One of the biggest challenges facing today’s average investor is deciding how to allocate personal savings or retirement assets.

Naturally, most individuals hope to create an investment portfolio that is consistent with their personal objectives and risk tolerance.

However, the lure of potentially high rates of return can easily skew a novice’s objectivity, resulting in unrealistic expectations and unnecessary exposure to risk.

This is where asset diversification comes in. Simply stated diversification is an investment strategy used to manage risk.

Diversification 101

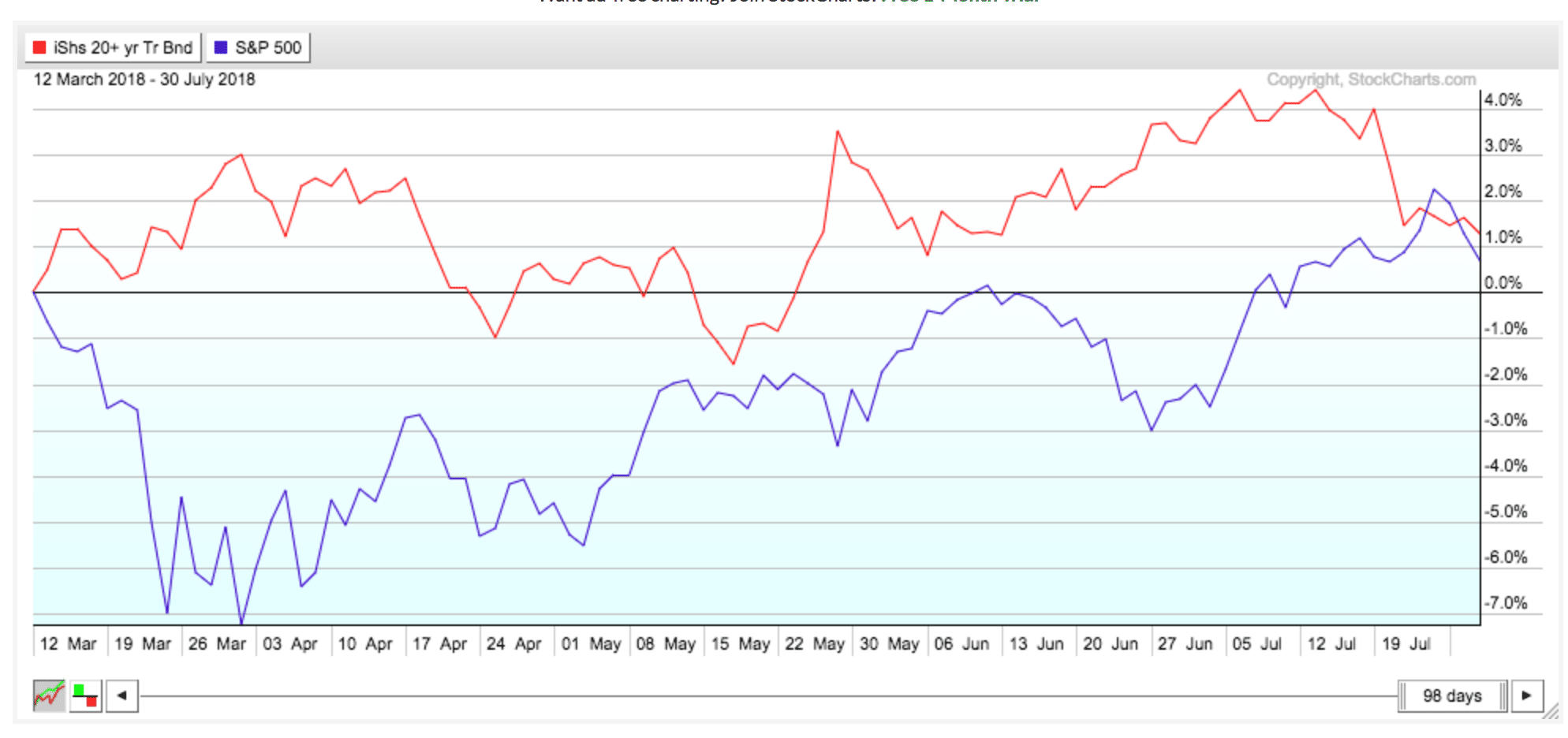

The cornerstone of diversification is a mixture of investments, each of which has broadly differing patterns of strength and weakness.

