[fusion_builder_container hundred_percent=”no” equal_height_columns=”no” menu_anchor=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”center center” background_repeat=”no-repeat” fade=”no” background_parallax=”none” parallax_speed=”0.3″ video_mp4=”” video_webm=”” video_ogv=”” video_url=”” video_aspect_ratio=”16:9″ video_loop=”yes” video_mute=”yes” overlay_color=”” video_preview_image=”” border_size=”” border_color=”” border_style=”solid” padding_top=”” padding_bottom=”” padding_left=”” padding_right=””][fusion_builder_row][fusion_builder_column type=”1_6″ layout=”1_6″ spacing=”” center_content=”no” link=”” target=”_self” min_height=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” hover_type=”none” border_size=”0″ border_color=”” border_style=”solid” border_position=”all” border_radius=”” box_shadow=”no” dimension_box_shadow=”” box_shadow_blur=”0″ box_shadow_spread=”0″ box_shadow_color=”” box_shadow_style=”” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” margin_top=”” margin_bottom=”” background_type=”single” gradient_start_color=”” gradient_end_color=”” gradient_start_position=”0″ gradient_end_position=”100″ gradient_type=”linear” radial_direction=”center” linear_angle=”180″ background_color=”” background_image=”” background_image_id=”” background_position=”left top” background_repeat=”no-repeat” background_blend_mode=”none” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=”” filter_type=”regular” filter_hue=”0″ filter_saturation=”100″ filter_brightness=”100″ filter_contrast=”100″ filter_invert=”0″ filter_sepia=”0″ filter_opacity=”100″ filter_blur=”0″ filter_hue_hover=”0″ filter_saturation_hover=”100″ filter_brightness_hover=”100″ filter_contrast_hover=”100″ filter_invert_hover=”0″ filter_sepia_hover=”0″ filter_opacity_hover=”100″ filter_blur_hover=”0″ last=”no”][/fusion_builder_column][fusion_builder_column type=”2_3″ layout=”1_1″ background_position=”left top” background_color=”” border_size=”” border_color=”” border_style=”solid” border_position=”all” spacing=”yes” background_image=”” background_repeat=”no-repeat” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” margin_top=”0px” margin_bottom=”0px” class=”” id=”” animation_type=”” animation_speed=”0.3″ animation_direction=”left” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” center_content=”no” last=”no” min_height=”” hover_type=”none” link=””][fusion_text columns=”” column_min_width=”” column_spacing=”” rule_style=”default” rule_size=”” rule_color=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=””]

U.S. Markets:

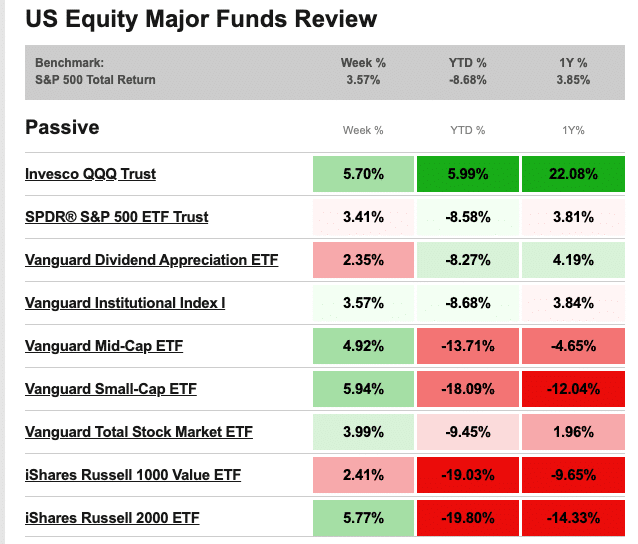

U.S. stocks recorded solid gains for the week as investors appeared to have reconciled themselves to the depth of the economic downturn and turned their focus to the reopening of parts of the economy.

The gains for the week even brought the technology-heavy NASDAQ Composite index back into positive territory for the year, and within a mere 7% of its all-time high. For the week, the NASDAQ added 6%, while the Dow Jones Industrial Average added 2.6% to close at 24,331.

By market cap, the large cap S&P 500 rose 3.5%, while the mid cap S&P 400 added 5.4% and the small cap Russell 2000 gained 5.5%.

International Markets:

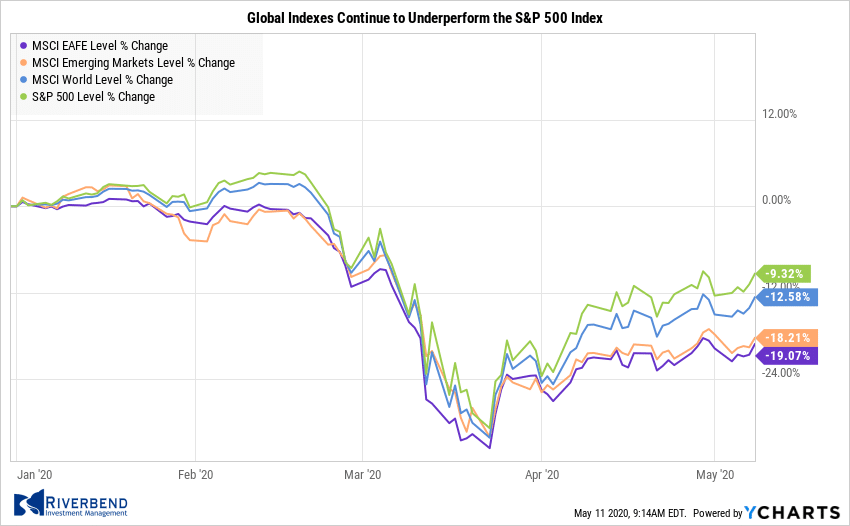

A majority of major international markets finished the week in the green. Canada’s TSX added 2.4% while the United Kingdom’s FTSE 100 rallied 3%.

On Europe’s mainland, France’s CAC 40 finished down -0.5%, while Germany’s DAX rose 0.4%.

In Asia, China’s Shanghai Composite rose 1.2% and Japan’s Nikkei added 2.9%. As grouped by Morgan Stanley Capital International, developed markets rose 2.7% while emerging markets added 4.3%.

Commodities:

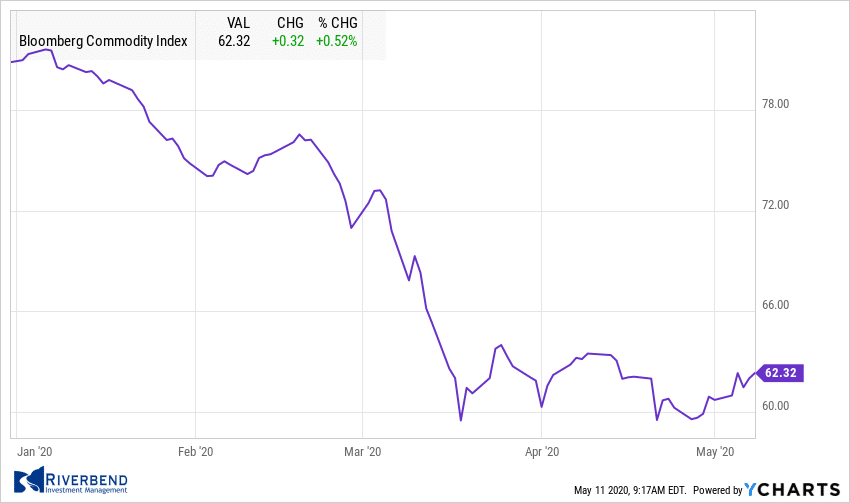

Precious metal retraced some of last week’s decline. Gold rose 0.8% to finish the week at $1713.90 an ounce, while Silver rallied 5.6% to finish the week at $15.78 an ounce.

Energy rebounded strongly for a second week rallying over 32% to close at $26.17 per barrel for West Texas Intermediate crude oil.

The industrial metal copper, viewed by some analysts as a barometer of global economic health due to its wide variety of uses, finished the week up 4.1%.

U.S. Economic News:

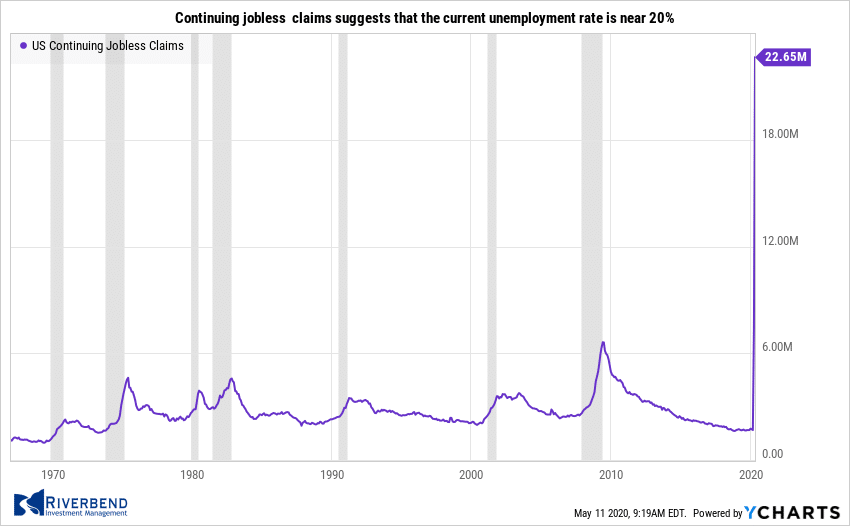

The number of Americans seeking first-time unemployment benefits fell by 677,000 last week to 3.169 million—its fifth consecutive week of declines. While lower than the previous weeks’ readings, the number is still more than ten times higher than the typical reading at the start of the year. Some 33 million new claims have been filed over the past seven weeks—a record-shattering surge that has sent the economy plunging into a deep recession.

Continuing claims, which counts those already receiving benefits, jumped 4.636 million to a new record high of 22.647 million. This suggests that the current unemployment rate is near 20%. “That’s one in five jobs likely gone in seven weeks,” said Nick Bunker, director of economic research at Indeed Hiring Lab. “The outlook for the labor market remains frightening. Not only does the pace of layoffs remain at unprecedented levels, but hiring intentions remain depressed.”

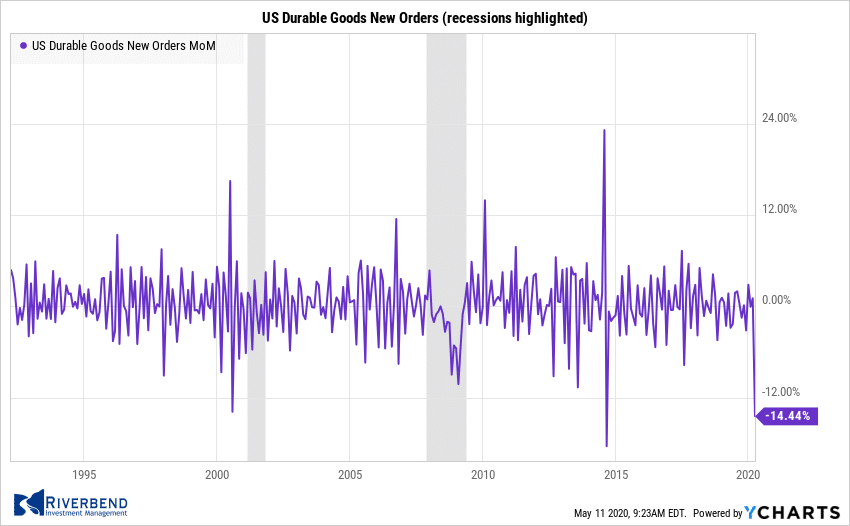

Manufacturing remains under pressure as factory orders fell at their fastest pace on record in March as the coronavirus pandemic shut down large parts of the economy. The Commerce Department reported factory orders tumbled a worse-than-expected $51 billion or -10.3% as travel slowed to a trickle and supply-chain disruptions started to build. Economists had predicted just a -9.7% decline.

