April was another difficult month for both stock and bond markets. The S&P 500 Index traded -8.8% lower during the month, while the Bloomberg Bond U.S. Aggregate Index traded -3.8% lower.

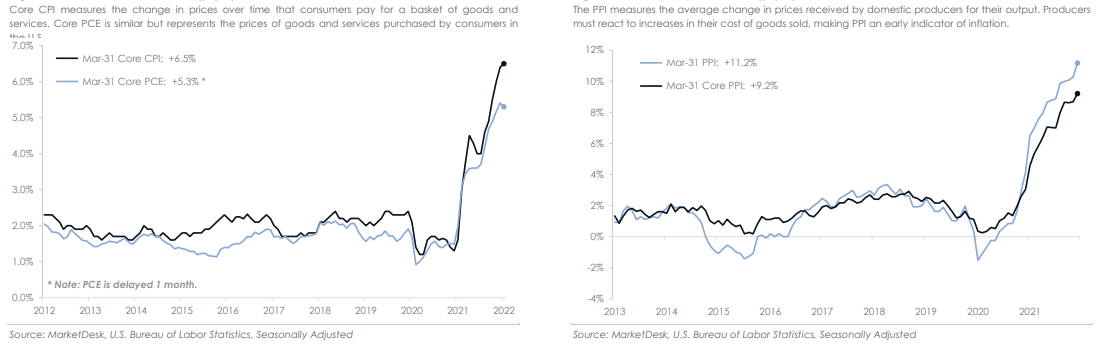

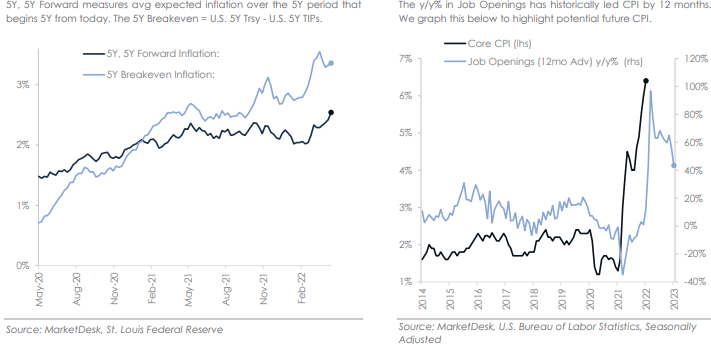

Federal Reserve policy remains the driving force as the central bank raises interest rates and prepares to shrink its balance sheet to ease inflation pressures.

It is a difficult and delicate balancing act to pull off.

Low interest rates and bond purchases stabilized the U.S. economy during the Covid pandemic, but removing the two pandemic-era monetary policies is proving to be enormously disruptive.

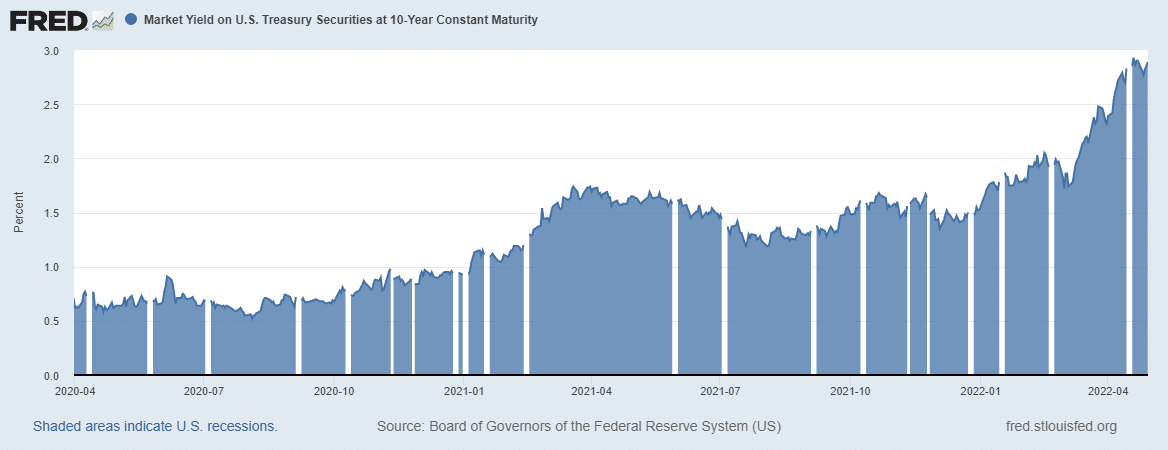

Interest rates rose again during April as the 10-year U.S. Treasury yield surged +0.57% to 2.89%.

While 0.57% may seem small on an absolute level, it significantly impacts how investors position portfolios.

So, why do rising rates impact portfolios?

Interest rates represent the cost of money and are used as an input to value company shares. A higher Treasury yield offers investors a higher rate of return.

To incentivize investors to own riskier assets, such as stocks, the expected return must increase.

Buying an asset, such as a house or stock, at a lower valuation should increase the expected return, which means the theoretical value of the asset should be lower as rates rise.

