Too often, investment choices may be based on an oversimplified understanding of objectives (i.e., whether to invest for income or growth, or some combination of both).

Thus, it’s important to consider individual factors such as risk tolerance, liquidity needs, income requirements, and time horizon in order to build a portfolio that is consistent with your overall objectives.

Below I am going to give an overview on single stock risks, measuring portfolio risks, and a quick and simple risk tolerance quiz you can take to help you determine how risky an investor you are.

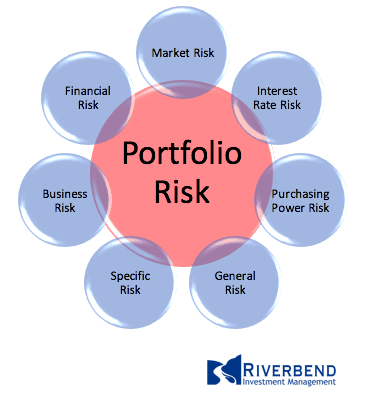

Types of Investment Risks Facing Individual Equites

General Risk

General risk refers to factors that lie outside individual companies, but that affect an entire class of investments, or the market as a whole (although individual companies may be affected to varying degrees).

Market Risk

One type of general risk, known as market risk, may be a function of political, economic, and sociological events, or changes in investor preferences.

For example, market risk occurs when the overall business climate changes, bringing expectations of lower corporate profits in general, and causing the larger body of common stock prices to fall.

Interest Rate Risk

A second general factor that may broadly affect all companies is interest rate risk—the fluctuations in the general level of interest rates. The bond market is particularly sensitive to interest rate risk in that bond prices tend to move in the opposite direction of interest rates.

Although fixed-income securities (such as bonds) are generally the securities most affected by interest rate risk, other investment vehicles may be affected as well.

Companies that borrow heavily for plants and equipment (e.g., utilities) may see their common stock prices affected by changes in the cost of borrowing.

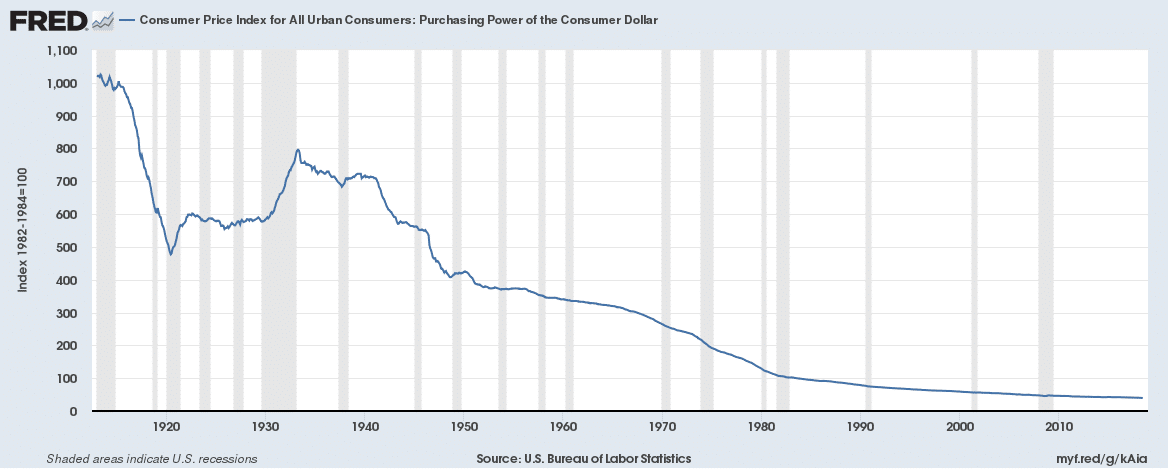

Purchasing Power Risk

A third general risk factor is purchasing power risk—the impact of inflation (a general rise in prices) or deflation (a general fall in price levels) on an investment.

Purchasing power risk is a reflection of the uncertainty of price levels during the time an investment is held, particularly the inability of a particular investment to keep pace with inflation.

For example, if an investment returns 3% annually, but inflation averages 4% annually during the holding period, the investor will be losing purchasing power by holding the investment.

Purchasing power risk is generally highest in investments paying relatively low fixed-interest rates, such as savings accounts.

Specific Risk

In contrast to general risk, specific risk is that portion of total risk that is unique to a firm, industry, or property (in the case of a real estate investment). Specific risk is typically subdivided into business risk and financial risk.

Business Risk

Business risk is the risk associated with the nature of the enterprise itself (or the industry in which the enterprise resides) and measures the company’s ability to meet its obligations, remain a profitable entity, and provide acceptable returns to investors.

It is generally believed that like kinds of firms or properties have similar business risk. However, among similar businesses, differences in management, operating costs, and market opportunities can create different levels of business risk.

Financial Risk

Financial risk measures a company’s mix of debt and equity used to finance its operations. Debt creates legal obligations (i.e., principal and interest payments) that must be met before earnings are distributed to owners (e.g., dividends to stockholders). The larger the proportion of debt, the greater the financial risk.

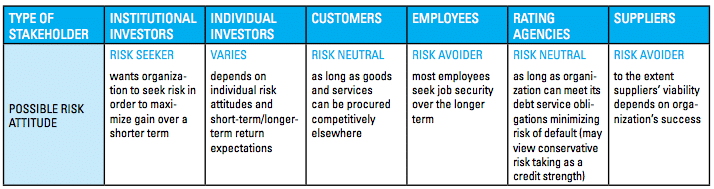

Investment Portfolio Risk Management for Individual Investors

Once individual stock risks are understood, the next step is to look at the risk facing the portfolio itself.

The best way to do this is to start with the investor himself/herself.

source www.rims.org

Different types of investors will have different risk levels. One size does not fit all.

Risk Tolerance

Risk tolerance refers to your “comfort zone” with regard to market volatility. Essentially, it’s how much risk you’re willing to trade off in exchange for the potential for higher returns.

This is one of the most important areas to focus on when you are examing investment portfolio risk management techniques.

For example, individuals with a low-risk tolerance are generally concerned about market volatility and, therefore, may be more inclined to pursue investments that offer safety of principal and provide income.

On the other hand, individuals with a greater risk tolerance are usually content at riding out market fluctuations and pursue more aggressive growth-type investments. You’ll need to determine what types of investments are compatible with your comfort zone.

Liquidity Needs

Liquidity is the ability to readily convert an investment into cash at any time without loss of original principal.

For example, money market funds are considered to have great liquidity because they generally maintain a fixed value of one dollar per share.

Consequently, if you’re dependent on a money market account for near-term cash needs, you can be reasonably certain of immediate access to investment principal that will maintain its value.

In short, liquidity implies safety, stability, and preservation of capital.

Income Producing Concerns

Your choice of funds should take income requirements over the near-term (one to five years) into consideration.

Generally, current income is less of a concern for younger investors. However, income-producing investments are important to many retirees and individuals nearing retirement.

For example, bond funds generally produce a more predictable income stream than do common stock mutual funds.

Many bond funds credit interest on at least a quarterly basis, some monthly. In contrast, stock funds typically make distributions semiannually, which could include dividends on individual stocks and both short-term and long-term capital gain distributions from the sale of securities.

Capital gain distributions can vary significantly from year to year, depending on management decisions to sell or hold individual stocks (although an investor could set up a periodic share redemption program in either a stock or bond fund to provide income by drawing down the account).

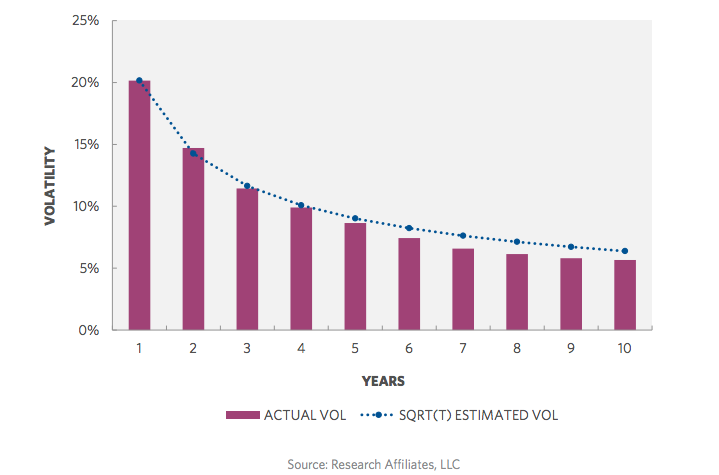

Time Horizon

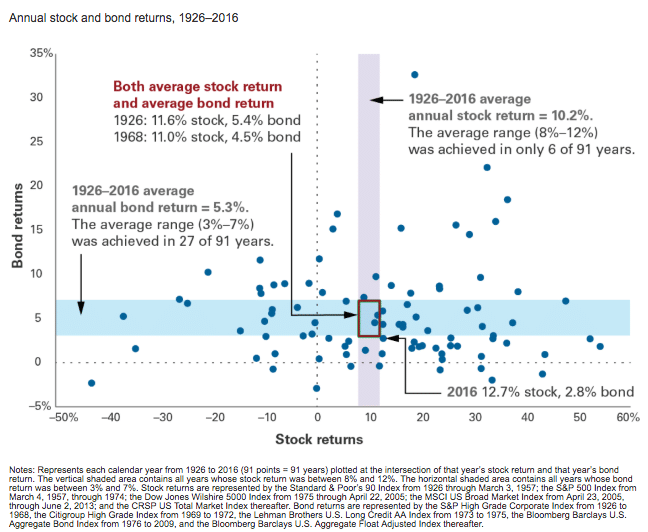

Generally, the longer your time horizon, the more risk you may be able to assume, because the historical long-term upward trend of the market has the potential to overcome short-term declines.

