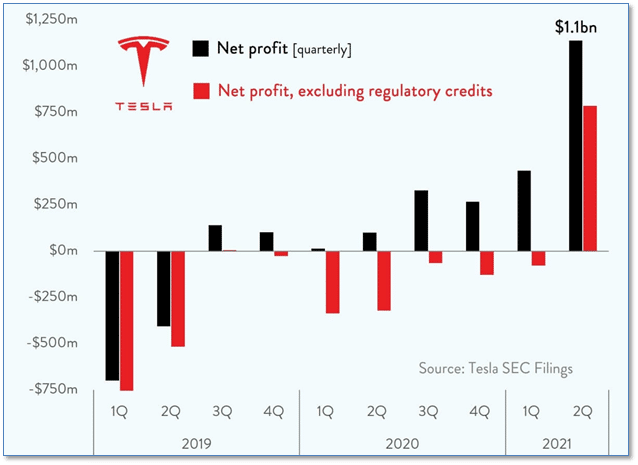

Most investors in Tesla are probably not expecting to see big profits anytime soon. Instead, they’re focused on the electric vehicle revolution and Tesla’s likely large share of the industry profits that will go with its leadership position.

In prior years, Tesla’s reported “profits” actually came from the sale of “regulatory credits” that accrue to the benefit of electric vehicle manufacturers for environmental reasons, and not from Tesla’s actual business.

So Tesla investors were both shocked and pleased this week when Tesla revealed a quite large profit even after excluding regulatory credits. Elon Musk likes taking regulators and markets by surprise, and this was a big one.

Riverbend Indicators:

Each week we post notable changes to the various market indicators we follow.

- As a reading of our Bull-Bear Indicator for U.S. Equities (comparative measurements over a rolling one-year timeframe), we remain in Cyclical Bull territory.

- Counting up of the number of all our indicators that are ‘Up’ for U.S. Equities, the current tally is that four of four are Positive, representing a multitude of timeframes (two that can be solely days/weeks, or months+ at a time; another, a quarter at a time; and lastly, the {typically} years-long reading, that being the Cyclical Bull or Bear status).

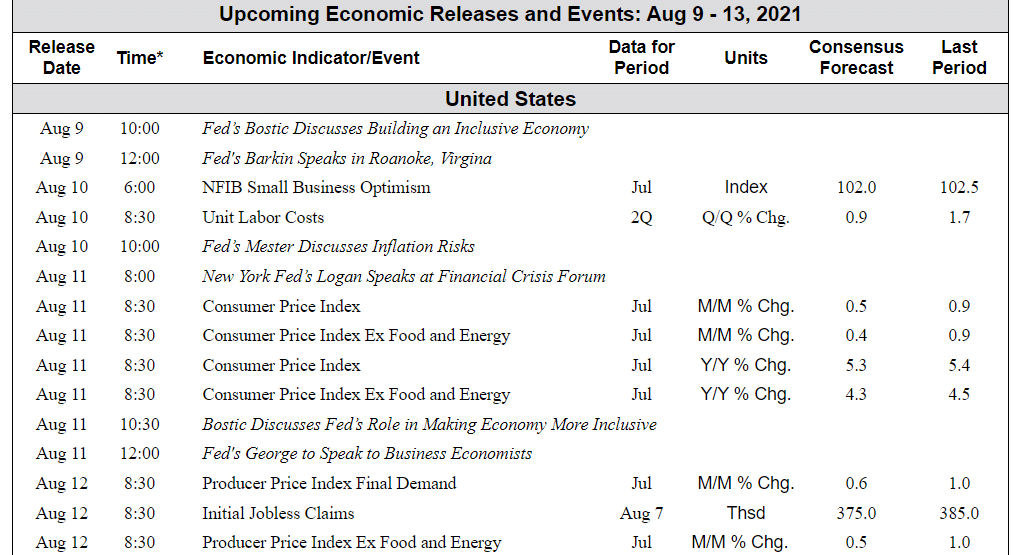

The Week Ahead:

(Sources: All index- and returns-data from Yahoo Finance; news from Reuters, Barron’s, Wall St. Journal, Bloomberg.com, ft.com, guggenheimpartners.com, zerohedge.com, ritholtz.com, markit.com, financialpost.com, Eurostat, Statistics Canada, Yahoo! Finance, stocksandnews.com, marketwatch.com, wantchinatimes.com, BBC, 361capital.com, pensionpartners.com, cnbc.com, FactSet.)

[/fusion_text][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]