[fusion_builder_container hundred_percent=”no” equal_height_columns=”no” menu_anchor=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”center center” background_repeat=”no-repeat” fade=”no” background_parallax=”none” parallax_speed=”0.3″ video_mp4=”” video_webm=”” video_ogv=”” video_url=”” video_aspect_ratio=”16:9″ video_loop=”yes” video_mute=”yes” overlay_color=”” video_preview_image=”” border_size=”” border_color=”” border_style=”solid” padding_top=”” padding_bottom=”” padding_left=”” padding_right=””][fusion_builder_row][fusion_builder_column type=”1_1″ layout=”1_1″ background_position=”left top” background_color=”” border_size=”” border_color=”” border_style=”solid” border_position=”all” spacing=”yes” background_image=”” background_repeat=”no-repeat” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” margin_top=”0px” margin_bottom=”0px” class=”” id=”” animation_type=”” animation_speed=”0.3″ animation_direction=”left” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” center_content=”no” last=”no” min_height=”” hover_type=”none” link=””][fusion_text]

U.S. Markets:

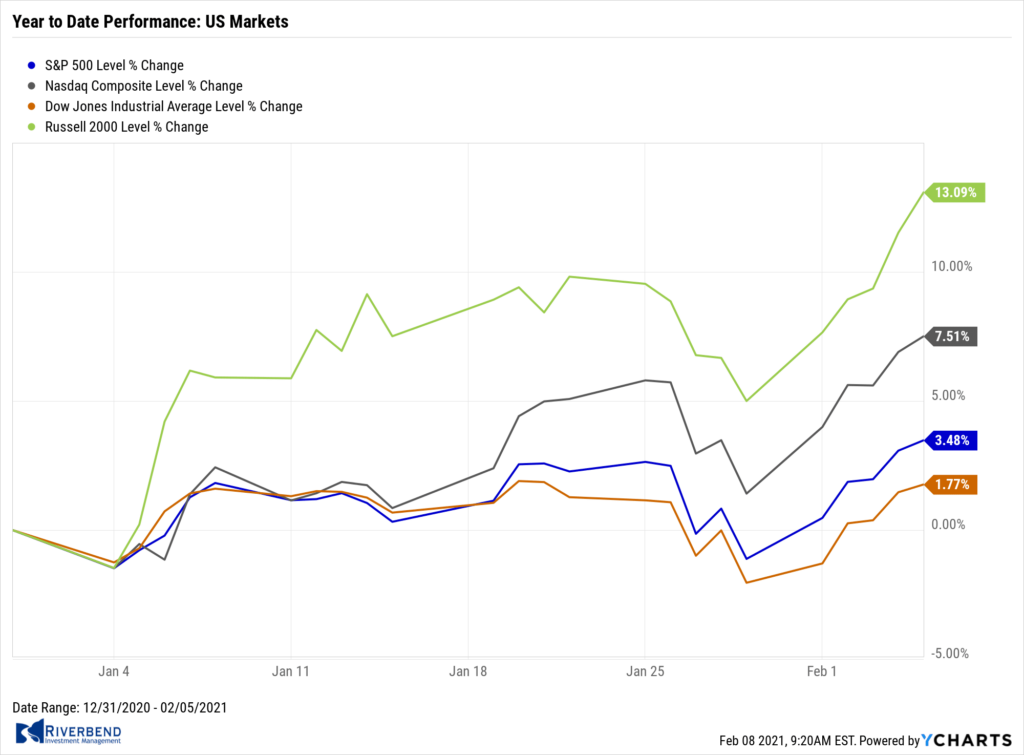

The major U.S. equity benchmarks rebounded from the previous week’s steep losses, helped by plans for a new fiscal stimulus and improving vaccine distribution. The large-cap S&P 500, Nasdaq Composite, and small-cap Russell 2000 indexes all reached record highs.

The Dow Jones Industrial Average soared over 1100 points finishing the week at 31,138, a gain of 3.9%. The technology-heavy NASDAQ surged 6% to 13,856.

