[fusion_builder_container hundred_percent=”no” equal_height_columns=”no” menu_anchor=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”center center” background_repeat=”no-repeat” fade=”no” background_parallax=”none” parallax_speed=”0.3″ video_mp4=”” video_webm=”” video_ogv=”” video_url=”” video_aspect_ratio=”16:9″ video_loop=”yes” video_mute=”yes” overlay_color=”” video_preview_image=”” border_size=”” border_color=”” border_style=”solid” padding_top=”” padding_bottom=”” padding_left=”” padding_right=””][fusion_builder_row][fusion_builder_column type=”1_1″ layout=”1_1″ background_position=”left top” background_color=”” border_size=”” border_color=”” border_style=”solid” border_position=”all” spacing=”yes” background_image=”” background_repeat=”no-repeat” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” margin_top=”0px” margin_bottom=”0px” class=”” id=”” animation_type=”” animation_speed=”0.3″ animation_direction=”left” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” center_content=”no” last=”no” min_height=”” hover_type=”none” link=””][fusion_text]

Market Commentary (Video):

[/fusion_text][fusion_vimeo id=”609938531″ alignment=”center” width=”1000″ height=”” autoplay=”false” api_params=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” css_id=”” /][fusion_text][fusion_text][fusion_text][fusion_text][fusion_text]

U.S. Markets:

U.S. stocks ended the week mostly lower as investors weighed positive economic reports with concerns over global supply chains and an inevitable tightening in monetary policy.

The small-cap Russell 2000 managed a slight gain, but the rest of the major indexes finished the week lower.

The Dow Jones Industrial Average ticked down 0.1% to 34,585, while the technology-heavy NASDAQ Composite fell a half percent to 15,044.

By market cap, the large cap S&P 500 gave up -0.6%, the mid cap S&P 400 fell -0.3%, and the Russell 2000 rose 0.4%.

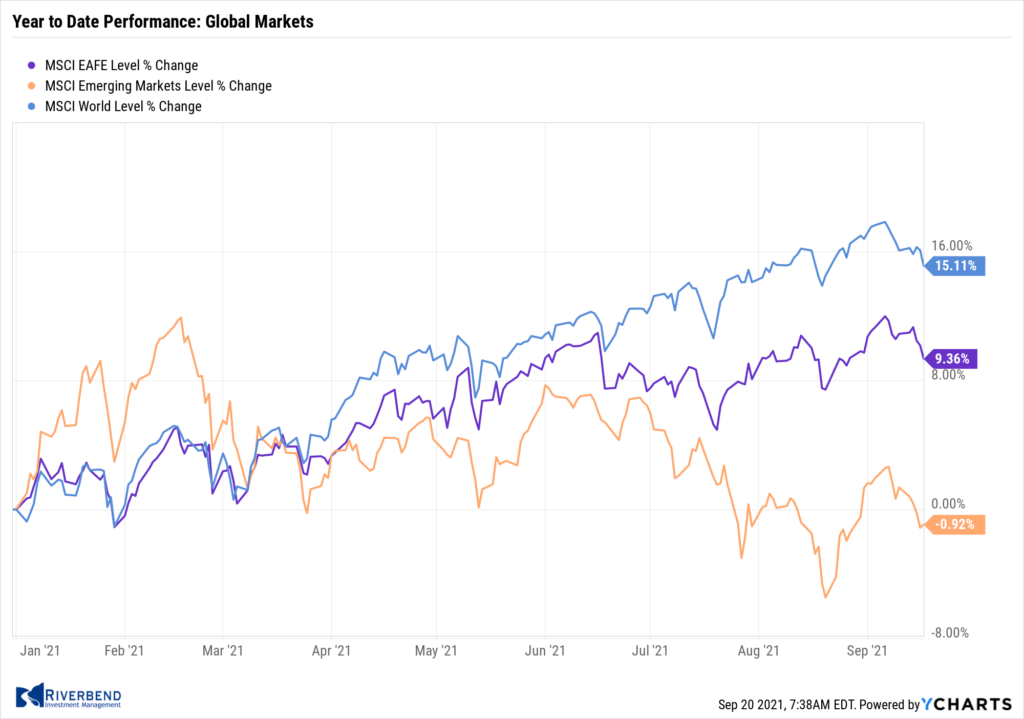

International Markets:

The vast majority of major international markets finished the week down as well.

Canada’s TSX declined for a second week, down -0.7%, while the United Kingdom’s FTSE 100 retreated -0.9.

