[fusion_builder_container hundred_percent=”no” equal_height_columns=”no” menu_anchor=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”center center” background_repeat=”no-repeat” fade=”no” background_parallax=”none” parallax_speed=”0.3″ video_mp4=”” video_webm=”” video_ogv=”” video_url=”” video_aspect_ratio=”16:9″ video_loop=”yes” video_mute=”yes” overlay_color=”” video_preview_image=”” border_size=”” border_color=”” border_style=”solid” padding_top=”” padding_bottom=”” padding_left=”” padding_right=””][fusion_builder_row][fusion_builder_column type=”1_5″ spacing=”” center_content=”no” link=”” target=”_self” min_height=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” hover_type=”none” border_size=”0″ border_color=”” border_style=”solid” border_position=”all” border_radius=”” box_shadow=”no” dimension_box_shadow=”” box_shadow_blur=”0″ box_shadow_spread=”0″ box_shadow_color=”” box_shadow_style=”” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” margin_top=”” margin_bottom=”” background_type=”single” gradient_start_color=”” gradient_end_color=”” gradient_start_position=”0″ gradient_end_position=”100″ gradient_type=”linear” radial_direction=”center” linear_angle=”180″ background_color=”” background_image=”” background_image_id=”” background_position=”left top” background_repeat=”no-repeat” background_blend_mode=”none” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=”” filter_type=”regular” filter_hue=”0″ filter_saturation=”100″ filter_brightness=”100″ filter_contrast=”100″ filter_invert=”0″ filter_sepia=”0″ filter_opacity=”100″ filter_blur=”0″ filter_hue_hover=”0″ filter_saturation_hover=”100″ filter_brightness_hover=”100″ filter_contrast_hover=”100″ filter_invert_hover=”0″ filter_sepia_hover=”0″ filter_opacity_hover=”100″ filter_blur_hover=”0″ last=”no”][/fusion_builder_column][fusion_builder_column type=”2_3″ layout=”1_1″ background_position=”left top” background_color=”” border_size=”” border_color=”” border_style=”solid” border_position=”all” spacing=”yes” background_image=”” background_repeat=”no-repeat” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” margin_top=”0px” margin_bottom=”0px” class=”” id=”” animation_type=”” animation_speed=”0.3″ animation_direction=”left” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” center_content=”no” last=”no” min_height=”” hover_type=”none” link=””][fusion_text columns=”1″ column_min_width=”” column_spacing=”” rule_style=”default” rule_size=”” rule_color=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=””]

Are investors about to overreact to Conroavirus? Perhaps.

Let’s face it unless you are a political junkie, the news cycle of late has been pretty boring. Don’t get me wrong, what is happening is an important part of history, BUT watching people arguing about the technicalities and details of the impeachment process for 10 hours a day isn’t making anyone’s toes curl.

It’s not sexy nor scary. Which is what the news channels love.

Enter the Wuhan Coronavirus.

Google Search Trends

Add to the fact that US Equities are very overbought, plus a news cycle hungry for a flashy/sexy/scary story, we may have enough of an of catalyst to get markets to change direction.

Risk In The Market

Before I go further, let me take a step back and talk about risk.

When I speak about risk in the current market, I like to use the analogy of driving in clear weather vs driving in poor weather.

When there is bad weather, we obviously slow down and drive safer.

Well, the roads have been clear and there has been good weather. As a result, investors are driving full speed – and many a bit over the speed limit.

While our market directional indicators are still showing clear skies, the road is cold and I think there is an increasing chance of a surprise snow shower.

As those of us in the Northeast can attest, the tiniest amount of snow on a cold road can create chaos for the unprepared.

That’s where I think we are now in the US equity market. We are speeding down the highway, unprepared for the surprise snowstorm (or in this case, virus) that is about to hit.