That way, strengths in one investment can potentially offset weaknesses in another at any given time.

The greater the difference in performance patterns of any two investments, the bigger the potential benefit from diversification.

Historically, such alternative investments as real estate and precious metals provided a non-correlated counterbalance in portfolios to traditional holdings such as stocks.

Over the past decade, some investments that once differed significantly began performing more alike and this reduced their potential to offset each other’s ups and downs in your portfolio.

As financial instruments and global markets became increasingly liquid and accessible, different asset classes became more closely interrelated.

How To Diversify Your Portfolio

It is important to, take into account your short-range and long-range goals. Here are some important questions to answer:

- What do I wish to accomplish with my money?

- How can I keep inflation from eroding the purchasing power of my money?

- How much risk am I willing to take with my money?

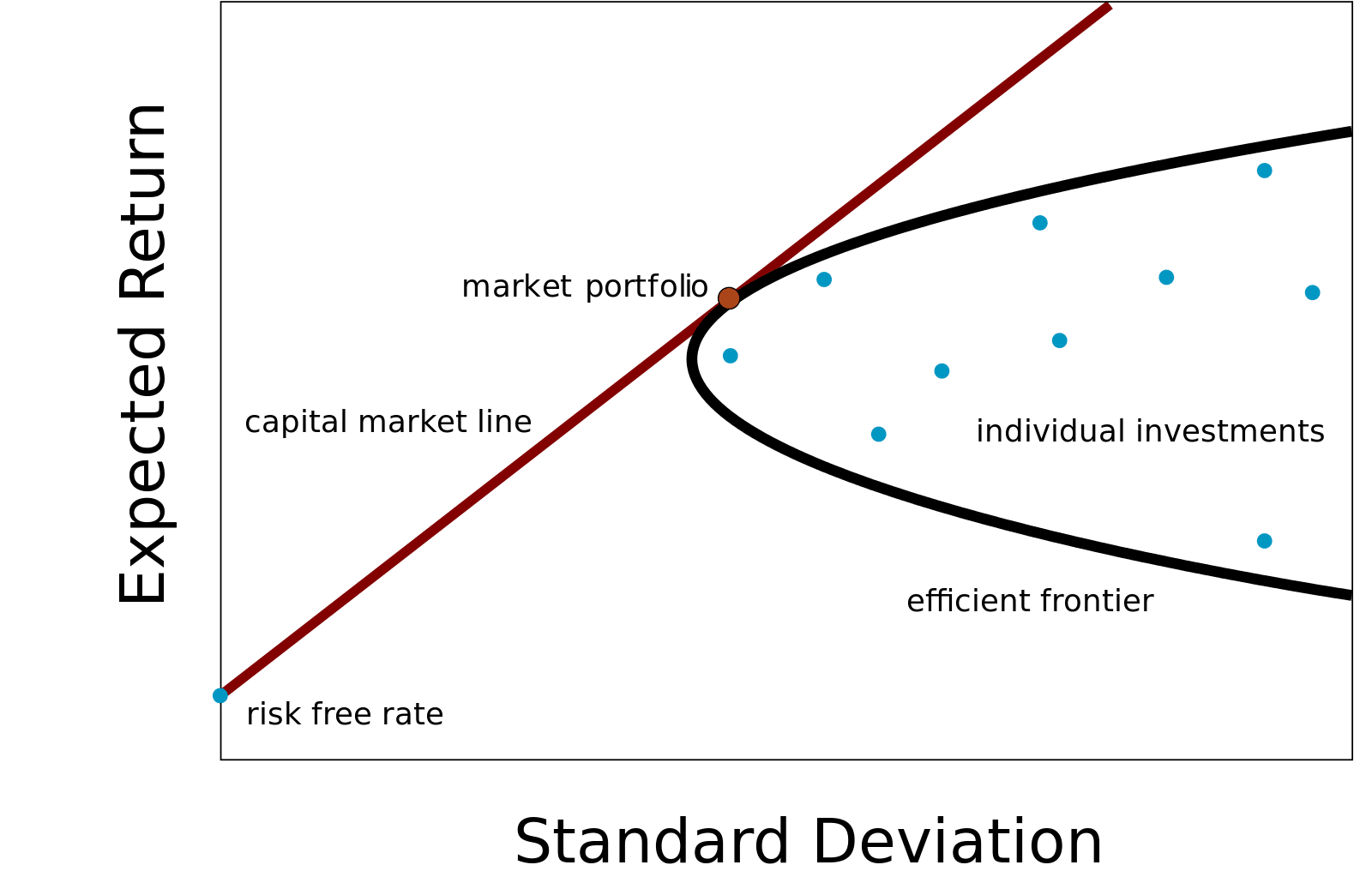

A well-diversified portfolio will have assets placed in investment classes that cover a wide range of the risk/return spectrum.

Examples of some investment vehicles include: stocks; bonds; mutual funds (which can comprise stocks, bonds, or a combination of both); certificates of deposit (CDs); savings; and money market accounts.

Each investment class tends to react differently to changes in financial markets and to the economy as a whole.

S&P 500 Index vs iShares 20 Year Treasury Bond ETF

Thus, by diversifying your portfolio, risk is spread over a broader range of investments, potentially minimizing the impact of downturns in the economy or a particular market sector.

It is also important to recognize that past performance of any investment is not indicative of future results that may perform well above or below your expectations and may, therefore, create an unbalanced portfolio, which could result in an investment mix that is inconsistent with your original objectives.

Remember: Diversification is an Investment Strategy to Manage Risk

We hear all the time that spreading your portfolio’s holdings across many classes of assets is one of the best defenses against losses when the bears hit Wall Street.

In fact, many times I have viewed portfolios that were spread out among different mutual funds, ETFs and stocks. However, the investor feels like their portfolio is still too risky.