On Europe’s mainland, France’s CAC 40 and Germany’s DAX ended down -1.4% and -0.8%, respectively.

In Asia, China’s Shanghai Composite reversed most of last week’s gains falling -2.4%, but Japan’s Nikkei finished the week up 0.4%.

As grouped by Morgan Stanley Capital International, emerging markets shed -2.1%. Developed markets fell -0.8%.

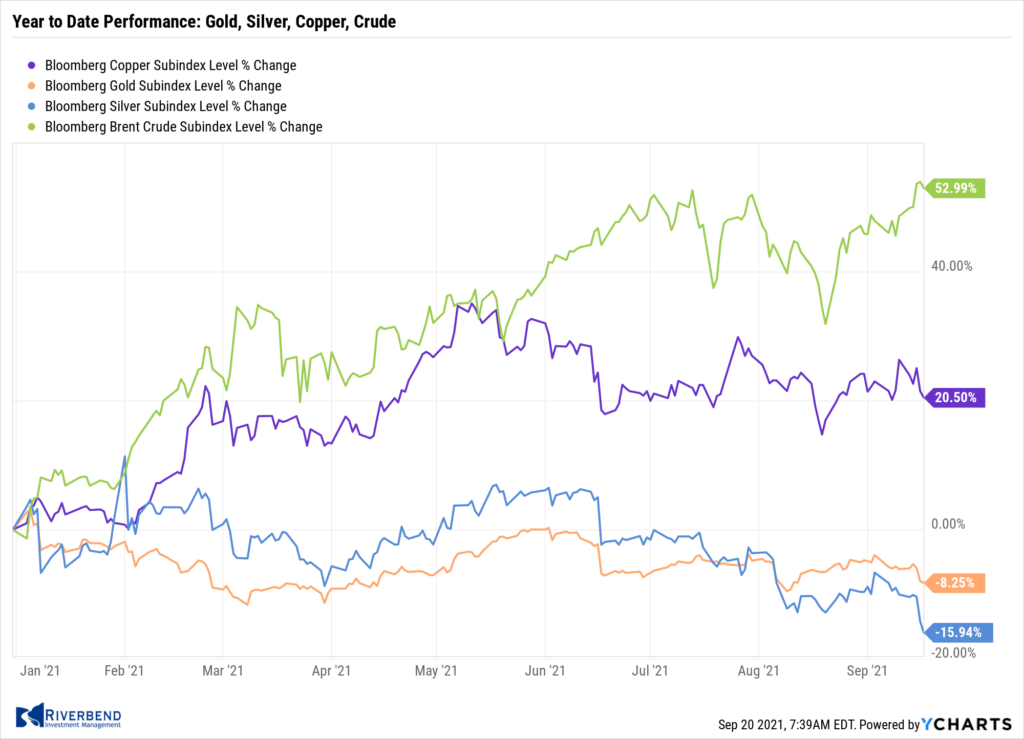

Commodities:

Precious metals sold off despite clear signs of inflation in the economy.

Gold ended the week down ‑2.3% to $1751.40 per ounce, while Silver dropped a larger -6.5% to $22.34.

Energy moved higher. West Texas Intermediate crude oil rose 3% to $71.82 per barrel.

The industrial metal copper, viewed by some analysts as a barometer of world economic health due to its wide variety of uses, plunged -4.6%–a four-week low.

U.S. Economic News:

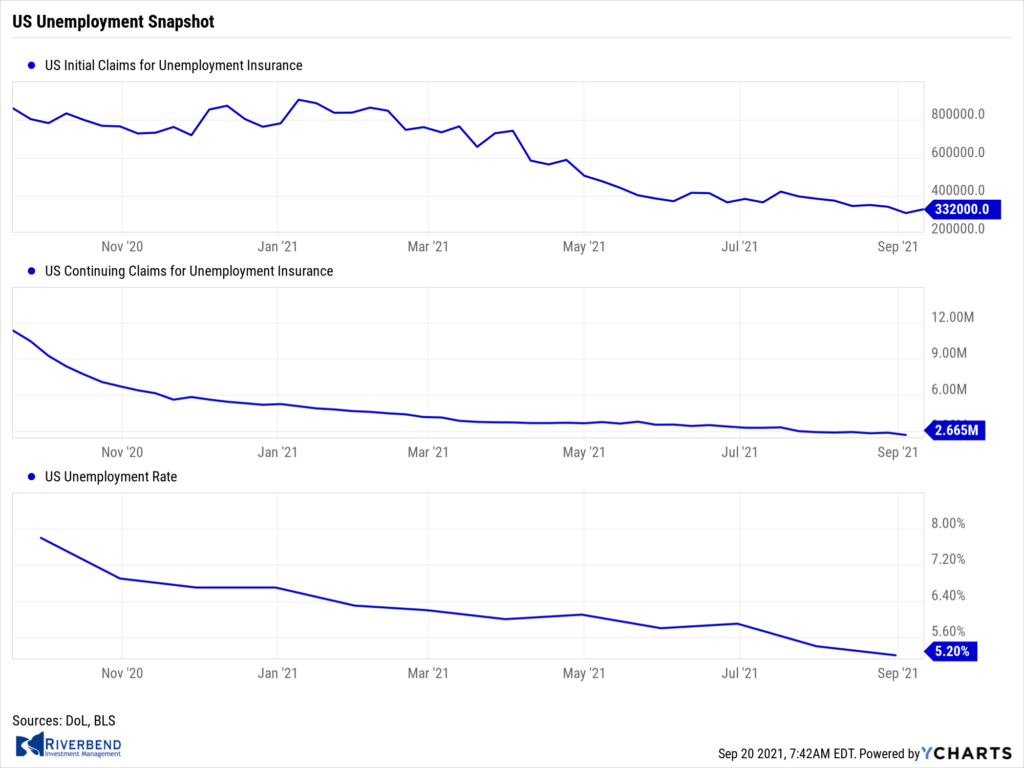

The number of Americans filing first-time applications for unemployment benefits rose last week, one week after hitting a pandemic low. Initial jobless claims rose 20,000 to 332,000 in the week ended September 11th. Economists had expected new claims to total 318,000. This latest report is the first since the extra federal benefits for the unemployed expired on September 6th.

Meanwhile, the number of people already collecting benefits, known as “continuing claims”, fell by 187,000 to 2.67 million. That number is currently at a pandemic era low. Other than taking into account Hurricane Ida analysts were at a loss for the slight uptick in claims. Thomas Simons of Jefferies LLC wrote in a note, “Demand for labor remains extremely strong, so there is no fundamental reason why we would see claims move higher.”

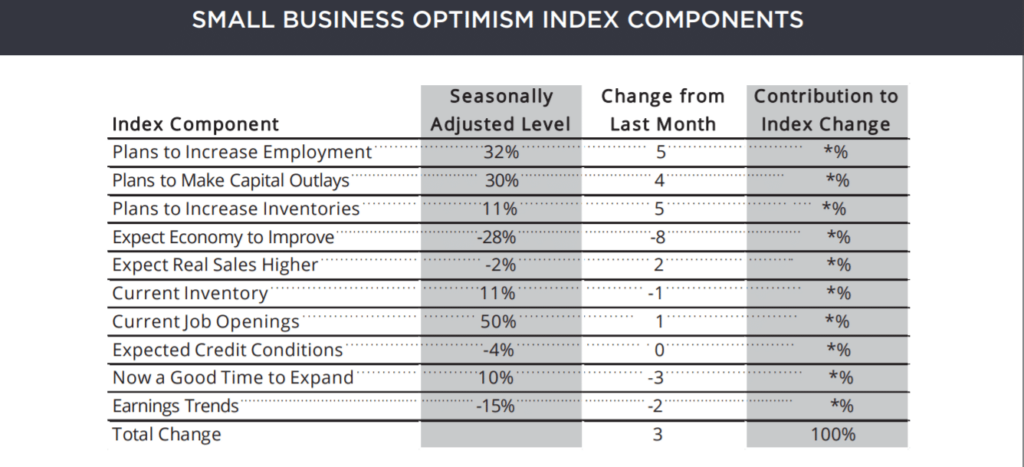

Small businesses continue to struggle with major shortages of both labor and supplies according to a closely-followed survey. The National Federation of Independent Business (NFIB) reported small-business owners were a bit more optimistic about the economy last month, but record shortages of materials and workers are having a significant impact on sales and profits hindering the economic recovery from the pandemic.

Source: NFIB

The NFIB reported its optimism index rose 0.4 point to 100.1. Economists were expecting a reading of 99.0. The lack of supplies stems from major disruptions in global trade tied to clogged ports and rail stations coping with large backlogs. While the supply bottlenecks are expected to ease, the labor shortage could prove to be a more difficult issue. Half of all small-business owners said they could not fill open positions—the highest level in the 48-year history of the survey.

