[fusion_builder_container hundred_percent=”no” equal_height_columns=”no” menu_anchor=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”center center” background_repeat=”no-repeat” fade=”no” background_parallax=”none” parallax_speed=”0.3″ video_mp4=”” video_webm=”” video_ogv=”” video_url=”” video_aspect_ratio=”16:9″ video_loop=”yes” video_mute=”yes” overlay_color=”” video_preview_image=”” border_size=”” border_color=”” border_style=”solid” padding_top=”” padding_bottom=”” padding_left=”” padding_right=””][fusion_builder_row][fusion_builder_column type=”1_1″ layout=”1_1″ background_position=”left top” background_color=”” border_size=”” border_color=”” border_style=”solid” border_position=”all” spacing=”yes” background_image=”” background_repeat=”no-repeat” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” margin_top=”0px” margin_bottom=”0px” class=”” id=”” animation_type=”” animation_speed=”0.3″ animation_direction=”left” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” center_content=”no” last=”no” min_height=”” hover_type=”none” link=””][fusion_text]

After the US stock market reached it’s low of the year, there has been a debate among market watchers — is the worst behind us, or are further declines ahead of us?

The real answer is nobody knows.

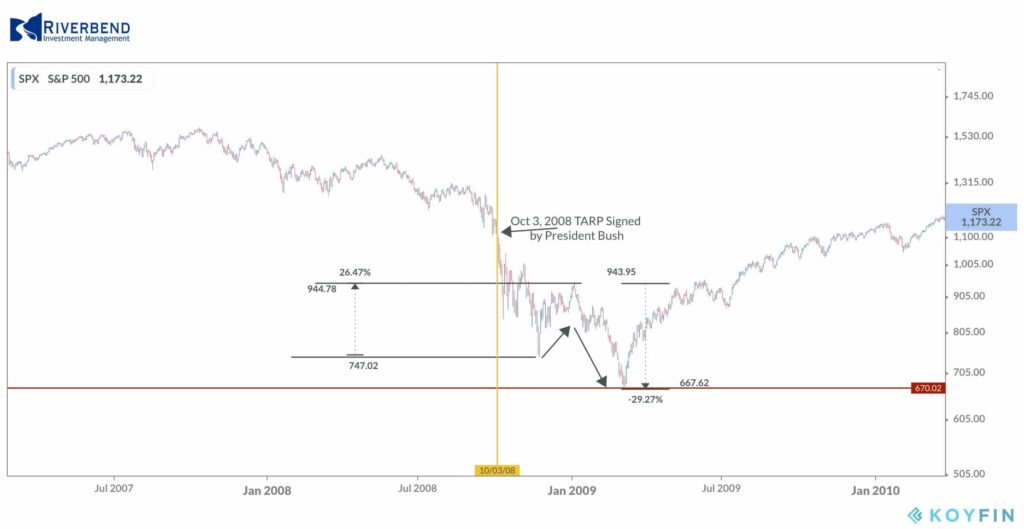

A look back at the 2008-2009 Financial Crisis shows that after the announcement of the government’s TARP program, the market continued to decline.

Some have argued that the quickness of the current decline is more akin to the 1987 crash. During that time, the market bottomed then retested the lows a few weeks later, before continuing its upward ascent.

In either case, I don’t think we are going to have the so-called “V” shaped recovery some are hoping for. We will have to wait to see what happens next, but I want to share some thoughts.

Below I am posting a few charts and thoughts on the current market as well as some key themes I am watching.

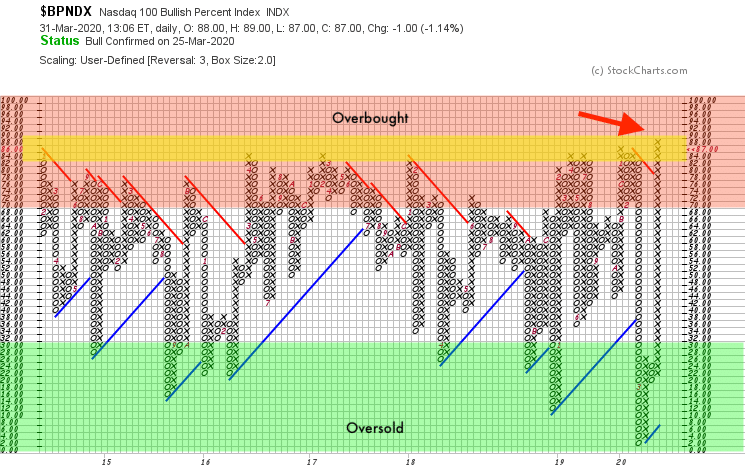

To start – markets are overbought.