Orders for so-called “durable goods”, items expected to last at least 3 years, fell -14.7%, while orders for nondurable goods slid a smaller -5.8%. On a year-over-year trend basis, factory orders were down -4.1%, the most since August 2016, with both durable and nondurable goods orders trending lower. Orders are expected to remain weak for months. The U.S. and global economies could take several years to recover, analysts say.

Orders for so-called “durable goods”, items expected to last at least 3 years, fell -14.7%, while orders for nondurable goods slid a smaller -5.8%. On a year-over-year trend basis, factory orders were down -4.1%, the most since August 2016, with both durable and nondurable goods orders trending lower. Orders are expected to remain weak for months. The U.S. and global economies could take several years to recover, analysts say.

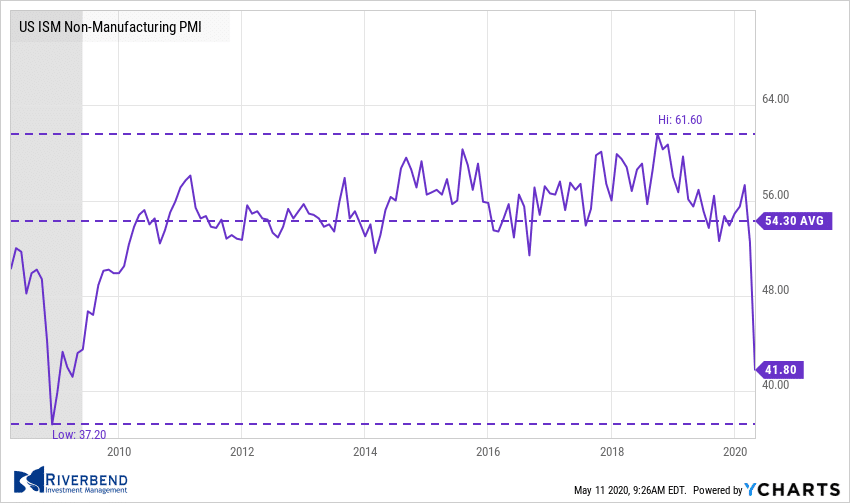

The vast services side of the U.S. economy crashed in April, according to the latest report from the Institute for Supply Management (ISM). The massive losses by retailers, restaurants, hotels, airlines, and other service-oriented companies from the coronavirus pandemic pushed the ISM’s non-manufacturing index (NMI) down 10.7 points to 41.8 in April. It was the index’s lowest reading since the 2007-2009 Great Recession.

Although slightly better than the consensus of 40.0, the current level is historically consistent with recession. Of the 18 NMI industries, 16 shrank, the worst breadth also since March 2009, indicating a broad-based contraction. Only two of the 18 service industries tracked by ISM — government and finance — grew in April.

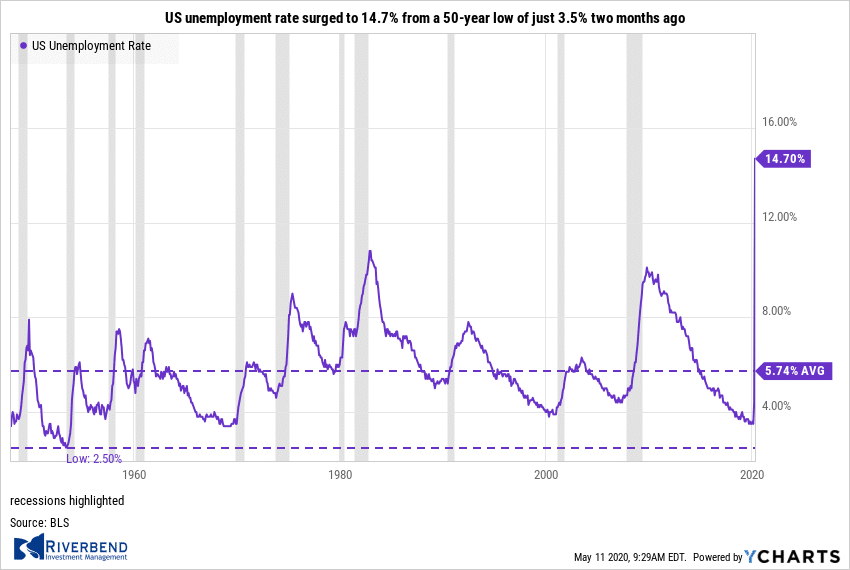

The “jobs report from hell” showed the highest unemployment rate since the 1930’s as the coronavirus pandemic and associated lockdown cost the U.S. almost 21 million jobs in April. The unemployment rate soared to 14.7%. In the report, job losses were heaviest at restaurants, hotels, and retailers but every major industry suffered large declines. Surprisingly, even the health-care sector wasn’t spared as nearly 1.5 million jobs were lost in that industry.

The unemployment rate surged to 14.7% from a 50-year low of just 3.5% two months ago. In the seven weeks since the coronavirus shut down much of the U.S. economy, more than 33 million people have applied for unemployment benefits.

Chart of the Week:

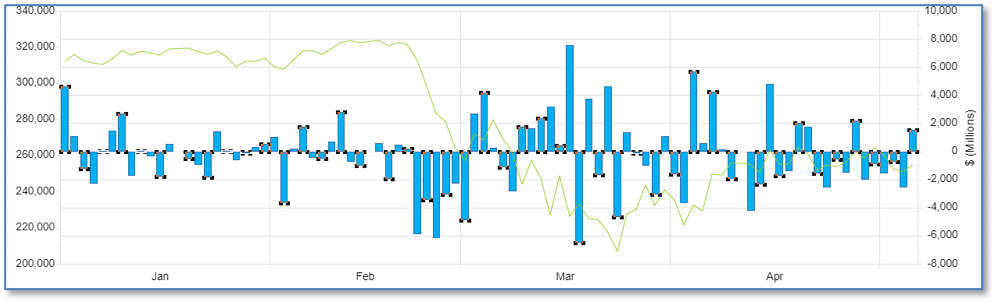

Even as the S&P surged back in April from its March lows, market technician Tom McClellan noted that investors have been fleeing one of the most popular ETFs on Wall Street. The SPDR S&P 500 ETF, symbol ‘SPY’, gives investors exposure to the stocks that make up the widely-followed S&P 500 index, and is among the most liquid and frequently traded ETFs in existence.

McClellan noted that, despite rising more than 29% since touching its low on March 23rd, funds have been flowing out of the SPY. However, in good news for market bulls, McClellan writes that negative flows may actually indicate that the uptrend in stocks could continue higher. “This conveys the message that investors are not believing in the uptrend, which of course is a sign familiar to every contrarian: the uptrend could continue,” he said.

The chart below shows daily inflows and outflows, with twice as many outflow days as inflow days during the robust April rally. (Chart from the McClellan Market Report).

Riverbend Indicators Update

As a reading of our Bull-Bear Indicator for U.S. Equities (comparative measurements over a rolling one-year timeframe), we remain in Cyclical Bull territory.

Counting-up of the number of all our indicators that are ‘Up’ for U.S. Equities the current tally is that three of four are Positive, representing a multitude of timeframes (two that can be solely days/weeks, or months+ at a time; another, a quarter at a time; and lastly, the {typically} years-long reading, that being the Cyclical Bull or Bear status).

Examing individual sectors, we continue to see sector rotation as a prominent theme as investors drive the overall US equity market into short/intermediate-term “overbought” levels.

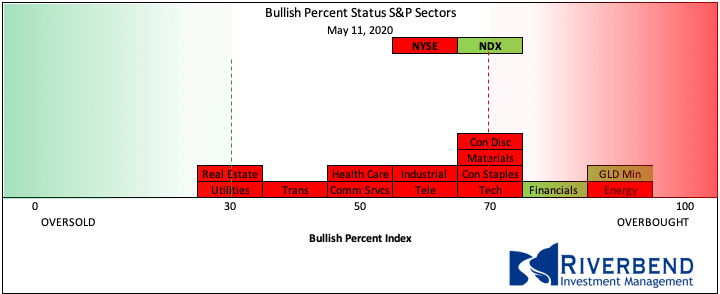

Current S&P 500 Bullish Percent Index Bell Curve:

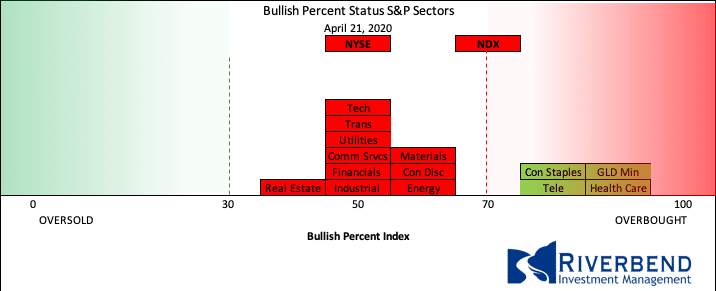

April 21st S&P 500 Bullish Percent Index Bell Curve:

The Bullish Percent Index, or BPI, is a breadth indicator that shows the percentage of stocks on Point & Figure Buy Signals. There is no ambiguity on P&F charts because a stock is either on a P&F Buy Signal or P&F Sell Signal. The Bullish Percent Index fluctuates between 0% and 100%. In its most basic form, the Bullish Percent Index favors the bulls when above 50% and the bears when below 50%. BPI is also considered overbought when above 70% and oversold when below 30%. – Source: StockCharts.com

The Week Ahead:

Monday: China CPI y/y 3.7% exp, 4.3% prior Earnings: CAH, ET, MAR, AN, SUN

Tuesday: Inflation U.S. CPI m/m -0.7% exp, -0.4% prior U.S. Core CPI m/m -0.2% exp, -0.1% prior Earnings: HMC, DUK, IR, PBPB

Wednesday: UK Prelim GDP q/q -2.5% exp, +0.0% prior Fed Chair Powell Speech U.S. 30-yr Bond auction 1.33 WI, 2.4 b/c China Industrial Production y/y +1.5% exp, -1.1% prior Earnings: SNE, CSCO, FLO, TSEM, JACK

Thursday: U.S. Unemployment Claims N/A exp, 3169k prior

Friday: Retail U.S. Retail Sales m/m -11.0% exp, -8.7% prior Industrial Production m/m -11.3% exp, -5.4% prior Prelim UoM Consumer Sentiment 67.6 exp, 71.8 prior

(Sources: Riverbend Investment Management, All index- and returns-data from Yahoo Finance; news from Reuters, Barron’s, Wall St. Journal, Bloomberg.com, ft.com, guggenheimpartners.com, zerohedge.com, ritholtz.com, markit.com, financialpost.com, Eurostat, Statistics Canada, Yahoo! Finance, stocksandnews.com, marketwatch.com, wantchinatimes.com, BBC, 361capital.com, pensionpartners.com, cnbc.com, FactSet, forexfactory.com.)

