U.S. Markets:

U.S. stocks pulled back for the week, but not before the S&P 500 index reached a new record high on Monday afternoon, more than double its intraday low of 2,192 on March 23, 2020.

The Dow Jones Industrial Average pulled back 395 points to finish the week at 35,120, a decline of -1.1%. The technology-heavy NASDAQ Composite retreated a second week, giving up -0.7%.

By market cap, the large cap S&P 500 declined -0.6%, while the mid cap S&P 400 and small cap Russell 2000 ended down ‑2% and ‑2.5%, respectively.

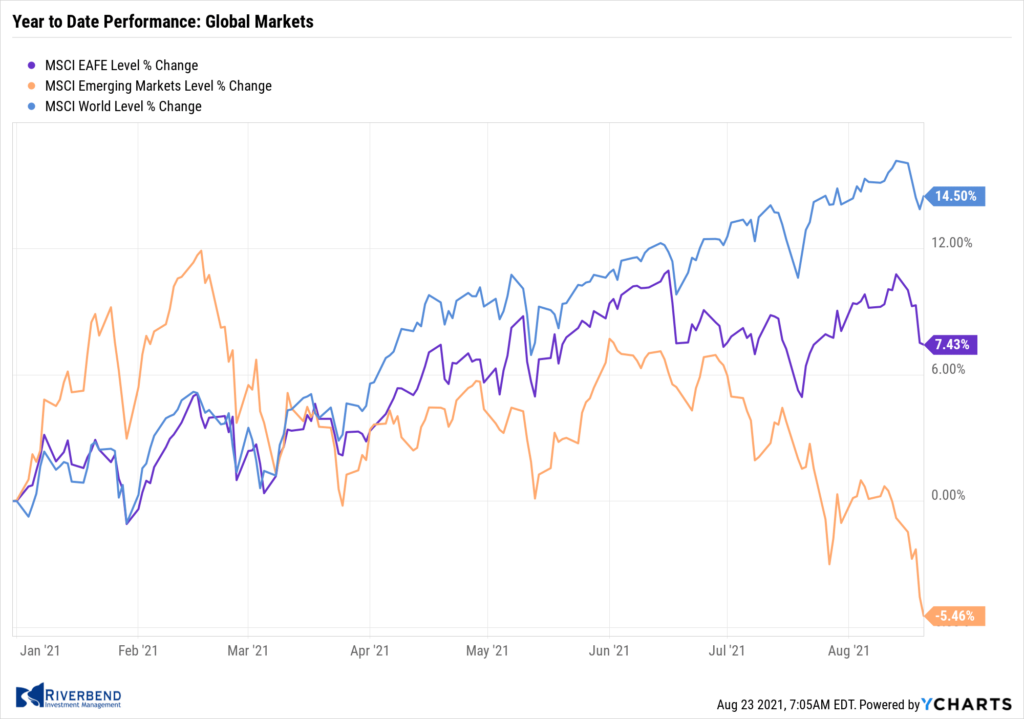

International Markets:

Major international markets finished the week in the red across the board. Canada’s TSX declined -0.9%, while the United Kingdom’s FTSE 100 retreated -1.8%.

On Europe’s mainland, France’s CAC 40 and Germany’s DAX pulled back -3.9% and -1.1% respectively, while in Asia China’s Shanghai Composite gave up ‑2.5%. Japan’s Nikkei ended the week down -3.4%.

As grouped by Morgan Stanley Capital International, developed markets retreated -2.4%, while emerging markets fell a much steeper -4.3%.