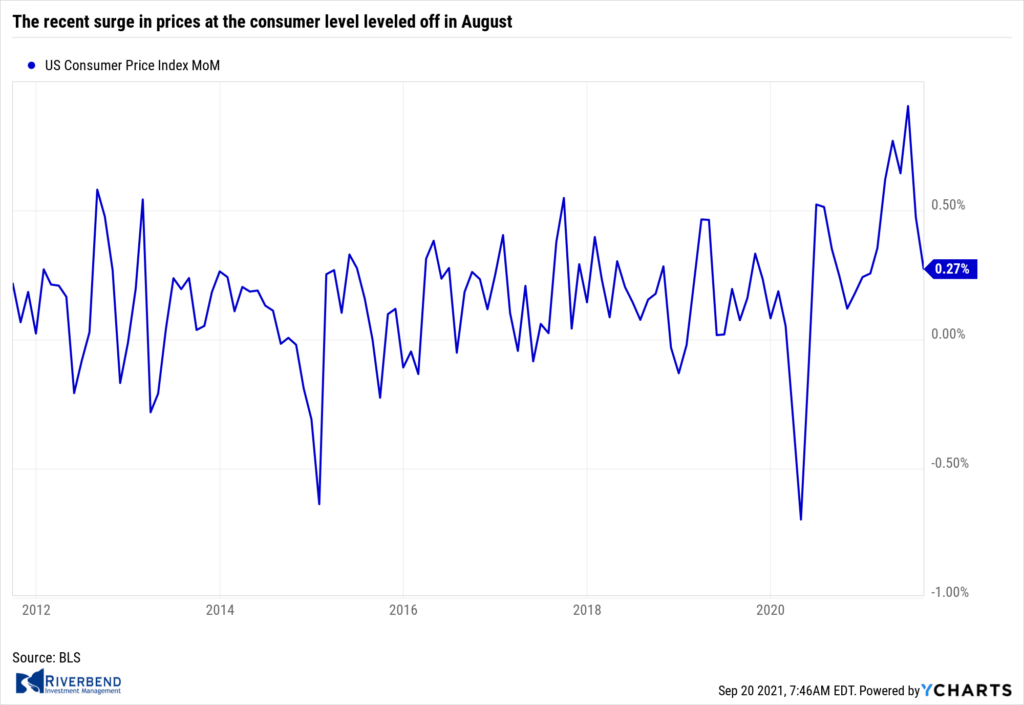

The recent surge in prices at the consumer level leveled off in August, however analysts don’t believe Americans are going to get much relief from higher prices anytime soon. The Bureau of Labor Statistics reported its index of consumer prices climbed 0.3% last month. Economists had estimated a 0.4% rise. Over the past year, the rate of inflation stands at 5.3% in August—down a tick from July. It was the first slowdown since last October. Aside from the brief oil-driven spike in 2008, consumer prices have risen this year at the fastest pace in three decades. Another closely watched measure of inflation that omits food and energy, so-called “core inflation”, rose just 0.1%. That was the smallest increase since February.

The recent surge in prices at the consumer level leveled off in August, however analysts don’t believe Americans are going to get much relief from higher prices anytime soon. The Bureau of Labor Statistics reported its index of consumer prices climbed 0.3% last month. Economists had estimated a 0.4% rise. Over the past year, the rate of inflation stands at 5.3% in August—down a tick from July. It was the first slowdown since last October. Aside from the brief oil-driven spike in 2008, consumer prices have risen this year at the fastest pace in three decades. Another closely watched measure of inflation that omits food and energy, so-called “core inflation”, rose just 0.1%. That was the smallest increase since February.