[/fusion_text][fusion_code]PHN0eWxlPgogI19mb3JtXzE3M18geyBmb250LXNpemU6MTRweDsgbGluZS1oZWlnaHQ6MS42OyBmb250LWZhbWlseTphcmlhbCwgaGVsdmV0aWNhLCBzYW5zLXNlcmlmOyBtYXJnaW46MDsgfQogI19mb3JtXzE3M18gKiB7IG91dGxpbmU6MDsgfQogLl9mb3JtX2hpZGUgeyBkaXNwbGF5Om5vbmU7IHZpc2liaWxpdHk6aGlkZGVuOyB9CiAuX2Zvcm1fc2hvdyB7IGRpc3BsYXk6YmxvY2s7IHZpc2liaWxpdHk6dmlzaWJsZTsgfQogI19mb3JtXzE3M18uX2Zvcm0tdG9wIHsgdG9wOjA7IH0KICNfZm9ybV8xNzNfLl9mb3JtLWJvdHRvbSB7IGJvdHRvbTowOyB9CiAjX2Zvcm1fMTczXy5fZm9ybS1sZWZ0IHsgbGVmdDowOyB9CiAjX2Zvcm1fMTczXy5fZm9ybS1yaWdodCB7IHJpZ2h0OjA7IH0KICNfZm9ybV8xNzNfIGlucHV0W3R5cGU9InRleHQiXSwjX2Zvcm1fMTczXyBpbnB1dFt0eXBlPSJkYXRlIl0sI19mb3JtXzE3M18gdGV4dGFyZWEgeyBwYWRkaW5nOjZweDsgaGVpZ2h0OmF1dG87IGJvcmRlcjojOTc5Nzk3IDFweCBzb2xpZDsgYm9yZGVyLXJhZGl1czo0cHg7IGNvbG9yOiMwMDAgIWltcG9ydGFudDsgZm9udC1zaXplOjE0cHg7IC13ZWJraXQtYm94LXNpemluZzpib3JkZXItYm94OyAtbW96LWJveC1zaXppbmc6Ym9yZGVyLWJveDsgYm94LXNpemluZzpib3JkZXItYm94OyB9CiAjX2Zvcm1fMTczXyB0ZXh0YXJlYSB7IHJlc2l6ZTpub25lOyB9CiAjX2Zvcm1fMTczXyAuX3N1Ym1pdCB7IC13ZWJraXQtYXBwZWFyYW5jZTpub25lOyBjdXJzb3I6cG9pbnRlcjsgZm9udC1mYW1pbHk6YXJpYWwsIHNhbnMtc2VyaWY7IGZvbnQtc2l6ZToxNHB4OyB0ZXh0LWFsaWduOmNlbnRlcjsgYmFja2dyb3VuZDojZTA2NjM2ICFpbXBvcnRhbnQ7IGJvcmRlcjowICFpbXBvcnRhbnQ7IC1tb3otYm9yZGVyLXJhZGl1czo0cHggIWltcG9ydGFudDsgLXdlYmtpdC1ib3JkZXItcmFkaXVzOjRweCAhaW1wb3J0YW50OyBib3JkZXItcmFkaXVzOjRweCAhaW1wb3J0YW50OyBjb2xvcjojZmZmICFpbXBvcnRhbnQ7IHBhZGRpbmc6MTBweCAhaW1wb3J0YW50OyB9CiAjX2Zvcm1fMTczXyAuX2Nsb3NlLWljb24geyBjdXJzb3I6cG9pbnRlcjsgYmFja2dyb3VuZC1pbWFnZTp1cmwoJ2h0dHBzOi8vZDIyNmFqNGFvMXQ2MXEuY2xvdWRmcm9udC5uZXQvZXNma3lqaDF1X2Zvcm1zLWNsb3NlLWRhcmsucG5nJyk7IGJhY2tncm91bmQtcmVwZWF0Om5vLXJlcGVhdDsgYmFja2dyb3VuZC1zaXplOjE0LjJweCAxNC4ycHg7IHBvc2l0aW9uOmFic29sdXRlOyBkaXNwbGF5OmJsb2NrOyB0b3A6MTFweDsgcmlnaHQ6OXB4OyBvdmVyZmxvdzpoaWRkZW47IHdpZHRoOjE2LjJweDsgaGVpZ2h0OjE2LjJweDsgfQogI19mb3JtXzE3M18gLl9jbG9zZS1pY29uOmJlZm9yZSB7IHBvc2l0aW9uOnJlbGF0aXZlOyB9CiAjX2Zvcm1fMTczXyAuX2Zvcm0tYm9keSB7IG1hcmdpbi1ib3R0b206MzBweDsgfQogI19mb3JtXzE3M18gLl9mb3JtLWltYWdlLWxlZnQgeyB3aWR0aDoxNTBweDsgZmxvYXQ6bGVmdDsgfQogI19mb3JtXzE3M18gLl9mb3JtLWNvbnRlbnQtcmlnaHQgeyBtYXJnaW4tbGVmdDoxNjRweDsgfQogI19mb3JtXzE3M18gLl9mb3JtLWJyYW5kaW5nIHsgY29sb3I6I2ZmZjsgZm9udC1zaXplOjEwcHg7IGNsZWFyOmJvdGg7IHRleHQtYWxpZ246bGVmdDsgbWFyZ2luLXRvcDozMHB4OyBmb250LXdlaWdodDoxMDA7IH0KICNfZm9ybV8xNzNfIC5fZm9ybS1icmFuZGluZyAuX2xvZ28geyBkaXNwbGF5OmJsb2NrOyB3aWR0aDoxMzBweDsgaGVpZ2h0OjE0cHg7IG1hcmdpbi10b3A6NnB4OyBiYWNrZ3JvdW5kLWltYWdlOnVybCgnaHR0cHM6Ly9kMjI2YWo0YW8xdDYxcS5jbG91ZGZyb250Lm5ldC9oaDl1anFndjVfYWNsb2dvX2xpLnBuZycpOyBiYWNrZ3JvdW5kLXNpemU6MTMwcHggYXV0bzsgYmFja2dyb3VuZC1yZXBlYXQ6bm8tcmVwZWF0OyB9CiAjX2Zvcm1fMTczXyAuX2Zvcm0tbGFiZWwsI19mb3JtXzE3M18gLl9mb3JtX2VsZW1lbnQgLl9mb3JtLWxhYmVsIHsgZm9udC13ZWlnaHQ6Ym9sZDsgbWFyZ2luLWJvdHRvbTo1cHg7IGRpc3BsYXk6YmxvY2s7IH0KICNfZm9ybV8xNzNfLl9kYXJrIC5fZm9ybS1icmFuZGluZyB7IGNvbG9yOiMzMzM7IH0KICNfZm9ybV8xNzNfLl9kYXJrIC5fZm9ybS1icmFuZGluZyAuX2xvZ28geyBiYWNrZ3JvdW5kLWltYWdlOnVybCgnaHR0cHM6Ly9kMjI2YWo0YW8xdDYxcS5jbG91ZGZyb250Lm5ldC9qZnRxMmM4c19hY2xvZ29fZGsucG5nJyk7IH0KICNfZm9ybV8xNzNfIC5fZm9ybV9lbGVtZW50IHsgcG9zaXRpb246cmVsYXRpdmU7IG1hcmdpbi1ib3R0b206MTBweDsgZm9udC1zaXplOjA7IG1heC13aWR0aDoxMDAlOyB9CiAjX2Zvcm1fMTczXyAuX2Zvcm1fZWxlbWVudCAqIHsgZm9udC1zaXplOjE0cHg7IH0KICNfZm9ybV8xNzNfIC5fZm9ybV9lbGVtZW50Ll9jbGVhciB7IGNsZWFyOmJvdGg7IHdpZHRoOjEwMCU7IGZsb2F0Om5vbmU7IH0KICNfZm9ybV8xNzNfIC5fZm9ybV9lbGVtZW50Ll9jbGVhcjphZnRlciB7IGNsZWFyOmxlZnQ7IH0KICNfZm9ybV8xNzNfIC5fZm9ybV9lbGVtZW50IGlucHV0W3R5cGU9InRleHQiXSwjX2Zvcm1fMTczXyAuX2Zvcm1fZWxlbWVudCBpbnB1dFt0eXBlPSJkYXRlIl0sI19mb3JtXzE3M18gLl9mb3JtX2VsZW1lbnQgc2VsZWN0LCNfZm9ybV8xNzNfIC5fZm9ybV9lbGVtZW50IHRleHRhcmVhOm5vdCguZy1yZWNhcHRjaGEtcmVzcG9uc2UpIHsgZGlzcGxheTpibG9jazsgd2lkdGg6MTAwJTsgLXdlYmtpdC1ib3gtc2l6aW5nOmJvcmRlci1ib3g7IC1tb3otYm94LXNpemluZzpib3JkZXItYm94OyBib3gtc2l6aW5nOmJvcmRlci1ib3g7IH0KICNfZm9ybV8xNzNfIC5fZmllbGQtd3JhcHBlciB7IHBvc2l0aW9uOnJlbGF0aXZlOyB9CiAjX2Zvcm1fMTczXyAuX2lubGluZS1zdHlsZSB7IGZsb2F0OmxlZnQ7IH0KICNfZm9ybV8xNzNfIC5faW5saW5lLXN0eWxlIGlucHV0W3R5cGU9InRleHQiXSB7IHdpZHRoOjE1MHB4OyB9CiAjX2Zvcm1fMTczXyAuX2lubGluZS1zdHlsZTpub3QoLl9jbGVhcikgKyAuX2lubGluZS1zdHlsZTpub3QoLl9jbGVhcikgeyBtYXJnaW4tbGVmdDoyMHB4OyB9CiAjX2Zvcm1fMTczXyAuX2Zvcm1fZWxlbWVudCBpbWcuX2Zvcm0taW1hZ2UgeyBtYXgtd2lkdGg6MTAwJTsgfQogI19mb3JtXzE3M18gLl9jbGVhci1lbGVtZW50IHsgY2xlYXI6bGVmdDsgfQogI19mb3JtXzE3M18gLl9mdWxsX3dpZHRoIHsgd2lkdGg6MTAwJTsgfQogI19mb3JtXzE3M18gLl9mb3JtX2Z1bGxfZmllbGQgeyBkaXNwbGF5OmJsb2NrOyB3aWR0aDoxMDAlOyBtYXJnaW4tYm90dG9tOjEwcHg7IH0KICNfZm9ybV8xNzNfIGlucHV0W3R5cGU9InRleHQiXS5faGFzX2Vycm9yLCNfZm9ybV8xNzNfIHRleHRhcmVhLl9oYXNfZXJyb3IgeyBib3JkZXI6I2YzN2M3YiAxcHggc29saWQ7IH0KICNfZm9ybV8xNzNfIGlucHV0W3R5cGU9ImNoZWNrYm94Il0uX2hhc19lcnJvciB7IG91dGxpbmU6I2YzN2M3YiAxcHggc29saWQ7IH0KICNfZm9ybV8xNzNfIC5fZXJyb3IgeyBkaXNwbGF5OmJsb2NrOyBwb3NpdGlvbjphYnNvbHV0ZTsgZm9udC1zaXplOjE0cHg7IHotaW5kZXg6MTAwMDAwMDE7IH0KICNfZm9ybV8xNzNfIC5fZXJyb3IuX2Fib3ZlIHsgcGFkZGluZy1ib3R0b206NHB4OyBib3R0b206MzlweDsgcmlnaHQ6MDsgfQogI19mb3JtXzE3M18gLl9lcnJvci5fYmVsb3cgeyBwYWRkaW5nLXRvcDo0cHg7IHRvcDoxMDAlOyByaWdodDowOyB9CiAjX2Zvcm1fMTczXyAuX2Vycm9yLl9hYm92ZSAuX2Vycm9yLWFycm93IHsgYm90dG9tOjA7IHJpZ2h0OjE1cHg7IGJvcmRlci1sZWZ0OjVweCBzb2xpZCB0cmFuc3BhcmVudDsgYm9yZGVyLXJpZ2h0OjVweCBzb2xpZCB0cmFuc3BhcmVudDsgYm9yZGVyLXRvcDo1cHggc29saWQgI2YzN2M3YjsgfQogI19mb3JtXzE3M18gLl9lcnJvci5fYmVsb3cgLl9lcnJvci1hcnJvdyB7IHRvcDowOyByaWdodDoxNXB4OyBib3JkZXItbGVmdDo1cHggc29saWQgdHJhbnNwYXJlbnQ7IGJvcmRlci1yaWdodDo1cHggc29saWQgdHJhbnNwYXJlbnQ7IGJvcmRlci1ib3R0b206NXB4IHNvbGlkICNmMzdjN2I7IH0KICNfZm9ybV8xNzNfIC5fZXJyb3ItaW5uZXIgeyBwYWRkaW5nOjhweCAxMnB4OyBiYWNrZ3JvdW5kLWNvbG9yOiNmMzdjN2I7IGZvbnQtc2l6ZToxNHB4OyBmb250LWZhbWlseTphcmlhbCwgc2Fucy1zZXJpZjsgY29sb3I6I2ZmZjsgdGV4dC1hbGlnbjpjZW50ZXI7IHRleHQtZGVjb3JhdGlvbjpub25lOyAtd2Via2l0LWJvcmRlci1yYWRpdXM6NHB4OyAtbW96LWJvcmRlci1yYWRpdXM6NHB4OyBib3JkZXItcmFkaXVzOjRweDsgfQogI19mb3JtXzE3M18gLl9lcnJvci1pbm5lci5fZm9ybV9lcnJvciB7IG1hcmdpbi1ib3R0b206NXB4OyB0ZXh0LWFsaWduOmxlZnQ7IH0KICNfZm9ybV8xNzNfIC5fYnV0dG9uLXdyYXBwZXIgLl9lcnJvci1pbm5lci5fZm9ybV9lcnJvciB7IHBvc2l0aW9uOnN0YXRpYzsgfQogI19mb3JtXzE3M18gLl9lcnJvci1pbm5lci5fbm9fYXJyb3cgeyBtYXJnaW4tYm90dG9tOjEwcHg7IH0KICNfZm9ybV8xNzNfIC5fZXJyb3ItYXJyb3cgeyBwb3NpdGlvbjphYnNvbHV0ZTsgd2lkdGg6MDsgaGVpZ2h0OjA7IH0KICNfZm9ybV8xNzNfIC5fZXJyb3ItaHRtbCB7IG1hcmdpbi1ib3R0b206MTBweDsgfQogLnBpa2Etc2luZ2xlIHsgei1pbmRleDoxMDAwMDAwMSAhaW1wb3J0YW50OyB9CiBAbWVkaWEgYWxsIGFuZCAobWluLXdpZHRoOjMyMHB4KSBhbmQgKG1heC13aWR0aDo2NjdweCkgeyA6Oi13ZWJraXQtc2Nyb2xsYmFyIHsgZGlzcGxheTpub25lOyB9CiAjX2Zvcm1fMTczXyB7IG1hcmdpbjowOyB3aWR0aDoxMDAlOyBtaW4td2lkdGg6MTAwJTsgbWF4LXdpZHRoOjEwMCU7IGJveC1zaXppbmc6Ym9yZGVyLWJveDsgfQogI19mb3JtXzE3M18gKiB7IC13ZWJraXQtYm94LXNpemluZzpib3JkZXItYm94OyAtbW96LWJveC1zaXppbmc6Ym9yZGVyLWJveDsgYm94LXNpemluZzpib3JkZXItYm94OyBmb250LXNpemU6MWVtOyB9CiAjX2Zvcm1fMTczXyAuX2Zvcm0tY29udGVudCB7IG1hcmdpbjowOyB3aWR0aDoxMDAlOyB9CiAjX2Zvcm1fMTczXyAuX2Zvcm0taW5uZXIgeyBkaXNwbGF5OmJsb2NrOyBtaW4td2lkdGg6MTAwJTsgfQogI19mb3JtXzE3M18gLl9mb3JtLXRpdGxlLCNfZm9ybV8xNzNfIC5faW5saW5lLXN0eWxlIHsgbWFyZ2luLXRvcDowOyBtYXJnaW4tcmlnaHQ6MDsgbWFyZ2luLWxlZnQ6MDsgfQogI19mb3JtXzE3M18gLl9mb3JtLXRpdGxlIHsgZm9udC1zaXplOjEuMmVtOyB9CiAjX2Zvcm1fMTczXyAuX2Zvcm1fZWxlbWVudCB7IG1hcmdpbjowIDAgMjBweDsgcGFkZGluZzowOyB3aWR0aDoxMDAlOyB9CiAjX2Zvcm1fMTczXyAuX2Zvcm0tZWxlbWVudCwjX2Zvcm1fMTczXyAuX2lubGluZS1zdHlsZSwjX2Zvcm1fMTczXyBpbnB1dFt0eXBlPSJ0ZXh0Il0sI19mb3JtXzE3M18gbGFiZWwsI19mb3JtXzE3M18gcCwjX2Zvcm1fMTczXyB0ZXh0YXJlYTpub3QoLmctcmVjYXB0Y2hhLXJlc3BvbnNlKSB7IGZsb2F0Om5vbmU7IGRpc3BsYXk6YmxvY2s7IHdpZHRoOjEwMCU7IH0KICNfZm9ybV8xNzNfIC5fcm93Ll9jaGVja2JveC1yYWRpbyBsYWJlbCB7IGRpc3BsYXk6aW5saW5lOyB9CiAjX2Zvcm1fMTczXyAuX3JvdywjX2Zvcm1fMTczXyBwLCNfZm9ybV8xNzNfIGxhYmVsIHsgbWFyZ2luLWJvdHRvbTowLjdlbTsgd2lkdGg6MTAwJTsgfQogI19mb3JtXzE3M18gLl9yb3cgaW5wdXRbdHlwZT0iY2hlY2tib3giXSwjX2Zvcm1fMTczXyAuX3JvdyBpbnB1dFt0eXBlPSJyYWRpbyJdIHsgbWFyZ2luOjAgIWltcG9ydGFudDsgdmVydGljYWwtYWxpZ246bWlkZGxlICFpbXBvcnRhbnQ7IH0KICNfZm9ybV8xNzNfIC5fcm93IGlucHV0W3R5cGU9ImNoZWNrYm94Il0gKyBzcGFuIGxhYmVsIHsgZGlzcGxheTppbmxpbmU7IH0KICNfZm9ybV8xNzNfIC5fcm93IHNwYW4gbGFiZWwgeyBtYXJnaW46MCAhaW1wb3J0YW50OyB3aWR0aDppbml0aWFsICFpbXBvcnRhbnQ7IHZlcnRpY2FsLWFsaWduOm1pZGRsZSAhaW1wb3J0YW50OyB9CiAjX2Zvcm1fMTczXyAuX2Zvcm0taW1hZ2UgeyBtYXgtd2lkdGg6MTAwJTsgaGVpZ2h0OmF1dG8gIWltcG9ydGFudDsgfQogI19mb3JtXzE3M18gaW5wdXRbdHlwZT0idGV4dCJdIHsgcGFkZGluZy1sZWZ0OjEwcHg7IHBhZGRpbmctcmlnaHQ6MTBweDsgZm9udC1zaXplOjE2cHg7IGxpbmUtaGVpZ2h0OjEuM2VtOyAtd2Via2l0LWFwcGVhcmFuY2U6bm9uZTsgfQogI19mb3JtXzE3M18gaW5wdXRbdHlwZT0icmFkaW8iXSwjX2Zvcm1fMTczXyBpbnB1dFt0eXBlPSJjaGVja2JveCJdIHsgZGlzcGxheTppbmxpbmUtYmxvY2s7IHdpZHRoOjEuM2VtOyBoZWlnaHQ6MS4zZW07IGZvbnQtc2l6ZToxZW07IG1hcmdpbjowIDAuM2VtIDAgMDsgdmVydGljYWwtYWxpZ246YmFzZWxpbmU7IH0KICNfZm9ybV8xNzNfIGJ1dHRvblt0eXBlPSJzdWJtaXQiXSB7IHBhZGRpbmc6MjBweDsgZm9udC1zaXplOjEuNWVtOyB9CiAjX2Zvcm1fMTczXyAuX2lubGluZS1zdHlsZSB7IG1hcmdpbjoyMHB4IDAgMCAhaW1wb3J0YW50OyB9CiB9CiAjX2Zvcm1fMTczXyB7IHBvc2l0aW9uOnJlbGF0aXZlOyB0ZXh0LWFsaWduOmxlZnQ7IG1hcmdpbjoyNXB4IGF1dG8gMDsgcGFkZGluZzoyMHB4OyAtd2Via2l0LWJveC1zaXppbmc6Ym9yZGVyLWJveDsgLW1vei1ib3gtc2l6aW5nOmJvcmRlci1ib3g7IGJveC1zaXppbmc6Ym9yZGVyLWJveDsgKnpvb206MTsgYmFja2dyb3VuZDojNTI4OWZmICFpbXBvcnRhbnQ7IGJvcmRlcjo0cHggc29saWQgI2IwYjBiMCAhaW1wb3J0YW50OyB3aWR0aDo2NTBweDsgLW1vei1ib3JkZXItcmFkaXVzOjE5cHggIWltcG9ydGFudDsgLXdlYmtpdC1ib3JkZXItcmFkaXVzOjE5cHggIWltcG9ydGFudDsgYm9yZGVyLXJhZGl1czoxOXB4ICFpbXBvcnRhbnQ7IGNvbG9yOiNmZmYgIWltcG9ydGFudDsgfQogI19mb3JtXzE3M18gLl9mb3JtLXRpdGxlIHsgZm9udC1zaXplOjIycHg7IGxpbmUtaGVpZ2h0OjIycHg7IGZvbnQtd2VpZ2h0OjYwMDsgbWFyZ2luLWJvdHRvbTowOyB9CiAjX2Zvcm1fMTczXzpiZWZvcmUsI19mb3JtXzE3M186YWZ0ZXIgeyBjb250ZW50OiIgIjsgZGlzcGxheTp0YWJsZTsgfQogI19mb3JtXzE3M186YWZ0ZXIgeyBjbGVhcjpib3RoOyB9CiAjX2Zvcm1fMTczXy5faW5saW5lLXN0eWxlIHsgd2lkdGg6YXV0bzsgZGlzcGxheTppbmxpbmUtYmxvY2s7IH0KICNfZm9ybV8xNzNfLl9pbmxpbmUtc3R5bGUgaW5wdXRbdHlwZT0idGV4dCJdLCNfZm9ybV8xNzNfLl9pbmxpbmUtc3R5bGUgaW5wdXRbdHlwZT0iZGF0ZSJdIHsgcGFkZGluZzoxMHB4IDEycHg7IH0KICNfZm9ybV8xNzNfLl9pbmxpbmUtc3R5bGUgYnV0dG9uLl9pbmxpbmUtc3R5bGUgeyBwb3NpdGlvbjpyZWxhdGl2ZTsgdG9wOjI3cHg7IH0KICNfZm9ybV8xNzNfLl9pbmxpbmUtc3R5bGUgcCB7IG1hcmdpbjowOyB9CiAjX2Zvcm1fMTczXy5faW5saW5lLXN0eWxlIC5fYnV0dG9uLXdyYXBwZXIgeyBwb3NpdGlvbjpyZWxhdGl2ZTsgbWFyZ2luOjI3cHggMTIuNXB4IDAgMjBweDsgfQogI19mb3JtXzE3M18gLl9mb3JtLXRoYW5rLXlvdSB7IHBvc2l0aW9uOnJlbGF0aXZlOyBsZWZ0OjA7IHJpZ2h0OjA7IHRleHQtYWxpZ246Y2VudGVyOyBmb250LXNpemU6MThweDsgfQogQG1lZGlhIGFsbCBhbmQgKG1pbi13aWR0aDozMjBweCkgYW5kIChtYXgtd2lkdGg6NjY3cHgpIHsgI19mb3JtXzE3M18uX2lubGluZS1mb3JtLl9pbmxpbmUtc3R5bGUgLl9pbmxpbmUtc3R5bGUuX2J1dHRvbi13cmFwcGVyIHsgbWFyZ2luLXRvcDoyMHB4ICFpbXBvcnRhbnQ7IG1hcmdpbi1sZWZ0OjAgIWltcG9ydGFudDsgfQogfQoKU3R5bGUgQXR0cmlidXRlIHsKICAgIGJhY2tncm91bmQ6ICM1Mjg5RkY7CiAgICBib3JkZXI6IDRweCBzb2xpZCAjQjBCMEIwOwogICAgLW1vei1ib3JkZXItcmFkaXVzOiAyMHB4OwogICAgLXdlYmtpdC1ib3JkZXItcmFkaXVzOiAyMHB4OwogICAgYm9yZGVyLXJhZGl1czogMjBweDsKICAgIGNvbG9yOiAjRkZGRkZGOwogICAgd2lkdGg6IDUxN3B4Owp9Ci5fZm9ybSBidXR0b24sIC5fZm9ybSBpbnB1dFt0eXBlPXN1Ym1pdF0gewogICAgZm9udC1mYW1pbHk6IGFyaWFsLHNhbnMtc2VyaWYhaW1wb3J0YW50OwogICAgLXdlYmtpdC1hcHBlYXJhbmNlOiBub25lOwogICAgY3Vyc29yOiBwb2ludGVyOwogICAgZm9udC1zaXplOiAyMHB4OwogICAgdGV4dC1hbGlnbjogY2VudGVyOwp9Ci5fZm9ybSBpbnB1dFt0eXBlPWRhdGVdLCAuX2Zvcm0gaW5wdXRbdHlwZT10ZXh0XSwgLl9mb3JtX2VsZW1lbnQgaW5wdXRbdHlwZT1kYXRlXSwgLl9mb3JtX2VsZW1lbnQgaW5wdXRbdHlwZT10ZXh0XSB7CiAgICBwYWRkaW5nOiA2cHg7CiAgICBib3JkZXI6IDFweCBzb2xpZCAjOTc5Nzk3OwogICAgYm9yZGVyLXJhZGl1czogNHB4OwogICAgZm9udC1zaXplOiAxOHB4OwoKLl9mb3JtLl9pbmxpbmUtZm9ybSB7CiAgICB0ZXh0LWFsaWduOiBjZW50ZXI7PC9zdHlsZT4KPGZvcm0gbWV0aG9kPSJQT1NUIiBhY3Rpb249Imh0dHBzOi8vcml2ZXJiZW5kaW52ZXN0bWVudG1hbmFnZW1lbnQuYWN0aXZlaG9zdGVkLmNvbS9wcm9jLnBocCIgaWQ9Il9mb3JtXzE3M18iIGNsYXNzPSJfZm9ybSBfZm9ybV8xNzMgX2lubGluZS1mb3JtICAiIG5vdmFsaWRhdGU+CiAgPGlucHV0IHR5cGU9ImhpZGRlbiIgbmFtZT0idSIgdmFsdWU9IjE3MyIgLz4KICA8aW5wdXQgdHlwZT0iaGlkZGVuIiBuYW1lPSJmIiB2YWx1ZT0iMTczIiAvPgogIDxpbnB1dCB0eXBlPSJoaWRkZW4iIG5hbWU9InMiIC8+CiAgPGlucHV0IHR5cGU9ImhpZGRlbiIgbmFtZT0iYyIgdmFsdWU9IjAiIC8+CiAgPGlucHV0IHR5cGU9ImhpZGRlbiIgbmFtZT0ibSIgdmFsdWU9IjAiIC8+CiAgPGlucHV0IHR5cGU9ImhpZGRlbiIgbmFtZT0iYWN0IiB2YWx1ZT0ic3ViIiAvPgogIDxpbnB1dCB0eXBlPSJoaWRkZW4iIG5hbWU9InYiIHZhbHVlPSIyIiAvPgogIDxkaXYgY2xhc3M9Il9mb3JtLWNvbnRlbnQiPgogICAgPGRpdiBjbGFzcz0iX2Zvcm1fZWxlbWVudCBfeDAyNDI0OTI3IF9mdWxsX3dpZHRoIF9jbGVhciIgPgogICAgICA8ZGl2IGNsYXNzPSJfZm9ybS10aXRsZSI+CiAgICAgICAgR2V0IG91ciByZXNlYXJjaCB1cGRhdGVzIHNlbnQgdG8geW91ciBpbmJveC4KICAgICAgPC9kaXY+CiAgICA8L2Rpdj4KICAgIDxkaXYgY2xhc3M9Il9mb3JtX2VsZW1lbnQgX3gwNjk2OTc3MSBfZnVsbF93aWR0aCAiID4KICAgICAgPGxhYmVsIGNsYXNzPSJfZm9ybS1sYWJlbCI+CiAgICAgICAgRW50ZXIgWW91ciBFbWFpbCBCZWxvdzoqCiAgICAgIDwvbGFiZWw+CiAgICAgIDxkaXYgY2xhc3M9Il9maWVsZC13cmFwcGVyIj4KICAgICAgICA8aW5wdXQgdHlwZT0idGV4dCIgbmFtZT0iZW1haWwiIHBsYWNlaG9sZGVyPSJUeXBlIHlvdXIgZW1haWwiIHJlcXVpcmVkLz4KICAgICAgPC9kaXY+CiAgICA8L2Rpdj4KICAgIDxkaXYgY2xhc3M9Il9idXR0b24td3JhcHBlciBfZnVsbF93aWR0aCI+CiAgICAgIDxidXR0b24gaWQ9Il9mb3JtXzE3M19zdWJtaXQiIGNsYXNzPSJfc3VibWl0IiB0eXBlPSJzdWJtaXQiPgogICAgICAgIFllcywgU2VuZCBNZSB0aGUgVXBkYXRlcyEgPj4KICAgICAgPC9idXR0b24+CiAgICA8L2Rpdj4KICAgIDxkaXYgY2xhc3M9Il9jbGVhci1lbGVtZW50Ij4KICAgIDwvZGl2PgogIDwvZGl2PgogIDxkaXYgY2xhc3M9Il9mb3JtLXRoYW5rLXlvdSIgc3R5bGU9ImRpc3BsYXk6bm9uZTsiPgogIDwvZGl2Pgo8L2Zvcm0+PHNjcmlwdCB0eXBlPSJ0ZXh0L2phdmFzY3JpcHQiPgp3aW5kb3cuY2ZpZWxkcyA9IFtdOwp3aW5kb3cuX3Nob3dfdGhhbmtfeW91ID0gZnVuY3Rpb24oaWQsIG1lc3NhZ2UsIHRyYWNrY21wX3VybCkgewogIHZhciBmb3JtID0gZG9jdW1lbnQuZ2V0RWxlbWVudEJ5SWQoJ19mb3JtXycgKyBpZCArICdfJyksIHRoYW5rX3lvdSA9IGZvcm0ucXVlcnlTZWxlY3RvcignLl9mb3JtLXRoYW5rLXlvdScpOwogIGZvcm0ucXVlcnlTZWxlY3RvcignLl9mb3JtLWNvbnRlbnQnKS5zdHlsZS5kaXNwbGF5ID0gJ25vbmUnOwogIHRoYW5rX3lvdS5pbm5lckhUTUwgPSBtZXNzYWdlOwogIHRoYW5rX3lvdS5zdHlsZS5kaXNwbGF5ID0gJ2Jsb2NrJzsKICBpZiAodHlwZW9mKHRyYWNrY21wX3VybCkgIT0gJ3VuZGVmaW5lZCcgJiYgdHJhY2tjbXBfdXJsKSB7CiAgICAvLyBTaXRlIHRyYWNraW5nIFVSTCB0byB1c2UgYWZ0ZXIgaW5saW5lIGZvcm0gc3VibWlzc2lvbi4KICAgIF9sb2FkX3NjcmlwdCh0cmFja2NtcF91cmwpOwogIH0KICBpZiAodHlwZW9mIHdpbmRvdy5fZm9ybV9jYWxsYmFjayAhPT0gJ3VuZGVmaW5lZCcpIHdpbmRvdy5fZm9ybV9jYWxsYmFjayhpZCk7Cn07CndpbmRvdy5fc2hvd19lcnJvciA9IGZ1bmN0aW9uKGlkLCBtZXNzYWdlLCBodG1sKSB7CiAgdmFyIGZvcm0gPSBkb2N1bWVudC5nZXRFbGVtZW50QnlJZCgnX2Zvcm1fJyArIGlkICsgJ18nKSwgZXJyID0gZG9jdW1lbnQuY3JlYXRlRWxlbWVudCgnZGl2JyksIGJ1dHRvbiA9IGZvcm0ucXVlcnlTZWxlY3RvcignYnV0dG9uJyksIG9sZF9lcnJvciA9IGZvcm0ucXVlcnlTZWxlY3RvcignLl9mb3JtX2Vycm9yJyk7CiAgaWYgKG9sZF9lcnJvcikgb2xkX2Vycm9yLnBhcmVudE5vZGUucmVtb3ZlQ2hpbGQob2xkX2Vycm9yKTsKICBlcnIuaW5uZXJIVE1MID0gbWVzc2FnZTsKICBlcnIuY2xhc3NOYW1lID0gJ19lcnJvci1pbm5lciBfZm9ybV9lcnJvciBfbm9fYXJyb3cnOwogIHZhciB3cmFwcGVyID0gZG9jdW1lbnQuY3JlYXRlRWxlbWVudCgnZGl2Jyk7CiAgd3JhcHBlci5jbGFzc05hbWUgPSAnX2Zvcm0taW5uZXInOwogIHdyYXBwZXIuYXBwZW5kQ2hpbGQoZXJyKTsKICBidXR0b24ucGFyZW50Tm9kZS5pbnNlcnRCZWZvcmUod3JhcHBlciwgYnV0dG9uKTsKICBkb2N1bWVudC5xdWVyeVNlbGVjdG9yKCdbaWRePSJfZm9ybSJdW2lkJD0iX3N1Ym1pdCJdJykuZGlzYWJsZWQgPSBmYWxzZTsKICBpZiAoaHRtbCkgewogICAgdmFyIGRpdiA9IGRvY3VtZW50LmNyZWF0ZUVsZW1lbnQoJ2RpdicpOwogICAgZGl2LmNsYXNzTmFtZSA9ICdfZXJyb3ItaHRtbCc7CiAgICBkaXYuaW5uZXJIVE1MID0gaHRtbDsKICAgIGVyci5hcHBlbmRDaGlsZChkaXYpOwogIH0KfTsKd2luZG93Ll9sb2FkX3NjcmlwdCA9IGZ1bmN0aW9uKHVybCwgY2FsbGJhY2spIHsKICB2YXIgaGVhZCA9IGRvY3VtZW50LnF1ZXJ5U2VsZWN0b3IoJ2hlYWQnKSwgc2NyaXB0ID0gZG9jdW1lbnQuY3JlYXRlRWxlbWVudCgnc2NyaXB0JyksIHIgPSBmYWxzZTsKICBzY3JpcHQudHlwZSA9ICd0ZXh0L2phdmFzY3JpcHQnOwogIHNjcmlwdC5jaGFyc2V0ID0gJ3V0Zi04JzsKICBzY3JpcHQuc3JjID0gdXJsOwogIGlmIChjYWxsYmFjaykgewogICAgc2NyaXB0Lm9ubG9hZCA9IHNjcmlwdC5vbnJlYWR5c3RhdGVjaGFuZ2UgPSBmdW5jdGlvbigpIHsKICAgICAgaWYgKCFyICYmICghdGhpcy5yZWFkeVN0YXRlIHx8IHRoaXMucmVhZHlTdGF0ZSA9PSAnY29tcGxldGUnKSkgewogICAgICAgIHIgPSB0cnVlOwogICAgICAgIGNhbGxiYWNrKCk7CiAgICAgIH0KICAgIH07CiAgfQogIGhlYWQuYXBwZW5kQ2hpbGQoc2NyaXB0KTsKfTsKKGZ1bmN0aW9uKCkgewogIGlmICh3aW5kb3cubG9jYXRpb24uc2VhcmNoLnNlYXJjaCgiZXhjbHVkZWZvcm0iKSAhPT0gLTEpIHJldHVybiBmYWxzZTsKICB2YXIgZ2V0Q29va2llID0gZnVuY3Rpb24obmFtZSkgewogICAgdmFyIG1hdGNoID0gZG9jdW1lbnQuY29va2llLm1hdGNoKG5ldyBSZWdFeHAoJyhefDsgKScgKyBuYW1lICsgJz0oW147XSspJykpOwogICAgcmV0dXJuIG1hdGNoID8gbWF0Y2hbMl0gOiBudWxsOwogIH0KICB2YXIgc2V0Q29va2llID0gZnVuY3Rpb24obmFtZSwgdmFsdWUpIHsKICAgIHZhciBub3cgPSBuZXcgRGF0ZSgpOwogICAgdmFyIHRpbWUgPSBub3cuZ2V0VGltZSgpOwogICAgdmFyIGV4cGlyZVRpbWUgPSB0aW1lICsgMTAwMCAqIDYwICogNjAgKiAyNCAqIDM2NTsKICAgIG5vdy5zZXRUaW1lKGV4cGlyZVRpbWUpOwogICAgZG9jdW1lbnQuY29va2llID0gbmFtZSArICc9JyArIHZhbHVlICsgJzsgZXhwaXJlcz0nICsgbm93ICsgJztwYXRoPS8nOwogIH0KICAgICAgdmFyIGFkZEV2ZW50ID0gZnVuY3Rpb24oZWxlbWVudCwgZXZlbnQsIGZ1bmMpIHsKICAgIGlmIChlbGVtZW50LmFkZEV2ZW50TGlzdGVuZXIpIHsKICAgICAgZWxlbWVudC5hZGRFdmVudExpc3RlbmVyKGV2ZW50LCBmdW5jKTsKICAgIH0gZWxzZSB7CiAgICAgIHZhciBvbGRGdW5jID0gZWxlbWVudFsnb24nICsgZXZlbnRdOwogICAgICBlbGVtZW50WydvbicgKyBldmVudF0gPSBmdW5jdGlvbigpIHsKICAgICAgICBvbGRGdW5jLmFwcGx5KHRoaXMsIGFyZ3VtZW50cyk7CiAgICAgICAgZnVuYy5hcHBseSh0aGlzLCBhcmd1bWVudHMpOwogICAgICB9OwogICAgfQogIH0KICB2YXIgX3JlbW92ZWQgPSBmYWxzZTsKICB2YXIgZm9ybV90b19zdWJtaXQgPSBkb2N1bWVudC5nZXRFbGVtZW50QnlJZCgnX2Zvcm1fMTczXycpOwogIHZhciBhbGxJbnB1dHMgPSBmb3JtX3RvX3N1Ym1pdC5xdWVyeVNlbGVjdG9yQWxsKCdpbnB1dCwgc2VsZWN0LCB0ZXh0YXJlYScpLCB0b29sdGlwcyA9IFtdLCBzdWJtaXR0ZWQgPSBmYWxzZTsKCiAgdmFyIGdldFVybFBhcmFtID0gZnVuY3Rpb24obmFtZSkgewogICAgdmFyIHJlZ2V4U3RyID0gJ1tcPyZdJyArIG5hbWUgKyAnPShbXiYjXSopJzsKICAgIHZhciByZXN1bHRzID0gbmV3IFJlZ0V4cChyZWdleFN0ciwgJ2knKS5leGVjKHdpbmRvdy5sb2NhdGlvbi5ocmVmKTsKICAgIHJldHVybiByZXN1bHRzICE9IHVuZGVmaW5lZCA/IGRlY29kZVVSSUNvbXBvbmVudChyZXN1bHRzWzFdKSA6IGZhbHNlOwogIH07CgogIGZvciAodmFyIGkgPSAwOyBpIDwgYWxsSW5wdXRzLmxlbmd0aDsgaSsrKSB7CiAgICB2YXIgcmVnZXhTdHIgPSAiZmllbGRcXFsoXFxkKylcXF0iOwogICAgdmFyIHJlc3VsdHMgPSBuZXcgUmVnRXhwKHJlZ2V4U3RyKS5leGVjKGFsbElucHV0c1tpXS5uYW1lKTsKICAgIGlmIChyZXN1bHRzICE9IHVuZGVmaW5lZCkgewogICAgICBhbGxJbnB1dHNbaV0uZGF0YXNldC5uYW1lID0gd2luZG93LmNmaWVsZHNbcmVzdWx0c1sxXV07CiAgICB9IGVsc2UgewogICAgICBhbGxJbnB1dHNbaV0uZGF0YXNldC5uYW1lID0gYWxsSW5wdXRzW2ldLm5hbWU7CiAgICB9CiAgICB2YXIgZmllbGRWYWwgPSBnZXRVcmxQYXJhbShhbGxJbnB1dHNbaV0uZGF0YXNldC5uYW1lKTsKCiAgICBpZiAoZmllbGRWYWwpIHsKICAgICAgaWYgKGFsbElucHV0c1tpXS5kYXRhc2V0LmF1dG9maWxsID09PSAiZmFsc2UiKSB7CiAgICAgICAgY29udGludWU7CiAgICAgIH0KICAgICAgaWYgKGFsbElucHV0c1tpXS50eXBlID09ICJyYWRpbyIgfHwgYWxsSW5wdXRzW2ldLnR5cGUgPT0gImNoZWNrYm94IikgewogICAgICAgIGlmIChhbGxJbnB1dHNbaV0udmFsdWUgPT0gZmllbGRWYWwpIHsKICAgICAgICAgIGFsbElucHV0c1tpXS5jaGVja2VkID0gdHJ1ZTsKICAgICAgICB9CiAgICAgIH0gZWxzZSB7CiAgICAgICAgYWxsSW5wdXRzW2ldLnZhbHVlID0gZmllbGRWYWw7CiAgICAgIH0KICAgIH0KICB9CgogIHZhciByZW1vdmVfdG9vbHRpcHMgPSBmdW5jdGlvbigpIHsKICAgIGZvciAodmFyIGkgPSAwOyBpIDwgdG9vbHRpcHMubGVuZ3RoOyBpKyspIHsKICAgICAgdG9vbHRpcHNbaV0udGlwLnBhcmVudE5vZGUucmVtb3ZlQ2hpbGQodG9vbHRpcHNbaV0udGlwKTsKICAgIH0KICAgIHRvb2x0aXBzID0gW107CiAgfTsKICB2YXIgcmVtb3ZlX3Rvb2x0aXAgPSBmdW5jdGlvbihlbGVtKSB7CiAgICBmb3IgKHZhciBpID0gMDsgaSA8IHRvb2x0aXBzLmxlbmd0aDsgaSsrKSB7CiAgICAgIGlmICh0b29sdGlwc1tpXS5lbGVtID09PSBlbGVtKSB7CiAgICAgICAgdG9vbHRpcHNbaV0udGlwLnBhcmVudE5vZGUucmVtb3ZlQ2hpbGQodG9vbHRpcHNbaV0udGlwKTsKICAgICAgICB0b29sdGlwcy5zcGxpY2UoaSwgMSk7CiAgICAgICAgcmV0dXJuOwogICAgICB9CiAgICB9CiAgfTsKICB2YXIgY3JlYXRlX3Rvb2x0aXAgPSBmdW5jdGlvbihlbGVtLCB0ZXh0KSB7CiAgICB2YXIgdG9vbHRpcCA9IGRvY3VtZW50LmNyZWF0ZUVsZW1lbnQoJ2RpdicpLCBhcnJvdyA9IGRvY3VtZW50LmNyZWF0ZUVsZW1lbnQoJ2RpdicpLCBpbm5lciA9IGRvY3VtZW50LmNyZWF0ZUVsZW1lbnQoJ2RpdicpLCBuZXdfdG9vbHRpcCA9IHt9OwogICAgaWYgKGVsZW0udHlwZSAhPSAncmFkaW8nICYmIGVsZW0udHlwZSAhPSAnY2hlY2tib3gnKSB7CiAgICAgIHRvb2x0aXAuY2xhc3NOYW1lID0gJ19lcnJvcic7CiAgICAgIGFycm93LmNsYXNzTmFtZSA9ICdfZXJyb3ItYXJyb3cnOwogICAgICBpbm5lci5jbGFzc05hbWUgPSAnX2Vycm9yLWlubmVyJzsKICAgICAgaW5uZXIuaW5uZXJIVE1MID0gdGV4dDsKICAgICAgdG9vbHRpcC5hcHBlbmRDaGlsZChhcnJvdyk7CiAgICAgIHRvb2x0aXAuYXBwZW5kQ2hpbGQoaW5uZXIpOwogICAgICBlbGVtLnBhcmVudE5vZGUuYXBwZW5kQ2hpbGQodG9vbHRpcCk7CiAgICB9IGVsc2UgewogICAgICB0b29sdGlwLmNsYXNzTmFtZSA9ICdfZXJyb3ItaW5uZXIgX25vX2Fycm93JzsKICAgICAgdG9vbHRpcC5pbm5lckhUTUwgPSB0ZXh0OwogICAgICBlbGVtLnBhcmVudE5vZGUuaW5zZXJ0QmVmb3JlKHRvb2x0aXAsIGVsZW0pOwogICAgICBuZXdfdG9vbHRpcC5ub19hcnJvdyA9IHRydWU7CiAgICB9CiAgICBuZXdfdG9vbHRpcC50aXAgPSB0b29sdGlwOwogICAgbmV3X3Rvb2x0aXAuZWxlbSA9IGVsZW07CiAgICB0b29sdGlwcy5wdXNoKG5ld190b29sdGlwKTsKICAgIHJldHVybiBuZXdfdG9vbHRpcDsKICB9OwogIHZhciByZXNpemVfdG9vbHRpcCA9IGZ1bmN0aW9uKHRvb2x0aXApIHsKICAgIHZhciByZWN0ID0gdG9vbHRpcC5lbGVtLmdldEJvdW5kaW5nQ2xpZW50UmVjdCgpOwogICAgdmFyIGRvYyA9IGRvY3VtZW50LmRvY3VtZW50RWxlbWVudCwgc2Nyb2xsUG9zaXRpb24gPSByZWN0LnRvcCAtICgod2luZG93LnBhZ2VZT2Zmc2V0IHx8IGRvYy5zY3JvbGxUb3ApICAtIChkb2MuY2xpZW50VG9wIHx8IDApKTsKICAgIGlmIChzY3JvbGxQb3NpdGlvbiA8IDQwKSB7CiAgICAgIHRvb2x0aXAudGlwLmNsYXNzTmFtZSA9IHRvb2x0aXAudGlwLmNsYXNzTmFtZS5yZXBsYWNlKC8gPyhfYWJvdmV8X2JlbG93KSA/L2csICcnKSArICcgX2JlbG