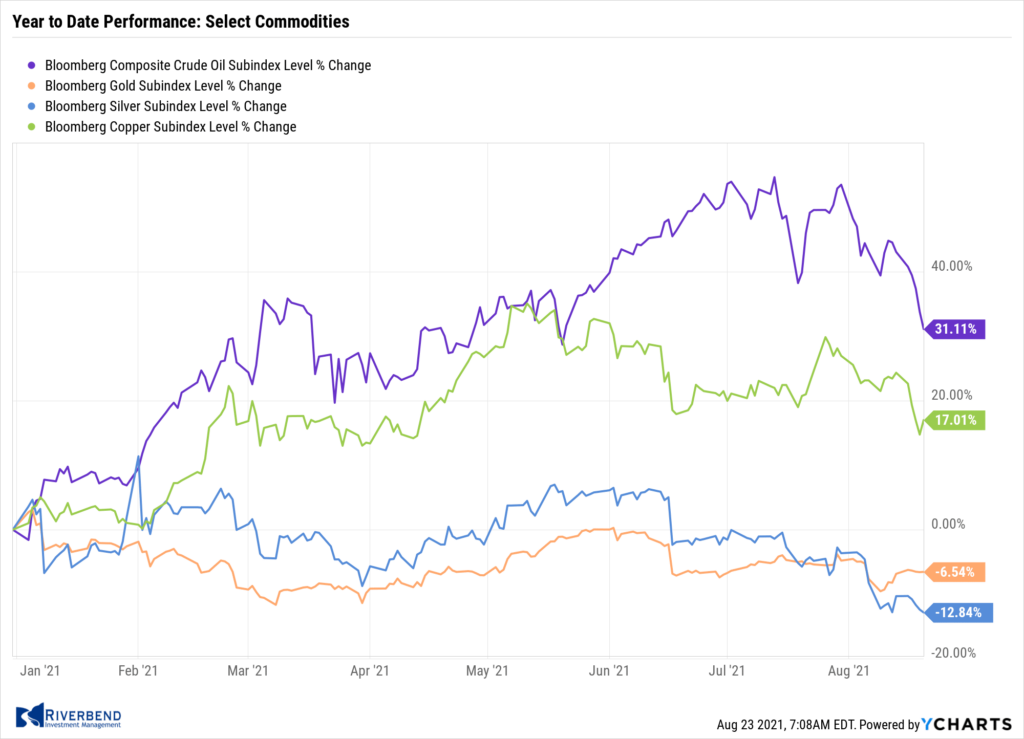

Commodities:

Like equities, commodities finished the week predominantly to the downside.

West Texas Intermediate crude oil plunged -9.2% last week closing at $62.14 per barrel. Silver declined -2.8% to $23.11 per ounce, while Gold managed a slight 0.3% gain to $1784.00 per ounce.

The industrial metal copper, viewed by some analysts as a barometer of global economic health due to its wide variety of uses, sold off -5.8%.

U.S. Economic News:

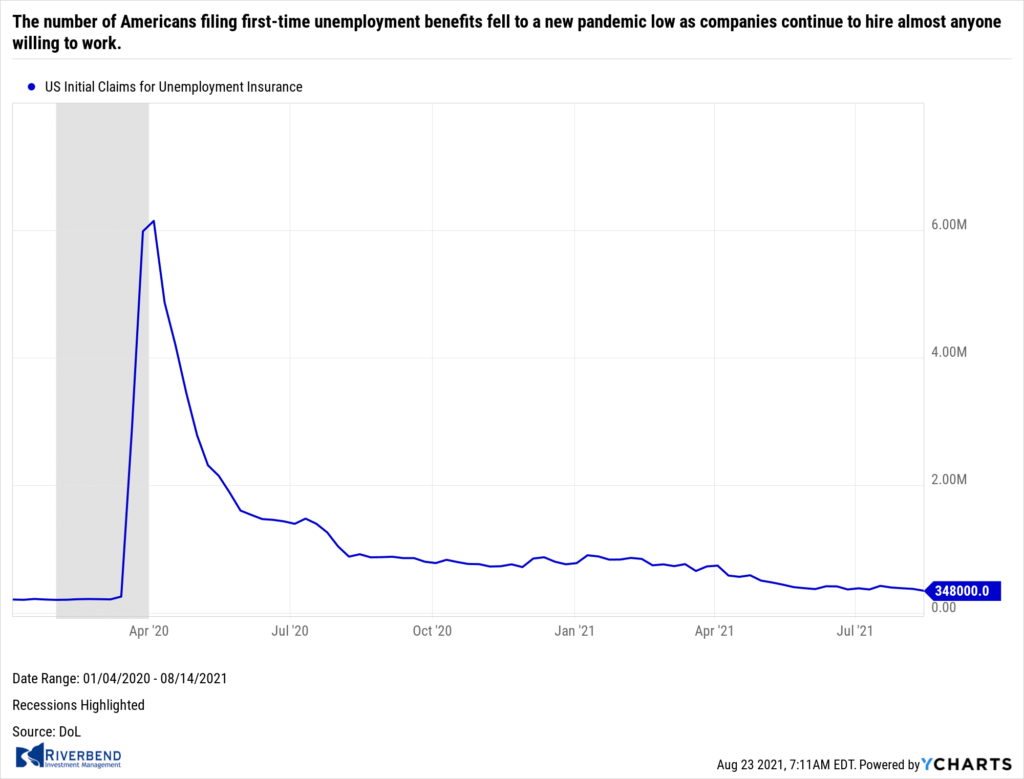

The number of Americans filing first-time unemployment benefits fell to a new pandemic low as companies continue to hire almost anyone willing to work. The Labor Department reported new applications for unemployment benefits fell to a more than year-and-a-half low of 348,000 in the week ended August 14th. Economists had estimated new claims would total 365,000.

Analysts note the big question is whether more people will return to the labor force in the fall as expected when schools reopen and extra federal unemployment benefits run out. Federal Reserve officials, for instance, worry delta could delay their return to work and prolong the labor shortage at least until the end of the year. Meanwhile, the number of people already collecting benefits, so-called “continuing claims”, slid by 79,000 to 2.82 million—also a pandemic era low.

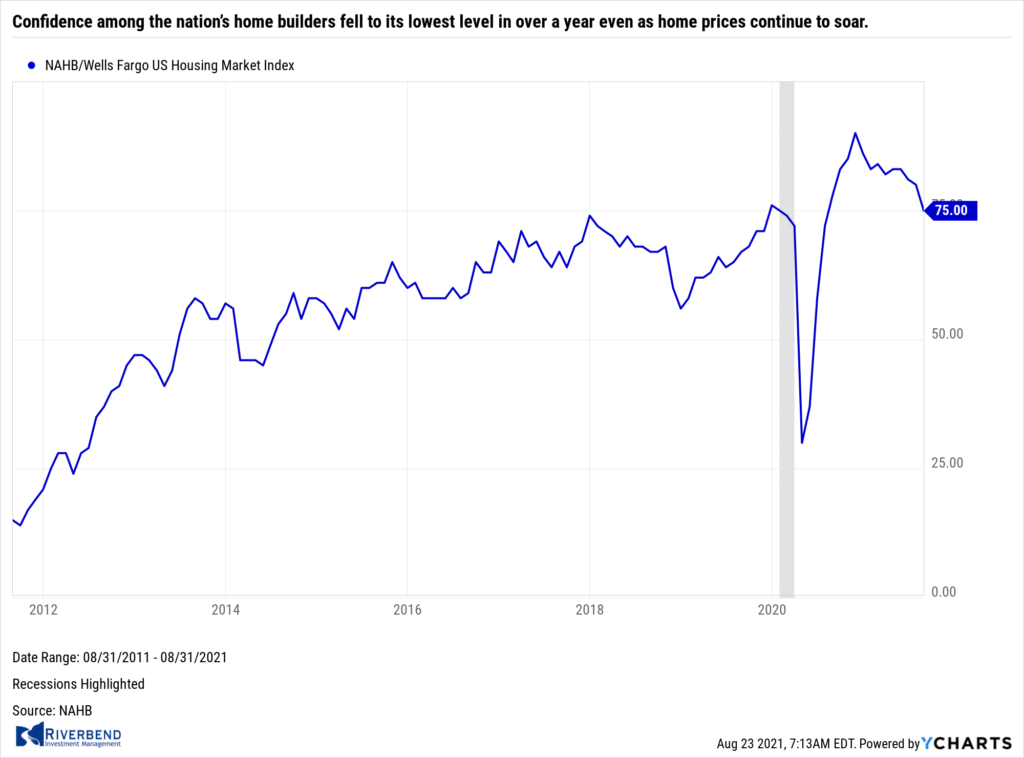

Confidence among the nation’s home builders fell to its lowest level in over a year even as home prices continue to soar. The National Association of Home Builders (NAHB) reported its monthly confidence index fell five points to a reading of 75 for August. That is the reading’s lowest level in 13 months.

Confidence among the nation’s home builders fell to its lowest level in over a year even as home prices continue to soar. The National Association of Home Builders (NAHB) reported its monthly confidence index fell five points to a reading of 75 for August. That is the reading’s lowest level in 13 months.