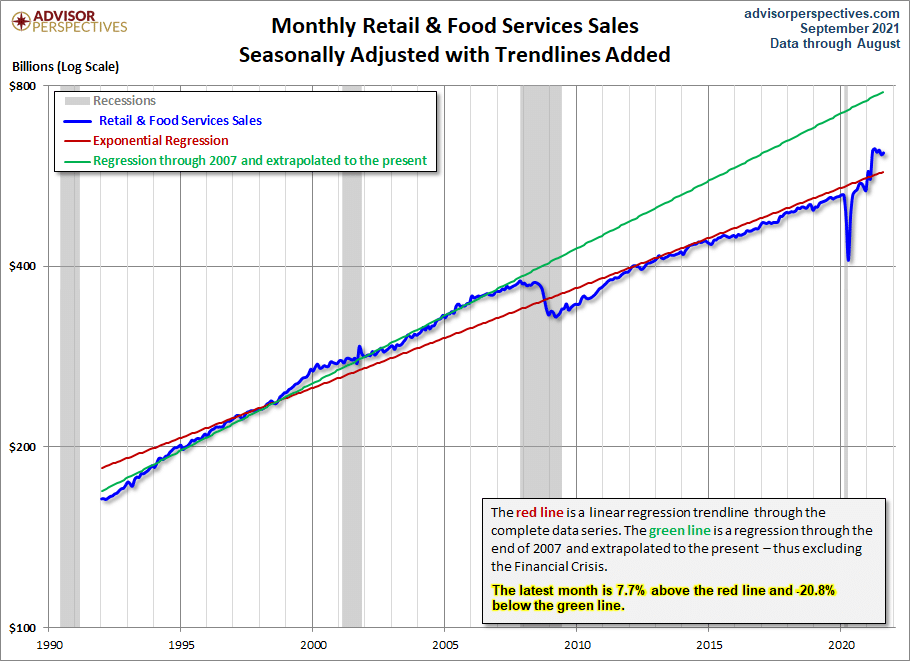

Sales at U.S. retailers rose sharply in August, a sign that consumers continued to spend despite the media reports of an uptick in the spread of the ‘delta-variant’ coronavirus. The Census Bureau reported retail sales increased 0.7% last month. The consensus forecast was for a -0.7% decline. Sales advanced in almost every major retail category in August, and they rose an even stronger 1.8% if autos are excluded.

Compared to the same time last year, retail sales were up 15%. Some analysts were quick to point out that part of the increase reflects the higher prices consumers are paying, particularly for groceries and building materials. Chris Low at FHN Financial summed up the report noting, “All in all, this was a solid showing by U.S. consumers, expected by no one, suggesting the economy continued to hum in August.”

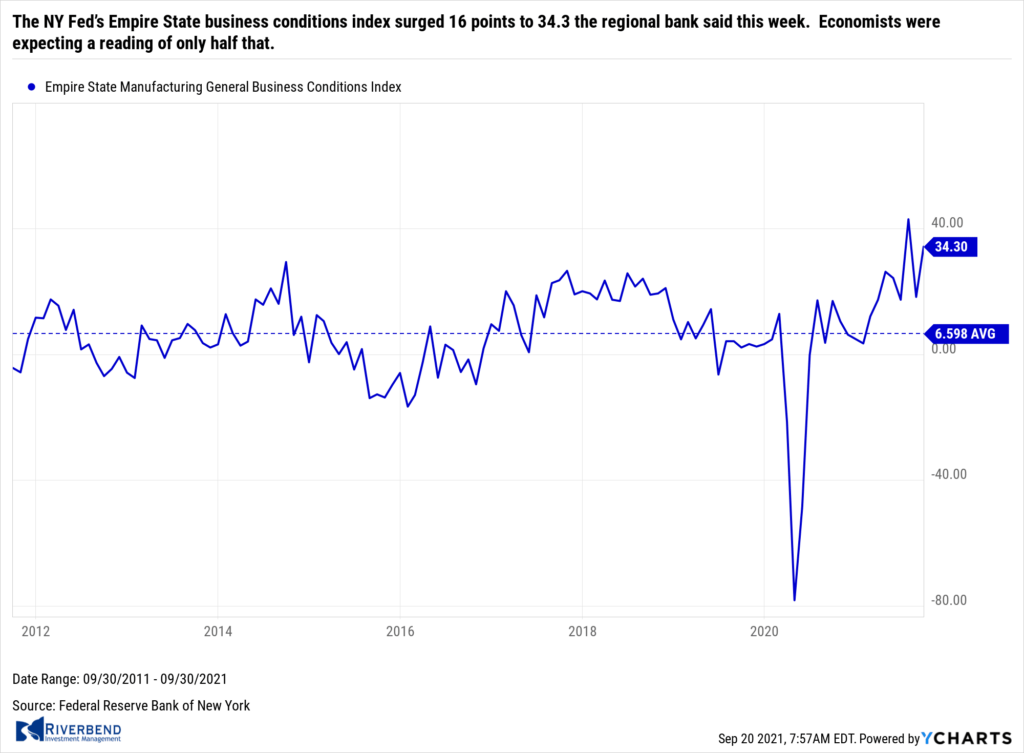

Business activity in the New York-region soared this month according to the New York Federal Reserve. The NY Fed’s Empire State business conditions index surged 16 points to 34.3 the regional bank said this week. Economists were expecting a reading of only half that. The new orders index jumped 18.9 points to 33.7, while the shipments index soared 22.5 points to 26.9. Both prices paid and prices received were at or near record highs in September. And business leaders expect the strength to continue. The sub-index of what the business leaders expect for the next 6 months also came in very positive.

