[fusion_builder_container hundred_percent=”no” equal_height_columns=”no” menu_anchor=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”center center” background_repeat=”no-repeat” fade=”no” background_parallax=”none” parallax_speed=”0.3″ video_mp4=”” video_webm=”” video_ogv=”” video_url=”” video_aspect_ratio=”16:9″ video_loop=”yes” video_mute=”yes” overlay_color=”” video_preview_image=”” border_size=”” border_color=”” border_style=”solid” padding_top=”” padding_bottom=”” padding_left=”” padding_right=””][fusion_builder_row][fusion_builder_column type=”1_1″ layout=”1_1″ background_position=”left top” background_color=”” border_size=”” border_color=”” border_style=”solid” border_position=”all” spacing=”yes” background_image=”” background_repeat=”no-repeat” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” margin_top=”0px” margin_bottom=”0px” class=”” id=”” animation_type=”” animation_speed=”0.3″ animation_direction=”left” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” center_content=”no” last=”no” min_height=”” hover_type=”none” link=””][fusion_text]

Another week, another decline.

The US equity markets declined again last week as the combination of rising rate fears and the Russian/Ukraine turmoil continue to spook investors.

The S&P 500 index looks to retest a key support level. If that level fails, we may see a larger retracement in the stock market.

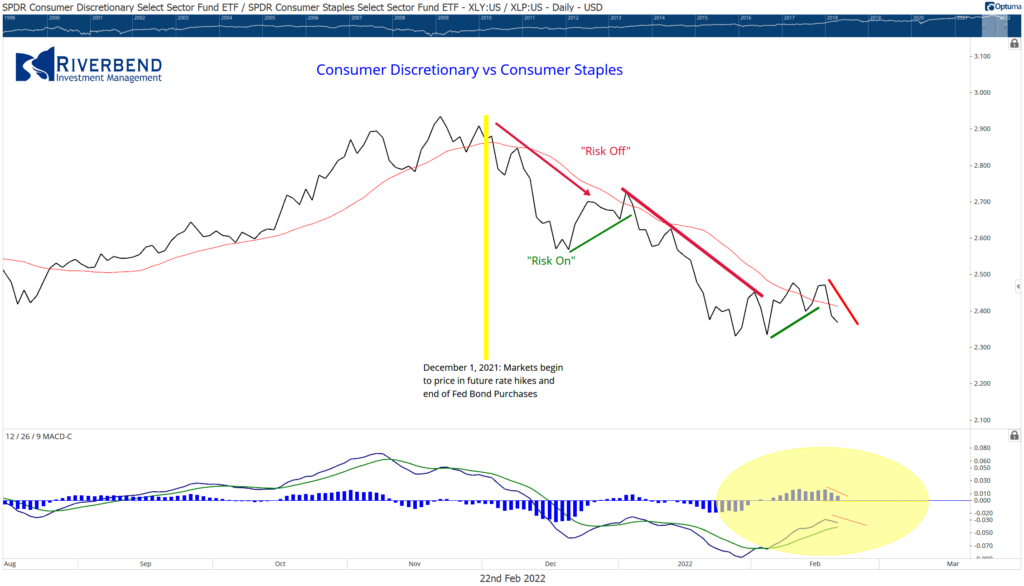

One of the tools I like to use for measuring risk in the market is to compare the relative strength between consumer discretionary (items like luxury goods, movies, leisure items, etc) and consumer staples (everyday items like food and toiletries).

When consumer discretionary companies are outperforming, it is an indication that consumers are feeling good with the economy and their own, personal financial outlook. (Risk-On)

However, when consumer staples outperform, it is an indication that consumers are worried about the economy and perhaps saving for a rainy day. (Risk-Off)

Since December 1st of last year – when the markets first started to price in the possibility of future interest rate hikes — the markets have been mostly “risk-off:

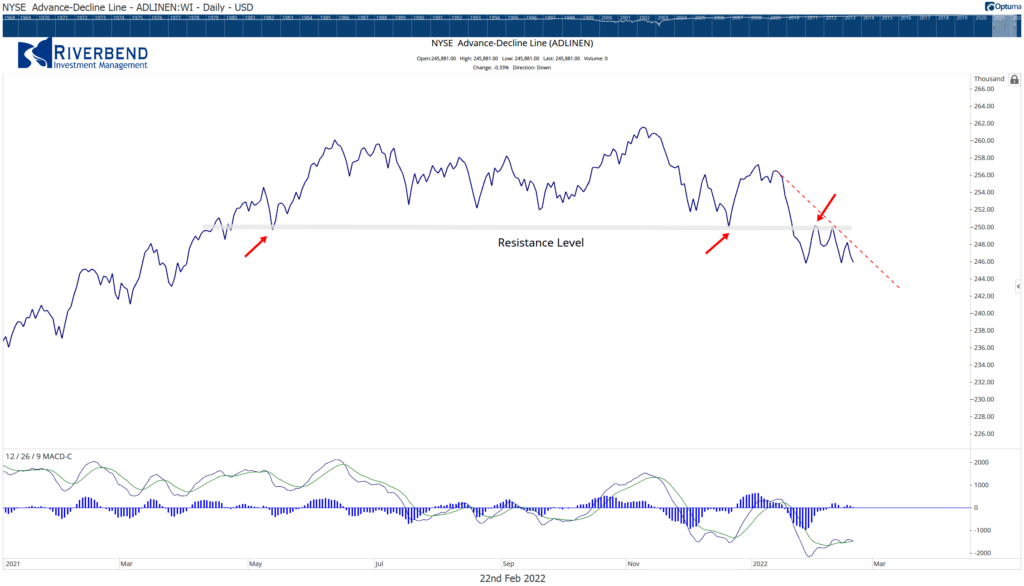

For the market to begin to look healthier, I want to see the Advance-Decline line begin to rise again.