Chuck Fowke, chairman of the NAHB, stated, “Buyer traffic has fallen to its lowest reading since July 2020 as some prospective buyers are experiencing sticker shock due to higher construction costs.” Two of the three gauges that makeup the overall builder confidence index each experienced five-point declines, including the index that measures current sales conditions and the component that tracks traffic of prospective buyers. The gauge that assesses sales expectations for the next six months remained unchanged from the previous month.

Concurrent with the NAHB report, the Census Bureau reported building activity for new homes slumped in July, reflecting the continued supply constraints facing construction firms nationwide. U.S. home builders started construction on homes at a seasonally-adjusted annual rate of 1.53 million in July, representing a 7% decrease from June’s upwardly-revised figure. Permits for new homes, which give analysts a gauge of future building activity, rose 2.6% in July and 6.0% from a year ago. Analysts note the pickup in permitting is a positive sign that the housing market is still on relatively solid ground.

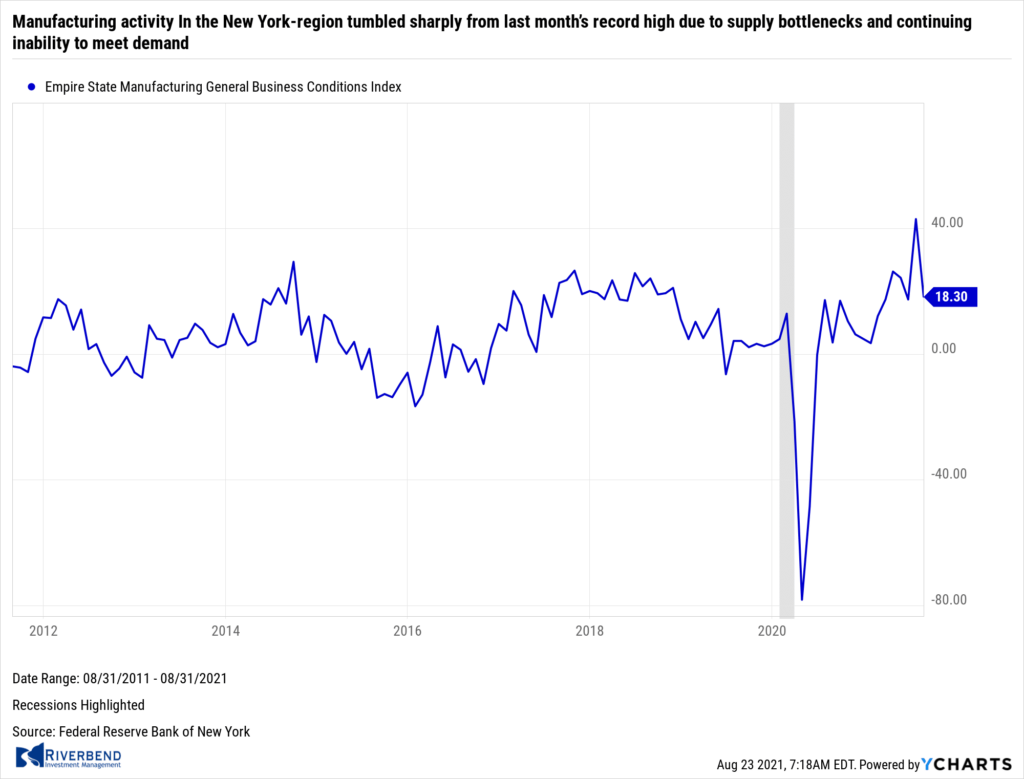

Manufacturing activity In the New York-region tumbled sharply from last month’s record high. The New York Federal Reserve reported its Empire State business conditions index fell 24.7 points to 18.3, the bank said. Economists had expected a reading of 30. This was the lowest reading since March.

Manufacturing activity In the New York-region tumbled sharply from last month’s record high. The New York Federal Reserve reported its Empire State business conditions index fell 24.7 points to 18.3, the bank said. Economists had expected a reading of 30. This was the lowest reading since March.

In the details, the new orders index fell 18.4 points to 14.8, while shipments plunged 39.4 points to just 4.4. With regard to inflation, the prices received index rose 6.6 points to a record-high 46. Following the release, analysts noted the U.S. manufacturing sector continues to be dogged by supply bottlenecks and continuing inability to meet demand.