By market cap, the large cap S&P 500 added 4.6%, while the mid cap S&P 400 and small cap Russell 2000 rallied 5.8% and 7.7%, respectively.

International Markets:

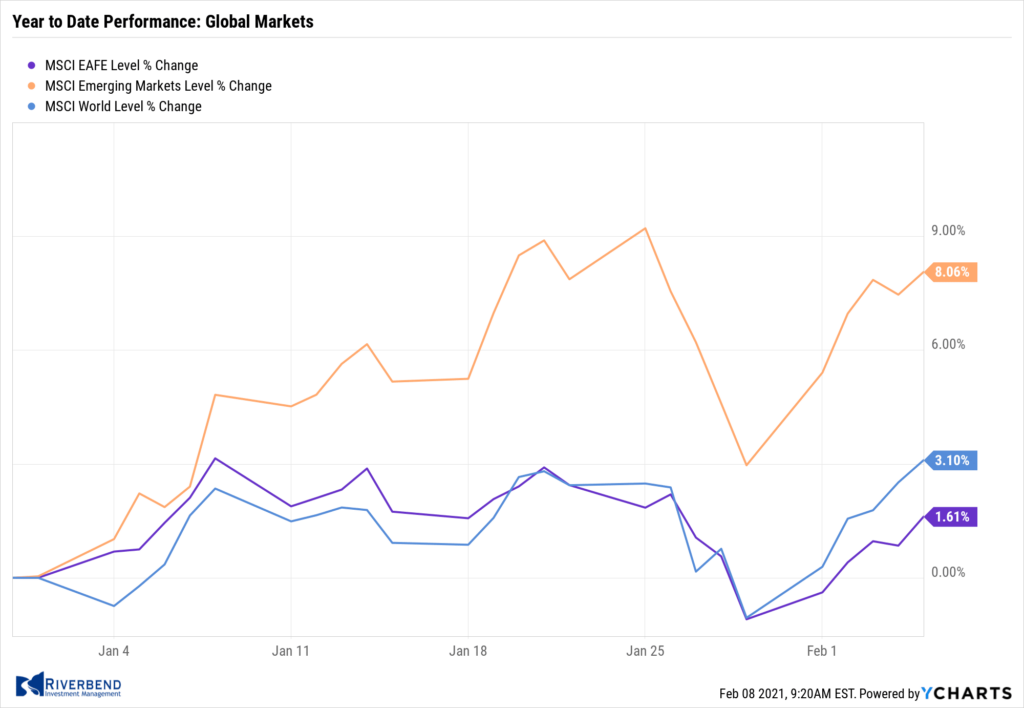

Major international markets finished the week with green across the board. Canada’s TSX rose 4.6% while the United Kingdom’s FTSE 100 gained 1.3%.

On Europe’s mainland, France’s CAC 40 added 4.8% and Germany’s DAX finished up 4.6%.

In Asia, China’s Shanghai Composite gained 0.4% while Japan’s Nikkei closed up 4.0%.

As grouped by Morgan Stanley Capital International, emerging markets finished the week up 5.5%, while developed markets rose 3.2%.

Commodities:

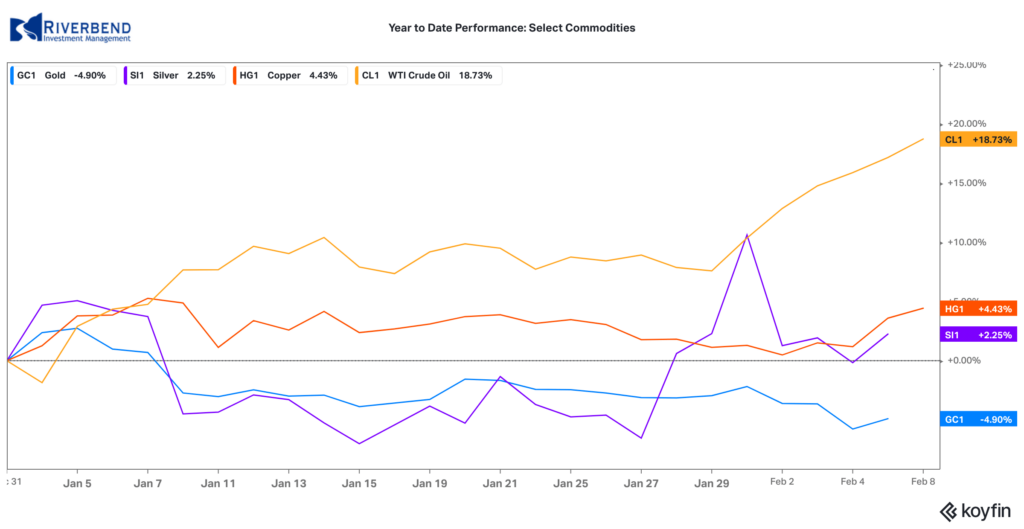

Precious metals were mixed last week. Gold retreated for a second week, declining -2% to $1813.00 per ounce. After hitting a high of over $30 per ounce, Silver settled to close at $27.02, a gain of 0.4%.

The big gainer among commodities was oil, surged almost 9% on renewed hopes that vaccination efforts would lead to a full reopening of the U.S. economy in the near future. West Texas Intermediate crude oil finished the week up $4.65 to close at $56.85 per barrel.

Copper, viewed by some analysts as a barometer of world economic health due to its wide variety of industrial uses, retraced last week’s decline finishing up 1.97%.

U.S. Economic News:

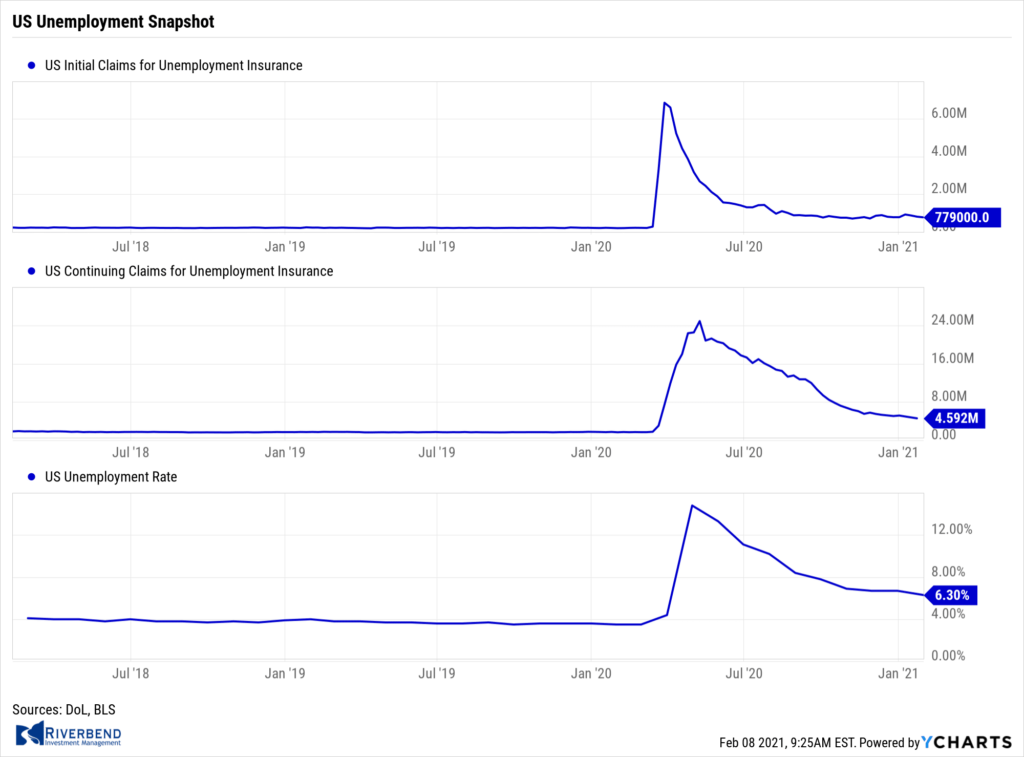

The U.S. added just 49,000 jobs in January as the U.S. struggles to recover from a resurgence of coronavirus cases at the end of last year. The reading was in line with the consensus forecast of 50,000 new jobs. There were notable gains in professional and business services (97,000 jobs created, but nearly all were temporary help). Private education, wholesale trade, and mining also added jobs. However, leisure and hospitality, retail trade, health care, and transportation and warehousing all lost jobs.

The unemployment rate tumbled to 6.3% from 6.7%, below expectations of an unchanged reading, but that decline was for the wrong reason: people abandoning job searches and thereby dropping out of the labor force. Economists say the true level of joblessness is several points higher. Curt Long, chief economist at the National Association of Federally-Insured Credit Unions stated, “There is still a long road ahead to full employment, and the case for fiscal stimulus got a bit stronger.”

The number of Americans filing first-time claims for unemployment benefits fell to a nine-week low last week, suggesting hiring is slowly beginning to pick up again. The Labor Department reported initial jobless claims declined by 33,000 last week to 779,000. Economists had forecast claims to total 830,000. It was the third consecutive decline and a hopeful sign that layoffs have begun to taper amid more vaccinations and a rollover in the COVID curve. Continuing claims, which counts the number of Americans already receiving benefits, fell by 193,000 to 4.592 million. That number is reported with a one-week delay.

The number of Americans filing first-time claims for unemployment benefits fell to a nine-week low last week, suggesting hiring is slowly beginning to pick up again. The Labor Department reported initial jobless claims declined by 33,000 last week to 779,000. Economists had forecast claims to total 830,000. It was the third consecutive decline and a hopeful sign that layoffs have begun to taper amid more vaccinations and a rollover in the COVID curve. Continuing claims, which counts the number of Americans already receiving benefits, fell by 193,000 to 4.592 million. That number is reported with a one-week delay.

