This has been an interesting week for investors. The bear market in bonds looks to have arrived, as we near a historically strong period for the market.

First let’s take a quick look at what’s happening now.

Bond yields have been rising. In fact, they have risen so much, the multi-decade downward trend has been broken. This seems to have spooked traders a bit.

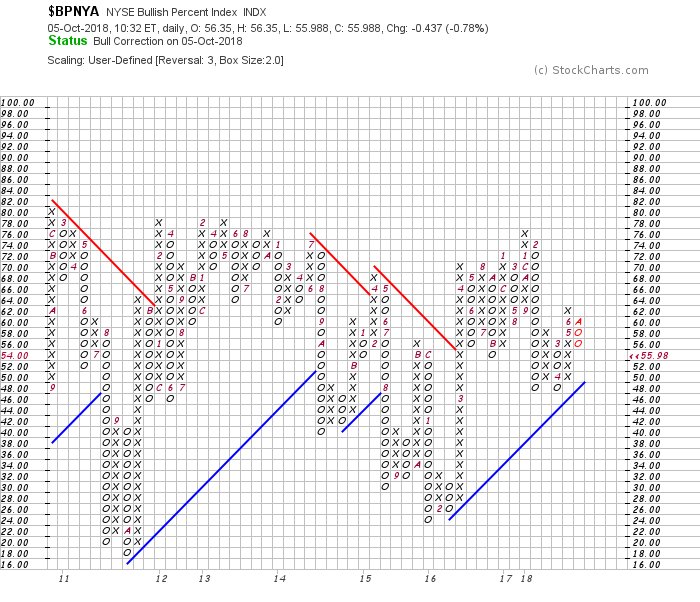

The rise in yields has caused a “knee-jerk” reaction in the equity markets. In fact, I am seeing a flight to cash and other safe-haven asset classes among most sectors. This has been confirmed by the latest reading on the NYSE Bullish Percent Index:

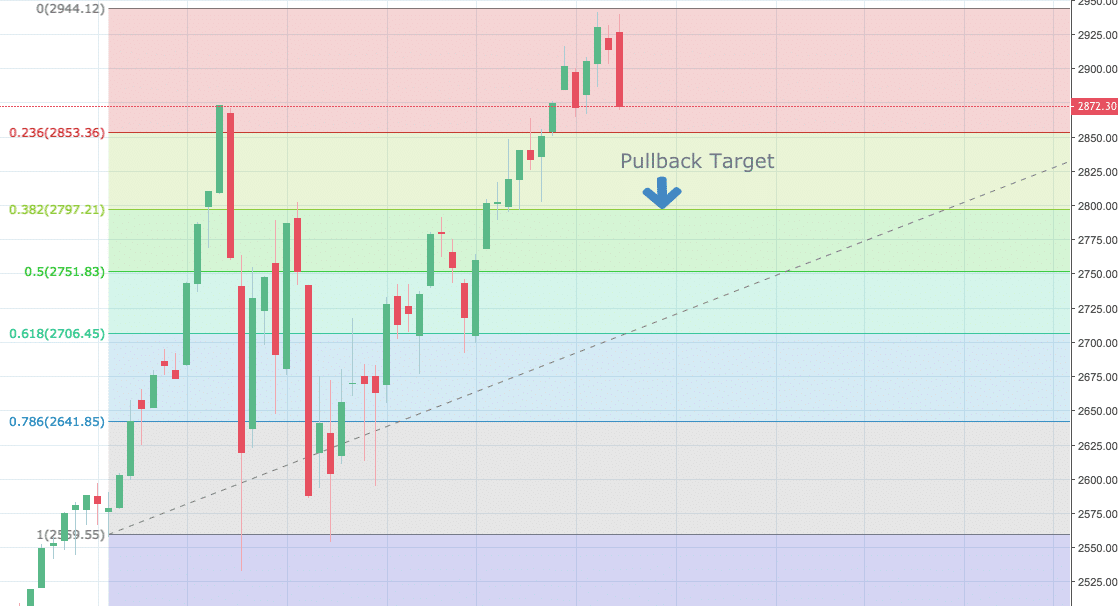

While I am not a fan of predicting future market levels, we do need to examine what a pullback in equities might look like.

The Fibonacci retracement shows a target near the 2800 level of the S&P 500 Index. In addition, markets tend to drift toward round numbers. So, this gives me another reason to focus on the 2800 level.

So, is this the start of a bear market in equities?

I don’t think so.

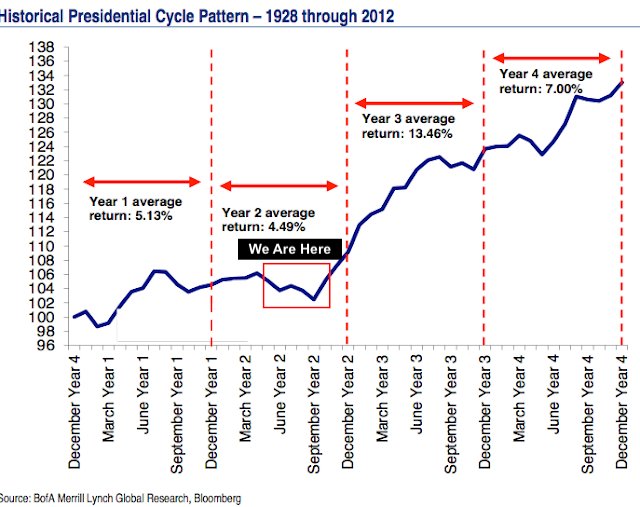

We are nearing a historically strong period in the market as we near the 3rd year of the Presidential Cycle. The economy is growing, and traders are still buying the dips.

To sum it up: this pullback feels more like the froth being removed from the top vs someone pulling the plug out of the drain.