93JzsKICAgIH0gZWxzZSB7CiAgICAgIHRvb2x0aXAudGlwLmNsYXNzTmFtZSA9IHRvb2x0aXAudGlwLmNsYXNzTmFtZS5yZXBsYWNlKC8gPyhfYWJvdmV8X2JlbG93KSA/L2csICcnKSArICcgX2Fib3ZlJzsKICAgIH0KICB9OwogIHZhciByZXNpemVfdG9vbHRpcHMgPSBmdW5jdGlvbigpIHsKICAgIGlmIChfcmVtb3ZlZCkgcmV0dXJuOwogICAgZm9yICh2YXIgaSA9IDA7IGkgPCB0b29sdGlwcy5sZW5ndGg7IGkrKykgewogICAgICBpZiAoIXRvb2x0aXBzW2ldLm5vX2Fycm93KSByZXNpemVfdG9vbHRpcCh0b29sdGlwc1tpXSk7CiAgICB9CiAgfTsKICB2YXIgdmFsaWRhdGVfZmllbGQgPSBmdW5jdGlvbihlbGVtLCByZW1vdmUpIHsKICAgIHZhciB0b29sdGlwID0gbnVsbCwgdmFsdWUgPSBlbGVtLnZhbHVlLCBub19lcnJvciA9IHRydWU7CiAgICByZW1vdmUgPyByZW1vdmVfdG9vbHRpcChlbGVtKSA6IGZhbHNlOwogICAgaWYgKGVsZW0udHlwZSAhPSAnY2hlY2tib3gnKSBlbGVtLmNsYXNzTmFtZSA9IGVsZW0uY2xhc3NOYW1lLnJlcGxhY2UoLyA/X2hhc19lcnJvciA/L2csICcnKTsKICAgIGlmIChlbGVtLmdldEF0dHJpYnV0ZSgncmVxdWlyZWQnKSAhPT0gbnVsbCkgewogICAgICBpZiAoZWxlbS50eXBlID09ICdyYWRpbycgfHwgKGVsZW0udHlwZSA9PSAnY2hlY2tib3gnICYmIC9hbnkvLnRlc3QoZWxlbS5jbGFzc05hbWUpKSkgewogICAgICAgIHZhciBlbGVtcyA9IGZvcm1fdG9fc3VibWl0LmVsZW1lbnRzW2VsZW0ubmFtZV07CiAgICAgICAgaWYgKCEoZWxlbXMgaW5zdGFuY2VvZiBOb2RlTGlzdCB8fCBlbGVtcyBpbnN0YW5jZW9mIEhUTUxDb2xsZWN0aW9uKSB8fCBlbGVtcy5sZW5ndGggPD0gMSkgewogICAgICAgICAgbm9fZXJyb3IgPSBlbGVtLmNoZWNrZWQ7CiAgICAgICAgfQogICAgICAgIGVsc2UgewogICAgICAgICAgbm9fZXJyb3IgPSBmYWxzZTsKICAgICAgICAgIGZvciAodmFyIGkgPSAwOyBpIDwgZWxlbXMubGVuZ3RoOyBpKyspIHsKICAgICAgICAgICAgaWYgKGVsZW1zW2ldLmNoZWNrZWQpIG5vX2Vycm9yID0gdHJ1ZTsKICAgICAgICAgIH0KICAgICAgICB9CiAgICAgICAgaWYgKCFub19lcnJvcikgewogICAgICAgICAgdG9vbHRpcCA9IGNyZWF0ZV90b29sdGlwKGVsZW0sICJQbGVhc2Ugc2VsZWN0IGFuIG9wdGlvbi4iKTsKICAgICAgICB9CiAgICAgIH0gZWxzZSBpZiAoZWxlbS50eXBlID09J2NoZWNrYm94JykgewogICAgICAgIHZhciBlbGVtcyA9IGZvcm1fdG9fc3VibWl0LmVsZW1lbnRzW2VsZW0ubmFtZV0sIGZvdW5kID0gZmFsc2UsIGVyciA9IFtdOwogICAgICAgIG5vX2Vycm9yID0gdHJ1ZTsKICAgICAgICBmb3IgKHZhciBpID0gMDsgaSA8IGVsZW1zLmxlbmd0aDsgaSsrKSB7CiAgICAgICAgICBpZiAoZWxlbXNbaV0uZ2V0QXR0cmlidXRlKCdyZXF1aXJlZCcpID09PSBudWxsKSBjb250aW51ZTsKICAgICAgICAgIGlmICghZm91bmQgJiYgZWxlbXNbaV0gIT09IGVsZW0pIHJldHVybiB0cnVlOwogICAgICAgICAgZm91bmQgPSB0cnVlOwogICAgICAgICAgZWxlbXNbaV0uY2xhc3NOYW1lID0gZWxlbXNbaV0uY2xhc3NOYW1lLnJlcGxhY2UoLyA/X2hhc19lcnJvciA/L2csICcnKTsKICAgICAgICAgIGlmICghZWxlbXNbaV0uY2hlY2tlZCkgewogICAgICAgICAgICBub19lcnJvciA9IGZhbHNlOwogICAgICAgICAgICBlbGVtc1tpXS5jbGFzc05hbWUgPSBlbGVtc1tpXS5jbGFzc05hbWUgKyAnIF9oYXNfZXJyb3InOwogICAgICAgICAgICBlcnIucHVzaCgiQ2hlY2tpbmcgJXMgaXMgcmVxdWlyZWQiLnJlcGxhY2UoIiVzIiwgZWxlbXNbaV0udmFsdWUpKTsKICAgICAgICAgIH0KICAgICAgICB9CiAgICAgICAgaWYgKCFub19lcnJvcikgewogICAgICAgICAgdG9vbHRpcCA9IGNyZWF0ZV90b29sdGlwKGVsZW0sIGVyci5qb2luKCc8YnIvPicpKTsKICAgICAgICB9CiAgICAgIH0gZWxzZSBpZiAoZWxlbS50YWdOYW1lID09ICdTRUxFQ1QnKSB7CiAgICAgICAgdmFyIHNlbGVjdGVkID0gdHJ1ZTsKICAgICAgICBpZiAoZWxlbS5tdWx0aXBsZSkgewogICAgICAgICAgc2VsZWN0ZWQgPSBmYWxzZTsKICAgICAgICAgIGZvciAodmFyIGkgPSAwOyBpIDwgZWxlbS5vcHRpb25zLmxlbmd0aDsgaSsrKSB7CiAgICAgICAgICAgIGlmIChlbGVtLm9wdGlvbnNbaV0uc2VsZWN0ZWQpIHsKICAgICAgICAgICAgICBzZWxlY3RlZCA9IHRydWU7CiAgICAgICAgICAgICAgYnJlYWs7CiAgICAgICAgICAgIH0KICAgICAgICAgIH0KICAgICAgICB9IGVsc2UgewogICAgICAgICAgZm9yICh2YXIgaSA9IDA7IGkgPCBlbGVtLm9wdGlvbnMubGVuZ3RoOyBpKyspIHsKICAgICAgICAgICAgaWYgKGVsZW0ub3B0aW9uc1tpXS5zZWxlY3RlZCAmJiAhZWxlbS5vcHRpb25zW2ldLnZhbHVlKSB7CiAgICAgICAgICAgICAgc2VsZWN0ZWQgPSBmYWxzZTsKICAgICAgICAgICAgfQogICAgICAgICAgfQogICAgICAgIH0KICAgICAgICBpZiAoIXNlbGVjdGVkKSB7CiAgICAgICAgICBlbGVtLmNsYXNzTmFtZSA9IGVsZW0uY2xhc3NOYW1lICsgJyBfaGFzX2Vycm9yJzsKICAgICAgICAgIG5vX2Vycm9yID0gZmFsc2U7CiAgICAgICAgICB0b29sdGlwID0gY3JlYXRlX3Rvb2x0aXAoZWxlbSwgIlBsZWFzZSBzZWxlY3QgYW4gb3B0aW9uLiIpOwogICAgICAgIH0KICAgICAgfSBlbHNlIGlmICh2YWx1ZSA9PT0gdW5kZWZpbmVkIHx8IHZhbHVlID09PSBudWxsIHx8IHZhbHVlID09PSAnJykgewogICAgICAgIGVsZW0uY2xhc3NOYW1lID0gZWxlbS5jbGFzc05hbWUgKyAnIF9oYXNfZXJyb3InOwogICAgICAgIG5vX2Vycm9yID0gZmFsc2U7CiAgICAgICAgdG9vbHRpcCA9IGNyZWF0ZV90b29sdGlwKGVsZW0sICJUaGlzIGZpZWxkIGlzIHJlcXVpcmVkLiIpOwogICAgICB9CiAgICB9CiAgICBpZiAobm9fZXJyb3IgJiYgZWxlbS5uYW1lID09ICdlbWFpbCcpIHsKICAgICAgaWYgKCF2YWx1ZS5tYXRjaCgvXltcK19hLXowLTktJyY9XSsoXC5bXCtfYS16MC05LSddKykqQFthLXowLTktXSsoXC5bYS16MC05LV0rKSooXC5bYS16XXsyLH0pJC9pKSkgewogICAgICAgIGVsZW0uY2xhc3NOYW1lID0gZWxlbS5jbGFzc05hbWUgKyAnIF9oYXNfZXJyb3InOwogICAgICAgIG5vX2Vycm9yID0gZmFsc2U7CiAgICAgICAgdG9vbHRpcCA9IGNyZWF0ZV90b29sdGlwKGVsZW0sICJFbnRlciBhIHZhbGlkIGVtYWlsIGFkZHJlc3MuIik7CiAgICAgIH0KICAgIH0KICAgIGlmIChub19lcnJvciAmJiAvZGF0ZV9maWVsZC8udGVzdChlbGVtLmNsYXNzTmFtZSkpIHsKICAgICAgaWYgKCF2YWx1ZS5tYXRjaCgvXlxkXGRcZFxkLVxkXGQtXGRcZCQvKSkgewogICAgICAgIGVsZW0uY2xhc3NOYW1lID0gZWxlbS5jbGFzc05hbWUgKyAnIF9oYXNfZXJyb3InOwogICAgICAgIG5vX2Vycm9yID0gZmFsc2U7CiAgICAgICAgdG9vbHRpcCA9IGNyZWF0ZV90b29sdGlwKGVsZW0sICJFbnRlciBhIHZhbGlkIGRhdGUuIik7CiAgICAgIH0KICAgIH0KICAgIHRvb2x0aXAgPyByZXNpemVfdG9vbHRpcCh0b29sdGlwKSA6IGZhbHNlOwogICAgcmV0dXJuIG5vX2Vycm9yOwogIH07CiAgdmFyIG5lZWRzX3ZhbGlkYXRlID0gZnVuY3Rpb24oZWwpIHsKICAgIHJldHVybiBlbC5uYW1lID09ICdlbWFpbCcgfHwgZWwuZ2V0QXR0cmlidXRlKCdyZXF1aXJlZCcpICE9PSBudWxsOwogIH07CiAgdmFyIHZhbGlkYXRlX2Zvcm0gPSBmdW5jdGlvbihlKSB7CiAgICB2YXIgZXJyID0gZm9ybV90b19zdWJtaXQucXVlcnlTZWxlY3RvcignLl9mb3JtX2Vycm9yJyksIG5vX2Vycm9yID0gdHJ1ZTsKICAgIGlmICghc3VibWl0dGVkKSB