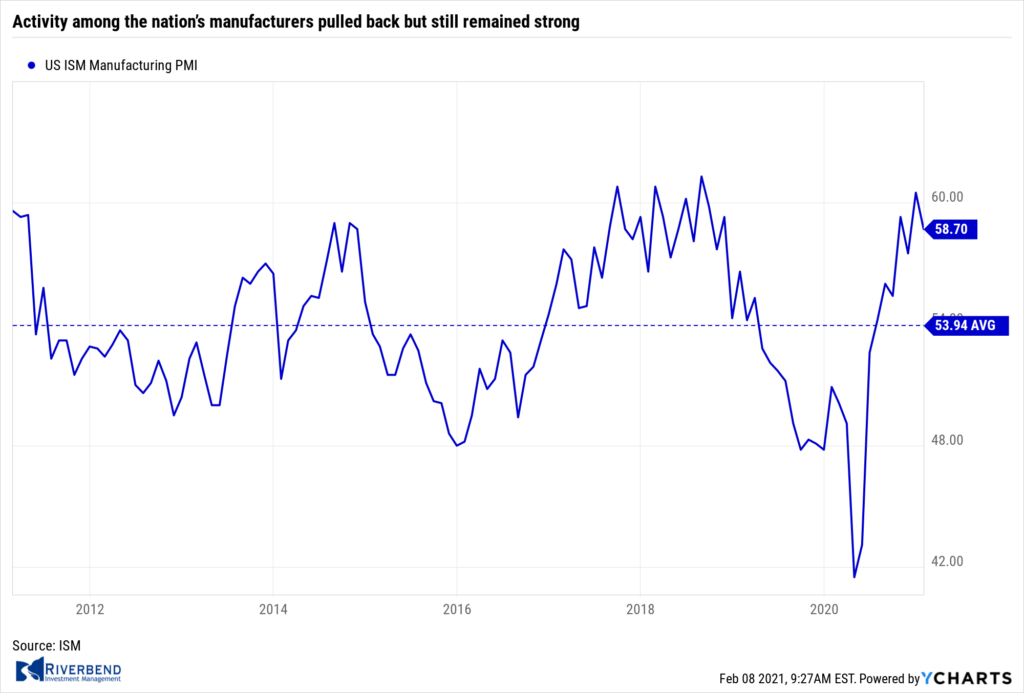

Activity among the nation’s manufacturers pulled back but still remained strong. The Institute for Supply Management (ISM) reported its manufacturing index fell 1.8 points in January to 58.7. Economists had expected a reading of 60.0. Still, it was only the second pullback in the index since last April and the index remains close to its highest level since November 2018. Of the 18 industries tracked by ISM, 16 reported growth. Analysts note the breadth of the expansion supports continued gains in manufacturing output.

Activity among the nation’s manufacturers pulled back but still remained strong. The Institute for Supply Management (ISM) reported its manufacturing index fell 1.8 points in January to 58.7. Economists had expected a reading of 60.0. Still, it was only the second pullback in the index since last April and the index remains close to its highest level since November 2018. Of the 18 industries tracked by ISM, 16 reported growth. Analysts note the breadth of the expansion supports continued gains in manufacturing output.

The pullback was led by slower growth in new orders and production. A separate survey from the Markit organization reported its U.S. Manufacturing Purchasing Managers’ Index (PMI) increased 2.1 points to 59.2—a record high. In contrast with the ISM report, the Markit survey indicated faster growth in output and new orders.

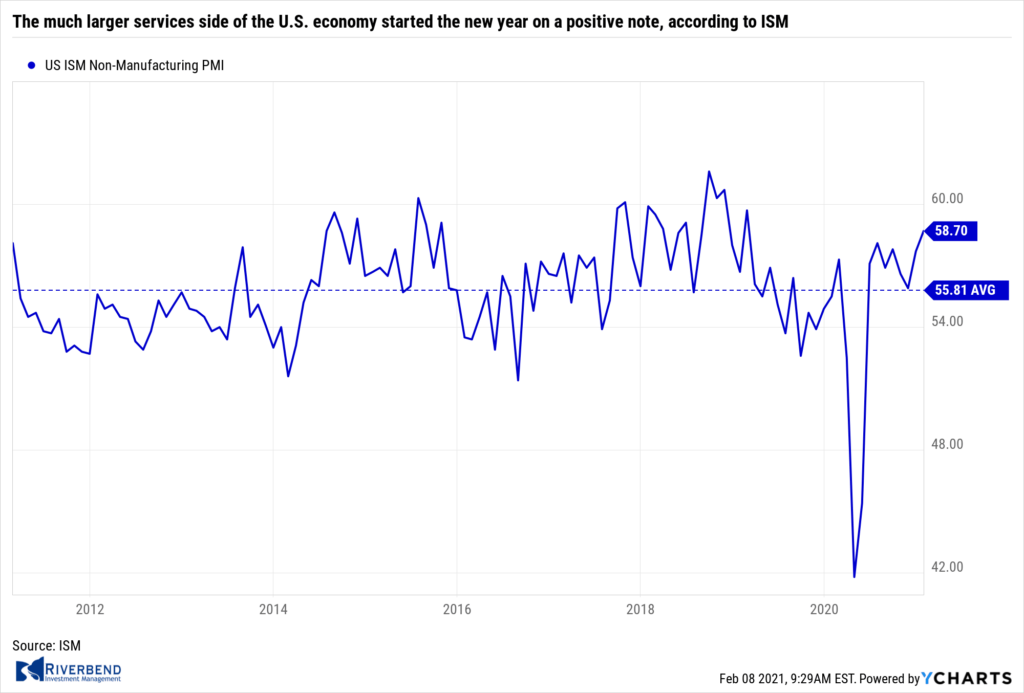

The much larger services side of the U.S. economy started the new year on a positive note, as well, according to ISM. ISM reported its non-manufacturing index (NMI) increased 1.0 point to 58.7. Economists were expecting a -0.7 point pullback to 57.0. The reading was its highest since February 2019. The latest reading is consistent with above-trend economic expansion. While survey respondents noted that various COVID restrictions continue to weigh on activity, they also expressed optimism about business conditions and the economic recovery.