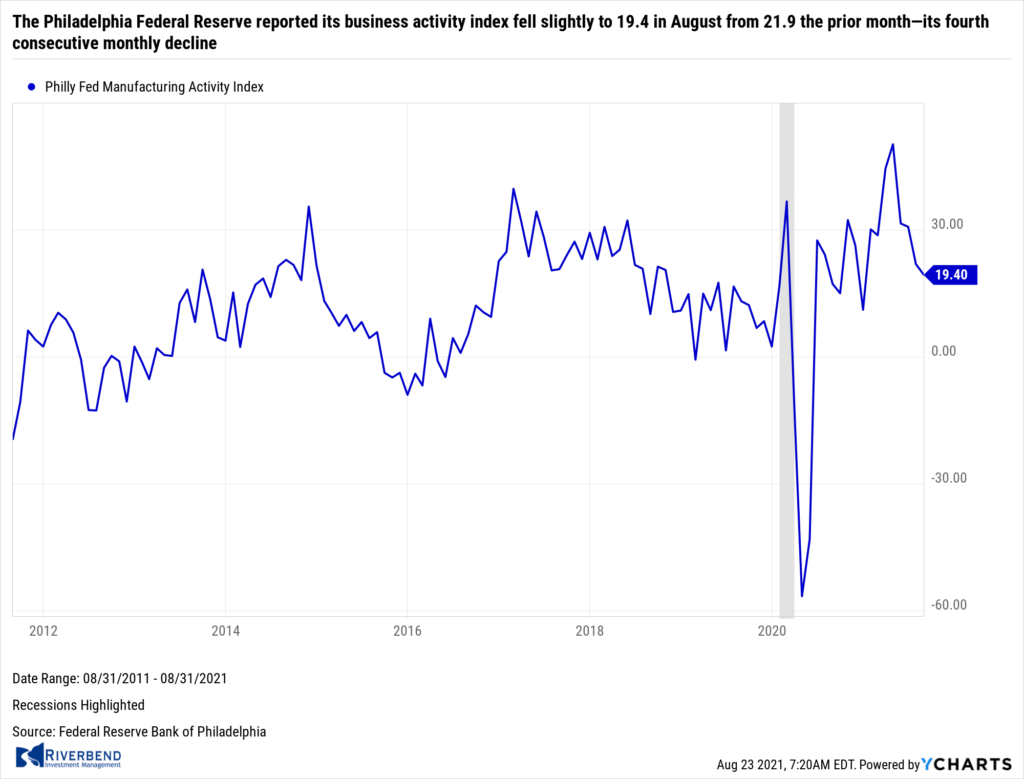

In the city of ‘brotherly love’, the Philadelphia Federal Reserve reported its business activity index fell slightly to 19.4 in August from 21.9 the prior month—its fourth consecutive monthly decline. Economists were expecting a reading of 22. In the details, the gauge of new orders increased 6 points to 22.8, while the shipments index fell 6 points to 18.9. Factory activity in the region continued to show solid growth, but rising prices continued to weigh on the outlook for the manufacturing sector. Firms reported that they expected to be able to pass on price increases to their customers. The report is similar to the New York Fed’s regional activity report that also showed growth slowing.

In the city of ‘brotherly love’, the Philadelphia Federal Reserve reported its business activity index fell slightly to 19.4 in August from 21.9 the prior month—its fourth consecutive monthly decline. Economists were expecting a reading of 22. In the details, the gauge of new orders increased 6 points to 22.8, while the shipments index fell 6 points to 18.9. Factory activity in the region continued to show solid growth, but rising prices continued to weigh on the outlook for the manufacturing sector. Firms reported that they expected to be able to pass on price increases to their customers. The report is similar to the New York Fed’s regional activity report that also showed growth slowing.