On a conceptual level, this is the messy valuation process the market is currently working through. It is trying to find the correct theoretical fair value of a company’s shares as interest rates rise.

This is in addition to dealing with geopolitical tensions, new Covid lockdowns in China, and surging inflation.

Chart of the Week:

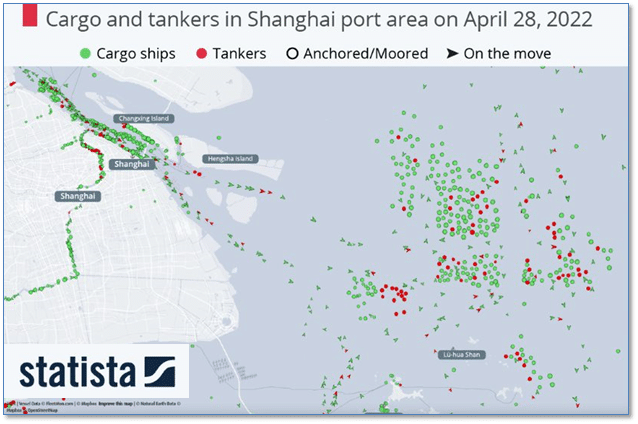

The largest city in China, Shanghai, remains in full lockdown as authorities try to contain yet another wave of COVID-19.

Those lockdowns have led to a major backlog of cargo and container ships around the Port of Shanghai—the busiest container port in the world.

Last year, over 47 million 20-foot equivalent units (unit of measure for container sizes) were handled there. For perspective, the largest container port in Europe, Rotterdam, had only 15.3 million TEUs.

U.S. trucking giant JB Hunt expects the delays that Shanghai is experiencing to spread to the US West Coast by July. Shelley Simpson, chief commercial officer stated, “We do forecast that [shipping delays] to get a lot worse as we come into the summer months.”

Riverbend Indicators

- As a reading of our Bull-Bear Indicator for U.S. Equities (comparative measurements over a rolling one-year timeframe), we remain in Cyclical Bull territory.

- Counting up the number of all our indicators that are ‘Up’ for U.S. Equities, the current tally is that zero of four are Positive, representing a multitude of timeframes (two that can be solely days/weeks, or months+ at a time; another, a quarter at a time; and lastly, the {typically} years-long reading, that being the Cyclical Bull or Bear status).

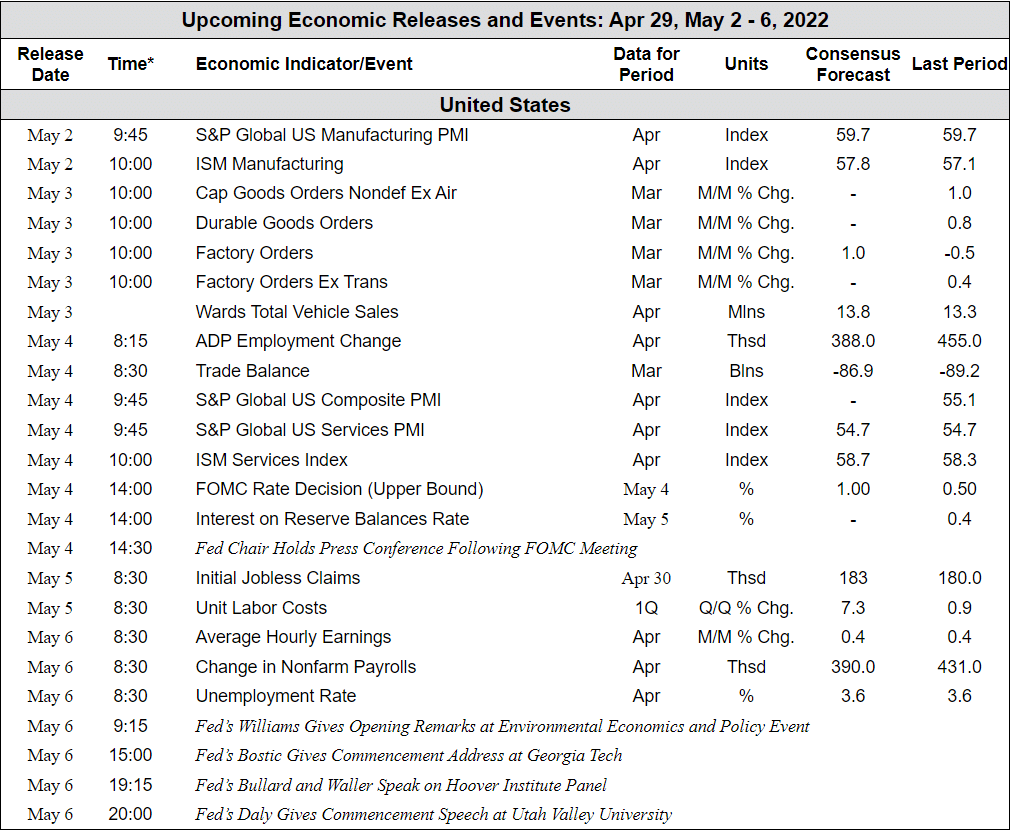

The Week Ahead