The much larger services side of the U.S. economy started the new year on a positive note, as well, according to ISM. ISM reported its non-manufacturing index (NMI) increased 1.0 point to 58.7. Economists were expecting a -0.7 point pullback to 57.0. The reading was its highest since February 2019. The latest reading is consistent with above-trend economic expansion. While survey respondents noted that various COVID restrictions continue to weigh on activity, they also expressed optimism about business conditions and the economic recovery.

Of the 18 industries in the survey, 14 registered growth and four contracted. The net number indicates a broad-based expansion and is consistent with continued growth. Separately, the Markit Services PMI rebounded 3.6 points in January to 58.3, its second-best level since March 2015.

Chart of the Week:

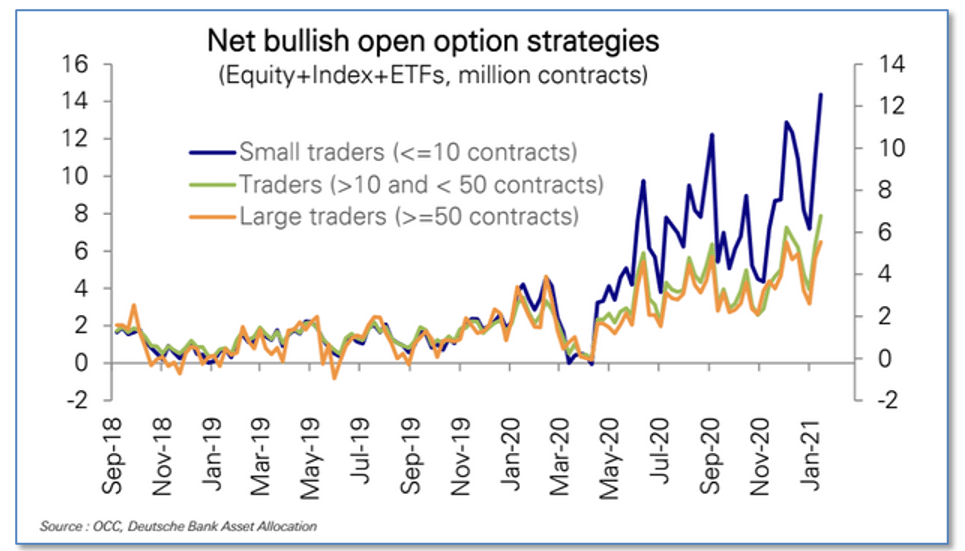

Individual investors are entering the market in droves and their newfound passion for options is making some market veterans nervous. Garrett DeSimone, head of quantitative research at OptionMetrics stated, “What we have seen is a focus on short-term, out-of-the-money call options because they have these lottery-like payoffs.”

Buying deeply out-of-the-money calls is usually a losing proposition. But some of those bets have paid off in dramatic fashion, with the buyers posting their gains on sites such as Reddit, Twitter and Instagram. Average daily call volumes over the past three months have hit a new peak, with the bulk of the increase driven by “very small” contract sizes, according to analysts at Deutsche Bank.

A combination of YOLO (You Only Live Once – the battle cry of many on reddit’s wallstreetbets forum), and FOMO (Fear of Missing Out – a powerful motivator in its own right) seem to be the ingredients of this powerful cocktail of market froth.

The chart above, from Deutsche Bank, shows that “Small traders” overtook all others in April of last year, and never looked back. By January of this year, there were twice as many “small trader” bullish options contracts outstanding compared to the other categories.