7CiAgICAgIHN1Ym1pdHRlZCA9IHRydWU7CiAgICAgIGZvciAodmFyIGkgPSAwLCBsZW4gPSBhbGxJbnB1dHMubGVuZ3RoOyBpIDwgbGVuOyBpKyspIHsKICAgICAgICB2YXIgaW5wdXQgPSBhbGxJbnB1dHNbaV07CiAgICAgICAgaWYgKG5lZWRzX3ZhbGlkYXRlKGlucHV0KSkgewogICAgICAgICAgaWYgKGlucHV0LnR5cGUgPT0gJ3RleHQnKSB7CiAgICAgICAgICAgIGFkZEV2ZW50KGlucHV0LCAnYmx1cicsIGZ1bmN0aW9uKCkgewogICAgICAgICAgICAgIHRoaXMudmFsdWUgPSB0aGlzLnZhbHVlLnRyaW0oKTsKICAgICAgICAgICAgICB2YWxpZGF0ZV9maWVsZCh0aGlzLCB0cnVlKTsKICAgICAgICAgICAgfSk7CiAgICAgICAgICAgIGFkZEV2ZW50KGlucHV0LCAnaW5wdXQnLCBmdW5jdGlvbigpIHsKICAgICAgICAgICAgICB2YWxpZGF0ZV9maWVsZCh0aGlzLCB0cnVlKTsKICAgICAgICAgICAgfSk7CiAgICAgICAgICB9IGVsc2UgaWYgKGlucHV0LnR5cGUgPT0gJ3JhZGlvJyB8fCBpbnB1dC50eXBlID09ICdjaGVja2JveCcpIHsKICAgICAgICAgICAgKGZ1bmN0aW9uKGVsKSB7CiAgICAgICAgICAgICAgdmFyIHJhZGlvcyA9IGZvcm1fdG9fc3VibWl0LmVsZW1lbnRzW2VsLm5hbWVdOwogICAgICAgICAgICAgIGZvciAodmFyIGkgPSAwOyBpIDwgcmFkaW9zLmxlbmd0aDsgaSsrKSB7CiAgICAgICAgICAgICAgICBhZGRFdmVudChyYWRpb3NbaV0sICdjbGljaycsIGZ1bmN0aW9uKCkgewogICAgICAgICAgICAgICAgICB2YWxpZGF0ZV9maWVsZChlbCwgdHJ1ZSk7CiAgICAgICAgICAgICAgICB9KTsKICAgICAgICAgICAgICB9CiAgICAgICAgICAgIH0pKGlucHV0KTsKICAgICAgICAgIH0gZWxzZSBpZiAoaW5wdXQudGFnTmFtZSA9PSAnU0VMRUNUJykgewogICAgICAgICAgICBhZGRFdmVudChpbnB1dCwgJ2NoYW5nZScsIGZ1bmN0aW9uKCkgewogICAgICAgICAgICAgIHZhbGlkYXRlX2ZpZWxkKHRoaXMsIHRydWUpOwogICAgICAgICAgICB9KTsKICAgICAgICAgIH0gZWxzZSBpZiAoaW5wdXQudHlwZSA9PSAndGV4dGFyZWEnKXsKICAgICAgICAgICAgYWRkRXZlbnQoaW5wdXQsICdpbnB1dCcsIGZ1bmN0aW9uKCkgewogICAgICAgICAgICAgIHZhbGlkYXRlX2ZpZWxkKHRoaXMsIHRydWUpOwogICAgICAgICAgICB9KTsKICAgICAgICAgIH0KICAgICAgICB9CiAgICAgIH0KICAgIH0KICAgIHJlbW92ZV90b29sdGlwcygpOwogICAgZm9yICh2YXIgaSA9IDAsIGxlbiA9IGFsbElucHV0cy5sZW5ndGg7IGkgPCBsZW47IGkrKykgewogICAgICB2YXIgZWxlbSA9IGFsbElucHV0c1tpXTsKICAgICAgaWYgKG5lZWRzX3ZhbGlkYXRlKGVsZW0pKSB7CiAgICAgICAgaWYgKGVsZW0udGFnTmFtZS50b0xvd2VyQ2FzZSgpICE9PSAic2VsZWN0IikgewogICAgICAgICAgZWxlbS52YWx1ZSA9IGVsZW0udmFsdWUudHJpbSgpOwogICAgICAgIH0KICAgICAgICB2YWxpZGF0ZV9maWVsZChlbGVtKSA/IHRydWUgOiBub19lcnJvciA9IGZhbHNlOwogICAgICB9CiAgICB9CiAgICBpZiAoIW5vX2Vycm9yICYmIGUpIHsKICAgICAgZS5wcmV2ZW50RGVmYXVsdCgpOwogICAgfQogICAgcmVzaXplX3Rvb2x0aXBzKCk7CiAgICByZXR1cm4gbm9fZXJyb3I7CiAgfTsKICBhZGRFdmVudCh3aW5kb3csICdyZXNpemUnLCByZXNpemVfdG9vbHRpcHMpOwogIGFkZEV2ZW50KHdpbmRvdywgJ3Njcm9sbCcsIHJlc2l6ZV90b29sdGlwcyk7CiAgd2luZG93Ll9vbGRfc2VyaWFsaXplID0gbnVsbDsKICBpZiAodHlwZW9mIHNlcmlhbGl6ZSAhPT0gJ3VuZGVmaW5lZCcpIHdpbmRvdy5fb2xkX3NlcmlhbGl6ZSA9IHdpbmRvdy5zZXJpYWxpemU7CiAgX2xvYWRfc2NyaXB0KCIvL2QzcnhhaWo1NnZqZWdlLmNsb3VkZnJvbnQubmV0L2Zvcm0tc2VyaWFsaXplLzAuMy9zZXJpYWxpemUubWluLmpzIiwgZnVuY3Rpb24oKSB7CiAgICB3aW5kb3cuX2Zvcm1fc2VyaWFsaXplID0gd2luZG93LnNlcmlhbGl6ZTsKICAgIGlmICh3aW5kb3cuX29sZF9zZXJpYWxpemUpIHdpbmRvdy5zZXJpYWxpemUgPSB3aW5kb3cuX29sZF9zZXJpYWxpemU7CiAgfSk7CiAgdmFyIGZvcm1fc3VibWl0ID0gZnVuY3Rpb24oZSkgewogICAgZS5wcmV2ZW50RGVmYXVsdCgpOwogICAgaWYgKHZhbGlkYXRlX2Zvcm0oKSkgewogICAgICAvLyB1c2UgdGhpcyB0cmljayB0byBnZXQgdGhlIHN1Ym1pdCBidXR0b24gJiBkaXNhYmxlIGl0IHVzaW5nIHBsYWluIGphdmFzY3JpcHQKICAgICAgZG9jdW1lbnQucXVlcnlTZWxlY3RvcignI19mb3JtXzE3M19zdWJtaXQnKS5kaXNhYmxlZCA9IHRydWU7CiAgICAgICAgICAgIHZhciBzZXJpYWxpemVkID0gX2Zvcm1fc2VyaWFsaXplKGRvY3VtZW50LmdldEVsZW1lbnRCeUlkKCdfZm9ybV8xNzNfJykpOwogICAgICB2YXIgZXJyID0gZm9ybV90b19zdWJtaXQucXVlcnlTZWxlY3RvcignLl9mb3JtX2Vycm9yJyk7CiAgICAgIGVyciA/IGVyci5wYXJlbnROb2RlLnJlbW92ZUNoaWxkKGVycikgOiBmYWxzZTsKICAgICAgX2xvYWRfc2NyaXB0KCdodHRwczovL3JpdmVyYmVuZGludmVzdG1lbnRtYW5hZ2VtZW50LmFjdGl2ZWhvc3RlZC5jb20vcHJvYy5waHA/JyArIHNlcmlhbGl6ZWQgKyAnJmpzb25wPXRydWUnKTsKICAgIH0KICAgIHJldHVybiBmYWxzZTsKICB9OwogIGFkZEV2ZW50KGZvcm1fdG9fc3VibWl0LCAnc3VibWl0JywgZm9ybV9zdWJtaXQpOwp9KSgpOwoKPC9zY3JpcHQ+[/fusion_code][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container][fusion_builder_container hundred_percent=”no” hundred_percent_height=”no” hundred_percent_height_scroll=”no” hundred_percent_height_center_content=”yes” equal_height_columns=”no” menu_anchor=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” status=”published” publish_date=”” class=”” id=”” border_size=”” border_color=”” border_style=”solid” margin_top=”” margin_bottom=”” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” gradient_start_color=”” gradient_end_color=”” gradient_start_position=”0″ gradient_end_position=”100″ gradient_type=”linear” radial_direction=”center” linear_angle=”180″ background_color=”” background_image=”” background_position=”center center” background_repeat=”no-repeat” fade=”no” background_parallax=”none” enable_mobile=”no” parallax_speed=”0.3″ background_blend_mode=”none” video_mp4=”” video_webm=”” video_ogv=”” video_url=”” video_aspect_ratio=”16:9″ video_loop=”yes” video_mute=”yes” video_preview_image=”” filter_hue=”0″ filter_saturation=”100″ filter_brightness=”100″ filter_contrast=”100″ filter_invert=”0″ filter_sepia=”0″ filter_opacity=”100″ filter_blur=”0″ filter_hue_hover=”0″ filter_saturation_hover=”100″ filter_brightness_hover=”100″ filter_contrast_hover=”100″ filter_invert_hover=”0″ filter_sepia_hover=”0″ filter_opacity_hover=”100″ filter_blur_hover=”0″][fusion_builder_row][/fusion_builder_row][/fusion_builder_container]