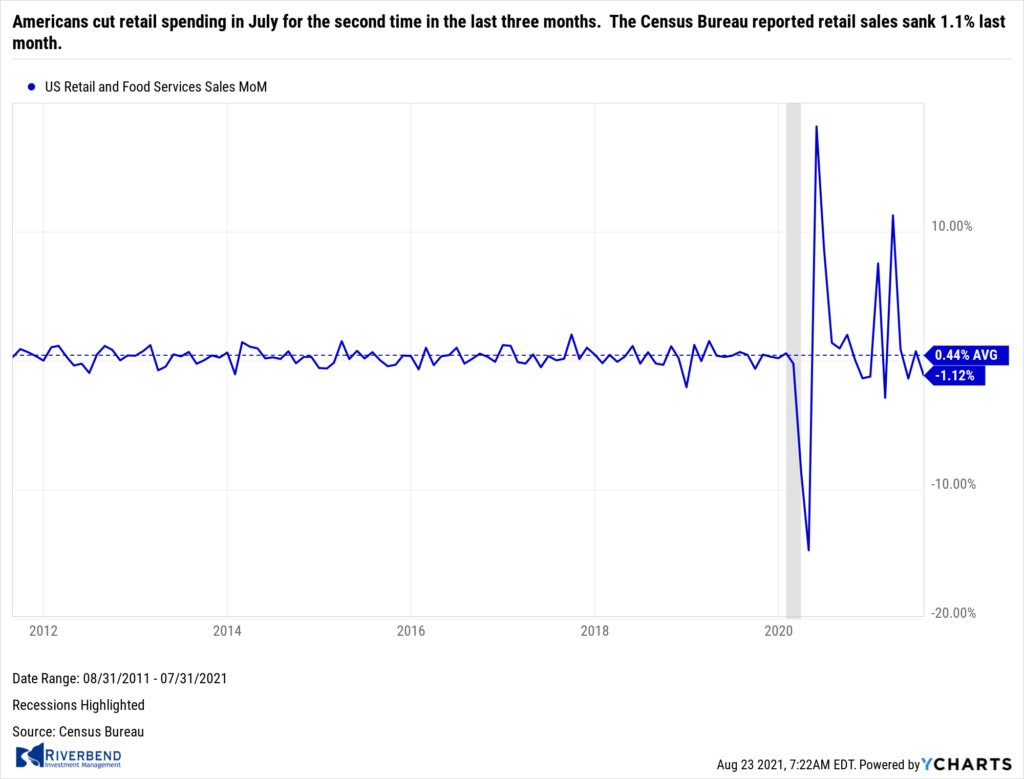

Americans cut retail spending in July for the second time in the last three months. The Census Bureau reported retail sales sank 1.1% last month. Economists had expected just a 0.3% decline. Although retail sales are up 16% over the past year and remain above pre-pandemic levels, the rate of increase has slowed over the past several months.

Americans cut retail spending in July for the second time in the last three months. The Census Bureau reported retail sales sank 1.1% last month. Economists had expected just a 0.3% decline. Although retail sales are up 16% over the past year and remain above pre-pandemic levels, the rate of increase has slowed over the past several months.

The chief source of lower retail sales last month was a decline in car-buying. Sales at auto dealers tumbled 3.9% to mark the third decline in a row. Automakers can’t produce enough new vehicles because of a global shortage of computer chips. Auto purchases account for about one-fifth of all retail sales. Excluding autos, retail sales fell a smaller 0.4%.

Chart of the Week:

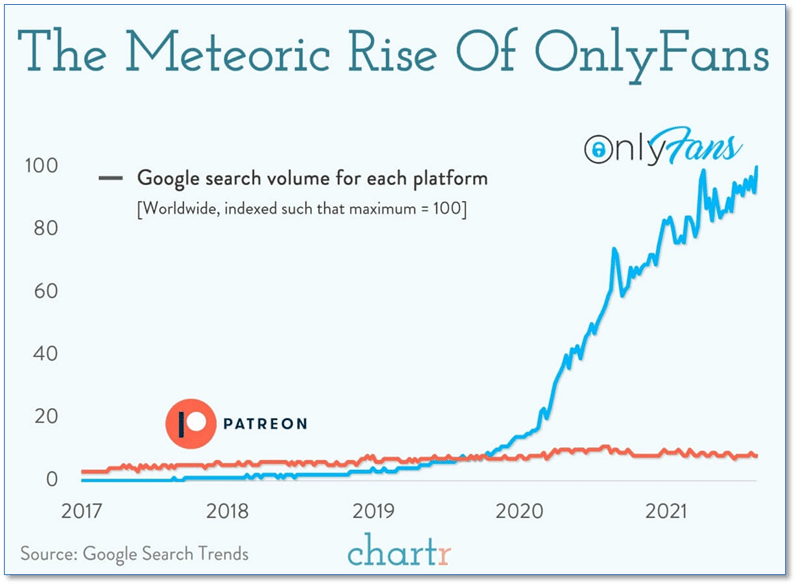

A popular “creator” internet platform called ‘OnlyFans’, which has rocketed in popularity worldwide among millions of fans of creator-produced porn, made a shocking announcement this week. Starting October 1, porn content will be banned.