Status of the Market

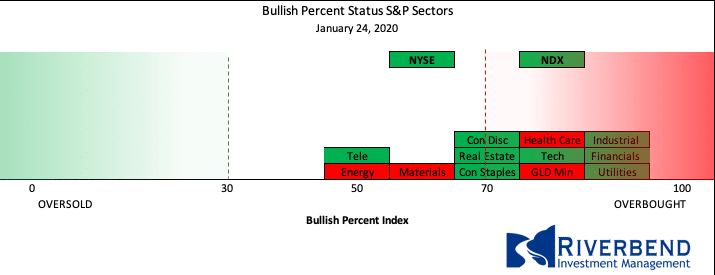

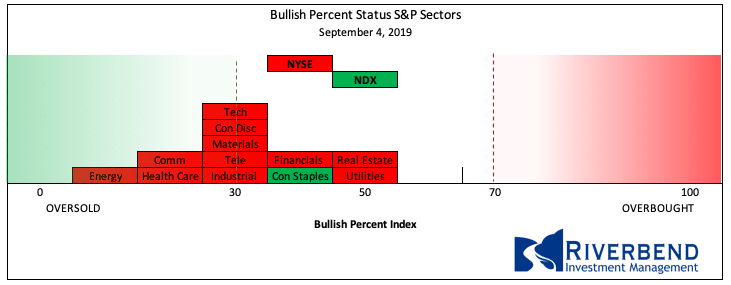

Currently, the Bullish Percent Status of the major S&P 500 sectors is overbought.

We can see the difference in status versus the reading back in September:

Clearly the market has shifted from oversold territory into overbought territory. This will cause traders to quickly take profits at the first sign of trouble.

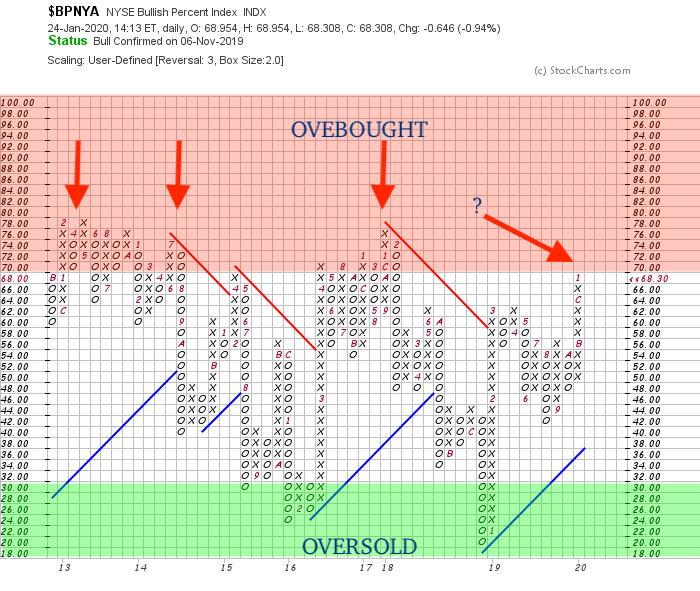

Additionally, the NYSE Bullish Percent Index is nearing the 70% level. This is a level that is considered by many technicians to represent an “overbought” zone.

Value At Risk (VaR)

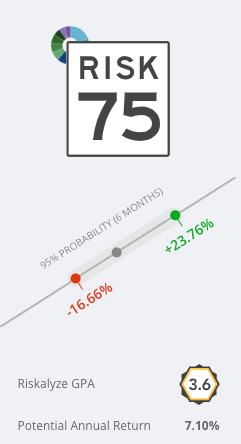

For those unfamiliar with VaR, the Value at Risk statistic has three components: a time period, a confidence level and a loss amount (or loss percentage).

For investors, the risk is about the odds of losing money, and VaR is based on that common-sense fact. By assuming investors care about the odds of a really big loss, VaR answers the question, “What is my worst-case scenario?”

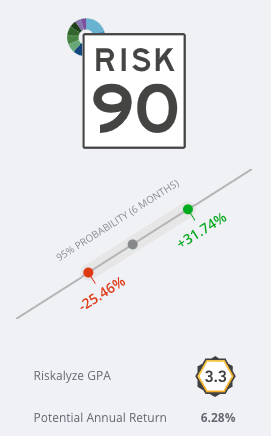

This is the VaR estimate for the ETF SPY, which mimics the S&P 500 index:

Risk Profile of SPDR S&P 500 ETF (SPY)

source: Riskalyze

I point this out because most retail investors have been spoiled by the uninterrupted run-up in stock prices. (How quickly they forgot 2018).