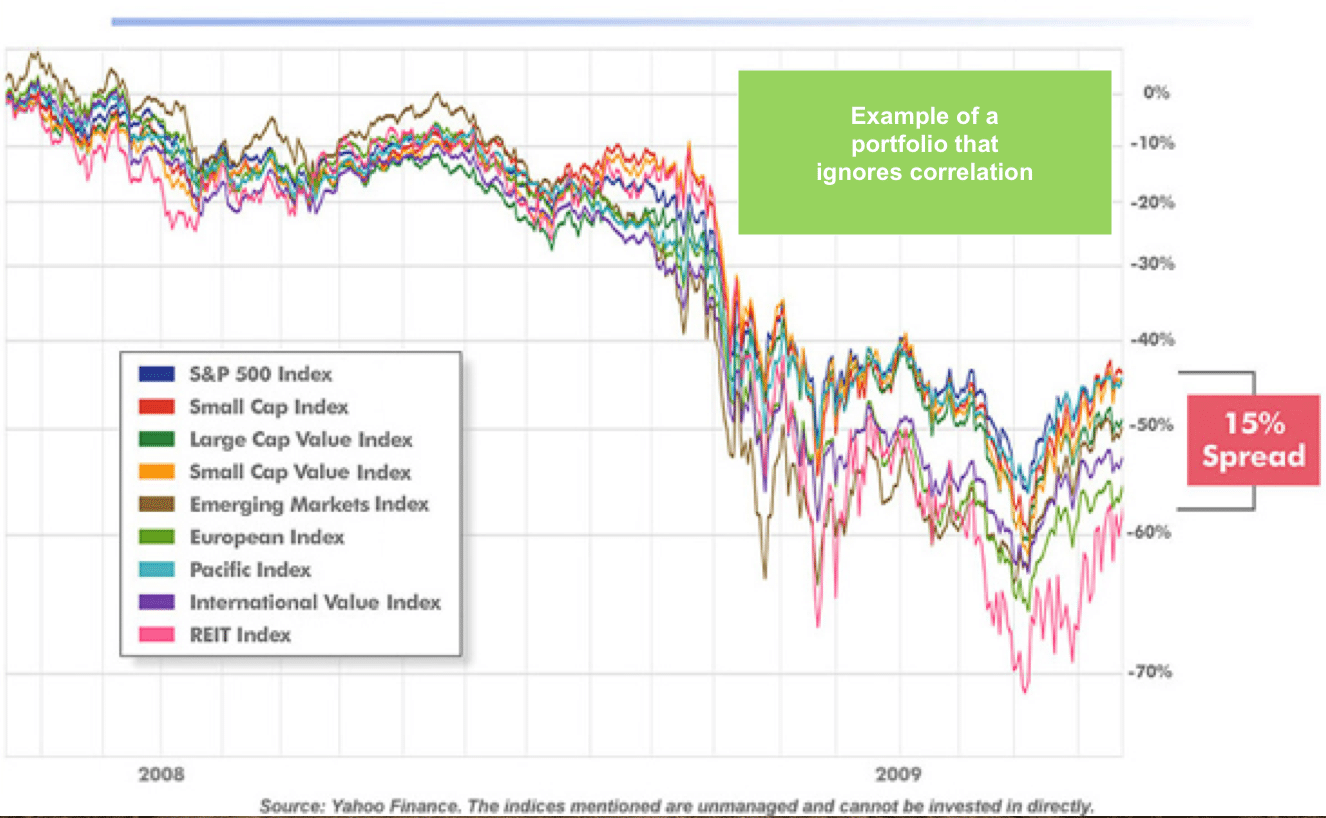

During the 2008-2009 market decline, many investors realized they ignored their portfolios were not properly correlated.

Well, diversification is more than just spreading investments assets among different holdings. There is a second step in this process — unfortunately, it is a step that is often missed.

Correlation 101

Correlation is a common measure of the variation in performance between two investments and is calculated using this formula:

Solving the above formula will give you the correlation coefficient.

Solving the above formula will give you the correlation coefficient.

The correlation coefficient is a statistical measure that calculates the strength of the relationship between the relative movements of the two variables.

The range of values for the correlation coefficient bounded by 1.0 on an absolute value basis or between -1.0 to 1.0.

A correlation of 1.0 means that all changes are synchronized exactly.

A correlation of minus 1.0 means that the amount of change synchronizes precisely but that the changes run in opposite directions.

A correlation of 0 denotes no statistically measurable relationship between changes in one set of returns and changes in another.

Convergence of key asset classes’ performance may be clear but the underlying reasons are complex.

Some point to the explosion of ultra-diversified hedge funds and exchange-traded funds. Others credit the melting borders of international trade. No one answer seems to constitute a sole reason.

Correlation Matrix of the 14 Asset Classes in 2018

Investors need to consider not only the risk and reward potential for each investment category but those categories’ correlations, as well. This lets you know how much of a portfolio can rise or fall at once.

Below is a chart of 14 asset classes and their correlation with each other:

(Apologies – this chart will look huge on small screens)

[table “11” not found /]In Conclusion

As you can see, investors who are looking to diversify their portfolio need to do more than just “spreading it out”.

Managing risk in a portfolio is one of the most important, yet underlooked, investing concepts. Unfortunately, investors do not always pay attention to risk metrics until they are in the middle of a bear market.