Riverbend Indicators Update:

Each week we post notable changes to the various market indicators we follow.

- As a reading of our Bull-Bear Indicator for U.S. Equities (comparative measurements over a rolling one-year timeframe), we remain in Cyclical Bull territory.

- Counting-up of the number of all our indicators that are ‘Up’ for U.S. Equities, the current tally is that four of four are Positive, representing a multitude of timeframes (two that can be solely days/weeks, or months+ at a time; another, a quarter at a time; and lastly, the {typically} years-long reading, that being the Cyclical Bull or Bear status).

Observations:

Last week, we saw our short term indicator turn back to “bull” status.

This indicator gives insight into how overbought or oversold the market is. For most of January, the indicator remained in “bear” status, as the US equity market became a bit frothy in the short term.

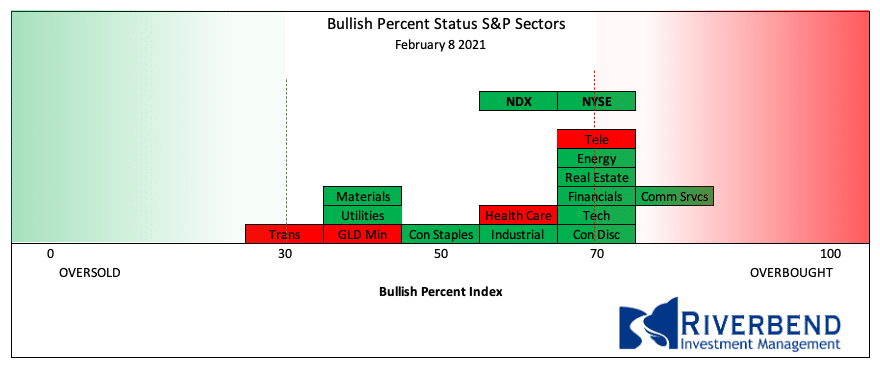

If we take a closer look at the individual sectors within the S&P500 index and plot them on a bell curve, ranked by their individual bullish percent index, we can see the overall market is no longer at the extreme (short-term) levels of a few weeks ago:

The short term pullback we saw in the market 2 weeks ago helped relieve some of the frothiness of the market and we are now seeing sectors resume their upward trend.

Going forward, the market may quickly rebound back into overbought levels, or we may see the market slow down as investors wait for updates on COVID vaccination rates and the passing of the next stimulus package.

The Week Ahead:

Monday:

- German Industrial Production m/m +0.1% exp, +0.9% prior

Tuesday:

- U.S. NFIB Small Business Index 97.6 exp, 95.9 prior

- U.S. JOLTs Job Openings 6.45 mln exp, 6.53 mln prior

- China CPI y/y -0.2% exp, +0.2% prior

- China PPI y/y +0.3% exp, -0.6% prior

Wednesday:

- U.S. CPI m/m +0.4% exp, +0.4% prior

- U.S. Core CPI m/m +0.3% exp, +0.1% prior U

- .S. 10-year Note Auction 1.16% WI, 2.5 b/c

- Fed Chair Powell Speaks

Thursday:

- U.S. Unemployment Claims 775k exp, 779k prior

- U.S. 30-year Bond Auction 1.83% WI, 2.5 b/c

Friday:

- UK Industrial Production m/m +0.5% exp, -0.1% prior

- U.S. Prelim UoM Consumer Sentiment 80.8 exp, 79.0 prior

(Sources: All index- and returns-data from Yahoo Finance; news from Reuters, Barron’s, Wall St. Journal, Bloomberg.com, ft.com, guggenheimpartners.com, zerohedge.com, ritholtz.com, markit.com, financialpost.com, Eurostat, Statistics Canada, Yahoo! Finance, stocksandnews.com, marketwatch.com, wantchinatimes.com, BBC, 361capital.com, pensionpartners.com, cnbc.com, CNBC, FactSet.)

[/fusion_text][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]