A quick drop in equity prices will surprise investors as many are unfamiliar, or have chosen to ignore, the probable range estimates of their portfolios.

And if Behavior Finance has taught us anything, it is that investors are quick to overreact and act irrationally.

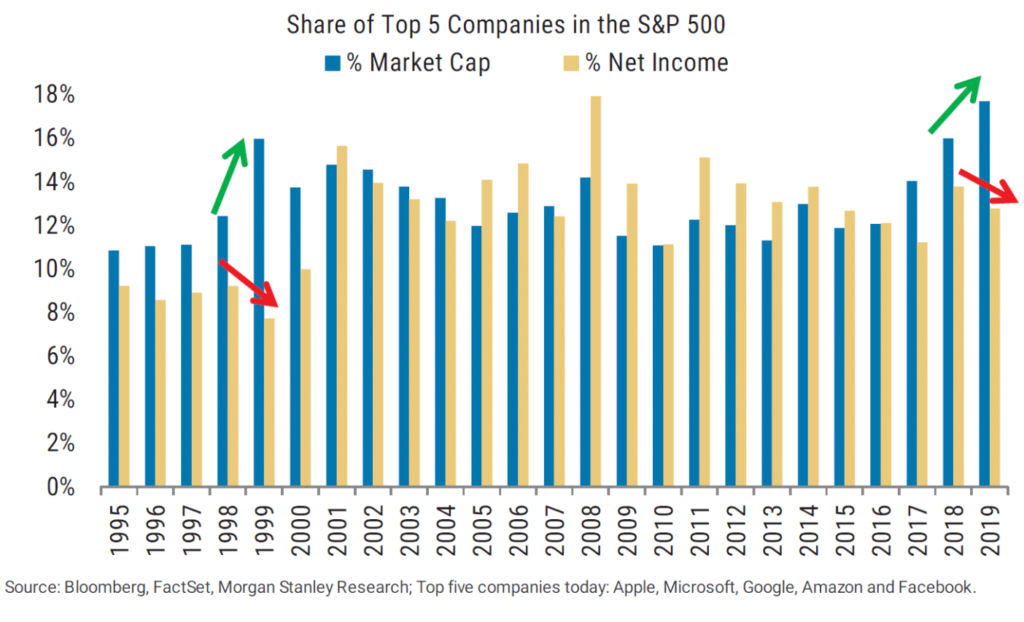

Big Companies Have Never Dominated the S&P 500 Like They Do Now

What may surprise investors, even more, is what they are holding in their portfolios. The S&P 500 is being dominated by 5 companies. As a result, investors are very overweight technology.

If we look at the risk profile of holding these 5 companies in a portfolio, the potential downside vs the potential annual return should have many scratching their heads and asking “Why am I taking so much risk for such a small potential annual return?”

Risk Profile Apple, Microsoft, Google, Amazon, Facebook. Allocated 20% to each holding.

source Riskalyze

Are Institutional Investors Already Taking Their Foot Off The Gas?

