We surpassed the 10-year mark of economic recovery, which started in 2009. The average expansion since World War II, according to the National Bureau of Economic Research, is just under five years.

Whether the current one continues or not might come down to three important macro-trends: employment, housing and manufacturing.

The government released gross domestic product numbers for the first quarter of 2019 from 2.2% to 3.2%. This has caused some to reevaluate growth, especially given the current global economic climate (think Brexit, China, etc.).

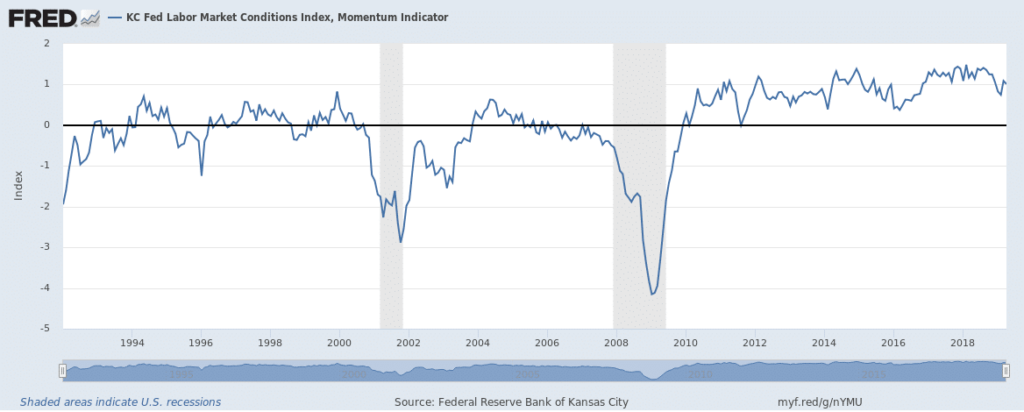

Employment

First, it appears that the unemployment number is going to remain at historically low levels, although the number could vary widely from month-to-month. Job postings have recently been at record highs, but an issue is the lack of the required job skills for these jobs.

With the retirement of baby boomers, we can expect that the labor participation rate (those working plus those looking for work), which has been on the downswing since the recession, will eventually increase.

While this seems to be a positive, a lot of intellectual knowledge will be lost, along with the required skills needed, to replace the retiring boomers. This will likely force businesses to train their own workers, and not leave the task to schools. A tighter labor market could also lead to some wage inflation, as those with the skills will be in very high demand.

Given the growth in jobs, it is hard to imagine a recession any time soon.

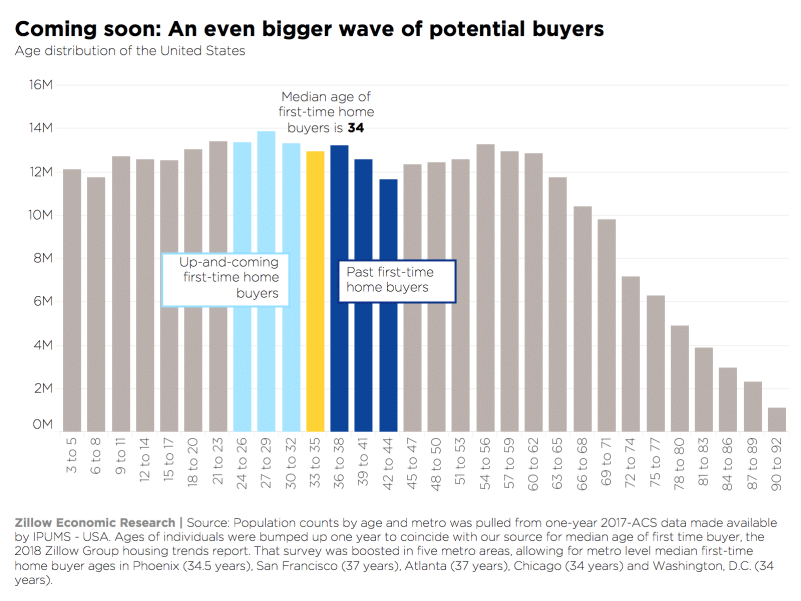

Housing

Next, housing appears to be continuing its rebound, with acceleration for both existing and newly built homes, although expectations are for growth to slow. And the rebound appears to be inconsistent from month to month. There is also a bit of a pull and a push as a result of slowly rising interest rates and a lowering of some borrowing standards.

Nonetheless, many first-time homebuyers have repaired their balance sheets by accumulating enough money to make a down payment on a home, albeit a relatively modest one. In many places around the country, the inventory of existing homes for sale is very limited as a result of the high demand.

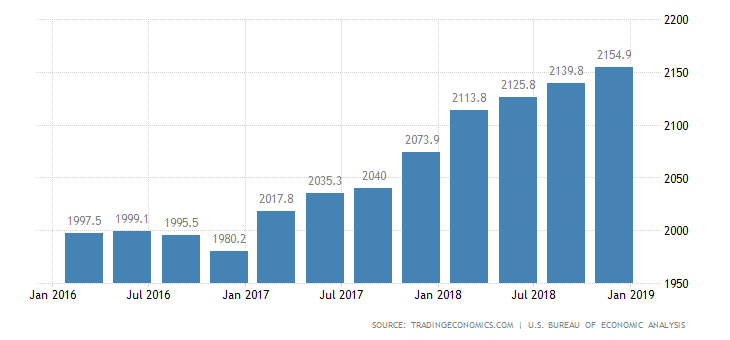

Manufacturing

Lastly, manufacturing will have a significant impact on the GDP number for the year. The chronic loss of American factory jobs to lower-cost nations – millions of them went away over the past two decades – appears to have reversed itself – for now.

Last year, 264,000 new manufacturing jobs were added, representing the highest number of new workers since 1988. As a percent of the total workforce, manufacturing rose for the first time since 1984.

GDP From Manufacturing in the United States

Earnings Drive Stock Prices

With all of that said, it will be up to companies to increase both their top and bottom lines to produce the earnings required to drive the equity markets forward at reasonable valuation levels.

But investors should also remain aware of the macro-trend lines when it comes to employment, housing and manufacturing.