Chart of the Week:

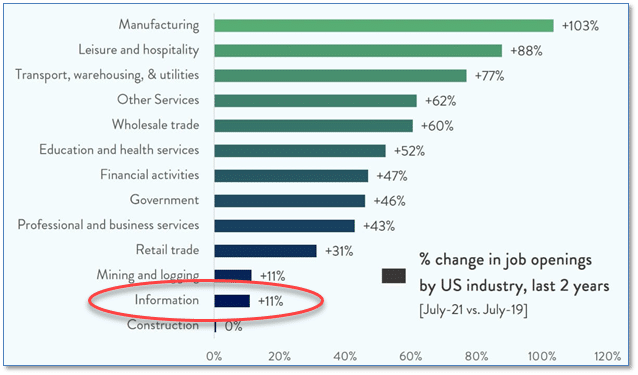

In December of 2019 then-candidate Joe Biden famously told a crowd in a hard-hit coal mining town to “learn to code” in order to transition to “the jobs of the future”. While there has probably never been a better time to be looking for a job in the United States, his advice may have been a bit early.

Recent data from the Bureau of Labor Statistics showed that while job openings in Manufacturing and Leisure and Hospitality have surged 103% and 88% since mid-2019, respectively, jobs in the Information sector are second from the bottom—up just 11% in two years.

Source: Bureau of Labor Statistics, chartr.co

Riverbend Indicators:

Each week we post notable changes to the various market indicators we follow.

- As a reading of our Bull-Bear Indicator for U.S. Equities (comparative measurements over a rolling one-year timeframe), we remain in Cyclical Bull territory.

- Counting up of the number of all our indicators that are ‘Up’ for U.S. Equities, the current tally is that three of four are Positive, representing a multitude of timeframes (two that can be solely days/weeks, or months+ at a time; another, a quarter at a time; and lastly, the {typically} years-long reading, that being the Cyclical Bull or Bear status).

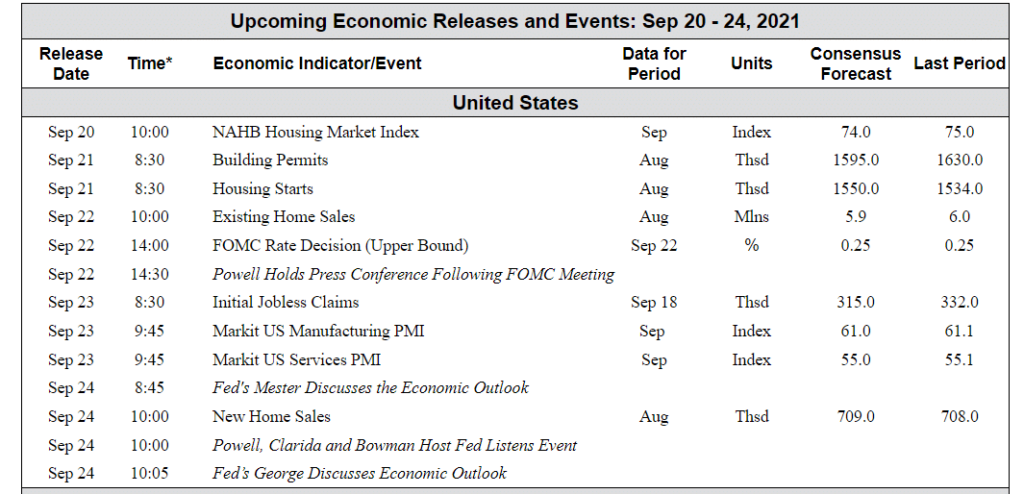

The Week Ahead:

Source: TD Economics, Bloomberg

(Sources: All index- and returns-data from Yahoo Finance; news from Reuters, Barron’s, Wall St. Journal, Bloomberg.com, ft.com, guggenheimpartners.com, zerohedge.com, ritholtz.com, markit.com, financialpost.com, Eurostat, Statistics Canada, Yahoo! Finance, stocksandnews.com, marketwatch.com, wantchinatimes.com, BBC, 361capital.com, pensionpartners.com, cnbc.com, FactSet.)

[/fusion_text][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]