The Advance-Decline line is a ratio of rising vs falling stocks. Right now, it is telling us the markets continue to get weaker.

For now, the weight of the evidence still favors cash and/or market-neutral portfolios within our investment models.

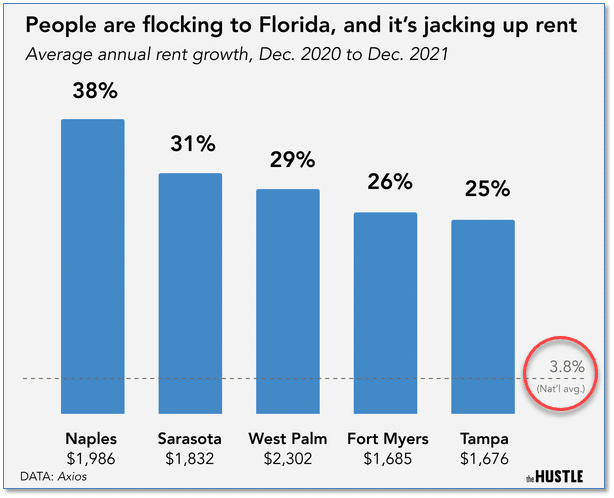

Chart of the Week:

According to the Bureau of Labor Statistics’ Consumer Price Index (CPI), rents rose 3.8% across the country last year.

But one state, in particular, scored six of the top ten cities with the highest average rent increase. That state is Florida.

According to Axios, a few factors explain the increase. More workplaces allowing remote work has pushed workers to warmer climates, and with more housing demand some residents are choosing to rent instead.

Furthermore, many residents of higher-tax restrictive states are choosing the low taxes and freedom of states like Florida.

Riverbend Indicators:

- As a reading of our Bull-Bear Indicator for U.S. Equities (comparative measurements over a rolling one-year timeframe), we remain in Cyclical Bull territory.

- Counting up of the number of all our indicators that are ‘Up’ for U.S. Equities, the current tally is that two of four are Positive, representing a multitude of timeframes (two that can be solely days/weeks, or months+ at a time; another, a quarter at a time; and lastly, the {typically} years-long reading, that being the Cyclical Bull or Bear status).

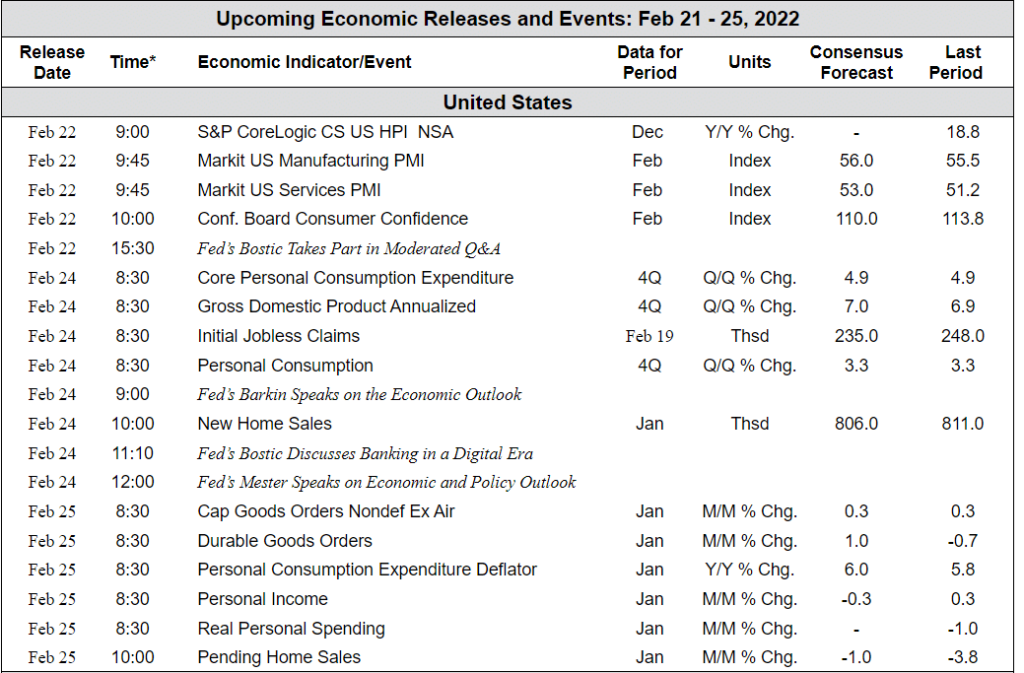

The Week Ahead:

Source: Bloomberg, TD Economics

[/fusion_text][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]