Yes, you read that correctly. Short term, the market looks to me to be a bit overbought.

The bullish percent index chart of the Nasdaq 100 (a breadth indicator that shows the percentage of stocks on Point & Figure Buy Signals) is currently at a level where we start to see profit-taking in the market.

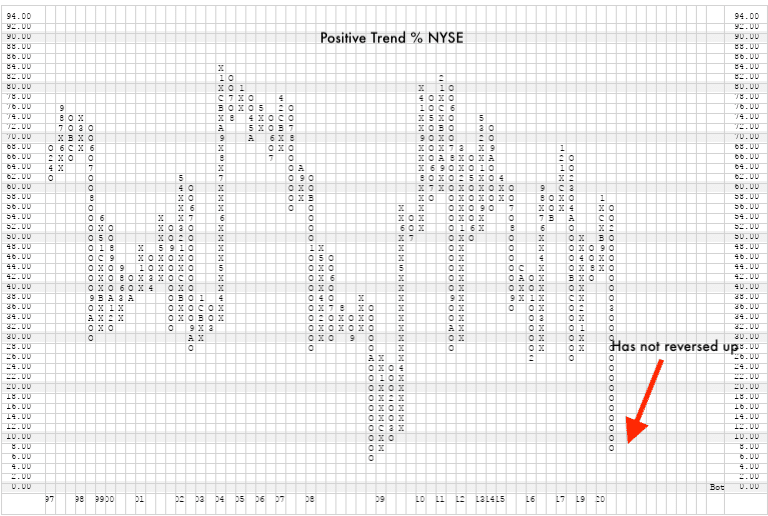

However, the price trend of US equities has not confirmed the recent price move indicating that this is likely a short term bounce:

source: Nasdaq Dorsey Wright, Riverbend Investment Management

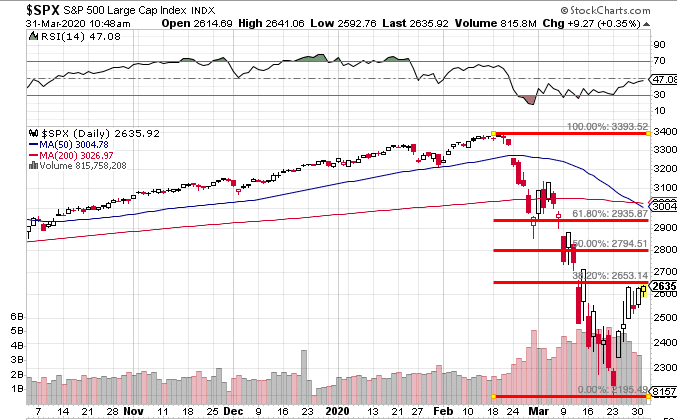

The S&P 500 index is also trading near a key Fibonacci level. The market keeps bouncing up against this level, but is having a hard time breaking through. This may be an indication that short term traders are taking profits at this level and unwilling to commit further capital.