However, you should not abandon your personal comfort level (risk tolerance) just because you have a longer investment time frame (say, 20 years).

Tax Concerns

Make sure you understand the tax ramifications of the various investment choices that are available to investors.

Mutual funds, for example, make periodic taxable distributions (whether taken in cash or reinvested in additional shares), and selling fund shares is a taxable event (either capital gain or loss).

Although individual tax concerns vary, they should be an important part of your overall strategy.

If you have a long time horizon, moderate-to-high risk tolerance, and minimal short-term income requirements, you could minimize tax exposure by investing in funds that make minimal annual distributions and holding those funds indefinitely.

Maintaining Your Portfolio

Generally, reasons for selling an investment may depend on whether or not it has underperformed relative to its peer group, or if something has changed within your set of personal factors.

That is, any change in risk tolerance, liquidity needs, income requirements, anticipated holding period, or tax exposure should trigger a reevaluation of a portfolio’s suitability.

Source: Vanguard

However, bear in mind, past performance is not indicative of future results. In addition, shares may be redeemed for more or less than their original purchase price.

The bottom line for any investor is that their portfolio should reflect their individual circumstances, and should be monitored as those circumstances change.

Understanding Your Risk Tolerance

Risk tolerance is a highly individual matter in investment portfolio risk management. A portfolio that keeps one investor awake at night may let another sleep soundly.

However, investors must be willing to accept a certain risk level to receive investment returns in the form of interest or capital gains.

All investments carry a tradeoff between risk and return—generally, the higher the risk, the higher the potential return—or loss. Conversely, the lower the risk, the lower the potential return or loss.

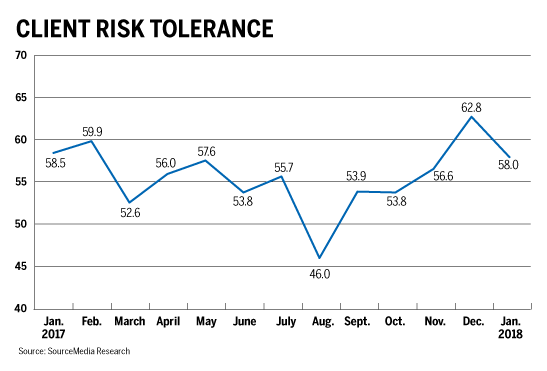

Investors that don’t have a set risk tolerance tend to change portfolio risk levels depending on stock market volatility.

The goal is to find the right level of risk that provides the returns you need, while letting you get a good night’s rest.

Temperament, age, stage in life, investment experience, financial goals, and time horizons are all factors that affect one’s risk tolerance. Following is a brief discussion of some of these points to help you assess your own personal risk tolerance:

Temperament

Not everyone is comfortable taking financial risks. Just because someone is a weekend extreme rock climber doesn’t necessarily mean that this risk-taking behavior extends to his or her finances.

When selecting investments, it is important to bear in mind that different types carry different degrees of risk, and also that returns for specific investment types may vary over time.

For instance, stock market returns that have historically risen over the long term have experienced wide short-run fluctuations.

Looking back at the historic 1973–1975 recession, the stock market dropped by 46%. Ask yourself: “How well would I have weathered that loss?”

Age and Stage in Life

Single investors may be able to carry more risk than married couples with children. Individuals just embarking on their careers and building wealth can usually take on more risk than those nearing, or already in, retirement.

Investment Experience

Sophisticated investors, who understand capital markets and are knowledgeable about specific investments, can typically assume more risk than novices.

Financial Goals and Time Horizons

Another consideration is the amount of time you have to meet your financial goals—that is, your time horizon. For example, if you begin saving for retirement early, you can generally afford to assume a higher degree of risk.

While it is not wise to take on more risk than you are comfortable with, remember that the amount of risk you are willing to carry may potentially affect the level of return you can expect.

Reassess Periodically

It is prudent to assess your risk tolerance before beginning an investment program. Then, reassess it periodically as you progress through life’s major stages, such as when starting a family, changing jobs, or approaching retirement.

Understanding your risk tolerance can help guide your investment decisions, and help you sleep more soundly at night.

A Simple Risk Tolerance Questionnaire

Most investors know that they should evaluate their risk tolerance when considering an investment. Oftentimes, investors think of risk only in terms of possibly losing money.

The below questionnaire will help you get a better understanding of how much risk you are comfortable with.

– – – –

For questions 1 through 6, give yourself 1 point if you strongly agree, 3 points if you somewhat agree, and 5 points if you disagree.

[table “7” not found /]

For the last two questions, give yourself 1 point if you answer 5 years or less, 3 points if you answer 15 years, and 5 points if you answer 25 or more years.

Scoring

8 – 17 points You have a low-risk tolerance

18 – 31 points You have an average risk tolerance

3 2 – 40 points You have a high-risk tolerance

These results can help serve as a starting point to guide you in selecting appropriate investments for your particular level of investment portfolio risk management.