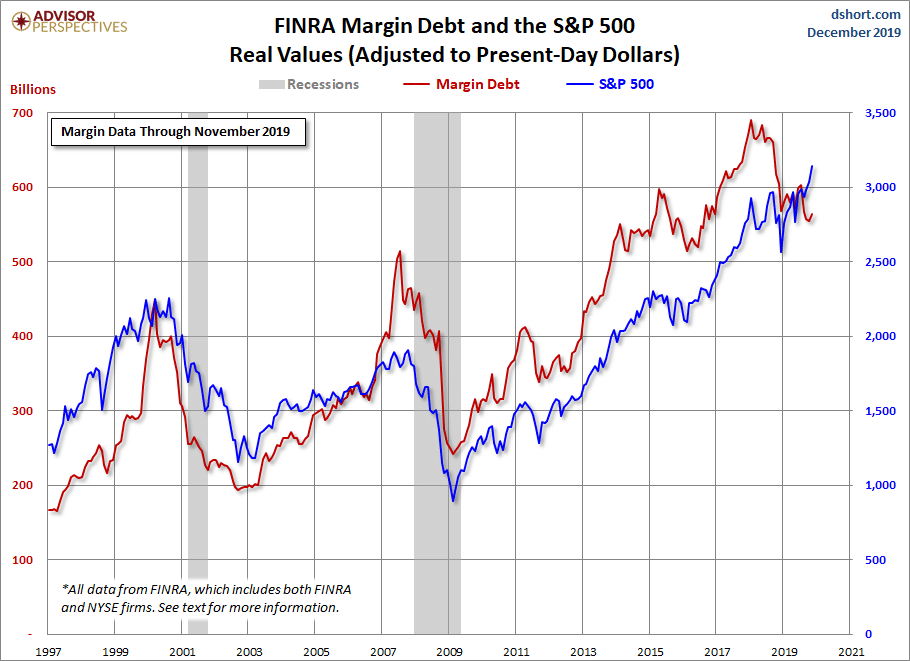

The amount of money being borrowed by institutional and individual investors is called margin debt. Typically, though, I find that it is institutional investors, like hedge funds, borrowing money in order to increase risk levels in their portfolios.

Margin debt and the S&P 500 index have historically been strongly correlated.

Currently, margin debt levels are still high, but they have been starting to fall. Is this an early indication that institutional investors have been paying attention to risk levels and have started to take their foot off the gas?

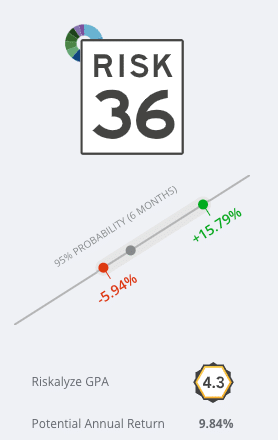

We may be starting to see the beginning of a shift from chasing returns, to managing risk. Nowadays, I’m finding it’s not too difficult to build a portfolio model with better long term risk-adjusted returns than the market.

For example, I used Riskalyze to input a blend of some of my favorite investment models. As you can see, the case for risk management is pretty strong.

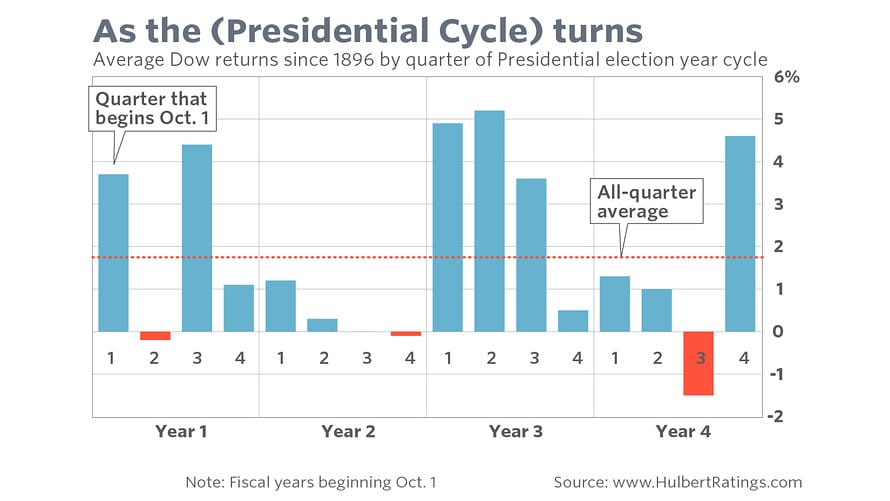

Presidential Cycle

So, is this lights out for the market? I don’t believe so.

Merely a passing storm that can cause some damage to the unprepared.

However, don’t forget this is an election year.

Election years are historically positive for the stock market, as politicians like to focus on ways to drive the economy higher.

So while equity markets are overbought, and can remain so for some time, it will take a catalyst to make investors want to act.

Only time will tell if it is the Wuhan Coronavirus or something else that causes investors to panic in the short term.

But panic will mostly be more akin to what we saw in late 2018. This will provide an opportunity to reallocate risk and, for the nimble investor, may provide an opportunity to find value in various sectors when/if they become oversold.

[/fusion_text][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]