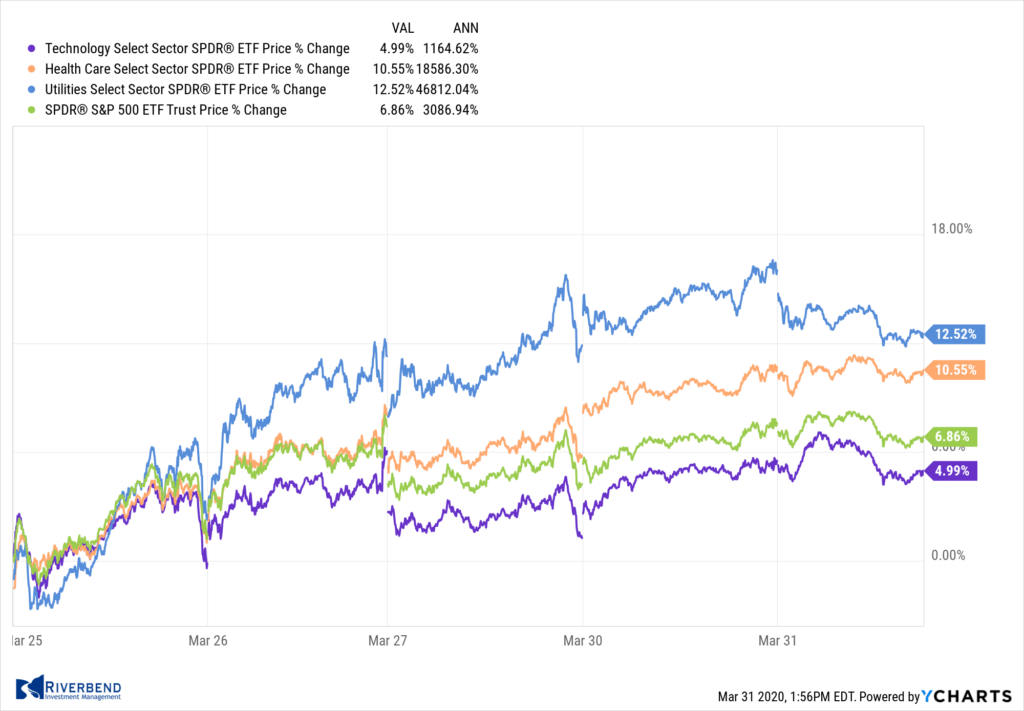

The market has been lead by traditionally lower beta names over the past week – not what you would expect from aggressive investors looking for a big move up. This may be from institutional investors selling bonds and buying equities for their required quarterly rebalancing – while trying to be as risk-averse as possible.

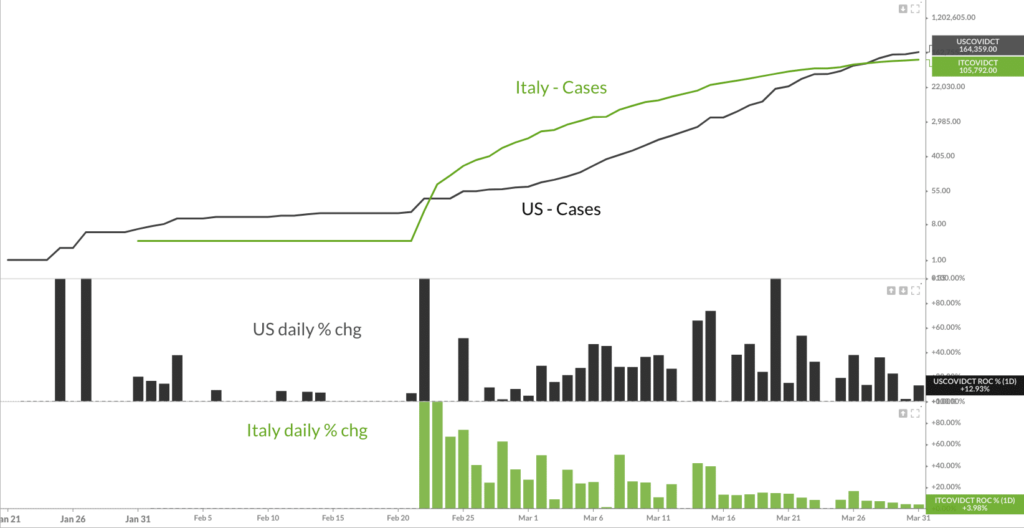

Finally, there has been a lot of commentary on how Italy’s outbreak is two weeks ahead of us. The thinking has been that the US will follow a similar curve.

Is the difference in the daily rate of change telling us that the US curve may look different?

Source: Koyfin

I am concerned that our curve may look very different for a couple of reasons:

- Italy’s lockdown seems to be stricter than anything the US has put in place.

- The difference in the average age of the two populations.

- The (potentially) unlimited financial resources of the US.

These unknows may keep investors on the sidelines – especially if our curve starts to look different than the one the market expects.

In the coming weeks, I expect the market to be more news-driven than financially driven. Volatility levels remain high. Positive or negative news may drive this market aggressively in either direction.

Happy trading and stay safe!

-John

[/fusion_text][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]