There are currently an astounding 2 million content producers offering their, um, wares on OnlyFans, and the most popular among them have made huge multi-million dollar incomes.

Analysts were quick to point out the similarities to a porn ban by Yahoo!-owned ‘Tumblr’, a site that in 2018 that had over 520 million monthly visitors. Tumblr’s subsequent traffic decline was swift and unforgiving. Tumblr became a shell of its former self and relatively worthless. Yahoo! bought Tumblr in May of 2013 for $1.1 billion, saying it “promises not to screw it up.”

That promise was not kept. In May of 2019, Tumblr was sold to Automattic (the owner of WordPress) for…get ready for it…$3 million. In other words, a 99.7% loss.

Riverbend Indicators:

Each week we post notable changes to the various market indicators we follow.

- As a reading of our Bull-Bear Indicator for U.S. Equities (comparative measurements over a rolling one-year timeframe), we remain in Cyclical Bull territory.

- Counting up of the number of all our indicators that are ‘Up’ for U.S. Equities, the current tally is that three of four are Positive, representing a multitude of timeframes (two that can be solely days/weeks, or months+ at a time; another, a quarter at a time; and lastly, the {typically} years-long reading, that being the Cyclical Bull or Bear status).

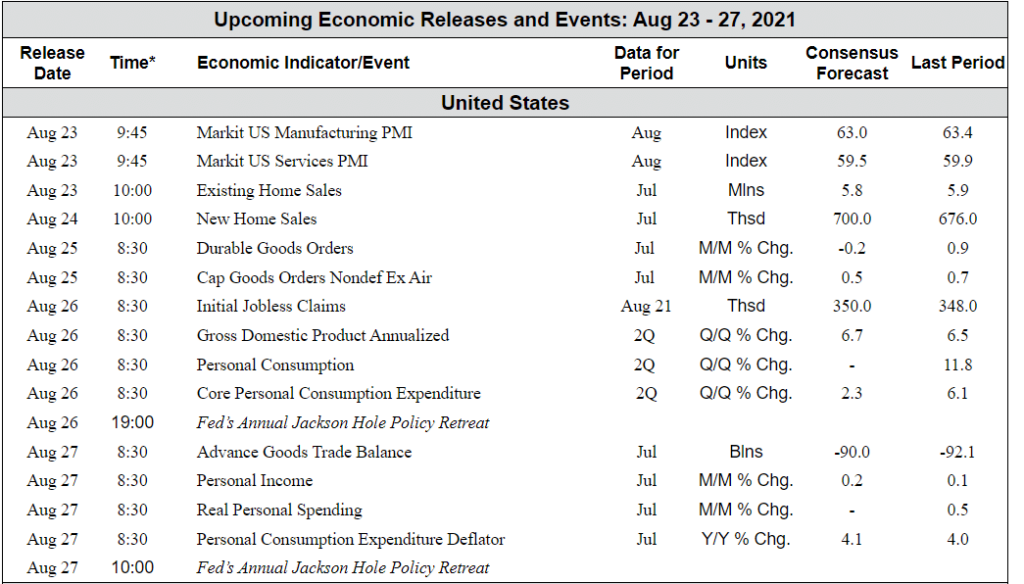

The Week Ahead:

(Sources: All index- and returns-data from Yahoo Finance; news from Reuters, Barron’s, Wall St. Journal, Bloomberg.com, ft.com, guggenheimpartners.com, zerohedge.com, ritholtz.com, markit.com, financialpost.com, Eurostat, Statistics Canada, Yahoo! Finance, stocksandnews.com, marketwatch.com, wantchinatimes.com, BBC, 361capital.com, pensionpartners.com, cnbc.com, FactSet.)